Bear Call Spread

All Option Strategies

Bear Call Spread is one of those options trading strategies that is confusing to a lot of beginner level traders. The bigger problem is while they “think” they are using Bear Call spread, most of the times, they move in exactly the opposite direction of it.

Bear Call Spread Basics

Trading the options on their own can be very challenging and complicated. A successful and efficient way of trading options is to use Options Spreads.

They are formed by combining two or more options in the form of legs under which options contracts are bought and sold equally, but with different strike prices, sometimes different options expiration dates and also different underlying assets.

Vertical spreads, in particular, are the spreads in which one option is bought and the other is sold simultaneously, with the same underlying asset and same expiration date, but different strike prices.

Of the spreads most commonly used, one of the best one is the Bear Call Spread.

The bear call spread consists of two calls, both with the same underlying asset and expiration date, but the strike price of the call options bought is less than the strike price of the same number of call options sold. Like most of the spread strategies, it is a limited-risk limited-reward strategy.

The exact construction of a bear call spread involves buying an out-of-the-money call option and selling a higher strike price in-the-money call option of the same asset with the same expiration date simultaneously. As a thumb rule, the expiration date must be about 30-45 days away in order to be able to take advantage of the accelerating time decay.

The purpose of the short call is to generate income, and that of the long call is to limit the risk.

Bear Call Spread comes into play when the trader is expecting the market to go down gradually, but moderately. So, this is also suitable for a moderately bearish forecast, just like the bear put option. The payoffs from both bear call spread and a bear put spread are similar, but the situations in which both can be used differ.

Bear put spread is used for the net debit, whereas the bear call spread is used for a net credit, which means that upfront payment is received at setting up a bear call spread.

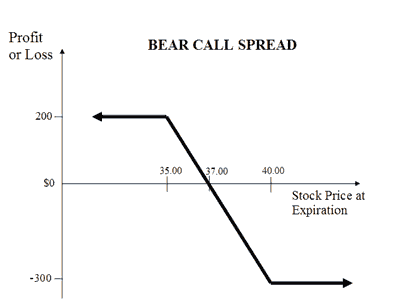

The maximum profit obtained from a bear call spread is the net credit received, which is the difference between the premium received and premium paid; and the maximum loss of this strategy is equal to the difference between spread and net credit.

Bear Call Spread Example

- Let us consider that Nifty Spot is at 6222 on April 4, 2018, and the OTM call option is at ₹6400 with a premium of ₹28 to be paid and the ITM call option is at ₹6100 with a premium of ₹126 to be received. The trader expects the market to go moderately down. The cash flow of this transaction is the net positive of ₹(126-28) = ₹98. There is a net credit to the account in the beginning.

- If the market closes at 6500, which is higher than the long call, the intrinsic value of 6400 call option will be 6500-6400= 100, and after paying a premium of ₹28, the net payoff will be ₹(100-28)= ₹72; and the 6100 call option will have an intrinsic value of 6500-6100= 400 and the net loss will be ₹(126-400)= -₹274. The net payoff of the strategy will be ₹(-274+72) = -₹202. So, the strategy will cause loss if the market goes up instead of going down, but the loss is restricted to spread-net credit=₹202.

- If the market closes at Rs 6198, it is the breakeven point. The 6400 call option will have no intrinsic value and premium of 28 will be lost. The 6100 call option will have an intrinsic value of 6198-6100= ₹98, and after paying a premium of ₹126, the net payoff will be 126-98= 28. The net payoff of the strategy will be ₹(28-28) = 0. At this point, there is no profit or loss.

- If the market closes at 6000, which is less than the short call, both the call options will expire worthless with no intrinsic values. The premium of ₹126 will be received and a premium of ₹28 will be paid and the net payoff will be a profit of ₹126-28= ₹98. So, the strategy gives a profit when the market goes down as expected and the maximum profit is also restricted to the net credit of ₹98.

Bear Call Spread Pros and Cons

Based on the above-mentioned example, we can explain the benefits and the drawbacks of entering into a bear call spread strategy.

- The strategy works when the market is moving down.

- The advantage is that the maximum loss is capped at the difference between the spread and the net credit of the strategy, which is ₹202 in the above case.

- The drawback is that profit is also capped, and it is equal to the net credit of the strategy, which is equal to ₹98 in this case.

So, in case you are looking to gear up for the share market trading, and especially for derivatives trading – just fill in the details below.

We will arrange a callback for you to get you started:

More on Share Market Education:

You can read this review in Hindi as well.