When it comes to Options Trading, there are different complexities involved in terms of choosing a specific strategy that works the best for you.

At the same time, each strategy has its own set of advantages as well as limitations, thus making the concept of options trading even more challenging. Thus, in case you are looking to fit a particular strategy in your option trades, just check few areas before you make a choice.

In this detailed comparison of Covered Put Vs Long Call Butterfly options trading strategies, we will be looking at the below-mentioned aspects and more:

- Current Market Position

- Your Risk Appetite

- Your Trading Experience

- Profit Potential

- Intention and Expectation of a trader

- Break-even point of your trade

Apart from the Covered Put Vs Long Call Butterfly strategies, there are more than 25 comparisons of each of these strategies with other option strategies. With all these comparisons, you should be able to filter the ones that work the best for you.

Here is the detailed Covered Put Vs Long Call Butterfly comparison:

| Comparison Aspect | Long Call Butterfly | Covered Put |

| View |  |  |

| Strategy Introduction | Long Call Butterfly is the options trading strategy which is used when the trader has a neutral outlook towards the market and expects the prices to remain range-bound...more | Covered Put is the options trading strategy which involves shorting the underlying asset, along with selling a put option on the same number of shares. By doing this, the trader is able to...more |

| Investor Obligation | Create Bull Spread when High Market Expectations, Create Bear Spread when Low Market Expectations. | If the price of the stock goes below the strike price of the put option, the put option will be expired and will have to be brought back. |

| Market Position | Neutral | Neutral or Slightly Bearish |

| Strategy Level Suitable for | Intermediates | Experts |

| Options Traded | Call | Put |

| Number of Positions | 4 | 2 |

| Action Needed | 2 ATM, 1 ITM, 1 OTM Calls | Short on Underlying and Short Put |

| Risk for You | Limited | Unlimited |

| Profit Potential | Limited | Limited |

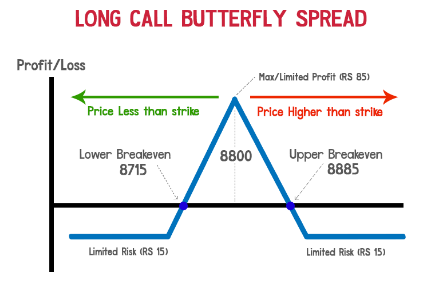

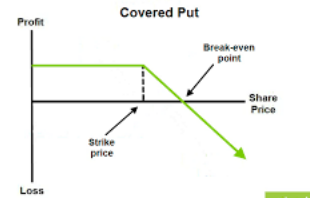

| Break Even Point for Investor | Lower Break-even = Lower Strike Price + Net Premium Upper Break-even = Higher Strike Price - Net Premium | Futures Price + Premium Received |

| Investor Intention | Options expire worthless except the one with the lower strike price | Let Options Expire Worthlessly |

| Investor Expectation | No Movement in Price of the Underlying Asset | Prices of Assets Go Down Slightly |

| Strategy Summary | Effective | Steady Profits with Caution |

| Advantages | Profits in Low Market Volatility, Limited Risks | Income Generation, Reduced Losses |

| Disadvantages | Limited Profit, High Premium | Unlimited Risk in specific situations |

| Market Scenarios - Profit | 1 | 2 |

| Market Scenarios - Loss | 1 | 1 |

| Also called as | NA | Married Put |

| More Comparisons | Long Call Butterfly Vs Short Put | Covered Put Vs Short Put |

| Long Call Butterfly Vs Long Combo | Covered Put Vs Long Combo | |

| Long Call Butterfly Vs Synthetic Call | Covered Put Vs Synthetic Call | |

| Long Call Butterfly Vs Long Put | Covered Put Vs Long Put | |

| Long Call Butterfly Vs Long Call | Covered Put Vs Long Call | |

| Long Call Butterfly Vs Covered Call | Covered Put Vs Covered Call | |

| Long Call Butterfly Vs Covered Put | Covered Put Vs Short Call | |

| Long Call Butterfly Vs Protective Call | Covered Put Vs Protective Call | |

| Long Call Butterfly Vs Short Box | Covered Put Vs Short Box | |

| Long Call Butterfly Vs Long Call Condor | Covered Put Vs Long Call Condor | |

| Long Call Butterfly Vs Short Call Condor | Covered Put Vs Short Call Condor | |

| Long Call Butterfly Vs Box Spread | Covered Put Vs Box Spread | |

| Long Call Butterfly Vs Short Strangle | Covered Put Vs Short Strangle | |

| Long Call Butterfly Vs Long Strangle | Covered Put Vs Long Strangle | |

| Long Call Butterfly Vs Collar Strategy | Covered Put Vs Collar Strategy | |

| Long Call Butterfly Vs Long Straddle | Covered Put Vs Long Straddle | |

| Long Call Butterfly Vs Short Straddle | Covered Put Vs Short Straddle | |

| Long Call Butterfly Vs Short Call | Covered Put Vs Long Call Butterfly | |

| Long Call Butterfly Vs Short Call Butterfly | Covered Put Vs Short Call Butterfly | |

| Long Call Butterfly Vs Bear Call Spread | Covered Put Vs Bear Call Spread | |

| Long Call Butterfly Vs Bear Put Spread | Covered Put Vs Bear Put Spread | |

| Long Call Butterfly Vs Bull Call Spread | Covered Put Vs Bull Call Spread | |

| Long Call Butterfly Vs Bull Put Spread | Covered Put Vs Bull Put Spread |

Thus, with this, we wrap up our comparison of Covered Put Vs Long Call Butterfly option strategies.

At the same time, if you are in a neutral market situation and want to take a limited risk, then Long Call Butterfly is one of the options trading strategies you can look out for.

The profit you get using this strategy is also limited in scope.

If you are looking at a bearish market momentum and are open towards high risk with consistent but limited profits, then Covered Put is suitable for your trading style.

Furthermore, as told above, it also depends on the market situation.

In case you are looking to trade in options segment or share market in general, let us assist you in that. Just fill the form below and we will take you to the steps ahead.