Synthetic Call

All Option Strategies

Synthetic Call position is the one options trading strategy in which a trading position is created to look like the characteristics of another position. In other words, using any synthetic strategy, same risk and reward profile are created, as it could have been in the equivalent position.

In order to create any synthetic strategy, either different options contracts are combined to make a long or short position, or an option contract is combined with the underlying asset to create a basic options strategy.

One of the synthetic trading strategies is the Synthetic Call.

Synthetic Call is an options strategy in which an underlying asset is combined with a put option to protect against depreciation in the value of the underlying asset. The overall effect is similar to insurance, by keeping the reward unlimited and the risks limited.

For the construction of a synthetic call strategy, the trader holds a long position in an underlying asset like a stock, and also owns a put option on the same stock. The strategy is used when the trader is bullish towards the market and expects the price of the stock to go up.

However, he also wants to protect himself from the risk of the stock price going down. For this protection, he buys a put option which will be exercised only when the price of the stock goes down. Thus, the profits remain unlimited, but the risk will only be limited to the amount paid as the premium for buying the put option.

Synthetic Call Strategy Timing

The strategy is used when the trader is moderately bullish on the direction of the underlying asset and wants to make fixed earning on his investment. By using this strategy, the trader becomes able to make changes to an already existing stock position at the time of slight volatility.

The trader does not have to square off the old position and take a new one; instead, he can just add a put option to the position and protect himself against the risks of volatility.

For instance, a trader expected the prices of security to go down, so he bought put options. Now, due to volatility in the market, the prices are expected to go up.

So, instead of selling the put options and buying the call options, the trader creates a synthetic call by taking a long position in the underlying security, along with the put options; thus, converting the put options to call options.

The benefit is that the trader will end up saving on a lot of transaction costs.

On the other hand, the synthetic call can also be used when the trader owns the underlying asset and has a bullish view, but also wants to protect himself from downward price movement. In this case, the trader can create a synthetic call by buying the put option on an equal number of shares, thereby creating a synthetic call.

The maximum profit in this strategy is unlimited, as the price of the security can go as high as possible. The maximum risk associated with the strategy is only equal to the amount of premium paid for the put option.

It is because even when the price of the security goes down, the trader has protected himself and he will only end up paying the premium by exercising the put option.

Synthetic Call Example

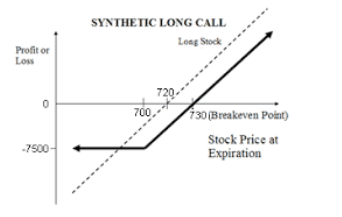

Let us consider a situation in which the trader owns 250 shares of Reliance Industries Limited, trading at ₹720 per share. The trader is bullish towards the price of the shares. However, he also wants to protect himself against the risk of the price of the stock going down.

The trader creates a synthetic call by buying a put option on 250 shares of Reliance India Limited at the strike price of ₹700, by paying a premium of ₹10 per share, along with holding the 250 shares directly.

The total investment made by the trader is (250*720) + (250*10) = 1,80,000+2500= ₹1,82,500

Scenario 1: The price of the Reliance shares goes up to ₹750 per share. In this case, the trader will make an unlimited profit. Total profit will be (750-720)*250= 30*250= ₹7500.

The net payoff will be profit-premium= 7500-2500= ₹5000.

Scenario 2: The price of the Reliance shares goes up to ₹730 per share. The total profit will be (730-720)*250= 2500.

Net payoff will be profit-premium= 2500- (250*10)= 2500-2500= ₹0.

This is the break-even point.

The profit gained will be offset by the premium paid.

Scenario 3: The price of the Reliance shares goes down to ₹690 per share. In this case, if the trader had not created a synthetic call, he would have suffered a loss of (720-690)* 250= 30*250= ₹7500.

However, due to the put option which will get exercised, the loss will be limited to 250*10= ₹2500.

The trader has, thus, kept his loss limited to the amount of premium paid, and protected himself against the downward movement in the price of the security.

Synthetic Call Advantages

Here are some of the benefits of using this trading strategy:

- The profit remains unlimited. The trader will make profits in the same pattern as he would have made by holding just the underlying asset.

- The risk becomes limited to the amount of premium paid for the put option.

- Along with the benefits of a call option, the trader is also able to get the benefits of owning the stock directly, like receiving dividends and holding the rights to vote.

Synthetic Call Disadvantages

At the same time, here are some of the concerns you must be aware of:

- There are still chances of loss if the underlying goes down and the option is exercised.

Conclusion

At the same time, the trader is also in a position to enjoy the direct benefits of owning stocks like dividends and ownership rights, in spite of taking the benefits of an options strategy.

Thus, the synthetic call is an excellent strategy when the trader wants to benefit from the increase in the price of the security, yet wants to keep the downward risk limited.

In case you are looking to start trading and use these options strategies in order to make money – just fill in some basic details and we will assist you ahead.

More on Share Market Education:

In case you are looking to learn more about stock market investments or options trading in general, let us assist you in taking the next steps ahead. Just fill in the form below to get started: