Covered Put

All Option Strategies

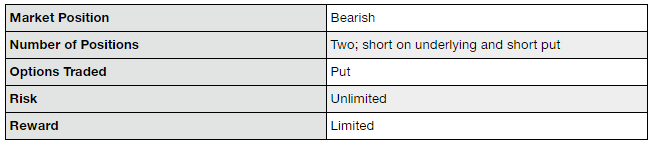

Covered Put is the options trading strategy which involves shorting the underlying asset, along with selling a put option on the same number of shares. By doing this, the trader is able to generate income in the form of premium for writing the put option.

The covered put strategy is constructed by taking a short position on the stock and combining it with writing a put option of the same stock.

The writing of put option gives the strategy a net credit. If the stock price at the time of options expiration is more than the strike price of the put option, the option can expire worthlessly, but if the stock price is less than the put strike price, the option needs to be brought back.

The covered put is used when the trader is neutral or slightly bearish towards the market and expects the price of the underlying to move down to some extent.

In this case, while holding a short position on the underlying, the trader also writes a put option on the same underlying and earns a profit. The risk, however, is that if the price of the underlying rallies upside, the trader will incur huge losses.

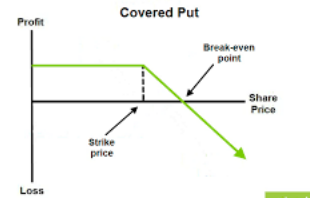

The covered put strategy has a limited profit and unlimited risk profile.

The profit is only limited to the amount of premium received on writing the put option. The risk is unlimited and will keep on increasing as the price of the underlying keeps going up.

Therefore, the strategy needs to be used only when the trader is certain that prices will either remain stable or go down. The neutral or slightly falling stock is compatible with this strategy, whereas a bullish stock is highly incompatible with it.

Covered Put Timing

The appropriate time to use the covered put strategy is when the trader is neutral or slightly bearish towards the market.

He is expecting the prices of the underlying to go down slightly and wants to make a profit on it. The strategy is, however, completely unsuitable when the price of the security is expected to go up. In that case, it will lead to unlimited losses.

The covered put strategy ensures that profit is earned if the stock prices move down.

It also moves the breakeven point higher and giver a wider margin of error. This means that before the trader starts incurring losses, the stock price has to move higher than the amount of premium received.

The premium received by writing the put option helps to compensate a part of the loss or may increase the profit by the same amount.

The covered put strategy has a limited profit profile. In the absence of the covered put, the trader can keep on earning profits as the price of the underlying keeps going down.

However, due to the presence of the put option in the covered put strategy, if the price of the stock goes below the strike price of the put option, the put option will be expired and will have to be brought back. The gains from shorting the stock will be balanced out by the loss in buying back the put, and thus, the profit becomes capped.

The risk profile is unlimited. If the price of the underlying stock goes up, which is against the expectations of the trader, the strategy will generate huge losses. Since there is no upper limit to the price of the underlying, there will be no upper limit to the loss incurred.

The premium received is not enough to balance out the losses.

Covered Put Example

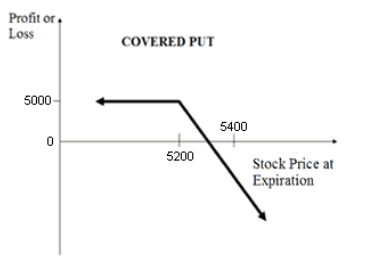

Let us consider an example at NIFTY to understand the covered put strategy.

We assume that NIFTY is trading at 5200 points currently and the trader expects the prices to go down slightly. In this scenario, a covered put strategy is created by shorting one NIFTY futures and writing one at-the-money put option at 5200 for a premium of ₹100.

The lot size is considered to be 50.

Scenario 1:

If NIFTY closes at 5000, which is less than the current price, the strategy will generate profit.

The short position will generate a profit of (5200-5000)= ₹200. However, the put option will get exercised and will generate a loss of (5200-5000)= ₹200, because the put option will need to be brought back.

The premium of ₹100 will also be received.

The net profit will be 200-200+100= 100*50= ₹5,000.

If the covered put was not used, the trader would have made a profit of (5200-5000)= ₹200*50= ₹10,000. Thus, the covered put caps the profit that can be earned.

Scenario 2:

If NIFTY remains at 5200, the strategy will generate a profit of (5200-5200)= ₹0 and the premium of ₹100 will be received.

The total profit will be 100*50= ₹5,000.

Scenario 3:

If NIFTY closes at 5400, which is higher than the current price, the strategy will generate a loss.

The loss will be equal to (5400-5200)= ₹200 and premium of ₹100 will be received. The net loss will be -200+100= -₹100.

The total loss will be 100*50= ₹5,000.

This loss will keep on increasing as the price of the stock increases.

If covered put was not used, the loss would have been equal to (5400-5200)= ₹200*50= ₹10,000.

The loss would have been higher as the premium would not compensate for a part of it.

Covered Put Advantages

There are the following advantages of using the covered put option in your trades:

- The strategy has a net credit and can generate income in the form of receiving the premium.

- The covered put can also help to reduce the losses by the amount of premium received.

Covered Put Disadvantages

Here are some of the concerns of using covered put as your options trading strategy:

- The strategy may lead to unlimited risk if the price of the underlying rallies up.

Covered Put in a Nutshell

Thus, in essence, the covered put strategy should be used very cautiously as it has the potential of unlimited losses, but the profits are capped.

It should only be used by experienced traders when they are very convinced of the slight downward movement in the prices.

In case you are looking to get started into options trading or share market investments in general, let us assist you in taking it forward.

More on Share Market Education:

If you wish to learn more about options strategies or stock market education in general, here are a few references for you: