SP Tulsian

List of all Advisory Firms Reviews

SP Tulsian is an old name in the stock advisory space. It was launched as a weekly magazine back in 1991 as Premium investments. Then in 2007, the firm moved into the advisory space with a registered office in Mumbai.

In this detailed review of SP Tulsian, let’s talk about its different service plans, fees, subscription, app, contact information, membership etc.

SP Tulsian Review

The major emphasis of SP Tulsian has been towards analyzing market news and upcoming IPOs and they don’t really have a wide variety of specific services if you are looking for one (more on that later).

Premium Investments was then re-branded as SP Tulsian Investment services in 2012. This change certainly brought a direct impact on the brand equity since now the firm could directly be related to a prominent name (of Mr S P Tulsian) in the advisory domain. The advisory firm has recently completed its 10 years in the research and advisory industry and is a much leaner team now.

Let’s talk about different services offered by the advisory firm SP Tulsian.

SP Tulsian Advisory Services

The SP Tulsian website has two clear-cut out zones on their website:

- Member Zone

- Free Zone

Now, depending on whether you have subscribed to their services or not, you are allowed to access the corresponding zone.

SP Tulsian Free Zone:

It is open to any user and allows you to access:

- IPO Analysis

- Market News

- Corporate linking

- Stocks to stay away from (or Danger Stocks)

- Stock Market Pathshala

SP Tulsian Member Zone:

At the same time, if you have subscribed as a member, you can access the following information from SP Tulsian through the Member Zone:

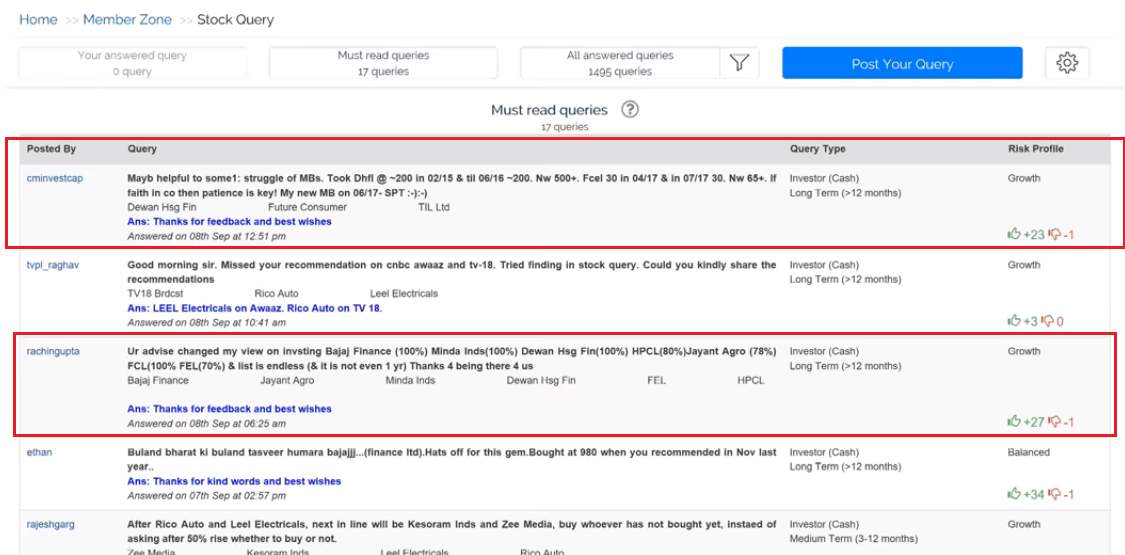

- Stock Query (you can get your stock queries resolved at a personal level with the decision on buy, sell, hold or accumulate)

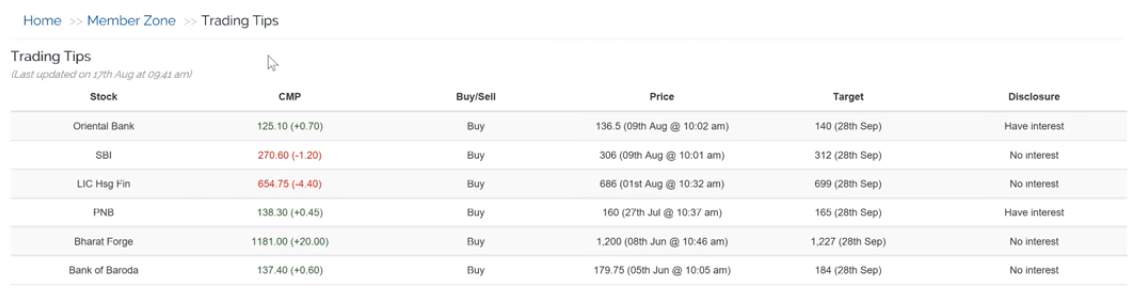

- Trading tips

- Long-term investment stocks

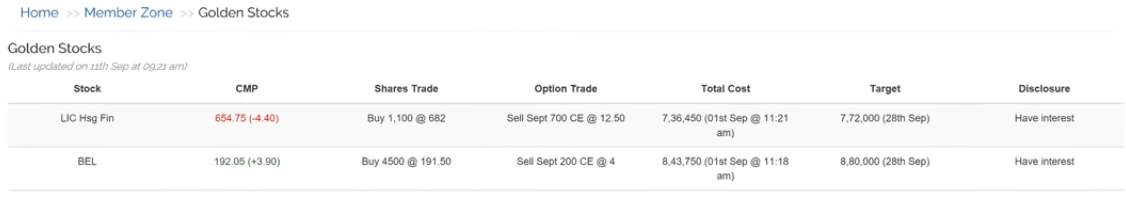

- Golden stocks

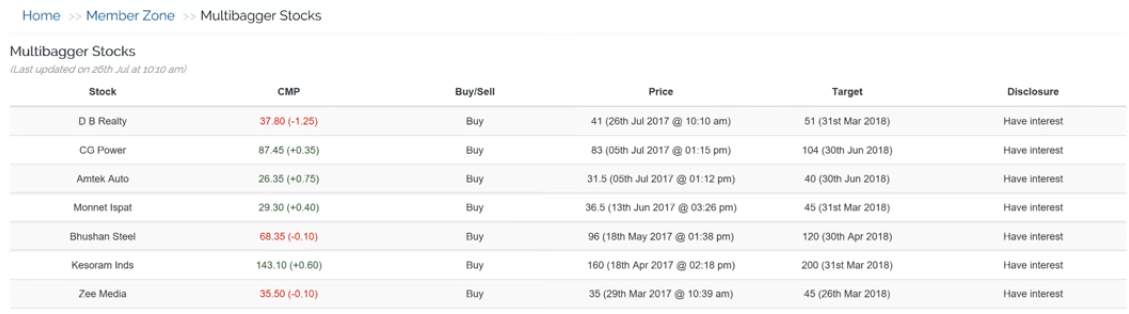

- Multibagger stocks

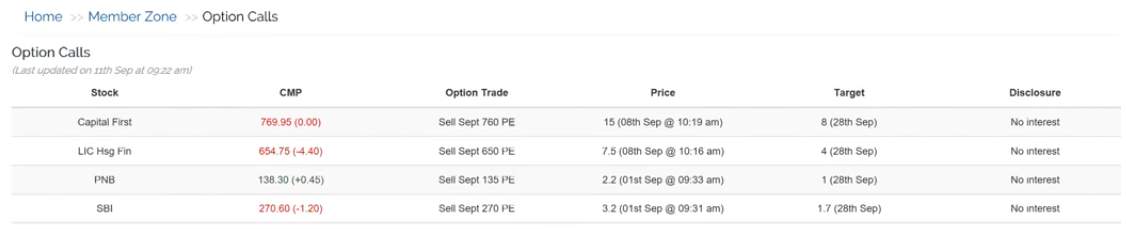

- Option calls

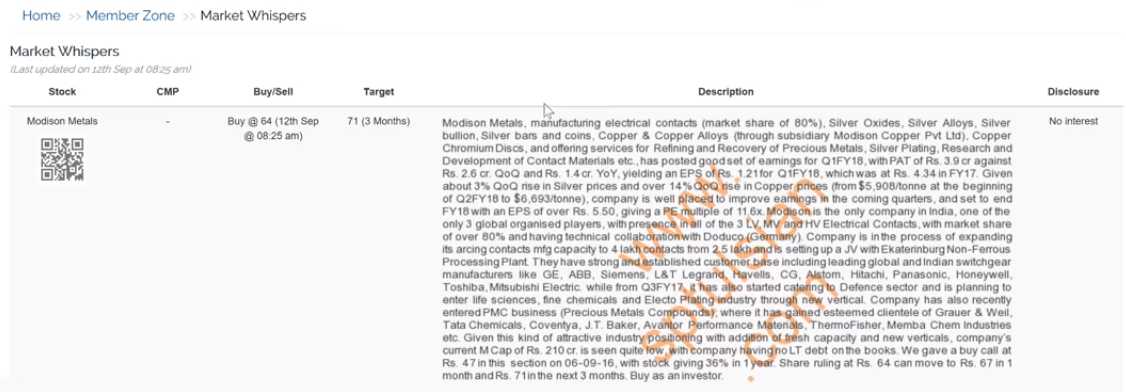

- Market whispers

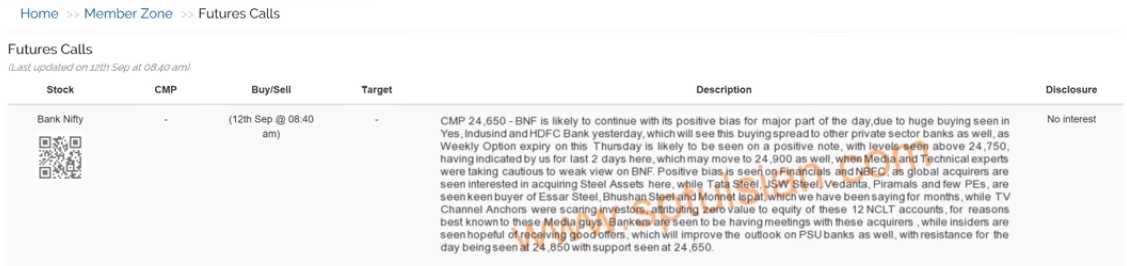

- Future calls

- Intraday calls

- Stock recommendations

All these recommendations and research tips are provided through multiple modes of communication including Email, SMS, Mobile app notifications and a website login.

SP Tulsian Intraday Tips

You can avail the intraday tips service, however, it is a paid one. You are supposed to pay a monthly fee of ₹2500 in order to avail this service.

The following data points are provided in each tip:

- Stock Name

- Current Market Price (CMP)

- Buy or Sell Action

- Price

- Target Price

- Disclosure, if any

Some of the guidelines one needs to follow while using these intraday trading tips are:

- You are not supposed to put more than 10% of your equity funds.

- Futures calls are of relatively higher risk.

- You will be provided with 6 to 8 calls in a month.

- Clients will be provided with exit calls as well.

SP Tulsian Subscription

If you subscribe to the services of this advisory, you will be provided access to the member zone. What that implies is that you get access to recommendations not only on the website but are regularly sent tips via App, email, phone and desktop notifications.

Furthermore, there is a segregation of different types of plans you can subscribe to, as mentioned below:

- Basic Plan

- Standard Plan

- Full Plan

If you are looking for recommendations (as mentioned in the Member Zone section above), then you can opt for the Basic Plan. However, you will not be provided with any stock query as this plan limits that particular service.

If you wish to avail all sorts of services including the stock query section, then you can opt for the Standard plan. However, you will get access to read the queries and not post anything under this plan.

Finally, if you prefer to post queries as well, then you can go for the Full Plan where you can post 8 queries over a period of 30 days and 24 queries within 90 days of time.

For pricing, refer to the next section of SP Tulsian charges.

SP Tulsian Fees

Moving ahead, let’s talk about pricing now.

As mentioned above SP Tulsian, as an advisory services firm, offers limited services to its clients. Thus, if you are looking for something specific in nature – for instance, if you want tips on agriculture-based commodity segment, you won’t really get such as service.

As far as pricing is concerned, it is based on the subscription period as shown below (GST Charges are levied separately at 18% on top of the prices shown below):

Although the pricing looks reasonable, it may be very tough for a beginner level trader to trust any advisory service without a free trial. Nonetheless, this could be the reason this advisory service has been trying to create a brand name in the industry so that the trust factor is taken care of.

If you are interested though, you are allowed to make the payment through the following options:

- Online Payment through net banking, credit/debit card

- Paypal

- Cheque/Demand draft

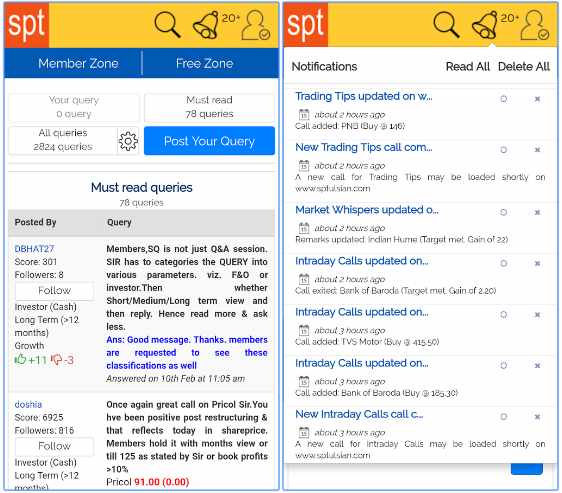

SP Tulsian App

The advisory firm offers mobile apps for both iOS and Android users with the following features:

- Quick tips on option calls, intraday and future trading segments

- Recommendations on Stocks for holding in your portfolio for a medium-term

- Regular tips on multi-bagger stocks

- Free zone available for users who have not paid for the subscription

- Regular updates provided to the app, available in both versions iOS and Android

This is how the SP Tulsian mobile app looks like:

At the same time, here are a few concerns that have been raised by the users of this app in the recent past:

- Auto-logouts implying the app logs out itself without any user action (at times).

- User experience/design can be improved, beginner traders tend to get confused

- Monitoring feature can be enhanced where users can keep an eye on selected stocks for a longer duration.

And this is how the app is rated at the Google Play Store:

SP Tulsian Contact

The advisory service provides you with different communication channels as listed below:

- Phone

As you can see, the service channels are very limited and SP Tulsian does not seem to employ quicker online mechanisms such as chat, email, Whatsapp etc for client resolutions.

Nonetheless, the advisory service provides contact details of its compliance officer. You can get in touch at the following communication details:

Ms Megha Tulsian (megha@sptulsian.com)

Furthermore, if you are still not satisfied with the response, you can choose to file a complaint at the advisory website itself.

Thus, from the hierarchy set-up, there are multiple levels of escalations SP Tulsian has put up.

SP Tulsian Disadvantages

Here are some of the concerns of using the services of SP Tulsian:

- No research service on specific trading segments

- No free trial available for the whole service set

SP Tulsian Advantages

At the same time, here are some of the merits of using the services of this advisory firm:

- Reasonable pricing plans

- Mobile app available for all types of notifications across different segments

- An old name in the advisory space

- Multiple modes of tips notifications through Email, SMS, website login and in-app notifications

With this, this review of SP Tulsian is complete. Feel free to share your experience or thoughts in the comments section below.

Are you looking to know about the Best stock market Advisory services in India?

Provide your details in the form below and we will set up a callback for you, right away:

Also Read:

You may also choose to have a look at some of the other advisory services available: