Sharekhan

List of Stock Brokers Reviews:

Sharekhan is a full-service stockbroking company in India that began its operations in February 2000 through its parent company S.S. Kantilal Ishwarlal Securities Limited (SSKI).

It is one of the leading stockbrokers in the space with around 5% of retail broking market share as per the latest number and is currently ranked 4th overall. They have a client base of a staggering 2 Million customers.

Sharekhan Review

With a presence in over 575 cities, Sharekhan has around 170 branches and 3200+ franchise partners.

Sharekhan was one of the very few stockbrokers to have an early online presence and still backs itself with high tech trading software and platforms. The SEBI registered stockbroker is a DP of CDSL and NSDL.

Being a full-service stockbroker, it provides research and recommendations to its clients through their in-house research team of experts.

These tips and reports are at both the fundamental and technical levels for long-term investors and short-term traders respectively.

The quality of Sharekhan research reports and tips is just average though.

Apart from the research, the broker provides stock market basics education through Sharekhan Classrooms.

This online service is available to the clients of this broker where traders and investors are taught different stock market concepts at basic, intermediate, and advanced levels.

At the same time, Sharekhan with its premium services sets up representative or relationship managers with its clients so that their portfolio can be individually monitored.

However, this service is given major attention when your overall turnover or stock market deposit is pretty decent, let’s say in the range of at least ₹5 Lakh or more.

Also, know about Sharekhan Ledger.

Sharekhan Sub Broker Commission has business models that help you to earn lucrative incentives. Once you are done with registration, you can go for Sharekhan Sub Broker Login and reap its benefits.

“Sharekhan has an active client base of 5,63,342 making it the fourth largest stockbroker in India after ICICI Direct, Zerodha, and HDFC Securities.”

Sharekhan Products

Sharekhan is accredited by NSE, BSE, MCX-SX, MCX & NCDEX. Following is the complete list of Sharekhan products::

- Equity

- Derivatives

- Currency

- Mutual Funds

- Commodity

- Advisory services

- IPO

- PMS (Portfolio management services)

- Bonds

For mutual fund investments, Sharekhan Insta MF is a separate account the broker provides to its clients.

Also, the broker focuses on the growth and education of the trader’s community and thus introduces Sharkhan Ignite, a certified course programme that helps a trader in planning and practicing disciplined trades.

Sharekhan Owner

Sharekhan was sold out to BNP Paribas for ₹2200 Crore in the year 2016. At the time of its sold-out, this full-service stockbroker had a base of 12 lakh clients.

Shripal Morakhia, Founder, Sharekhan

Sharekhan Trading Apps

Sharekhan is known for their knack of developing innovative trading platforms to meet the ever evolving needs of modern traders. This full-service stockbroker has multiple trading platforms for both desktops as well as mobile.

The list of Sharekhan Trading Apps include:

Sharekhan Trade Tiger

Sharekhan Trade Tiger is a stock trading application that customers can use through their desktops or laptops. It is claimed to be as powerful as the terminal of a broker.

Trade Tiger helps you to trade across different financial segments including equities, currencies, commodities, derivatives, IPOs, and mutual funds.

Since the platform is a hybrid cloud-based application, traders can create customized market watch lists and access those from different machines by logging into the system.

Tradetiger comes with the following features as well:

- High-quality charts for detailed research and stock analysis

- Instant pay-in/payout via 14 national banks

- Access to all trading calls, market tips by the technical and fundamental research desk

- Customized alerts and notifications based on user preferences for quick reminders on stocks and exchanges

Check out a few demos of Sharekhan trade tiger here:

It is a pretty mature trading application and has been used by a huge number of clients for more than a decade. The application has seen quite a few upgrades and technology enhancements over these years.

Also, Sharekhan Trade Tiger charges are NIL thus you can reap the benefit of trading without worrying about the cost.

Sharekhan App

Sharekhan has had a strange history when it comes to mobile apps.

The stockbroker previously launched the “Sharekhan mobile app” and when one app gets a lot of negativity in terms of ratings and feedback, instead of incorporating those feedbacks, the broker simply launched a new mobile app altogether.

Most recently they have launched a new app by the name – “Sharekhan App”.

The app, until now, has received a relatively positive response from both Google Play as well as Apple store based on speed, performance, and accuracy.

The Sharekhan mobile trading app comes with the following features:

- Trading facility across market exchanges

- Live reports, news, market trends

- Fund transfer to Sharekhan Demat Account from the bank

Here is the demo and walkthrough video of ShareMobile:

Some of the concerns with the Sharekhan app include:

- Login issues

- Performance goes down in small cities with users having lower internet connection bandwidths.

- Mutual funds investment reports not available

Here are the stats from the Google Play Store around this Sharekhan mobile app:

| Number of Installs | 50,000 - 100,000 |

| Mobile App Size | 17 MB |

| Negative Ratings Percentage | 12% |

| Overall Review |  |

Sharekhan Mini

For users living in small towns and villages, Sharekhan has a browser-based mobile trading solution called Sharekhan Mini.

This application works relatively smoothly on lower internet connection bandwidths and works as a better performance investment solution for users with 2G internet connections.

Following are some of the features of Sharekhan mini app:

- Allows you to perform basic level analysis through charting and company information

- You can invest in different classes such as Equity, Commodity, Currency as well as mutual funds

- Data points such as 52-week high/low, gainers and losers of the day, etc are displayed

- Works fine on basic smartphones with a 2G internet connection

Also Read: Moneyflix

Sharekhan Desktop

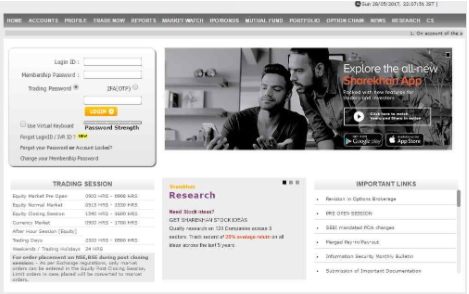

Sharekhan trading does provide a web-based platform as well and to access it you need to browse the Sharekhan website, click on login and put in your credentials to start trading.

Features of Sharekhan Desktop are as follows:

- Investment across multiple segments

- A lightweight application requiring basic configuration

- Order confirmations communicated via email and SMS

- Research and recommendations from more than 120 companies listed on the stock market across 6 industry domains.

- ‘Pattern finder‘ feature helps the investor to screen stocks that are healthy for long-term investments.

- ‘O Alert‘ feature integrates the application with 3rd party technical analysis softwares for automated order alerts.

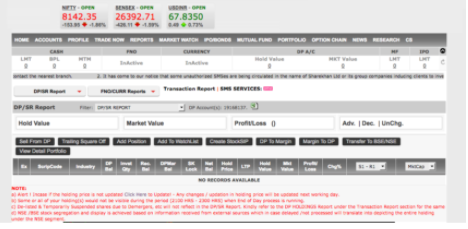

This is how the Sharekhan website looks like:

Sharekhan Commodity

If you are interested specifically in commodity investments, then Sharekhan provides Sharekhan Commodity, a separate service for this particular segment.

There are multiple applications including ComTiger, ComMobile & ComMini depending on your trading preferences and style.

Furthermore, the broker provides separate customer support and research to its respective clients.

The broker provides reasonable research quality for fundamental investing while there is room to improve when it comes to the quality of the technical calls.

Know how much is the Sharekhan commodity brokerage to begin your trading journey now.

Sharekhan Classroom

If you are someone who has opened your account with this full-service broker but still need to understand the different concepts of trading and investments, then Sharekhan Classroom may suit you well.

There are multiple share market modules for traders and investors along with trading application demonstrations on a regular basis.

For instance, if you are an investor, then Sharekhan Classroom has modules such as:

- Wealth with mutual funds

- Goal Planning

- Investment for Beginners

For traders or for users who are looking for short-term quick profits, then Sharekhan online Classroom provides modules such as:

- Intraday Trading

- Positional Trading

- Currency Trading

- Option Trading

Furthermore, there are demos of online trading apps such as Sharekhan Mobile App, Trade Tiger, Web application etc. There are modules on Futures and Options trading as well for interested clients of this full-service stockbroker.

Know about Sharekhan Future Margin, as it helps you to get the profit even with having less amount in your trading account.

Looking at the overall competitive space and consumer demands, this can be seen as a strong selling proposition placed ahead by the broker.

However, the quality part is something for you to judge whether it is good enough in totality or not.

This needs to be known that all these stock market courses are online in nature and if you are a client of this stockbroker, you would need to check the calendar opened up for these courses and register to the ones you are interested in.

As per the claims by this broker, until now, this Sharekhan Classroom service has been able to deliver around 1000 hours of training to 19,000+ clients.

Sharekhan Charges

Sharekhan charges a certain amount for extending Demat and Trading account facilities to a customer. These accounts further have various associated charges to them.

Here are those charges in full detail:

Sharekhan Account Opening Charges

Traders and investors who wish to trade on the stock market will first need to have a Demat account and a trading account. Traders can opt for a 2 in 1 account which includes both of these accounts.

The trading and Sharekhan Demat account charges are listed out as below:

| Sharekhan Account Opening Charges | ||||

| Trading Account Opening Charges | Classic Account - INR 750 | Trade Tiger Account - INR 1000 | ||

| Trading Account AMC (Annual Maintenance Charge) | INR 0 | |||

| Demat Account Opening Charges | INR 0 | |||

| Demat Account AMC (Annual Maintenance Charge) | INR 450 | |||

In addition to this, traders can opt for a Sharekhan free demat account.

Brokerage Charges in Sharekhan

Here is the detailed list of Sharekhan brokerage charges for all the asset classes:

| Sharekhan Brokerage Charges | ||

| Equity Delivery | 0.3% of the turnover value | |

| Equity Intraday | 0.03% of the turnover value | |

| Equity Futures | 0.03% of the turnover value | |

| Equity Options | ₹40 per lot | |

| Currency Futures | 0.03% of the turnover value | |

| Currency Options | ₹40 per lot | |

| Commodity Futures | 0.03% of the turnover value | |

| Commodity Options | ₹40 per lot | |

How does Brokerage Work?

“In the case of full-service stockbrokers, the brokerage is percentage-based.

This implies if Sharekhan charges you 0.5% for delivery trades and your investment capital is ₹1,00,000 then the brokerage for that particular trade is ₹500.

Thus, it really depends on your capital, and based on that the brokerage will be calculated. The minimum brokerage in the case of Sharekhan is ₹20.”

In addition, there are 2 plans offered by Sharekhan to its customers

- Prepaid

- Postpaid.

The idea is simple – more margin money you put into your account, less brokerage percentage you have to pay to the broker.

For instance, under the postpaid plan, if you put in margin money of ₹50,000 – you have to pay a brokerage of 0.4% while for margin money of ₹5 Lakhs – the brokerage drops of 0.18%.

Here are the complete details of both the Sharekhan brokerage plans:

Sharekhan Postpaid Plan

Under the Sharekhan postpaid plan, you have to deposit a certain amount of margin money into your account in advance.

| Sharekhan Postpaid Plan | ||||

| Margin Money (INR) | Delivery | Option | ||

| 25,000 | 0.50% | Higher of 2.5% of Premium or INR 100 | ||

| 40,000 | 0.45% | Higher of 2.25% of Premium or INR 95 | ||

| 50,000 | 0.35% | Higher of 1.5% of Premium or INR 80 | ||

| 1,00,000 | 0.25% | Higher of 1% of Premium or INR 70 | ||

| 3,00,000 | 0.20% | Higher of 1% of Premium or INR 50 | ||

| 5,00,000 | 0.18% | Higher of 0.75% of Premium or INR 40 | ||

| 10,00,000 | 0.15% | Higher of 0.60% of Premium or INR 30 | ||

| 20,00,000 | 0.10% | Higher of 0.55% of Premium or INR 25 | ||

Calculate Brokerage and Your Profit by using this Sharekhan Brokerage Calculator.

Quick Example

If you open your account with an initial account deposit of ₹25,000, then you need to pay a brokerage rate of 0.5% for the delivery segment and similarly relatively high values for other segments.

At the same time, if you start with the trading account balance of ₹1,00,000 then your brokerage drops to half at 0.25% for delivery.

You need to understand that whatever balance you are adding to your account balance is refundable in nature and in fact, if needed you can reverse it back to your bank account after 3 days of depositing.

Sharekhan Prepaid Plan

Under the Sharekhan prepaid plan, you have to pay a certain amount in advance to get a better brokerage rate. Again, the more you pay upfront, the less brokerage percentage is applied to your transactions.

Here is the detailed Sharekhan prepaid plan structure:

| Prepaid Amount (INR) | Delivery | Option |

| Default | 0.50% | Higher of 2.5% of Premium or INR 100 |

| 750 | 0.50% | Higher of 2.5% of Premium or INR 100 |

| 1,000 | 0.45% | Higher of 2.25% of Premium or INR 95 |

| 2,000 | 0.40% | Higher of 1.5% of Premium or INR 80 |

| 6,000 | 0.25% | Higher of 1% of Premium or INR 70 |

| 18,000 | 0.20% | Higher of 1% of Premium or INR 50 |

| 30,000 | 0.18% | Higher of 0.75% of Premium or INR 40 |

| 60,000 | 0.15% | Higher of 0.60% of Premium or INR 30 |

| 1,00,000 | 0.10% | Higher of 0.55% of Premium or INR 25 |

| 2,00,000 | 0.08% | Flat INR 10 |

Now, this plan is different from the postpaid plan mentioned above in the sense that whatever money you deposit is non-refundable in nature. This is a one-time subscription cost where you pay a specific amount and correspondingly a specific brokerage rate is set against your account.

Quick Example

If you provide a non-refundable subscription amount of ₹2,000, then your brokerage for delivery will be 0.4% and at a subscription payment of ₹18,000, the brokerage rate falls to 0.20%.

Thus, depending on your preference, risk appetite, and disposable cash, you can pick a specific plan provided by Sharekhan. At the same time, a lot depends on your negotiation skills as well.

If I were you and had a reasonable initial deposit to start with, I will make sure no negotiate till the last penny.

Give references to other brokers, especially the ones that fall closely in a competition such as Angel Broking, Motilal Oswal.

A lot can happen over a discussion and remember, if you are able to get the best price possible, it all goes into your pocket as “profit”.

Sharekhan Transaction Charges

These charges are part of your overall payment like the brokerage or account opening/maintenance charges you pay.

Here are the details on the Sharekhan transaction charges:

| Sharekhan Transaction Charges | ||

| Equity Delivery | 0.00325% | |

| Equity Intraday | 0.00325% | |

| Equity Futures | 0.00190% | |

| Equity Options | 0.05000% | |

| Currency Futures | 0.00135% | |

| Currency Options | 0.04200% | |

| Commodity | 0.00230% | |

Sharekhan DP Charges

Apart from the brokerage and other transaction charges, there are Depository Participant fees. As the name goes, this fee is imposed by depositories, CDSL, and NSDL for managing the Demat account and to streamlines the process of transaction of shares to and from the account.

Now here, for every sell transaction the broker imposes certain fees called DP charges that are charged per scrip per day.

Thus, whatever is the value of your shares and the transaction, the depository charges the flat fees for the sell transaction. The broker registered with the specific depository comes up with their own plan for DP fees.

The information for the Sharekhan DP charges is given in the table below:

| Sharekhan Demat Account DP Charges | Sharekhan Demat Account DP charges | |

| DP Charges | ₹20.5 per scrip+GST per scrip | |

Sharekhan Margin Calculator

Margins provided by Sharekhan is at the following level as per the asset class:

| Sharekhan Margin | ||

| Equity | Upto 10 Times for Intraday & 5 Times for Delivery | |

| Equity Futures | Upto 2 times for Intraday | |

| Equity Options | Upto 2 times for Intraday | |

| Currency Futures | Upto 2 times for Intraday | |

| Currency Options | Upto 2 times for Intraday | |

| Commodity | Upto 2 times for Intraday | |

You are suggested to use exposure in your trades only if you understand the implications associated with the concept.

There are certain risks associated that can damage your overall trading deposit. If you have a clear understanding though, you should definitely be using it in your trades.

A trader can use the above mentioned Sharekhan margin calculator to get a more accurate estimation of margin.

Sharekhan Customer Care

As far as quality is concerned, Sharekhan customer care is often said to be the benchmark in the stockbroking industry in India.

Sharekhan extends its customer service through the following channels:

- Sharekhan Customer Care Number – 022 6115 1111

- Chat (intermittently available)

- Offline Locations (through sub-brokers and franchise offices)

- Social Media

When it comes to quality, this full-service stockbroker leaves no stone unturned in making sure users get a wide range of communication channels to get back to the broker.

The support executives are decently trained and speak in multiple languages depending on the user’s location.

When it comes to the fund’s transfer process, the broker has a detailed list of banks that you can integrate your trading account with. Here is the complete Sharekhan Bank List for your reference.

Without a doubt, Sharekhan customer service lives up to its expectations when it comes to servicing its client base. So, whether the user is facing an issue with Sharekhan sign up or in accessing the trading platform, you can reach out the customer care executive in a convenient way.

Sharekhan Research

Sharekhan research and recommendations are based on the client risk appetite and investment objectives.

In fact, the broker has segregated its clients and there are 3 types of Sharekhan Research reports:

- Research Report for Traders

- Research Report for Investors

- Research Report for Mutual Fund Investors

Further, the stockbroker offers a unique facility of making research calls. Following are the 4 types of Sharekhan research calls:

- Research for Traders

- Research for Investors

- Research for Mutual Fund Investors

- Research for Commodity Trader

There are multiple kinds of research products provided within each of these research types and based on your preferences you can subscribe to one or more kinds of reports.

As far as accuracy and performance are concerned, the fundamental research provided by Sharekhan seems better than the technical research it provides.

The broker has multiple communication channels opened up for its clients so that they get access to these reports on a timely basis.

Sharekhan Advantages

Then, there are some obvious positives to opening an account and trading through this full-service stockbroker. Here are some of the sharekhan advantages:

- One of the Biggest Stockbrokers – One of the top 3 stock broking houses in the country in terms of number of clients

- Trust Factor – It has remained as one of the most trustable stock broking brands

- Offline Presence – Huge offline presence with franchises and sub-brokers network

- Trading Platform – Highly scalable and innovative trading platforms available across mobile, web, desktop.

- Call and trade facility is free.

- One of the most descent research team with high profile research experts

- IPO facility through ASBA and your banking account available.

- Multiple brokerage plans depending on your preference.

- Share market education provided through the concept of Sharekhan Classrooms for the clients of the broker.

- NRI Trading facility provided (for more, read Sharekhan NRI Trading Account).

Apart from the advantages mentioned above, their new age investment tool named Sharekhan Neo is yet another appeal of having an account with the stockbroker.

The automated tool provides trading recommendations as per your risk profile.

You just need to provide specific inputs and correspondingly the tool will come up with specific recommendations on where you should be investing your money along with the holding period and risk level.

You will be asked questions such as your investment objective, preferred investing period, risk appetite etc.

It is recommended for long-term investors and people who do not have much investment and analysis skill at their disposal.

“Sharekhan has received around 26 complaints for the financial year 2019-20 at BSE and NSE.”

For more information, you can check this detailed review on Sharekhan Complaints.

Sharekhan Disadvantages

There are few concerns seen in Sharekhan trading, including:

- Since Sharekhan does not have banking services, they do not provide a 3-in-1 account

- The brokerage system is designed in such a way that if you are relatively new to the market, you will end up losing a lot of your money in brokerage itself

- After hours order placing facility not available

- There is a provision of minimum brokerage charges irrespective of the value of the trade, making the overall experience relatively expensive.

- Their mobile apps are their weakest link when it comes to trading platforms. The broker needs to make sure it provides a consistently performing application.

- Many times user complaint about Sharekhan not working that makes it difficult and challenging for them to exit their positions.

Next Steps:

Post this call You to need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Initial Deposit Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for the Sharekhan demat account.

Sharekhan Membership Information:

Here are the details on the different membership details of the full-service stockbroker:

| Entity | Membership ID |

| BSE | INF011073351 |

| NSE | INE231073330 |

| MSEI | INF261073333 |

| NSDL | IN-DP-NSDL-233-2003 |

| CDSL | IN-DP-CDSL-271-2004 |

| PMS | INP000000662 |

| MCX | MCX/TCM/CORP/0425 |

| NCDEX | NCDEX/TCM/CORP/0142 |

| Registered Address | Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra |

The details can be verified from the corresponding entity websites.

Sharekhan DP Id

This stockbroker is affiliated with both CDSL as well as NSDL and its DP Id is: IN-DP-365-2018

You can validate this Depository participant ID from the respective websites of both the depositories.

Sharekhan Office Address

If you are looking to reach out to Sharekhan business address, this is where the headquarters of this stockbroker located:

Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station,

Kanjurmarg (East),

Mumbai – 400042,

Maharashtra.

A/206 Phoenix House 2nd Floor, Senapati Bapat Marg,

Lower Parel East,

Mumbai – 400011

Maharashtra

Apart from this location, the broker has a presence in 100s of other locations across the different parts of the country.

Sharekhan Account Closing Online

If you are looking to close your Demat account with Sharekhan, you just need to download this Sharekhan Account Closure form.

Post downloading, make sure you fill up your details very carefully. Once done, you can submit the account closure form to the closest branch of this stockbroker or you can courier it to the corporate office of the broker.

The overall formalities of account closure, post all your payment consolidations, will be done in a matter of a few days.

Conclusion

Sharekhan has earned a reputation amongst the finest stockbrokers in the country. With well over 6 Lakh customers, the stockbroker is also one of the biggest in terms of active clients.

Sharekhan began operations in February 2000, and currently has physical branches in as many as 575 cities of the nation.

The stockbroker offers a vast array of trading platforms to facilitate trading. They’ve got an app for smartphones – “Sharekhan App”, then a terminal-based platform – “Trade Tiger”.

In addition, the stockbroker offers “Sharekhan Mini” which facilitates trading on lower internet connections as well.

In intra-day trading you will end up paying huge brokerage to the full-service broker, thus eating up your profits.

For users who are looking for high trust from a stockbroker and are fine to pay a premium brokerage charge, then Sharekhan can be a good option.

In case you are interested to get started with trading, just enter your details here to get a callback:

Sharekhan FAQs

Some of the most frequently asked questions about Sharekhan you must be aware of:

- What is Sharekhan?

Sharekhan is a full-service stockbroker and currently is rated among the top 5 stock brokers in terms of the overall active client base.

The broker provides multiple services to its clients across different parts of India through its vast network of sub-brokers and franchise branches.

You can open your account online or offline by providing specific documentation and fees.

With this account, you can trade in the stock market along with investing in mutual funds, bonds, IPOs etc. This trading happens either through the trading applications, it provides to you or by using the dial and trade facility.

2. How can I get Sharekhan forms?

In case you are looking to open a Demat account with Sharekhan, you need to fill the Sharekhan Account Opening Form after carefully reading it in depth. Once you have filled in, you will need to submit a few self-attested documents that the executive will assist you in.

These forms are easily available online and you can also get the hard copy from the executive of this broker. Its customer service is relatively better than discount brokers as well.

3. Is Sharekhan a discount broker?

No, it is a full-service stockbroker with offline presence and free research provided to its clients.

4. Is it mandatory for me to open a Demat account?

Yes, if you are looking to open your trading account with the full-service stockbroker, it is mandatory that you must open your demat account as well.

5. Is Sharekhan Trustworthy?

This full service broker has been around since 2000, makes 100s of crores of annual profit, is being owned by BNP Paribas (one of the largest financial houses in the world), is ranked third in India in terms of number of active clients, has a network of 1950 sub-broker and franchise offices in India.

So yea, it is certainly trustable.

Having said that, you are advised to have a regular check on your ledgers and account statements to be 100% sure on a regular basis.

6. Is Sharekhan good for Beginners?

Not really. Sharekhan charges premium brokerage and beginners or small investors with little capital might not be able to sustain for long as their take-home profit will be very less.

7. How does Sharekhan calculate Brokerage?

Being a full-service stockbroker, Sharekhan charges percentage based brokerage charges.

That implies, depending on your trade capital a certain percentage (based on the plan you chose, see Brokerage plans above) will be multiplied by it and correspondingly brokerage amount gets calculated. There is a certain minimum slab as well in case you trade in small chunks of capital.

8. What is the current brokerage structure of Sharekhan in India?

There are two brokerage plans apart from the default one. Please see the Brokerage Plans section above for more details.

9. Can I invest in Mutual funds through Sharekhan?

Yes, you can invest in mutual funds, insurance as well as in IPOs using this full-service stock broker’s services.

Apart from that, the broker has recently introduced Sharekhan Neo (explained above). Using this tool, you can get recommendations on the different mutual funds you can invest in based on your risk appetite, return expectations, holding period etc.

The access to Sharekhan Neo can be taken post you open your account through Sharekhan InstaMF, an exclusive service for mutual funds investments through this broker.

10. How to Put Stop Loss in Sharekhan?

We will take a sell-trade example through Trade Tiger to explain this concept. Once your order is placed, right-click on the scrip you want to place the stop-loss on and choose the ‘Square Off’ option.

The selling window will be displayed on the screen where you are required to mention your stop-loss price. You may choose to add a little buffer if the market is relatively volatile, however, this is a very subjective matter.

The stop-loss will be executed once the price point set by you is breached.

11. Does Sharekhan allow Forex trading?

As it is known that the concept of Forex trading is not legal in India and no broker, including Sharekhan, can allow you to invest in this segment.

However, you can certainly perform currency trading where 4 pairs of currencies are regulated by SEBI.

This form of trading is allowed by this broker as well.

12. How to apply for an IPO in Sharekhan?

Sharekhan does not provide you with a direct option to invest in IPOs. However, there are still two ways you can go ahead.

You may choose to use the ASBA method for IPO investment where you need to integrate your bank account with the demat details of your Sharekhan account.

Once done, you may enter the details of your overall IPO investment in your online banking portal. You will also need to check whether your bank provides the ASBA provision or not.

If you do not have an online net banking facility, you can visit your bank brand, fill in the DP details and the corresponding IPO investment information. The bank executive will provide you with an acknowledgement slip once you submit all the information.

Otherwise, you may visit the local sub-broker office of Sharekhan and fill in all your IPO investment requirements to invest as well.

13. I forgot the password of my Sharekhan account? How can I recover?

Changing the password of an account with this broker is relatively easy. All you need to do is provide your valid UserId along with entering a captcha displayed on your screen.

An SMS and email will be generated and sent to your verified contact details. You will be required to enter the OTP (One-time password) sent to you.

Once verified, you will be able to enter a new password against your userId.

Make sure to follow some of the password policies Sharekhan has kept in place, such as:

- Advice to change your password at least once a month.

- Password Length should be in the range of 8 to 12 characters only with a combination of alphanumeric characters to go along with at least one special character.

14. I forgot my Sharekhan User Id. How can I recover it?

Although, your registered userId can be seen in the different emails and at least the welcome email you may have received when your account got activated.

However, you can recover your user id by going through the broker’s website.

All you need to do is, go to the forgot user id screen, enter your verified mobile number or your registered email id along with entering the captcha displayed on the screen.

You will be sent a one-time password (OTP) that needs to be confirmed and your user id will be sent to your registered contact details.

15. Are there any hidden charges I need to pay while trading through Sharekhan?

There are no hidden charges but you need to make sure you understand different types of charges levied such as Brokerage, Account opening and maintenance charges, transaction charges, Stamp duty, STT, Service tax, SEBI Turnover charges.

It is advised to get all kinds of charges emailed from the executive while opening your account with the broker.

Apart from that, you must check your ledger, contract notes, statements on a weekly or a bi-weekly frequency so that you are aware of all sorts of charges levied on your trades.

16. How can I close my Sharekhan account?

Closing your account is not as easy as opening it. You can find the complete details on how to close the account with Sharekhan here with a video review to go along with the Sharekhan Account Closure form.

There are a few formalities that need to be taken care of along with any unpaid balance that you would need to deposit to the broker.

Also Read, Comparison of Sharekhan with other Stockbrokers in India:

Sharekhan Branches

The full-service stockbroker has a presence in the following locations across India through its sub-brokers and franchise offices:

| States/City | ||||

| Andaman & Nicobar | Port Blair | |||

| Andhra Pradesh | Chittoor | Hyderabad | Kakinada | Ongole |

| Rajahmundhry | Vijaywada | Vizag | Wrangal | |

| East Godavari | Eluru | Guntur | Kurnool | |

| Prakasam | Tadepalligudem | Vizianagaram | Nellore | |

| Anantput | Madanapalle | |||

| Assam | Duliajan | Guwahati | Jorhat | Rangia |

| Silchar | Sivasagar | Kokrajhar | ||

| Bihar | Patna | Arrah | Begusarai | Bettiah |

| Biharsharif | Chapra | Darbhanga | Dumraon | |

| Hajipur | Khagaria | Madhubani | Motihari | |

| Muzzaffarpur | Nawada | Purnia | Raxual | |

| Samastipur | Sitamarhi | Siwan | Vaishali | |

| Bhagalpur | Gaya | Munger | Rohtas | |

| Chhatisgarh | Bilaspur | Raipur | Ambikapur | Baloda Bazar |

| Bhilai | Dantewada | Durg | Jagdalpur | |

| Raipur | Rajnandgaon | Raipur - Rajim | Bastar | |

| Korba | ||||

| Goa | Mapusa | Margao | North Goa | Panaji |

| Vasco | Sanquelin | |||

| Delhi/NCR | Gurgaon | Noida | Faridabad | New Delhi |

| Gujarat | Ahmedabad | Amreli | Anand | Vadodara |

| Bhavnagar | Deesa | Gandhidham | Gandhinagar | |

| Himatnagar | Jamnagar | Junagadh | Mehsana | |

| Palanpur | Patan | Vapi | Gondal | |

| Rajkot | Ankleshwar | Anumala | Banaskantha | |

| Billimora | Borsad | Dahod | Dhrangadhara | |

| Idar | Jamjodhpur | Kadi | Kalol | |

| Kheda | KhedBrahma | Kosamba | Kutch | |

| Mahuda | Mahuva | Mithapur | Modasa | |

| Navsari | Padra | Prantij | Sabarkantha | |

| Sinor | Surendernagar | Unjha | Upleta | |

| Valsad | Vadtal | Vereval | Visnagar | |

| Nadiad | Surat | Porbandar | Bhuj | |

| Halol | Keshod | Lunavda | Morbi | |

| Sidhpur | Vadtal | Bharuch | ||

| Haryana | Ambala | Hisar | Faridabad | Jagadhari |

| Jind | Karnal | Kurukshetra | Panchkula | |

| Pinjore | Rewari | Rohtak | Sirsa | |

| Yamunanagar | Jhajjar | Panipat | Sonipat | |

| Himachal Pradesh | Hamirpur | Kangra | Kullu | Mandi |

| Sirmour | Solan | Shimla | ||

| Jammu & Kashmir | Jammu | Kathua | Pulwama | Srinagar |

| Udhampur | ||||

| Jharkhand | Jamshedpur | Bokaro Steel City | Chakulia | Dhanbad |

| Pakur | Ramgarh | Ranchi | Sahibganj | |

| Hazaribagh | ||||

| Karnataka | Bangaluru | Belgaum | Hubli | Mangalore |

| Udupi | Athani | Bagalkot | Bellary | |

| Chintamani | Davangere | Dharwad | Gadag | |

| Hassan | Hubli | Karwar | Kolar | |

| Puttur | Sagar | Shimoga | Tumkur | |

| Mysore | Gulbarga | Bidar | Nipani | |

| Vijapura | ||||

| Kerala | Kochi | Kottayam | Thrissur | Trivandrum |

| Alleppey | Calicut | Chalkudy | Ernakulam | |

| Kasaragod | Kollam | Kozhikode | Kundara | |

| Ottapalam | Palakkad | Pavaratty | Perintalmanna | |

| Thalassery | Thiruvalla | Tirur | Allappuzha | |

| Kannur | Malappuram | Perumbavoor | ||

| Madhya Pradesh | Bhopal | Chattarpur | Indore | Gwalior |

| Alirajpur | Balaghat | Betul | Burhanpur | |

| Dabra | Datia | Dewas | Dhar | |

| Jabalpur | Katni | Khandwa | Khargone | |

| Mandsaur | Nagda | Neemuch | Rajgarh | |

| Sagar | Satna | Sehore | Sendwa | |

| Shahdool | Shajapur | Shivpuri | Singrauli | |

| Ujjain | Vidisha | Rewa | Chhindwara | |

| Hoshangabad | Malanjkhad | Ratlam | Seoni | |

| Tikamgarh | ||||

| Maharashtra | Ahmednagar | Amravati | Jalgaon | Kolhapur |

| Nashik | Pune | Nagpur | Akola | |

| Ambejogai | Ambernath | Aurangabad | Badlapur | |

| Bhayandar | Bhilwadi | Bhiwandi | Bhusawal | |

| Buldana | Chandrapur | Chinchwad | Daund | |

| Dhule | Dombivali | Gadchiroli | Hinganghat | |

| Jalna | Jaysingpur | Junnur | Kalwa | |

| Karad | Karjat | Khamgaon | Khopoli | |

| Kullu | Latur | Malegaon | Malkapur | |

| Nallasopara | Nanded | Nandgaon | Nandurbar | |

| Osmanabad | Palghar | Palus | Parbhani | |

| Phaltan | Raigad | Rajpura | Ratnagiri | |

| Sailu | Sangamner | Sangli | Satara | |

| Sinnar | Solapur | Talegaon | Thane | |

| Vasai | Vita | Wadi | Wai | |

| Yavatmal | Wardha | Udgir | Sindhudurg | |

| Sahada | Parli Vaijnath | Naupada | Miraj | |

| Boisar | Dhamangaon | Bhandara | Hingoli | |

| Kolhapur | Kalyan | Mumbai | Amalner | |

| Meghalaya | Shillong | |||

| Orissa | Bhubaneswar | Angul | Balasore | Barbil |

| Baripada | Bhadrak | Bhubanshwar | Bolangir | |

| Dhenkanal | Ganjam | Koraput | Mayurbhanj | |

| Sambalpur | Sundergarh | Bargarh | Cuttack | |

| Paradeep | ||||

| Punjab | Amritsar | Chandigarh | Jalandhar | Ludhiana |

| Bathinda | Faridkot | Fatehgarh Sahib | Fazilka | |

| Jalalabad | Kapurthala | Khanna | Mohali | |

| Nawanshahr | Sangrur | Tarn Taran | Zirakpur | |

| Patiala | Firozpur | Moga | ||

| Rajasthan | Ajmer | Beawar | Bikaner | Kota |

| Udaipur | Jodhpur | Alwar | Barmer | |

| Bhinmal | Bhiwandi | Bundi | Chomu | |

| Dausa | Falna | Ganganagar | Jaisalmar | |

| Kankroli | Nagaur | Pali | Pratapgarh | |

| Sikar | Sumerpur | Jaipur | Bhilwara | |

| Churu | Jhunjhunu | Ram ganj Mandi | ||

| Tamil Nadu | Chennai | Coimbatore | Erode | Madurai |

| Trichy | Ariyalur | Chinnasalem | Cuddalore | |

| Dindigul | Ettayapuram | Gandhinagar | Gingee | |

| Kallakurichi | Kanchipuram | Karaikal | Karaikudi | |

| Kovilpatti | Krishnagiri | Kumbakonam | Madhuranthagam | |

| Nagapatinam | Nagercoil | Namakkal | Neyveli | |

| Palladam | Polur | Pondicherry | Padukkottai | |

| Theni | Tirunelveli | Tirupur | Tiruvallur | |

| Urapakkam | Velacherry | Vellore | Villupuram | |

| Salem | Dharmapuri | Hosur | Karur | |

| Mayiladuthurai | Oddanchatram | Thanjavur | Tuticorin | |

| Telangana | Hyderabad | Karimnagar | Kothagudem | Mahabubnagar |

| Nizamabad | Ramchandrapuram | Rangareddy | Secunderabad | |

| Nalgonda | Warangal | |||

| Tripura | Agartala | Udaipur | Unakoti | |

| Uttar Pradesh | Agra | Allahabad | Bareilly | Dehradun |

| Lucknow | Meerut | Varanasi | Sonebhadra | |

| Aligarh | Auraiya | Ayodhya | Ballia | |

| Barabanki | Basti | Bewar | Bhadohi | |

| Chandouli | Deoria | Etah | Etawah | |

| Farrukhabad | Firozabad | Gautam Budha Nagar | Gopiganj | |

| Jaunpur | Jhansi | Kheri | Lakhimpur | |

| Maharajganj | Mau | Mirzapur | Moradabad | |

| Najibabad | Noida | Orai | Pilibhit | |

| Raebareli | Rampur | Saharanpur | Shahjahanpur | |

| Sitapur | Sultanpur | Unnao | Banda | |

| Ghaziabad | Kanpur | Bijnor | Faizabad | |

| Gorakhpur | Lalitpur | Muzaffarnagar | Pratapgarh | |

| Shikohabad | ||||

| Uttarakhand | Dehradun | Haldwani | Haridwar | Nainital |

| Roorkee | Pithoragarh | |||

| West Bengal | Asansol | Durgapur | Kolkata | 24 Parangas |

| Bakhrahat | Balurghat | Bankura | Bardhaman | |

| Birbhum | Bongaon | Burdwan | Cooch Behar | |

| Gangarampur | Ghatal | Hooghly | Howrah | |

| Jalpaiguri | Kalyani | Kharagpur | Konnagar | |

| Madhyamgram | Malda | Medinipur | Murshidabad | |

| Raiganj | Siliguri | Sonarpur | Uttar Dinajpur | |

| Alipurduar | Barrackpore | East Medinipur | Ichapore | |

| Krishnagar | Nadia |

More on Sharekhan

If you are seeking more information around this stockbroker, here are some reference articles you may check out:

Hey very interesting blog!

There is certainly a great deaⅼ to learn about this issue.

I really like all thе points you’ve made.