Stockaxis

List of all Advisory Firms Reviews

Stockaxis is a SEBI registered research and advisory firm and is based out of Mumbai for quite a while now. The advisory firm claims to design an auto-generated stock-rating system that runs at both fundamental and technical levels before providing recommendations to clients.

Stockaxis Reviews

The research firm also owns a mobile app with limited access to guest users and provides a decent user experience to get a detailed understanding of the market (more on that later).

In this review, we will be looking at the different services offered by Stockaxis to go along with their pricing plans, features, positives, negatives and more.

Stockaxis Research

Stockaxis offers 6 different plans for their clients and depending on one’s preferences, risk appetite and requirements, a specific plan can be selected. In most of the plans, the calls are made through SMS and email along with the services of a dedicated relationship manager.

Here are the details:

1. Multibagger Stocks

The plan is suitable for long-term investors looking for detailed fundamental analysis as part of the research. Users get access to 8-10 researched stocks over a period of a year, with a minimum investment period expectation of 18 to 24 months.

2. Wealth Builder

With Wealth builder, users are given access to fundamentally strong listed companies with a mid-term investment period of 6 to 9 months where users get around 12 to 15 stocks for a period of 1 year.

3. Premium Plus Stocks

This plan is suitable for High Net worth Individuals 0r specific retail investors as well who are looking for relatively low term investments. The investment period generally stays in the range of 3 to 6 months with users getting 1 or 2 tips every month or around 20 to 25 recommendations in a year.

The focus in this plan is around the technical base of fundamentally strong stocks.

4. Momentum Stocks

This plan is for clients who are looking for short-term quick profits in the bookings they make on the stock market. Since the calls are for quick-term, so the risk is relatively higher as compared to other plans and that is why users of this plan must have a bigger risk appetite than the ones opting for other plans.

Users get 15-20 stocks in a year with no specific exit duration. Depending on the market trend, users are intimated about when to exit and (re)enter the listing.

As the name suggests, this plan revolves around the blue-chip shares i.e. large-cap listed stock companies with sound fundamentals over the years. These are safe investments and that is why returns are relatively low. The suggested investment period is around 12 months in this plan.

6. All in One

If a user is looking to get all the services offered from StockAxis, there is an All-in-One plan as well offered at a discount price overall.

Stockaxis Pricing

After the details of different plans, here is the information about the damage(s) these plans will cause your pockets or in simple terms, the pricing of these plans with the duration:

| Plan Name | 3 months | 6 months | 1 year |

| Multi-Bagger Stocks | ₹20k | ₹30k | ₹40k |

| Wealth Builder | ₹20k | ₹30k | ₹40k |

| Premium Plus Stocks | ₹20k | ₹30k | ₹40k |

| Momentum Stocks | NA | NA | ₹30k |

| Blue Chip Stocks | NA | NA | ₹20k |

| All in One | NA | NA | ₹1.1L |

Stockaxis App

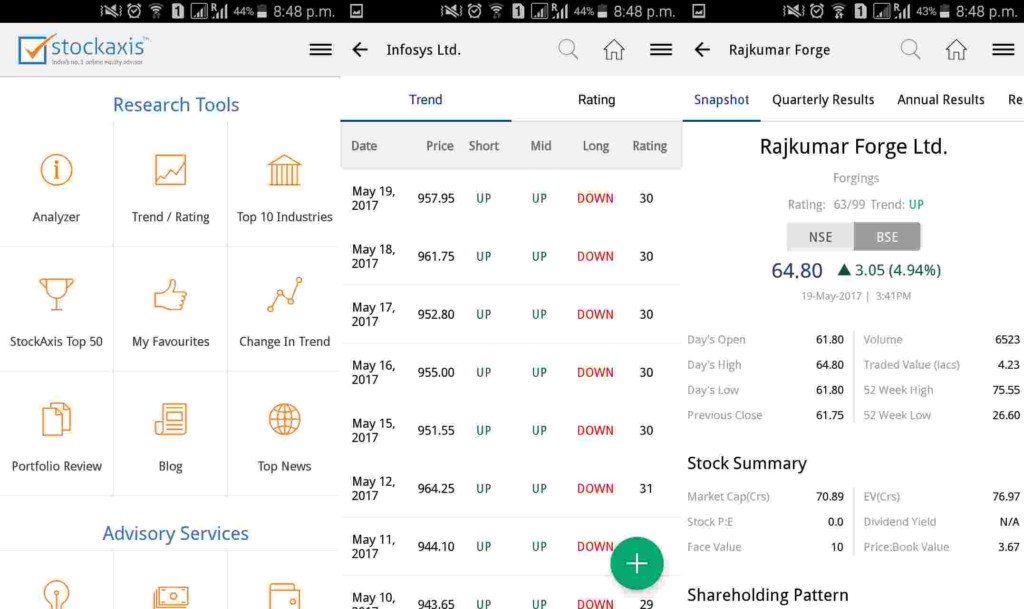

Stockaxis offers a mobile app for its clients as well as guest users with the latter getting access to basic features of the app. Some of the features offered in this mobile app are:

- Stock Analyzer

- Trend or Rating of stock

- Top 10 Industries and corresponding companies performing well in those industries

- Top 50 stocks as per StockAxis

- Trend Analysis

- Portfolio Review

- News

Registered users get access to advisory services within the mobile app as well apart from SMS and email form of communication.

The app is designed well and offers a simple clean user interface with the optimal user experience. Usability of the app is also just fine with a good number of features available for guest users too.

Some of the concerns in this app are:

- Basic app design and performance

- App size can be optimized for smoother usage

You can read this review in Hindi as well.

Stockaxis Subscription

Although the advisory service does a good job in marketing its plans and the premium subscription services, however, when it comes to execution, there are multiple flaws.

In a sense, it is disappointing since you expect the brand to stay on its promises. After all, they levy pretty hefty charges.

Although multiple users reported against the premium subscription plan, a quora-user provided complete screenshots and details on how his investments were mishandled by the advisory service.

Thus, Stockaxis service team needs to pull up its socks and stay on its promises that are done by their sales service. The subscription charges have already been discussed above.

Stockaxis Trial

The advisory service offers a small trial where they provide interested users with 2 recommendations, one each for multi-bagger and premium plus.

Post using this trial, you may choose to subscribe to any of the services offered by Stockaxis.

During the free trial, you will be assigned a relationship manager to get in touch with. Mostly, these are salespeople who are looking to close accounts.

Thus, only go ahead and finalize the subscription if you are completely satisfied with the trial tips.

Stockaxis Complaints

This advisory service has seen its complaints coming primarily from the tips accuracy perspective. A portion of traders has not had pleasant experience following the recommendations of Stockaxis.

Here are some of the top complaints raised:

- Exit calls are not provided at the right time.

- Limited accuracy of tips, especially at Intraday trading level.

- Customer service seems to be of low quality as rated by a lot of users.

Thus, like any other advisory service, Stockaxis has its share of flaws and it certainly needs to work on the areas mentioned above.

Stockaxis Disadvantages

Here are some concerns with this advisory firm for your reference:

- Not an exhaustive list of plans, as yet.

- No monthly plans are available.

Stockaxis Advantages

At the same time, you get the following benefits while using the services of this research firm:

- Reasonable Pricing

- Well designed mobile app and offers a decent number of features.

- Better than average customer service.

- As per the advisory claims, some of the tools provided are – Analyzer, Change in Trends, Rating, Market Intelligence etc.

If you are interested in the services, you would need the following documentation:

- PAN Card

- Aadhar Card

- Transaction Slip (post successful money transfer)

These documents can be shared through Email or Whatsapp.

Are you looking to know about the Best stock market Advisory services in India?

Provide your details in the form below and we will set up a callback for you, right away:

Also Read:

Here are some of the other advisories available for your reference:

Dear Sir,

I have already trading account . I want to Buy Premium Stock in equity Market from your Company. i want to know about Your Pricing of Premium Calls.

We have already taken the multibagger services for 1 year. if you interested then please Ping on 7977214401. cost sharing will reduce the membership plan for both.

People this is a pathetic company. I am already planning to report them to legal. I had paid for multi bagger annual subscription last year and if you look at the performance of all their recommendations , more than 90% have fallen like crazy with some high value stocks depreciating to 50% of their price . All they would do is accept their mistake and ask you to avail their service once more. Pathetic bunch of individuals run this organization

A FRAUDY MISLEADING COMPANY ALL RECOMMENDATIONS AVERAGE LOSS HEAVY

IREQUEST NOT TO SUBCRIBE

I TAKE LS SERVICE AND MULTIBEGGER

WITHIN 5 MONTH AND WITHIN TWO MONTH HEAVY LOSSES

MANIPULATED SERVICE I THINK THEY GIVE RECOMMENDATIONS TO SELL OR

BUY.SELFLY I THINK