Long Call Butterfly

All Option Strategies

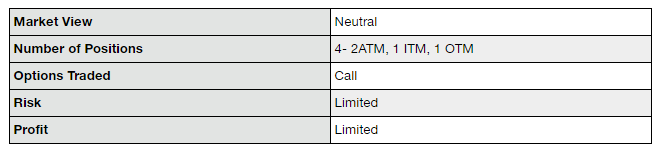

Long Call Butterfly is the options trading strategy which is used when the trader has a neutral outlook towards the market and expects the prices to remain range-bound. The trader believes that there will not be much movement in the prices of the underlying asset.

In this case, the trader can still make a profit, without much volatility in the market, by employing the long call butterfly.

The long call butterfly, as opposed to the Short Call Butterfly options strategy, is formed by the combination of a long call spread and a short call spread, with both of them coinciding at a specific strike price. This means that a bull spread and a bear spread are combined.

A bull spread is created when the trader is expecting the prices to go up, so he buys and sells call options simultaneously, at different strike prices but with the same underlying asset. Similarly, a bear spread is created when the trader is bearish for the market and buys and sells call options simultaneously, at different strike prices but with the same underlying asset.

Thus, when a bullish spread and a bearish spread are combined, they result in a neutral long call butterfly spread.

Long Call Butterfly is constructed by buying one in-the-money option at a lower strike price, writing two at-the-money options and buying one out-of-the-money option at a higher strike price. So, four positions need to be taken.

It is to be kept in mind that the strike prices of the in-the-money option and out-of-the-money option must be equidistant from the at-the-money option, that is, the current price.

Long Call Butterfly Timing

The suitable time to implement the long call butterfly strategy is when the trader is expecting little to no volatility in the market. This strategy is most positively affected by the decrease in volatility and an increase in the passage of time.

Therefore, when the trader thinks that the price of the underlying asset will neither decrease nor increase too much, he sets up a long call butterfly. By doing so, he can make a limited profit, when otherwise without the strategy he would not have gained anything.

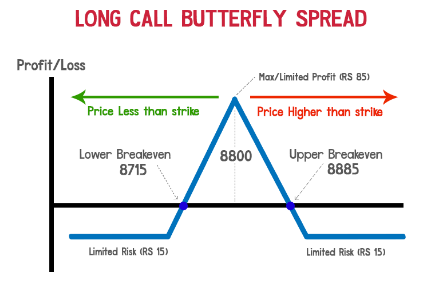

Long Call Butterfly is a limited risk and limited profit strategy.

The maximum risk is limited to the total premiums paid on the four positions. The maximum risk is reached when the market becomes highly volatile, contrary to the expectations of low volatility. It is when the prices either go below the lower strike price or above the higher strike price.

The maximum profit is gained in this strategy when the price of the underlying asset remains constant. At this stage, all the other options expire worthless except the one with the lower strike price. The maximum profit gained is equal to the strike price of the short call.

Long Call Butterfly Example

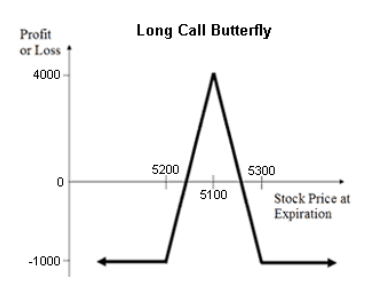

Let us understand the strategy with respect to NIFTY. Consider that the current price at NIFTY is 5200 points. The trader expects that there will be low volatility in the market and the price will remain bound in a certain range. In this case, he will implement the long call butterfly strategy.

The trader writes two at-the-money call options at the current price of 5200 at a premium of ₹100 each, buys one in-the-money option at 5100 at a premium of ₹165 and buys an out-of-the-money option at 5300 at a premium of ₹55.

Please note that the strike price of the in-the-money option and out-of-the-money option is equidistant from the current price.

Scenario 1:

The maximum loss is incurred in this strategy when there is high volatility. Let us assume that at the time of options expiration, NIFTY is at 4700 or 5700, which is a huge movement from the current price, the trader will incur a maximum loss.

The loss, in this case, is equal to the net premium paid, which is ₹(100*2)-165-55= ₹20. Considering the lot size to be 50, the maximum loss is equal to 20*50= ₹1000 in any case.

The loss will never be more than the net premium paid, as all the other options will expire worthlessly.

Scenario 2:

Maximum profit is obtained in this strategy when the price does not change at all, i.e. there is no volatility as expected. Considering the price remained constant at 5200 at the expiration date, the out-of-the-money option will expire worthlessly.

The payoff from the in-the-money option will be ₹(5200-5100)-165= -₹65;

The payoff from the at-the-money options will be ₹100*2= ₹200,

and the payoff from the out-of-the-money option will be ₹0-55= -₹55. The net payoff will be -65+200-55= ₹80.

Thus, the maximum profit will be ₹80*50= ₹4000, considering a lot size of 50.

Thus, the maximum loss is limited to the total premiums paid and the maximum profit limited to the maximum strike price minus the middle strike price minus the net premium paid and is possible when the current price does not change at all.

Long Call Butterfly Advantages

Here are some of the benefits you get if you apply Long Call Butterfly strategy in your trades:

- This strategy is particularly beneficial when there is no volatility in the market.

- The trader can make money even when the market prices are not moving at all

- The risks are limited to the net premium paid.

Long Call Butterfly Disadvantages

At the same time, here are some of the concerns you must be aware of as well:

- The profit in this strategy is also limited and is bound in a narrow range between the two wing strikes.

- The premiums are paid for four positions, which add up to be quite high and may neutralise all the profit earned.

Long Call Butterfly Strategy in a Nutshell

Thus, as a bottom line, long call butterfly strategy is a very effective strategy when very low volatility is expected in the market. If the strategy is not used, the trader will not be making any profit or loss as the prices will not change, however, with the implementation of this strategy, the trader can create a potential for limited profit, with exposure to limited risk.

In case you are looking to start trading and use these options strategies in order to make money – just fill in some basic details and we will assist you ahead.

More on Share Market Education:

You can read this review in Hindi as well.