When it comes to Options Trading, there are different complexities involved in terms of choosing a specific strategy that works the best for you.

At the same time, each strategy has its own set of advantages as well as limitations, thus making the concept of options trading even more challenging. Thus, in case you are looking to fit a particular strategy in your option trades, just check few areas before you make a choice.

In this detailed comparison of Bear Put Spread Vs Long Call Condor options trading strategies, we will be looking at the below-mentioned aspects and more:

- Current Market Position

- Your Risk Appetite

- Your Trading Experience

- Profit Potential

- Intention and Expectation of a trader

- Break-even point of your trade

Apart from the Bear Put Spread Vs Long Call Condor strategies, there are more than 25 comparisons of each of these strategies with other option strategies. With all these comparisons, you should be able to filter the ones that work the best for you.

Here is the detailed Bear Put Spread Vs Long Call Condor comparison:

| Comparison Aspect | Bear Put Spread | Long Call Condor |

| View |  |  |

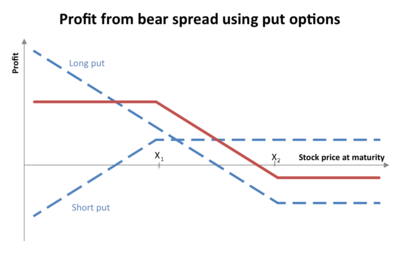

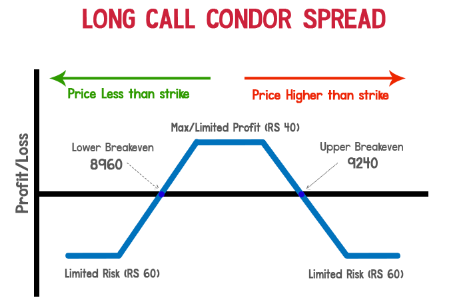

| Strategy Introduction | Bear Put Spread is a type of vertical spread wherein buys a put option hoping to make a profit due to the market decline, and at the same time writes another put option with...more | Long call condor is a direction-neutral strategy. It is not necessary to know the direction in which the market is expected to move. In fact, it works at the time when...more |

| Investor Obligation | If the prices fall as expected, the trader can make profits and limit his losses, but if the prices fall far more than expected then the trader won’t be able to make any profit. | The trader has the obligation to choose the Strike Prices optimally in order to see decent profits. |

| Market Position | Moderately Bearish | Neutral |

| Strategy Level Suitable for | Intermediates | Intermediates |

| Options Traded | Put | Call |

| Number of Positions | 2 | 4 |

| Action Needed | Buy ITM Put, Sell OTM Put | 1 Long ITM Call, 1 Short ITM Call, 1 Short OTM Call, 1 Long OTM Call |

| Risk for You | Limited | Limited |

| Profit Potential | Limited | Limited |

| Break Even Point for Investor | Strike Price of Long Put MINUS Net Premium | Lower Breakeven = Lower Strike Price + Net Premium Upper breakeven = Higher Strike Price - Net Premium |

| Investor Intention | Let Put Options Expire Worthlessly | Let Options Expire Worthlessly |

| Investor Expectation | Market Prices to go Down | Little or no movement in the price of the underlying asset |

| Strategy Summary | Limit Your Losses | Straight-Forward |

| Advantages | Limited Risk, Capped Losses | Profits in Low Volatilty, Limited Risk |

| Disadvantages | Limited Profit | High Premium, Selection of Correct Strike Prices is Paramount. |

| Market Scenarios - Profit | 1 | 1 |

| Market Scenarios - Loss | 2 | 1 |

| Also called as | NA | NA |

| More Comparisons | Bear Put Spread Vs Short Put | Long Call Condor Vs Short Put |

| Bear Put Spread Vs Long Combo | Long Call Condor Vs Long Combo | |

| Bear Put Spread Vs Synthetic Call | Long Call Condor Vs Synthetic Call | |

| Bear Put Spread Vs Long Put | Long Call Condor Vs Long Put | |

| Bear Put Spread Vs Long Call | Long Call Condor Vs Long Call | |

| Bear Put Spread Vs Covered Call | Long Call Condor Vs Covered Call | |

| Bear Put Spread Vs Covered Put | Long Call Condor Vs Covered Put | |

| Bear Put Spread Vs Protective Call | Long Call Condor Vs Protective Call | |

| Bear Put Spread Vs Short Box | Long Call Condor Vs Short Box | |

| Bear Put Spread Vs Long Call Condor | Long Call Condor Vs Short Call | |

| Bear Put Spread Vs Short Call Condor | Long Call Condor Vs Short Call Condor | |

| Bear Put Spread Vs Box Spread | Long Call Condor Vs Box Spread | |

| Bear Put Spread Vs Short Strangle | Long Call Condor Vs Short Strangle | |

| Bear Put Spread Vs Long Strangle | Long Call Condor Vs Long Strangle | |

| Bear Put Spread Vs Collar Strategy | Long Call Condor Vs Collar Strategy | |

| Bear Put Spread Vs Long Straddle | Long Call Condor Vs Long Straddle | |

| Bear Put Spread Vs Short Straddle | Long Call Condor Vs Short Straddle | |

| Bear Put Spread Vs Long Call Butterfly | Long Call Condor Vs Long Call Butterfly | |

| Bear Put Spread Vs Short Call Butterfly | Long Call Condor Vs Short Call Butterfly | |

| Bear Put Spread Vs Bear Call Spread | Long Call Condor Vs Bear Call Spread | |

| Bear Put Spread Vs Short Call | Long Call Condor Vs Bear Put Spread | |

| Bear Put Spread Vs Bull Call Spread | Long Call Condor Vs Bull Call Spread | |

| Bear Put Spread Vs Bull Put Spread | Long Call Condor Vs Bull Put Spread |

Thus, with this, we wrap up our comparison of Bear Put Spread Vs Long Call Condor option strategies.

At the same time, if you are in a neutral market situation and have a limited risk appetite, then Long Call Condor may suit you well. You need to know that this strategy provides limited level profit only.

At the same time, if you are looking to make some money from a market decline and can take some basic risk – then Bear Put Spread options strategy makes sense to you.

This needs to be known that the profit you get using both of these strategies is also limited in scope.

Furthermore, as told above, it also depends on the market situation.

In case you are looking to trade in options segment or share market in general, let us assist you in that. Just fill the form below and we will take you to the steps ahead.