A1 Intraday Tips

List of all Advisory Firms Reviews

A1 Intraday Tips is one of those advisory firms that has been giving stock trading related advises to clients for a few years now. The ups and downs of the stock market are critically analyzed by their team of experienced analysts.

They also have a team of professional technical analysts and chart readers, who track every movement of the share market from the pre-opening to the closing bell. Let’s have a quick at the services, charges and the overall performance of this firm.

A1 Intraday Tips Review

Facing financial losses in the share market is a common thing. However, tasting profits while trading in the stock market is also not that difficult. All you need is some experience and proper guidance from a reliable and reputed advisory firm.

A1 Intraday Tips provides several services that are suitable for clients with different needs.

A1 Intraday Tips Services

Let’s quickly check some of the services offered by this research and advisory firm to its clients and you would know which of the service(s) you may prefer opting for:

1. Pre-Opening Call Service

Before the proper opening of the NSE market, A1 Intraday Tips provides a pre-opening call to its clients. This service is specially designed for those clients or online traders who do not have enough time to track the stock market on a continuous basis.

The pre-open session of the share market lasts for a maximum of 15 minutes before the market officially opens for trading.

Features:

- If you opt for this service, you will get 2 opening stocks in the pre-opening calls.

- You will also get “buy” or “sell” recommendations in this service.

2. Equity Cash Call Service

Equity cash call or intraday trading is basically the same thing. This usually refers to stock trading in the cash segment of NSE. This type of service is targeted towards those clients who usually fall into the category of small intraday stock traders.

They normally do not prefer to take many risks in the F&O segment.it is obvious that the risk involved in the F&O segment is much higher than the intraday cash segment. The advantage of cash trading is the possibility of enjoying more profits than most other ways of trading in the share market.

However, as a disadvantage, you have to pay a higher brokerage charge when you trade in the cash segment.

3. F&O Tips Service

F&O or Futures and Options are 2 of the highly common forms of Derivatives. For those of you who do not know, Derivatives are basically financial instruments that usually derive their monetary value from underlying, which mean the stocks issued by any company.

2 types of contracts are common Futures Contract and Options Contract.

The former means you agree to the fact that you will either buy or sell the shares at a given future date. On the other hand, the latter gives the buyer the right to either sell or buy the underlying assets at a price which is determined beforehand.

You need to do this at the end of any specified period of time. This type of investment requires less capital and you are only required to pay a marginal amount, usually 5% to 20% of the entire contract. You can also enjoy a bigger profit with low capital and the brokerage is also usually low.

4. Jackpot Call Service

A1 Intraday Tips provides jackpot call service in which you will receive a call anytime during the normal NSE market hours. However, usually, this call made between 10am and 12pm. Until the call is made to you, the technical team of A1 Intraday Tips provides a full follow-up of the calls.

Features:

- Jackpot calls are made 3 or 4 times a week and only when the experts are 80% to 90% sure about such calls, these calls are made to clients.

- Jackpot calls are usually made in the F&O segment.

- Whenever stop-loss triggers in their jackpot calls, A1 Intraday Tips will let you know of the same through SMS.

- High volume stocks are recommended in these jackpot calls and penny stocks are avoided.

- Share tips are provided at the prevailing price in the stock market.

5. Sure Shot Call Service

A1 Intraday Tips also provides sure shot calls to clients once their experts are assured that the stock will surely hit the target. These tips are generally buying and selling recommendations normally given in the F&O segment.

Features:

- Sure shot calls are made anytime during the day and any day of the week during normal working hours of the NSE market.

- If the experts are not sure that a specific stock will hit the target and the market trend is not in favour, then you will not receive any sure shot calls.

- Sometimes you may also receive 2 or 3 such calls in a week.

- If the experts are not 100% sure about the stop loss and target, you will be sent an SMS which will state the proper buying or selling rate.

- Accuracy margin of the sure-shot calls made by A1 Intraday Tips is 85%.

6. BTST/STBT Calls Service

BTST/STBT stands for Buy Today Sell Tomorrow and Sell Today Buy Tomorrow. In this type of trading, traders have to carry forward a long position for the following day either in F&O or cash segment.

Traders have to either buy or sell in the F&O segment and square off all positions the following day the market reopens before the end of the day.

It is important for traders to know the Intraday square off time to avoid any sort of hidden charges.

Features:

- A1 Intraday Tips mentions the price, quantity, stop loss and target in their calls.

- Premium quality SMS service is used by the advisory firm to send bulk messages to clients availing the BTST/STBT call service.

- Accuracy margin for such calls is between 80% and 90%.

- Paid members can enjoy a complete follow-up.

7. Nifty Call Service

You will get free intraday Nifty levels on a daily basis. The Nifty Supports 1 and 2, Nifty Resistance 2, and Nifty Range will also be specified.

Features:

- If you avail this service you will receive 2 or 3 Nifty tips each week.

- These tips are sent to clients almost immediately through premium SMS service.

- The Nifty intraday trading tips provided by A1 Intraday Tips have an accuracy margin of 90%.

8. Bank Nifty Call Service

When you talk about the most volatile stocks in the NSE, bank Nifty will be a good example. There are days when these stocks go 50 to 100 points either up or down within a very short time span.

Features:

- Bank Nifty Calls are made with an accuracy of 99%.

- You will receive 2 or 3 Bank Nifty tips on a weekly basis.

- The tips are delivered to you through premium SMS service.

- A complete follow-up is done until the call is finally open.

9. Options Call-Put Tips Service

In order to know everything about options trading, you need to have enough knowledge about the NSE F&O segment.

However, for those of you who do not know, a call option is a type of contract that allows you to purchase the underlying stocks at a specified price for a definite period of time.

On the other hand, a put option allows you to sell the underlying shares at a pre-determined price or a definite period of time. A1 Intraday Tips does not provide such tips on a daily basis. Once the technical team is sure about such tips, these are forwarded to clients.

10. Nifty Options Tips Service

Nifty options are basically divided into call options and put options. These are important aspects of intraday trading. Call options are applicable when you think that Nifty values will rise up the same day itself.

On the other hand, put options are applicable when you think that Nifty values will fall down the same day. Experts at A1 Intraday Tips provide such tips to help you gain the most profits from your NSE trades.

11. Nifty Future Tips

A1 Intraday Tips also provides effective and useful Nifty future tips to clients. Nifty future is a type of Index Futures and one of the multiple aspects of Nifty.

A1 Intraday Tips Mobile App

This research and advisory firm also provide a mobile app to its clients so that they can get the recommendations directly from the app. This removes the chances of any delays or confusions and you can be in a better position to place your trades.

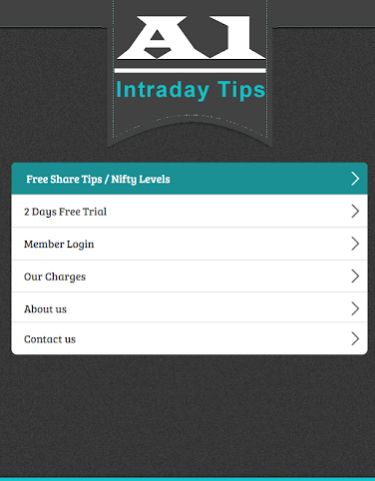

This is how the mobile app looks:

The app design is pretty basic in nature and you can just expect the app to provide you with tips on a regular basis. If you have high expectations from user experience and design perspective, then you are in for a disappointment.

Depending on the service(s) you have subscribed to, you are allowed to visit those specific areas of the app and you get notifications accordingly as well.

Here are some of the concerns raised by the users of this mobile app:

- Not user-friendly with a pretty bland design.

- Delayed SMS for free trial users, kills the point of having a free trial in the first place.

- Relatively slow in smaller cities

As far as the rating is concerned, this is how the mobile app is positioned at the Google Play Store:

| Number of Installs | 100,000+ |

| Mobile App Size | 19 MB |

| Negative Ratings Percentage | 22.7% |

| Overall Review |  |

| Update Frequency | 3-4 Months |

A1 Intraday Tips Charges

A1 Intraday Tips has multiple packages under its Share Tips Services. The weekly package comes for ₹3500 which will contain 5 NSE working days. The monthly package comes with ₹8500 and the quarterly package comes for ₹16500.

A1 Intraday Tips also has a half-yearly package which comes with ₹31500 and an annual package for ₹51500.

A1 Intraday Tips Performance

As per the claims of this advisory firm, the performance of their tips is in the accuracy range of more than 80%.

However, realistically speaking, that number is too high to be good.

Nonetheless, our recommendation is to take the free trial provided by A1 Intraday tips. Observe how their tips perform in the real market (without actually placing any trades based on the tips).

Then start with a small capital to kick off the trades using their services. By time, if tips perform reasonably well, you may choose to increase your capital amount.

A1 Intraday Tips Benefits

Some of the benefits of subscribing to the services of this advisory firm are:

- Unlike several other advisory firms, A1 Intraday Tips does not have a lot of packages which can easily make you confused.

- They also provide a 2-days free trial package for their clients which will let you know whether you like their services or not.

You can read this review in Hindi as well.

A1 Intraday Tips Complaints

Some of the users have raised complaints against A1 Intraday tips. The nature of the complaints is around:

- The accuracy margin of their tips claimed by them may not seem possible if you check it closely.

- Their tips are sometimes made in the interest of their own profits or losses.

It is not possible to gauge an advisory firm overnight. You need some time in order to understand whether their tips are really useful or not. This is why it is always advisable to opt for small-time packages so that you do not have to stick to an advisory firm for long if you do not like their services.

This is also one of the reasons why most of the stock advisory firms provide trial periods for new clients.

In case you are looking to get research and tips, just fill in some basic details in the form below.

A Callback will be arranged for you:

Also Read:

If you wish to learn more about some of the other advisory firms in India, here are a few references for you: