Dematerialisation Meaning

More on Demat Account

What is Dematerialisation Meaning? What does it have anything to do with the Stock market space?

Let’s take a step back in time to understand this mysterious term.

So, there was a time when investors used to carry shares in physical files, put them into suitcases and go to their stockbrokers in order to sell them off. Similarly, when they bought any shares, you would get heaps of files from the broker which they needed to store.

Of course, they had the option to let those stay with the broker itself, but won’t that be a risky affair?

Then came the concept of Dematerialisation and in this review, that is what we will do – we will learn the Dematerialisation meaning!

Wait, what?

The word “Dematerialisation” might look like a heavy technical term but Dematerialisation meaning is really simple. It is basically a way of converting your stocks into a non-physical or non-tangible entity.

Once you Dematerialise your shares, there is no further need to access your stocks physically. In fact, all these shares are moved to a Demat Account that can be accessed online, anytime, anywhere without anybody else’s dependency.

It is something like you do with your banking account.

If you use internet banking, then you actually credit and debit ‘digits’ and not any physical money. The only difference between a bank account and a demat account is bank account takes care of money while the demat account keeps your investment products such as Equity stocks.

The Demat accounts are managed by Depositories only.

In India, there are 2 such Depositories namely NSDL (National Securities Depository Limited) and CDSL (Central Depository Services Limited). In case you want to open a demat account, then you need to get in touch with a depository participant (or a stockbroker) that is a member of any of the depositories mentioned above.

However, the shares that are getting dematerialised and moved into your demat account must be in your name.

What did we tell you? Isn’t Dematerialisation meaning really simple, right?

The process of Dematerialisation might look cumbersome to you or the Dematerialisation meaning might seem complex, but it is actually pretty straightforward. And simple too! Especially if you have the habit of using the internet for the most part of your daily routine be it booking a cab, ordering food and so on.

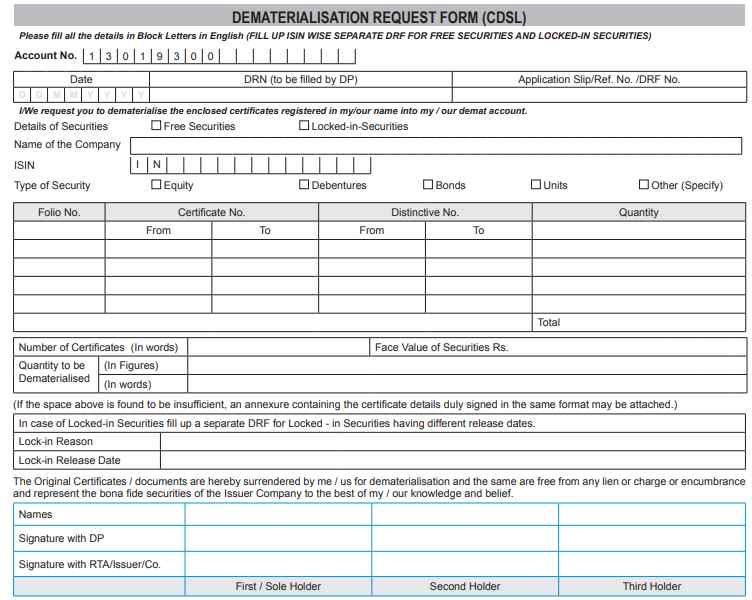

In order to dematerialise your physical shares, as the first step, you need to fill up the Dematerialisation request form. This is how a Dematerialisation form looks like:

Some of the basic details you need to fill up in this form include:

- Name of the Company where you have invested

- Type of security out of Equity, Debentures, bonds etc.

- Details of the shares bought with information on Folio number, Quantity, Purchase date etc.

- Monetary value/face value of shares

- Requisite signatures

There will be specific fields where signatures and inputs of your DP and its corresponding executive will be needed as well.

Feel free to refer to this CDSL Dematerialisation form in order to clearly understand how a CDSL demat account actually works.

You need to submit your share certificates along with this Dematerialisation form and make sure you write “Surrendered for Demat Account” on top of each of the stock certificates before you submit those to the stockbroker.

Now, the stockbroker will need to process this request to the company, registrars and transfer agents in parallel.

Once the process is complete, the shares in the form of physical files are destroyed by the stockbroker. The depository will be notified once the shares are dematerialised by the stockbroker.

Once the notification is received by the depository, a verification of the Dematerialisation post-checking will be sent back to the depository participant.

Generally, stockbrokers take a duration of 2 to 4 weeks or so for the whole process of Dematerialisation to complete and credit the respective shares into your demat account, although it can be less than that. Then those shares will be reflected in the online demat account.

Dematerialisation Example

Let’s take a basic example to understand the Dematerialisation meaning even further.

For instance, let’s say Rakesh’s father invested in a stock of MRF in 2001 and he has all the shares in physical files.

It’s been a long time and they have been able to keep those files safely but they always feel insecure about the safety of these files. Now, this is where Dematerialisation comes in.

Rakesh can simply call up a stockbroker and open a demat account.

The broker will send an executive who will learn the concern and then, will suggest going ahead with the demat account where all these physical files get converted to electronic entries with a depository associated with the stockbroker.

Rakesh, with the consent of this father, confirms to go ahead with the demat account and get DIS slips in return of the physical shares they are looking to convert.

Now, post Dematerialisation, all the shares of MRF will be linked to the demat account in the name of Rakesh’s father.

Dematerialisation Types

Primarily, there are two types of Dematerialisations done.

First is the one where neither the client nor the depository participant keeps any physical scrip. Here an electronic ledger is maintained by the DP and the client can access it using private credentials.

The second type is the one where depository vaults are maintained in order to store the physical scrips. In parallel, the scrip entries are maintained at the server level as well.

Thus, as a trader, you can discuss with your stockbroker what kind of Dematerialisation you are looking for. The charges may vary although a few stockbrokers provide this facility for free as well.

Since 2018, the Dematerialisation of shares has been made compulsory by SEBI. There have been a lot of mandates added by the stock market regulator in order to maximize the usage of the online demat account format.

Some of those are listed below:

- A public company, if looking to issue new securities, can only do so in the dematerialised format.

- You cannot transfer physical securities. This has been added as a sub-rule under the existing 9A rule.

- If you are holding physical securities, you cannot subscribe to new ones unless you have the current ones in the dematerialised format.

- The company that you hold the stock of will assist you in getting your shares dematerialised as per the communication by SEBI.

Dematerialisation Charges

There are generally no charges levied by any of the depositories, however, different stockbrokers may charge a small amount depending on the number of shares to be dematerialised and/or the overall amount of the shares involved in the Dematerialisation process.

It is advised you check with your broker and seek a written document that confirms the said pricing.

Dematerialisation Advantages and Disadvantages

Let’s quickly look at some of the advantages of Dematerialisation:

- No risk of forgery, theft or loss of the securities you own.

- Access to your shares is easy and can be done online.

- Transfer of shares can be done online or through your stockbroker.

- Even for the regulatory bodies, with Dematerialisation, the process of handling the orders and linked entities has become much simpler.

- There is no stamp duty that you need to pay for securities that are electronic in nature.

- Unlike in the case of physical shares, you can trade (buy shares or sell shares) stocks even in a single unit which is not possible if you use physical shares.

- Pledging and un-pledging your shares is easier in a demat account rather than the shares in physical form.

You can also check this detailed review on the benefits of demat account for further reference.

At the same time, there could be few concerns with the Dematerialisation of the shares. Let’s discuss those here:

- You might not be able to control yourself with the frequency of your trading.

- Few investors might find the process of Dematerialisation a little cumbersome

- In case you are someone who is not tech-savvy, then you will be relatively more prone to internet fraud.

- Most likely, you will need to pay a demat account opening fee along with annual maintenance charges (AMC).

For more information, you can check detailed information on the disadvantages of demat account as well.

Conclusion

In the end, it can be said that the Dematerialisation of shares has huge advantages against the earlier convention of holding the shares in the physical format.

Irrespective of the fact, that you trade in the stock market on a daily basis or you invest for years, having a demat account with the Dematerialisation of shares done definitely makes your life hassle-free.

Furthermore, if you are interested to open an account?

Enter Your details here and we will arrange a FREE Call back.