HDFC Life IPO Review

Check All IPO Reviews

HDFC Life IPO Performance Overview

HDFC Life Day 3 Performance

HDFC Standard Life Insurance Company’s initial public offer (IPO) was subscribed 4.89 times on the closing day of bidding on Thursday.

The Rs 8,695-crore IPO, received bids for 1,07,50,87,700 shares against the total issue size of 21,97,59,218 shares, according to NSE data till 1915 hrs.

HDFC Life Day 2 Performance

The HDFC Life IPO was subscribed 1.15 times of 115% of its original quota on day 2.

The IPO, estimated to raise Rs 8,695 crore, received bids for 25,17,92,650 shares against the total issue size of 21,97,59,218 shares, NSE data till 1630 hrs showed.

HDFC Life Day 1 Performance

The ₹8,695-crore initial public offer (IPO) by HDFC Standard Life Insurance Company got 46 per cent subscription on the first day of the bidding process on Tuesday, which is actually a pretty good start.

Data available with the NSE showed that the issue received bids for 10,03,43,050 shares till 5.00 pm against the issue size of 21,97,59,218 shares.

If you are interested, you still have 2 more days to go as the IPO is open for bidding until 9th November 2017.

HDFC Life Background

HDFC Life is one of the leading insurance companies in India which offers a wide range of individual and group insurance solutions. HDFC Standard Life Insurance Company Limited is a joint venture between Housing Development Finance Corporation Limited and Standard Life Aberdeen plc. Housing Development Finance Corporation Limited is one of the leading housing finance institutions of India and Standard Life Aberdeen plc. is one of the largest investment companies in the United Kingdom.

HDFC Life was established in the year 2000 and has pan India presence with 414 branches. The company also has over 11,200 branches all over India with its top 15 bancassurance partners. 61.65 % of the stake is held by HDFC, 35% is held by Standard Life, and the rest is held by others. The company also has two wholly owned subsidiaries HDFC Pension Management Company Ltd. and HDFC International Life and Re Company Ltd.

Important HDFC Life IPO Data Points

HDFC Life one of the top three life insurers in terms of profitability is going to open its INR 8,700 crore Initial Public Offering (IPO) on Tuesday 7th November 2017.

The purpose of IPO is to raise funds to maintain the adequate funds for the growth. The issue consists total 299,827,818 shares of which 191,246,050 shares are by HDFC and 108,581,768 equity shares are by Standard Life. In the public issue, HDFC is diluting 9.55% of its stake, and Standard Life is offloading 5.42% of its shares. So the total dilution of HDFC Life will be 14.92% of the stake.

The Price band per share is fixed between INR 275 to INR 290 per share. The minimum bid lot is 50 shares so the investors who want to buy share can make a bid in the multiple of 50.

According to Amitabh Chaudhry MD & CEO of HDFC Life, the issue is attractively priced for the retail investors and they should not look for the first-day pop and should invest for the long term. On 17th November HDFC Life will get listed on National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

HDFC Standard Life is fifth insurance company heading for an Initial Public Offering (IPO). The IPO of HDFC Life was delayed because of market conditions and due to the cancellation of the merger of HDFC Life and Max Life. If the merger of HDFC Life and Max Life would have been coming into existence than HDFC Life was to be automatically listed on the stock exchanges because of reverse listing.

The merger was extremely complex structure, so they didn’t get approval from the Insurance Regulatory and Development Authority of India. If HDFC Life and Max Life get the required regulatory approvals, then they will again like to evaluate the option of the merger.

Lets talk some numbers here:

| IPO Size | INR 8,700 crore |

| Total Number of Share | 299,827,818 |

| Face Value | 10 |

| IPO Price Band | INR 275-290 |

| Bid Lot | 50 |

| Amount for 50 shares | INR 14500 |

HDFC Life Revenue and other financial details

HDFC Life is the third largest private insurance company in the country which has 16.5% of total premium collected by the private sector insurance companies in the financial year 2017. HDFC Life has a more balanced product mix HDFC Life has a higher proportion of term insurance and annuities which are considered as safe and low-risk products. The higher percentage of these products reduces the risk of market volatility.

The total income of the company has also doubled to INR 30,544.4 crore between FY2013 and FY2017. Net profit also increased with the same magnitude to INR 886 Crore.

The table below will give you a quick idea about the performance of HDFC Life in the past some years.

All Numbers are in INR Crore:

| FY2015 | FY2016 | FY2017 | |

| Net Premium Income | 14,763 | 16,179 | 19,275 |

| Profit After Tax (PAT) | 786 | 818 | 892 |

| Growth in Profit | NA | 4% | 9% |

The revenue of the company is growing at a fast pace and already doubled from FY2013. The company’s net income has also maintained the same pace of the growth. According to the above table, the growth in the net profit is even increasing over the years. The VNB margin (Value of New Business) has also increased from 18.5% in FY2015 to 22% in FY2017 because of the better persistency ratio, cost efficiencies, and selling balanced product mix.

The product mix of HDFC Life is around 53% in favor of the non-linked product.

IPO Events

HDFC Life IPO will open on Tuesday 7th November 2017 and close on Thursday 9th November 2017. The company is also getting a very good response from anchor investors including Global investors. The issue will be open for anchor investors on 6th November 2017.

The allotment of share will be on 14th November 2017. If you have applied for the shares and the shares are not allotted to you, then you will get your money refunded on 15th November 2017.

| IPO Open Date | 07-Nov-17 |

| IPO Close Date | 09-Nov-17 |

| Basis of Allotment | 14-Nov-17 |

| Refunds | 15-Nov-17 |

| Credit to Demat accounts | 16-Nov-17 |

| Listing to Stock Exchanges | 17-Nov-17 |

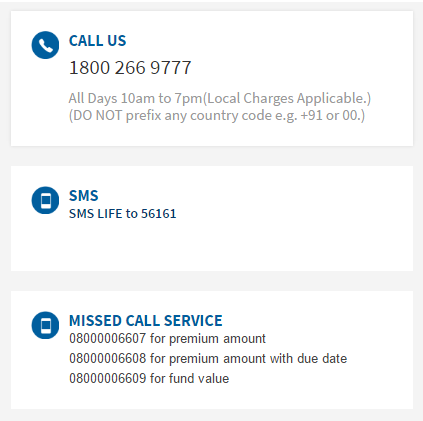

HDFC Life contact information for Individuals

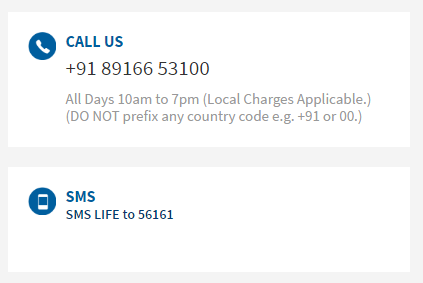

HDFC Life contact information for NRIs

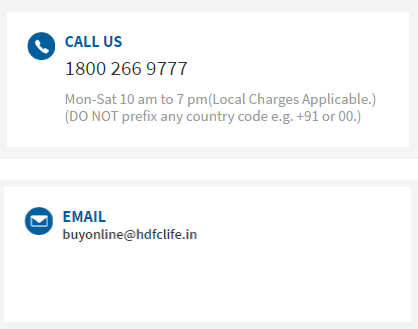

HDFC Life contact information for Groups

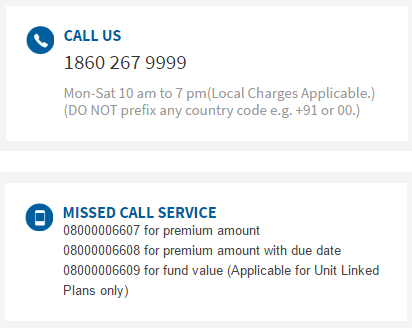

HDFC Life contact information for Policy Holders

The website also has a chat option so you can go to the website of HDFC Life and initiate a chat with the company executives.

Our Recommendation

HDFC Life IPO is coming at the time when the last three insurance IPOs have demonstrated weak listing day performance. Shares of General Insurance Corp. of India Ltd. and SBI Life insurance Co. Ltd. are trading below their IPO price. The shares of recently listed ICICI Lombard General Insurance Co. Ltd. are trading 2.9% above its issue price.

ICICI Lombard went public in September this year. According to the chairman of HDFC Deepak Parekh, the pricing of the share is right, and insurance is a long-term sector so investors should not think to make money on the first day of the listing. The strong performance of HDFC Life will support the increase in the share price in the long run. In the fiscal year 2017, the new business of HDFC Life has grown 34% to INR 8,696.3 crore from the previous year.

India is a leg behind in the penetration of Insurance. Global life insurance penetration benchmark is 6.2% of the GDP. But the life insurance penetration rate of India in 2017 is 3.42% which is far below the global average. So in the near future because of development and awareness, the insurance sector is expected to see the robust growth.

HDFC Life has a strong balance sheet and solid profitability. The solvency ratio of the company is 200.5% as on 30 September 2017 which is above the minimum 150% solvency ratio required under IRDA regulations. The price band of shares INR 275-290 values the business at a P/E ratio of 62.5-65.91 which is much higher than the recently listed ICICI Prudential’s 33.4 and closer to the SBI Life’s 69.4. The return on net worth is 25.6 % which is better than SBI Life’s 18.6% and little below than ICICI Prudential’s 28.7. The Net Asset Value of HDFC Life is 19.1 per share, and the Price/Book Value Ratio is 15.2 which is higher than SBI Life’s 11.6 and ICICI Prudential’s 8.7.

HDFC Life is well positioned in the insurance sector and enjoying the years of high growth and profitability. The growing business and better product mix of HDFC Life justify the premium valuation of the share price. The share is suitable for the investors who have a high-risk appetite with long-term horizon.

If you are looking to open an account, you can provide your details in the form below: