5paisa

List of Stock Brokers Reviews:

5Paisa is a leading online discount stockbroking company based out of Thane, Maharashtra and was established in the year 2015.

The discount broker was an arm of IIFL (India Infoline Limited) before becoming an isolated enterprise in 2017. Although it is relatively a new player in the industry, it is already into three financial domains including Online trading, Insurance, and Mutual funds.

5Paisa Review

Within stockbroking, it allows trading within NSE, BSE, MCX & MCX-SX exchanges through its membership with the respective exchanges.

With its roots from India Infoline, the discount broker has a huge advantage when it comes to industry know-how, dynamics, customer behaviour and so on. And that is why 5Paisa provides you with research tips and recommendations for technical and fundamental analysis as well.

The discount broker claims to have a turnover of ₹50,000 Crore every day on the stock market through its clients.

It also offers a program called 5Paisa Partner where you can get into a partnership with the broker and earn by referring clients for stock market investments. There is a separate 5Paisa refer and earn plan as well.

“India Infoline or IIFL has invested ₹100 Crore into it’s discount broking arm 5Paisa recently.

The discount broker has been listed as an individual entity at BSE and NSE in 2017 and works as a separate broker now.”

Very recently, 5Paisa has been listed at BSE and NSE making it the only discount stock broker in India to be listed on the stock market. The broker looks to expand its client base by another 50,000 by the next 12 months, while it currently stands in the range of 1.2 million clients.

Out of the current client base, 60% come from smaller cities i.e. tier 3 or tier 4 of India.

Furthermore, IIFL, its earlier parent company, will be investing ₹100 Crore into this discount stockbroker.

For the past 1 year or so, this discount broker has witnessed a quarter-on-quarter growth of 100% in turnover.

All these facts seem promising for sure.

The million-dollar question, however, is whether 5Paisa will able to leverage these benefits?

Coming back to the review, this allows you to trade in 5paisa in the following segments:

- Equity

- Currency Trading

- Mutual Funds

- Insurance (Car, Term Life, Health, Auto)

- Commodity Trading

- Derivative Trading

- IPOs

- NFO

- NCD

Thus, in a sense, it offers a wide range of trading and investment products for clients. And, as a discount stock broker, it is one of the rare USPs for sure.

Prakarsh Gagdani, CEO – 5Paisa

5Paisa Trading Platforms

Pretty much in line with some of the other discount brokers, 5Paisa trading is done through Desktop, Browser, and mobile-based applications.

However, what differentiates it from the rest are the unique features these platforms provide over the rest. Here are the details:

5Paisa App

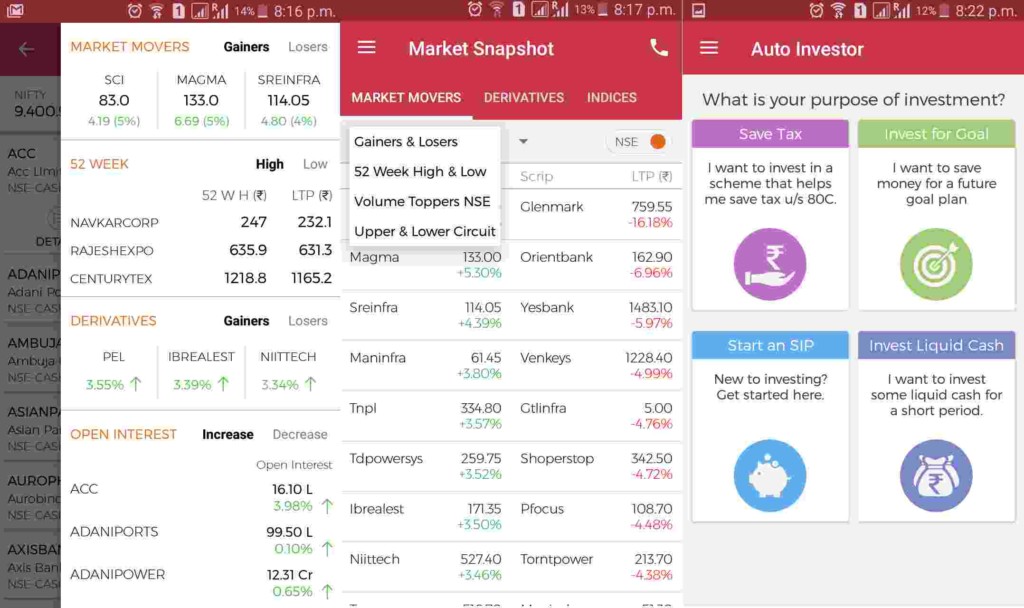

5Paisa Trading & Robo Advisory is first of its own kind of mobile app that provides Online trading as well as Robo advisory services within the same app. This mobile app is pretty exhaustive when it comes to usability or the number of features.

The app has all the stocks, advisory, personal loans, insurances, mutual funds, and research all in a single app.

The management of this discount stock broker claims that 70% of the transactions done every day happen through this mobile app, giving an idea of the robustness of the mobile app.

The app has over 6.5 million downloads.

This app allows the users the following features:

- All in one account (Trading + Investment)

- Access Mutual Fund

“You can access the mobile app of 5Paisa with demo user id and password. Get in touch with Us for you to provide you with the credentials.”

- Auto Investor feature allows you to choose from different plans such as Save Tax, Investment for a specific goal, Starting a SIP or Invest liquid cash.

- Get Live Quotes and order placement for Insurance and other related segments

- Live NSE & BSE market Quotes

- Advanced Charting and Multi-asset Live Watchlist for better analysis

- Provides decent Performance or order execution speed.

Here are some of the screenshots of the mobile app:

Here are a few stats about the mobile app from the Google Play store:

| 5paisa Mobile App | ||

| Number of Installs | 1Cr+ | |

| Mobile App Size | 44 MB | |

| Technical Indicators | 100+ | |

| Chart Types | 5 | |

| Rating |  | |

Also, Read – 5Paisa Free Demat Account

“All the trading platforms from 5Paisa provide a unique proposition to trade in the stock market to go along with a provision to invest in Mutual Funds as well as Insurance.”

5Paisa Trade Station

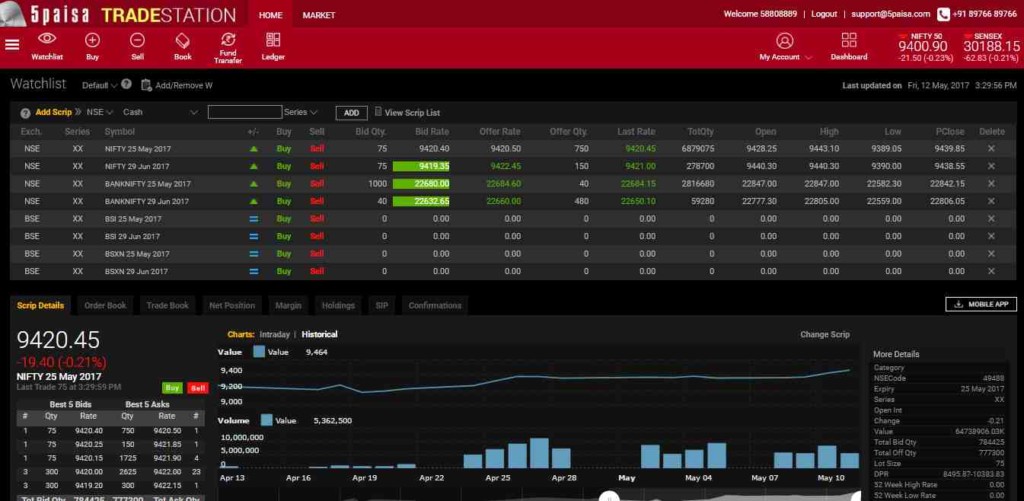

The browser trading platform from this discount stockbroker is a cloud-based application available on selected browsers i.e. Chrome, Internet Explorer and Mozilla Firefox only.

The platform lets you invest in Mutual Funds as well apart from other financial instruments. The application is known for fast execution time and seamless user experience.

To access this application, the user just needs to go to the official website of the discount broker, click Login, enter username and password and get going with their trading.

5Paisa Trade Station offers you the following features:

- Multiple order types offering flexibility to the user.

- Intraday as well as historical data available for technical and fundamental analysis respectively.

- Provision to invest in Mutual funds and Insurance segments.

- Provides research tips and calls to make quick judgments.

This is how this browser-based application looks like:

Users are allowed to create a demo account for themselves to get an idea around the performance and user experience of the application.

5Paisa Trader Terminal

The 5paisa desktop app is called ‘Trader Terminal‘ and it provides an exhaustive list of features, including:

- Second Level Authentication brings in a high amount of security so that users can transact and trade without any security breach concerns.

- The application provides a consolidated view of user’s portfolio along with access to all trade reports, charges & bills.

- Interactive charting tool that provides real-time indications about the market trends and behaviour

- With Market-watch, users can get updates on Real-time accurate scrips

- Highly usable and easy to use user interface

- Users can buy and sell using the same integrated window

Here are some of the screenshots:

5Paisa Algo Trading

When it comes to algo trading, this discount broker does not have much to offer yet, as far as stock market investments are concerned. At the same time, we have industry examples such as Zerodha Streak or Angel Broking ARQ.

However, 5Paisa does not really have anything to show-off.

Having said that, the broker does offer on similar lines in mutual funds investments and it offers a platform titled 5Paisa Auto Investor.

Here are the details:

5Paisa Auto Investor

5Paisa Auto Investor is a web-based robo-advisory mechanism offered by the discount broker to its clients.

Users can provide their requirements for return expectations, risk appetite, investment spread etc and based on these preferences, personalized recommendations on investment classes along with capital segregation and return period are provided back to the user.

With this system in place, the angle of human error goes out of the window and you can get recommendations based on data points and in fact, get your portfolio monitored for future movements.

5Paisa School

5Paisa School or 5P School is an initiative from the discount stockbroker towards stock market education for all kinds of traders, be it – beginners, intermediate or expert level traders. The whole portal provides different modules on topics such as:

- Equity

- Technical Analysis

- Mutual Funds

- Derivatives

- Trading Psychology

For more information, you can read 5paisa Option Trading to know about 5paisa option trading charges in detail. Apart from that, there are various videos and blogs that are written and updated on a regular basis.

This helps you understand the intricacies and techniques of trading and investment at different levels.

Furthermore, the portal is free to use and does not even require user 5paisa demat account login to access.

5Paisa Smallcase

As mentioned in the case of Smallcase Zerodha, 5Paisa smallcase works in a pretty much similar manner.

Here the platform recommends specific stocks in relevant packages based on industry, company size, volatility and other related information.

When you use a smallcase for your investments, it provides you with multiple data points such as CAGR, growth comparison with the industry indices, Stocks within the smallcase with their weight percentage.

You may choose to subscribe to this service which helps to diversify your investments. These smallcases are of several types as mentioned below:

- Thematic

- Model-based

- Smart Beta

- Sector Trackers

Each smallcase is priced at a certain amount and to invest in a particular smallcase, you need to invest a minimum recommended amount along with paying for the smallcase price.

5Paisa Smart Investor

5Paisa has done another collaboration with a research advisory, MarketSmith India.

The latter is an app-based research firm that provides multiple products to users which can be used for stock market advisory.

Through this integration with 5Paisa, clients of 5Paisa can access this research and advisory within the 5Paisa app itself.

The small investor advisory comes free of cost with all three packs, that is, the basic plan, the power investor, and the ultra trader plan.

The subscription of Smart investor is priced at ₹5899 (including taxes) and is charged on an annual basis.

Using this research product, clients of this discount broker can get access to the fundamental analysis of stocks within the trading platforms.

5Paisa Back Office

The clients of this discount broker can access the back-office if in case they are looking to perform some administrative tasks such as:

- Fund transfers

- Share transfers

- Checking Ledger

- Accessing Contract Notes

- Update personal information

The credentials to your 5Paisa back-office are provided when your account is activated with the broker.

If in case, you do not get those details, you can ask the 5Paisa support team.

5Paisa Login

If you are looking to login into 5Paisa systems, you can do it through multiple ways depending on the kind of platform you are looking to log in to.

For instance, if you are looking to log in to the web app of this discount broker, then you can just browse the website of 5Paisa, click on login displayed at the top right part of the screen and enter your credentials.

Once you do that, a login pop up will be displayed where you’d be required to enter your username, password and date of birth.

Post validation, you will be logged into the system.

Similarly, you can use your credentials to log in to the other trading apps and back-office system of this discount broker.

5Paisa Bracket Order

If you are looking to perform intraday trading and want to take a larger margin, then it makes sense for you to place bracket order. The advantage of doing that would be that you not only will get high margin but also be protected through stop-loss.

You can even avail the 5paisa intraday square off time benefits in which the order gets executed automatically after square off time.

Placing a 5Paisa bracket order is relatively easy.

Also Read: Intraday Tips

All you need to do is log in to the trading app of 5Paisa, go to the scrip you are looking to trade. Click on buy or sell, depending on the kind of trade you are looking to place and then go to advanced.

And the best part about intraday trading in 5paisa is their charges. The 5paisa Intraday Trading Charges are ₹10 per executed order, which less comparatively other stockbrokers.

Here you will get the option of choosing the order type as ‘Bracket Order’. Select that option and submit.

Easy, right?

5Paisa Customer Care

5Paisa offers multiple communication channels to its clients for customer service. These channels include:

- Phone

- Social Media

- Play Store

The number of communication channels in case of this discount broker is certainly limited and the quality of service in terms of turnaround time can also be improved.

At the same time, it is a discount broker and customer service is not really a top USPs of these kinds of brokers. However, the discount broker does better than an average job as compared to most of the discount stock brokers in India.

Not only support, but the broker also tries to educate its users through trading and investment tutorials and blogs on its website.

“5Paisa maintains a financial blog for its users that gives an idea towards the happenings in the stock market with the point of view of the broker.”

5Paisa Charges

Let’s quickly check some details as far as pricing levied by 5Paisa is concerned along with the subscription plans it has unveiled for its clients.

5Paisa Subscription Plans

Well, the broker has introduced subscription plans with a mix of free and paid. The plans are called:

The paid plans are charged on a monthly basis and improve value in terms of research, margin, brokerage etc.

Here are the details for your reference:

| 5Paisa Subscription Plans | ||||||

| Equity | Basic Plan | Power Investor Plan | Ultra Trader Plan | |||

| Brokerage | Rs.20/order | Rs.10/order | Rs.10/order | |||

| Account opening charges | Free | Free | Free | |||

| DP Charges | Rs.12.5 | Free | Free | |||

| Account Maintenance charges | Upto Rs. 50,000- Rs.0 Rs.50,000 to Rs. 2,00,000-Rs.8 Above Rs.2,00,000- Rs.25 | Upto Rs. 50,000- Rs.0 Rs.50,000 to Rs. 2,00,000-Rs.8 Above Rs.2,00,000- Rs.25 | Upto Rs. 50,000- Rs.0 Rs.50,000 to Rs. 2,00,000-Rs.8 Above Rs.2,00,000- Rs.25 | |||

| Small Investor Advisory | NIl | Free | Free | |||

| Swing Trader- Short Term | NIl | Free | Free | |||

| Portfolio Analyser | NIL | Free | Free | |||

| Monthly Brokerage Cashback | Rs.0 | Rs.0 | Upto Rs. 1000 | |||

| Call and Trade Charges | Rs.100/call | Rs.100/call | NIL | |||

| Fund Transfer Charges | Net Banking- Rs.10 UPI- Free IMPS- Free | Net Banking- Rs.10 UPI- Free IMPS- Free | Net Banking- Free UPI- Free IMPS- Free | |||

So, the essence of these plans is that if you keep a monthly subscription fee to the broker, you will get:

- Free Trades

- Low or No Annual maintenance fee

- Smallcase investment

- Low or no debit charges

- Free Call and Trade facility etc

It depends on the kind of trader you are and at what stage of trading you are at.

If you are a beginner, it makes sense to stick to the basic plan and if your trades gradually increase and if you stick to stock market investments, then you may think of upgrading later.

5Paisa Account Opening Charges

There is an account opening charge of ₹250 if you are looking for both trading and 5Paisa demat account. For transacting in commodities, there is no account opening charge involved.

There is also no yearly maintenance charge for holding the value of security upto 50,000 on the last day of the month.

Thereafter, if the holding value of the security is around Rs.50,000- Rs.2,00,000, the yearly maintenance charges is Rs.8 and above Rs. 2,00,000, it is Rs.25.

5Paisa Offers

You can avail an exclusive offer through A Digital Blogger as follows:

- Get the first 5 trades for Free without any brokerage

- Get 100% Discount on Account Opening Fees

Simply, leave your details in the form below and the executive of 5Paisa will call you back!

5Paisa Brokerage

Here are the brokerage charges across segments (flat-rate):

| 5Paisa Brokerage | ||||||

| Basic Pack | Power Investor Pack | Ultra Trader Pack | ||||

| Equity Delivery | Rs. 20 /order | Rs. 10/order | Rs. 10/order | |||

| Equity Intraday | Rs. 20 /order | Rs. 10/order | Rs. 10/order | |||

| Equity Futures | Rs. 20 /order | Rs. 10/order | Rs. 10/order | |||

| Equity Options | Rs. 20 /order | Rs. 10/order | Rs. 10/order | |||

| Currency Futures | Rs. 20 /order | Rs. 10/order | Rs. 10/order | |||

| Currency Options | Rs. 20 /order | Rs. 10/order | Rs. 10/order | |||

| Commodity Futures | Rs. 20 /order | Rs. 10/order | Rs. 10/order | |||

| Commodity Options | Rs. 20 /order | Rs. 10/order | Rs. 10/order | |||

Check this 5Paisa Brokerage Calculator to calculate your profits.

How does Brokerage work?

Like in case of discount brokers, 5Paisa charges a flat rate of INR 10 implying irrespective of your trade capital, be it INR 10,000, 1 Lakh or Crore, the brokerage will always be INR 10 per executed order.

In fact, 5Paisa is half the price of the likes of Zerodha or Upstox when it comes to brokerage at Intraday levels.

5Paisa Transaction Charges

Apart from the brokerage, account opening and maintenance charges, you are required to pay transaction charges and few taxes as well. Here are the details on the transaction charges levied on trades:

| Segments | Basic Pack | Power Investor Pack | Ultra Trader Pack |

| Equity Delivery | Rs. 20 /order | Rs. 10/order | Rs. 10/order |

| Equity Intraday | Rs. 20 /order | Rs. 10/order | Rs. 10/order |

| Equity Futures | Rs. 20 /order | Rs. 10/order | Rs. 10/order |

| Equity Options | Rs. 20 /order | Rs. 10/order | Rs. 10/order |

| Currency Futures | Rs. 20 /order | Rs. 10/order | Rs. 10/order |

| Currency Options | Rs. 20 /order | Rs. 10/order | Rs. 10/order |

| Commodity Futures | Rs. 20 /order | Rs. 10/order | Rs. 10/order |

| Commodity Options | Rs. 20 /order | Rs. 10/order | Rs. 10/order |

5Paisa DP Charges

Apart from the generic account level charges and the brokerage levied, there are a few charges levied by the broker some specific services provided.

You must know about all these charges so that you don’t get surprised later. Here are the details:

| Nature of Transaction | DP Charges |

| Transfer of shares from your demat a/c (on selling the shares) | Rs 12.5 |

| Transfer of shares from one demat account to another | Rs 12.5 |

| Pledge (Funding) | Rs. 25/scrip |

| Pledge (Margin) | Rs. 12.5/scrip |

| Unpledge | Rs. 12.5/scrip |

| Unpledge and Sell | Rs. 12.5 + Rs. 12.5 (Rs. 25 per scrip) |

This must be known that all stockbrokers these kinds of charges. The literal pricing may vary but you’d still be required to pay if you use any of these services.

5Paisa Hidden Charges

The discount broker does not charge any hidden charges as such. Most of the charges described above are pretty much explicit.

However, there have been few complaints raised by some of the clients of this broker of being charged on customer service, account-level deductions etc.

Thus, it is suggested that you keep a close eye on the transactions made in your account along with checking contract notes on a regular basis. For instance, there would be 5Paisa Auto square off charges applicable in case the trader forgets to exit the trades before the market ends for MIS orders.

By the way, there would be 5Paisa STT charges levied on your trade turnover, keep an eye on that!

5Paisa Margin Trading

The following margin values are provided to clients across segments:

| 5Paisa Margin | ||||||

| Basic Pack | Power Investor Pack | Ultra Trader Pack | ||||

| Equity Delivery | 4X | 4X | 4X | |||

| Equity Intraday | 20X | 20X | 20X | |||

| Equity Futures | 4X | 4X | 4X | |||

| Equity Options | 4X | 4X | 4X | |||

| Currency Futures | 3X(buy and sell) | 3X(buy and sell) | 3X(buy and sell) | |||

| Currency Options | 3X (only sell) | 3X (only sell) | 3X (only sell) | |||

| Commodity Futures | 4X | 4X | 4X | |||

| Commodity Options | NIL | NIL | NIL | |||

Although the broker offers decent exposure it is advised that you should use leverage only if you understand the risks of using it. Yes, it is a lucrative concept but using it without knowing the implications, can put you in a risky situation.

Also Read: 5Paisa Margin For Delivery and Delivery Charges in 5paisa

5Paisa Fund Transfer

There are multiple ways in which 5Paisa allows you to transfer your funds:

Net Banking

One of the easiest modes of funds transfer using which you can transfer funds from your linked bank account to your trading account. 5Paisa has an integrated payment gateway that allows you to transfer funds from 28 prominent banks of India.

The minimum amount you can transfer through Net banking is ₹50.

NEFT

NEFT or National Electronic Funds Transfer is another mode that you can use to transfer your funds. You will need to following details in order to use this method:

- Bank Name

- Payee Name

- Branch Name

- Account number

- IFSC Code of the bank branch

Once the fund transfer is complete, you are required to provide the following details to the 5Paisa Support:

- Transaction reference number

- Statement of the bank you used for the transfer

IMPS

For a quick transfer, you can use IMPS or Immediate Payment Service through online banking. Use this link to check quick information on 5Paisa Bank List.

Paytm

For people preferring mobile payment wallets, the discount broker has an integration of the payment wallet and you can try this mode as well in order to transfer your funds.

How to Withdraw Funds from 5Paisa Trading Account?

The broker allows you a couple of provisions by which you can withdraw funds from your trading account. This can be done by:

- Web application

- Mobile App

In the case of the web application, you will find this option along with Mutual Funds. While when you are using the mobile app of 5Paisa, it can be accessed under the ‘Trade’ menu item which further displays ‘Funds’ as a sub-item.

The withdrawal process of funds or the funds’ payout goes through a specific timeline and depending on the day and time of your request, the request processes. This is how it works:

| Monday To Friday | ||

| Client Payout Request time | Ideal Payout Receipt time in client's bank account | |

| Previous Day 3.45 pm to Next day 10.30 am | 1.00 pm | |

| From 10.30 am to 01.30 pm | 4.00 pm | |

| From 01.30 pm to 3.45 pm | 6.30 pm | |

| Working Saturday of Banks | ||

| Previous Day 3.45 pm to Next day 1.00 pm | 4.00 pm | |

| Request after 1.00 pm | Monday 1.00 pm | |

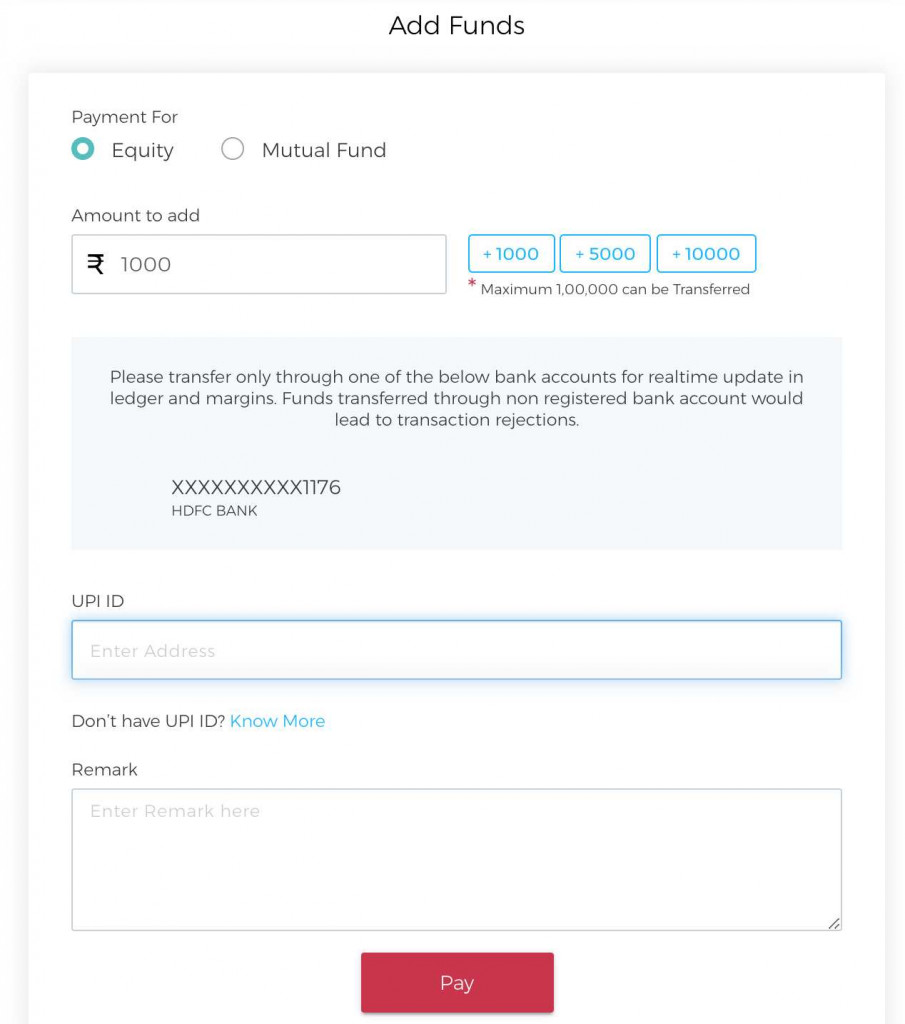

5Paisa UPI ID

The broker allows payment through the UPI mode as well.

The process of transfer is simple too. Here is a quick snapshot of the UPI transfer interface:

All you need to do is:

- Select the investment product (Equity or Mutual Funds)

- Amount to be transferred

- Your UPI ID

- Any specific remarks for your future reference

Post entering all these details, you can click on pay. This will be followed by a quick confirmation of the details and then the transfer is made.

“With 5Paisa, You can open perform 5Paisa account opening using your Aadhar Card as well. With this, the overall account opening process takes a few hours.”

5Paisa Advantages

At the same time, here is the bright side of the picture:

- One of the cheapest discount brokers in India at ₹10 brokerages per executed order.

- Offers a wide range of trading and investment products.

- Has gained a reasonable amount of brand equity and trust among its client base in quick time.

- High tech trading platforms including the mobile app and browser-based application

- Even though 5Paisa is a discount broker, it still provides quality research and tips to its clients through its research team.

- Process of how to buy IPO in 5Paisa along with mutual funds and insurance pretty simple.

5Paisa Disadvantages

Here are a few concerns associated with the stockbroker:

- Service turnaround times can be a little high at times

- No fixed brokerage monthly or yearly plans.

- Hidden charges reported by clients.

- Customer service can be improved.

5Paisa Registration

Interested in Opening an account?

Post this call, there are 2 ways to get started.

- If you have an Aadhar card, then the account opening process can be completed in a few minutes.

- Otherwise, you need to provide a few documents to start your account opening process. The 5Paisa Account Opening Documents are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

5Paisa POA Form

As per the broker, the POA form is not a mandatory document. However, it is advisable to provide a signed copy of the power of attorney document so that there are no unnecessary hiccups while you place trades from your account.

Once your account is activated with the broker, you will be provided with a blank copy of the POA form. You need to sign this form at the requisite places and courier it to the broker.

A lot of users feel uncomfortable providing the POA form, however, there is not much to worry about when you submit it to the broker along with the rest of the documents.

5Paisa Account Closure

In case, you are looking to close your Demat account with 5Paisa, then you just need to fill up the 5Paisa Account Closure form and dispatch it to the broker.

Once you dispatch the account closure form, you also need to make sure that there are no dues pending from your end to be cleared. Because, if there are, that will only delay the proceedings.

Post all the formalities are done, it generally takes 4-5 business days for your account to be closed in the system.

5Paisa Account Closure Form

In order to close your demat account, you need to fill this 5Paisa closure form.

Make sure you are filling the details correctly and as per the documentation. Otherwise, it will lead to rejection, thereby, delaying your account closure formality.

5Paisa Membership Information

Here are the details on the different membership details of the discount stockbroker:

| Entity | Membership ID |

| SEBI Reg. no | INZ000010231 |

| SEBI RA Registration | INH000004680 |

| CIN | U67190MH2007PLC289249 |

| AMFI | ARN-104096 |

| NSE Member Id | 14300 |

| Registered Address | Sun Infotech Park, Road No. 16V, Plot No.B-23 Thane Industrial Area, Wagle Estate, Thane - 400604 |

The details can be verified from the corresponding entity websites.

5Paisa Forms

When you open a demat account with a broker, there are multiple forms that you need to use at different points of time, be it at the account opening stage, managing your account with the broker or closing the account (like discussed above).

Thus, getting access to these forms at the right time is not only just crucial but also sort of necessary.

Here are some of the 5Paisa forms that you think, you may need while you looking open your demat account with this stockbroker and trade through it:

- 5Paisa Account Opening – Institutional

- 5Paisa Account Opening Form

- 5Paisa BSDA Form

- 5Paisa Change Broker

- 5Paisa Trading Segment Addition Form

- 5Paisa Account Update Form

- 5Paisa Name Mismatch Form

- 5Paisa Pledge Request Form

- 5Paisa Unpledge Request Form

- 5Paisa Remat Form

- 5Paisa DIS Issue Form

- 5Paisa Bank Details Update Form

- 5Paisa Dematerialization Form

- 5Paisa Nominee Detail Form

Feel free to download these forms, fill them up and submit to the broker. In case you have any queries, we suggest you use the comment section at the bottom part of this review and let us know.

Know about the Pledge of Shares

We will get back with the response as soon as we can.

5Paisa DP ID

5Paisa is associated with both CDSL as well as NSDL.

Both the depositories have issued corresponding DP IDs to the broker as follows:

- CDSL: 82500

- NSDL: 12082500

For further verification, you are suggested to check out the respective websites of the depositories and validate these details. In fact, this needs to be done for any stockbroker you are looking to open your demat account with.

5Paisa Owner

Nirmal Jain is the owner of 5Paisa.

He is also the founder and the chairman of the IIFL group. This was the group that launched 5Paisa back in the year 2015 and pumped 100s of crores to get this venture moving in the stockbroking space.

Conclusion

“5Paisa certainly looks one of the promising discount stock brokers of the country.

With a low brokerage, decent trading platforms, provision of tips and recommendations – it certainly offers more than value for money service to its clients.

If you are a beginner or a small to medium level investor, this discount stock broker suits the requirements you might have at this stage or phase of your trading career.

Customer service, though, is one area that needs immediate attention and must be improved across communication channels.”

5Paisa FAQs

Here are a few most frequently asked questions about 5Paisa you must be aware of:

Is 5Paisa cheaper than Zerodha and Upstox?

Yes, 5Paisa charges only ₹10 per executed order as brokerage charges while in case of Zerodha or Upstox, the brokerage can go as high as ₹20, double of what 5Paisa charges.

Is 5Paisa a trustworthy Broker? Will my money be safe?

5Paisa is the discount trading arm of India Infoline (IIFL), a prominent full-service stockbroker of India which was established in the year 1995. Further IIFL has regularly injected capital into this discount stockbroker ( the last one being ₹100 Crore).

The discount broker is going to be listed as an individual entity on BSE and NSE this month in June 2017.

What are the account opening and maintenance charges at 5Paisa?

The 5Paisa AMC Charges are ₹400 per year and Account opening costs ₹250. If you can start with a capital of ₹50,000 or more, you can negotiate with the executive to levy off these charges for the first year.

In which segments I can invest and trade using 5Paisa?

With this discount stockbroker, you can trade and invest in multiple segments including Equity, Currency, mutual funds and insurance. All these investments can be done through any of their trading platforms.

Yes, 5paisa safe for trading. It is widely known for its advanced trading platforms that are easy to access.

Also, read Check out the comparison of 5Paisa with other stockbrokers:

Wish to open a Demat Account? Please refer to the form below

More on 5Paisa

In case you are looking to know more about 5Paisa, here are some reference articles for you:

Does 5Paisa provide Tips and Recommendations? Isnt it a discount stock broker?

Yes Varun, even though 5Paisa is a discount stock broker, it still provides tips and research at no extra cost.

Do we need to send any signed copy of documents for account activation formalities? What are all the documents

If you have Aadhar eKYC, then you don’t need to go through the offline documentation, otherwise yes.

Hi Aseem ji,

is 5paisa.com has a branch in Hyderabad TS? If not how can I open account with 5paisa.com?

Discount brokers do not have offline presence Nayakwadi. 5Paisa communicates through email, phone and social media.

Worst company to associate with. Never open account with them . You can not trust them.custimer service is pathetic. Illieterate guys are sitting there. Lootne ka digital tarika

Incredible points. Great arguments. Keep up the amazing spirit.

When are you starting commodities trading ?

5paisa trading platform ki ekdam ghatiya bekar service hai

naye trader jinko operating sirf samajna ho wo bhi nahi shikhate

kuch bhi pucho to jawab me ek line bolte rahete hai

“youtube pe hamara video pahele dekho baad me hamse baat karo”

per call Rs 100/- ka charges batate hai

mera to Rs.650/- bekar hi gaya

galti ho gai 5paisa me account open karvake

Its good, but I believe in real world situations, you never get benefit on regular basis without advisers, That’s why I follow only SEBI registered advisers.

The most unprofessional and unreliable. Don’t purchase it’s smart investor account,if you really concern about your money. They have no rules for customer satisfaction, they have rules only for benefit of 5paisa.

Don’t open trading account in 5paisa company. Cheating investors/traders money without informations. Be careful