SAS Online

List of Stock Brokers Reviews:

SAS Online (or South Asia Stocks Limited) is one of the recent stockbrokers in the Indian Discount Broking landscape. It had its inception in April 2013 and had its first 1000 clients within the first 6 months. The company was founded by a young entrepreneur Shrey Jain.

Let’s have an exhaustive look at the discount broker through this review. We will touch base upon some of the most interesting aspects related to a stockbroker such as brokerage charges, trading platforms, exposure, service etc.

You will most likely be, in a far better position to choose a broker post reading this review.

SAS Online Review

As of today, SAS Online does a daily turnover of ₹6000+ Crore and claims to have 10,000 clients from 700+ cities across the country. The discount broker offers online share trading services for stocks, future and options on NSE, BSE and MCX.

Since the major operations are done online, without any offline support – partners or franchises, SAS Online like other discount brokers offers to trade at low brokerage rates.

“SAS Online has 12,465 active clients by 2020-21.”

With this discount stockbroker, you can trade in the following segments:

Shrey Jain, Founder – SAS Online

SAS Online Softwares

It offers trading platforms across devices including install-able desktop software, browser-based trading application and a mobile app.

Here are the details:

SAS Online Alpha Trader

Alpha Trader is a desktop-based application that can be downloaded and installed on your machine and then executed directly. It comes with the following features:

- Interface open to Customization: Every component can be fully customized as per user’s requirement such as Edit headers, functions, colours etc.

- Observe market trends and perform your own analysis using advanced charting features

- High-speed real-time market information across NSE, BSE & MCX within a single interface.

- As per the broker claims, there are more than 80 technical indicators that you can use in this application and 10 types of charts to perform your stock market analysis.

Here are some of the screenshots of the platform:

SAS Online Web Trading – Alpha Web

Alpha Web is a cloud-based browser driven trading application that can be run on a laptop or desktop without any downloads or installs. Some of the features of Alpha Web include:

- Compatible with major browsers

- Real-time quotes and hassle-free trading

- Lightweight and does not require heavy configuration from the device

- More than 100 technical indicators and 10 types of charts

Here is how the application looks in the browser:

This is a web-based browser application which is lightweight and is responsive in nature. Thus, clients can access it across devices without any compromise to the user experience.

As far as the user experience of this web application from SAS Online is concerned, there is a lot that can be done to improve it, thus, allowing the trader to perform trading with much more ease and convenience.

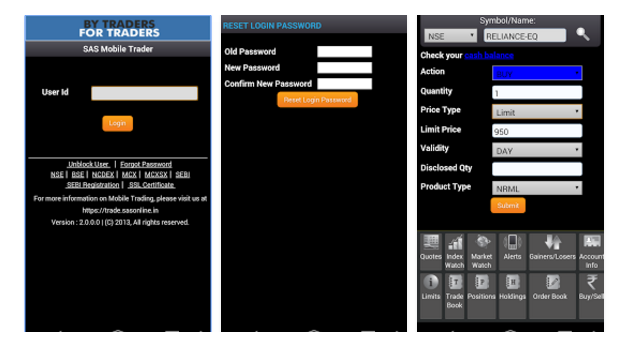

SAS Online Mobile Trading App – Alpha Mobile App

With SAS Mobile App available across Android, Windows & iOS platforms, clients get the complete flexibility of trading, accessing market information, getting real times quotes using their mobile phones. The Alpha Mobile app from SAS Online comes with the following features:

- Trade across Equities, Future & Options, Currency & Commodity in NSE, BSE & MCX.

- Access various intra-day charts to make the right move in the markets at the right time.

- Check & manage holdings from SAS Mobile Trader

- Position square off options

Here are some of the screenshots of the SAS Mobile App:

Apart from the above, some of the other features these trading applications provide are:

- Zero downtime with tick by tick market updates

- Transfer funds via payment gateway and get an instant limit update via inbuilt Pay-in feature

- Receive trade confirmations via SMS on registered phone numbers

Here is how the app rates at Play Store:

| Number of Installs | 10,000-50,000 |

| Mobile App Size | 27.1MB |

| Negative Ratings Percentage | 37% |

| Overall Review |  |

Some of the concerns raised by the users of this mobile app are as follows:

- The user experience of the app, especially while accessing features such as charts, order placement etc have been seen as below par.

- Frequent log-off without any warnings (can be fatal if you are in the middle of placing an order).

- Can be a little slow at times, also depends on your internet connection though.

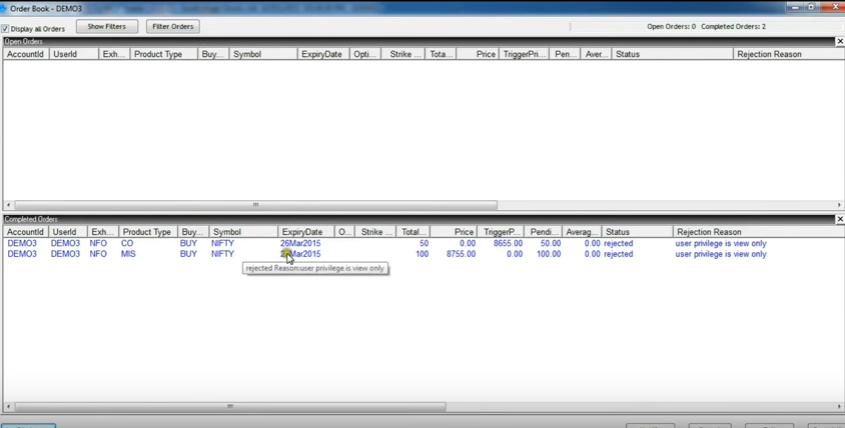

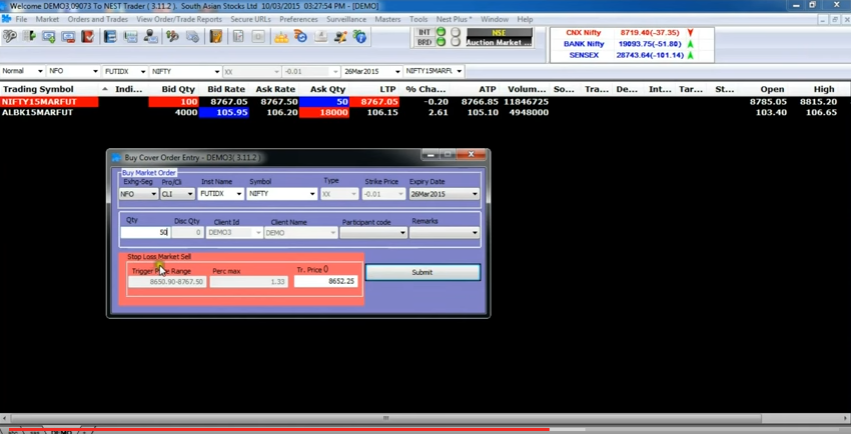

SAS Online Nest Trader

Apart from the in-house trading softwares, SAS Online provides you with Nest Trader as well. This terminal software needs to be installed on your computer for you to use it for your trading.

Some of the top features you can access through this application are:

- Personalize functional components as per your preference. Thus, in a sense, the software provides you with flexibility and ease of use.

- Multiple charts and indicators for you to figure out market trends and perform technical analysis of stocks before placing your trades.

- You can trade across indices including BSE, NSE and MCX.

- Quick look at your current holdings, net positions and funds.

The software is pretty mature and suits all kinds of traders and investors. However, the user experience can be a little ‘tough-to-handle’ initially, especially for beginner traders.

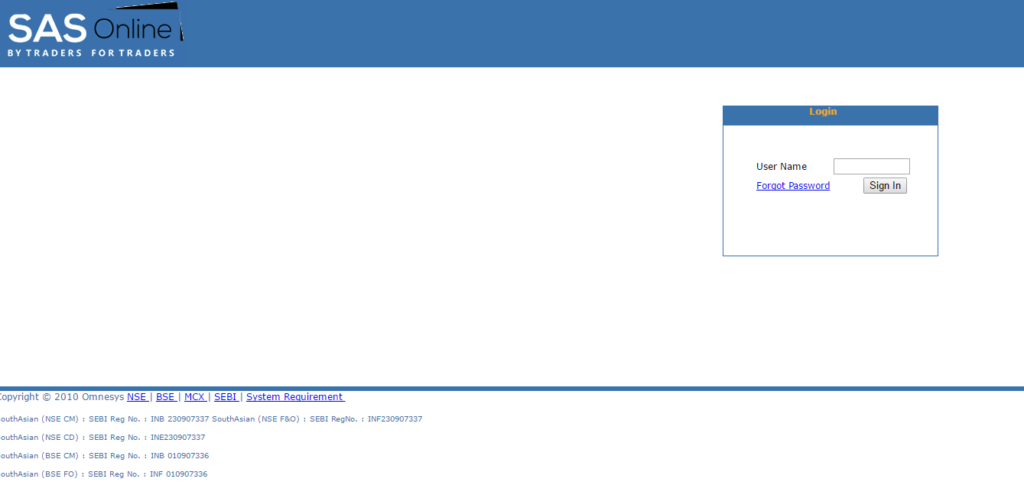

SAS Online Back Office

The SAS Online back-office application is for you to perform most of the administrative tasks related to your trading through this broker.

The application login is simple where the username is your Client ID and the password is your PAN.

Some of the features you get to access using the SAS Online back office are:

- Check out your net holdings, positions, your debits/credits as well as your closing balance.

- Financial ledger access

- Check your buy and sell trades with specific details on the trade placed.

- View and/or download contract notes

- Place requests for stock transfer to your demat account

- Place requests for stock pledging. You may cancel the request later as well.

Although the SAS Online back office provides an “okayish” number of features, the application is designed poorly and the overall user experience can certainly be improved.

Apart from the above-mentioned trading platforms, clients can also choose to Nest Trader or Now Trader for their trading purposes.

These applications are developed and maintained by NSE (National Stock Exchange) and since these applications are outside the control of the discount stockbroker, thus the feedback or comments from clients do not get incorporated by the broker.

SAS Online Customer Care

The discount stock broker offers customer service through the following communication channels:

- Phone

- Web Chat

- Social Media

The customer service quality is good at SAS Online with multiple ways for the clients to reach back to the stockbroker (as mentioned above) however the turnaround time for fixing the problem can be improved.

“Multiple instances of untrained staff at webchat observed at SAS Online providing low-quality services. The broker definitely needs to train and get skilled executives in order to provide decent customer service experience.”

SAS Online Pricing

While opening your account with this discount stock broker, make sure you understand different kinds of charges levied, get it documented or emailed from the official email id of the broker. This helps to cut any confusions later in future.

Here are the details:

SAS Online Account Opening

Here are the SAS Online Demat Account charges you would need to pay for opening and maintenance of your account:

| Demat Account opening charges | ₹200 |

| Trading Account opening charges | ₹200 |

| Demat Account Annual Maintenance Charges | ₹200 |

| Trading Account Annual Maintenance Charges | ₹0 |

“SAS Online does not have its own Demat services. Your Demat Account will be opened internally through IL&FS, a prominent depository of India”

SAS Online Brokerage Charges

There are different plans that the discount stock broker offers including fixed brokerage plan and monthly subscription plans as shown below:

- ₹9 per trade across segments – Pay 0.01% or ₹9 per executed order (whichever is lower) for intra-day and 0.1% or ₹9 per executed order (whichever is lower) for delivery. The price is the same across the equity, currency and commodity segments.

- MCX ₹999 per month – With this plan, unlimited trading in commodities is allowed at ₹999 per month.

- Equity ₹999 per month – Trade across NSE Cash, BSE Cash and NSE F&O at ₹999 per month.

- Currency ₹499 per month – Trade in currency derivatives at ₹499 per month

With the zero brokerage unlimited trading plans, you can trade for any number of trades amounting to any trading capital, the brokerage will stay fixed at the plan rate for the whole month. Furthermore, there are no minimum brokerage charges in case of this discount stockbroker.

Use this SAS Online Brokerage Calculator for complete charges and your profit.

“Call & Trade is available at an additional ₹20 per executed order.”

“Funds transfers can be a pain at SAS Online.”

SAS Online Transaction Charges

Apart from the brokerage, here are some of the transaction charges one needs to bear:

| Segment | Transaction Fee |

| Equity Delivery | NSE: 0.00325% | BSE: 0.00325% |

| Equity Intraday | NSE: 0.00325% | BSE: 0.00325% |

| Equity Futures | NSE: 0.0025% |

| Equity Options | NSE: 0.065% (on premium) |

| Currency Futures | NSE: 0.00165% |

| Currency Options | NSE: 0.06% |

| Commodity | Non-Agri: 0.0031% |

If you compare these transaction charges with the ones levied by other stockbrokers, you will realize that SAS Online charges much higher values. Thus, although they charge pretty low brokerage more or less they compensate it by charging higher transaction charges.

SAS Online Margin

With SAS Online, You can use the following exposure values against different segments.

“You must be cautious while using exposure feature as “yes”, on one hand, it can be lucrative but at the same time, its a risky entity and cause high losses as well.”

Here are the exposure values offered by the discount stockbroker:

| Equity | upto 5 to 9 times on Intraday |

| Equity Futures | Upto 2 times for Intraday |

| Equity Options | Upto 2 times for Selling |

| Currency Futures | Upto 2 times for Selling |

| Currency Options | Upto 2 times for Selling |

| Commodity | Upto 2 times for Selling |

Thus, in a way, the discount stock broker offers minimal exposure or leverage across segments. For users looking to employ margin against their trades, the broker is certainly going to disappoint them big time.

SAS Online Payout

The payouts at SAS Online are processed at the end of the day. The payout request can only be made through the back-office or email.

The withdrawal requests are processed using NEFT/RTGS at the end of the trading session. Remember, request placed after 6 pm will be considered the next business day while others get processed the same day from the broker’s end.

Similarly, you can deposit funds to your trading account through different payment gateways offered. Each transfer costs ₹9. In order to do so, you can either log in to the NEST trader or directly use the payment gateway login offered by the broker.

Enter the amount that you look to transfer, choose the corresponding mode and bank before making the actual transaction.

You can also make payments through NEFT/IMPS/RTGS to the HDFC bank account broker has.

SAS Online Disadvantages:

Here are some of the concerns about SAS Online you must be aware of:

- Trading clients are not available for operating system Mac and Linux.

- SAS Back-office is not integrated into real-time data with trading portal/terminal and thus, most data gets updated on an overnight basis.

- Average Customer Service quality.

- No facility to invest in IPOs, Fixed Deposits, Mutual Funds, NCDs or FPOs

- No provision for NRI Trading.

“SAS Online has received 2 complaints this financial year which is 0.01% of its total active client base. (industry average is also 0.01%).”

SAS Online Advantages:

At the same time, here are some of the benefits this discount broker provides to its clients:

- Plans with unlimited trading across segments are available giving complete flexibility to the number of trades a user wants to make in a month

- One of the cheapest stockbrokers

- Trading platforms across devices are available

- Margin against shares is available

- Client Referral plan available with a sharing bracket range of 20% to 50% of the brokerage.

Conclusion

“SAS Online still has a long way to go when it comes to positioning itself well enough when it comes to the overall discount stockbroking space. So be it trading platforms, customer service, trading products – the value propositions are pretty mediocre, as of now.

It is relying primarily on low brokerage and decent exposure but that is not a long-term survival strategy. Thus, if you are looking to cut your brokerage charges ONLY, then you may opt to choose this discount stockbroker.”

How to Open a Demat and Trading Account?

Enter Your details here to get a callback!

SAS Online Documentation:

Post this call You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

SAS Online Membership Information:

Here is the membership information of the broker with different exchanges and intermediate parties:

| Entity | Membership ID |

| BSE | INB010907336 |

| NSE | INB230907337 |

| SEBI | INZ000089835 |

| NSDL | IN-DP-NSDL-3742014 |

| MCX | 55215 |

| NCDEX | 1233 |

| Registered Address | 3rd Floor, Building No.5, Local Shopping Complex, Rishabh Vihar, Near Karkarduma Metro Station. East Delhi - 110092 |

The details can be verified from the corresponding websites of the exchanges.

SAS Online FAQs:

Some of the most frequently asked questions about SAS Online are discussed here for your reference:

Is SAS online discount brokerage firm a scam? Is it reliable?SE

Although the discount stockbroker is a registered one by SEBI and comes under tight its scrutiny, there have been mixed reviews for/against the broker. For instance, the broker has seen 5 complaints registered already this financial year, which is 2.04% of its overall active client base.

This number must be as low as possible and the industry average is 0.06%. Thus, from the numbers point of view, SAS Online fails to impress users who are looking to open a new demat/trading account.

In short, for now, the broker is NOT reliable and has to work hard to earn the trust factor from its current and future client base.

What are the brokerage charges of SAS Online?

The discount stock broker is pretty flexible as far as brokerage charges are concerned. Depending on your trading behaviour and preferences, the broker has brokerage at per executed order level as well as monthly plans in terms of segments.

If you are looking to opt for a brokerage plan at per order level, then you are required to pay 0.01% of the trade value or ₹9 (whichever is lower). Otherwise, you can opt to pay ₹999/month for unlimited trading in Equity or Commodity segment and ₹499/month for currency segment.

What is the account opening charge of SAS Online?

The discount stock broker charges ₹400 for demat and trading account and requires a payment of ₹200 per year to maintain your demat account with them.

There are no charges to maintain your trading account with the broker.

How is the customer service of SAS Online?

Customer service of the discount stock broker is below average, especially the time it takes to resolve your query or concern. Most of the times, clients need a quick and immediate resolution of their problems and due to this particular concern, the resolutions are received when its already too late. The broker is advised to address this issue pretty quickly since it has been raised time and again by its clients.

What trading and investment products are available at SAS Online?

With this discount stockbroker, you can trade and invest across segments including Equity, commodity, currency and derivatives. This is another area the discount stock broker needs to work upon and increase its coverage across other segments.

How is the mobile trading app of SAS Online?

The discount stock broker offers an average performing mobile app with 37% of users unsatisfied with the mobile app. Overall rated at 3.2 with the industry average of 3.9, thus, it’s better to use other trading applications offered by the stockbroker.

Also Read:

More on SAS Online:

If you are looking to find more information about this discount broker, here are a few reference resources for you:

SAS Online Review  |

SAS Online Comparisons  |

| SAS Online Transaction Charges |

| SAS Online Brokerage Calculator |

| SAS Online Margin |

SAS Online Hindi Review  |

Don’t go for sas online . there is lot of issue in alpha app.if you call also it will take more time to square off your shares.Last Friday the application stopped more than 20 min .I have lost more than 3k out of 8k .