Action Financial

List of Stock Brokers Reviews:

Action financial services limited is a discount stock broker based out of Mumbai since 1992. The broker claims to the first one to be registered as a portfolio manager with SEBI as well as to be the first broking company to get listed on the Bombay stock exchange (BSE) in 1995.

Action Financial Review

The discount stock broker has memberships with NSE, BSE, MCX, USE, BGSE and NSDL. With these memberships, the broker allows its clients to trade and invest in the following segments:

- Equity

- Currency

- Mutual funds

- Derivatives Trading

- NRI Services

- Depository services

As you can observe in the list above, you will not be able to trade in commodities or IPO segment. Thus, be very sure of the segments you are looking to put your money into and only then make a selection.

“Action Financial has an active retail client base of only around 400 by 2020”.

Mr Milan R Parekh, Chairman & MD – Action Financial

Action Financial Trading Platforms

When it comes to trading platforms, Action financial has a long way to go. As of now, it provides outsourced third-party trading platforms across devices. Thus, be it the mobile app or the terminal solution, they do not have anything that is developed or maintained in-house by the brokerage house.

And the problem with such a set up is, that is you – as a client, have any feedback or comment that you think must be incorporated within the trading platform, that will not happen when there are third party softwares in place.

The stockbroker(s) in such cases, do not have much of a control over what goes in and out of the application.

Nonetheless, here are the details of the trading platforms offered by the discount broker here:

NSE Now

NSE Online is a web-based browser trading application that does not require any download or installs. You can just click on the login button on the broker’s website, put invalid credentials and you can start trading. This lightweight application has the following features added in:

- A responsive application that can be used across different devices

- Multiple types of charts for technical and fundamental analysis

- Real-time streaming quotes from multiple indices

This is how the application looks like:

NSE Mobile App

This mobile app from NSE (National Stock exchange) is provided through a license to multiple stock brokers of India, including Action Financial Services limited. The app provides multiple features as listed below:

- Multiple features for technical and fundamental analysis

- Decent speed and performance

- Various market watchlists

There are few concerns with this mobile app as well:

- Compromised user experience with tough usability

- Low update frequency cycle

This is how the mobile app is rated at the Google Play Store:

| Number of Installs | 1,000,000 - 5,000,000 |

| Mobile App Size | 37.4 MB |

| Negative Ratings Percentage | 13.9% |

| Overall Review |  |

| Update Frequency Cycle | 1 year |

The broker can also provide you access to NEST, but that is a paid software and if you want to use this, you will be required to pay a monthly software usage payment to the broker.

Action Financial Customer Service

The discount stock broker provides the following communication channels to its clients to get in touch with:

- Phone

As you can see, the broker offers a very limited number of communication channels for service and that makes the whole process very weak.

Although the turnaround time is better than average, however, in this day and age where users look for quick resolutions, primarily through online channels, Action financial seems to be missing the trick here.

Thus, we would suggest you keep your expectations pretty low when it comes to customer service from this discount stock broker.

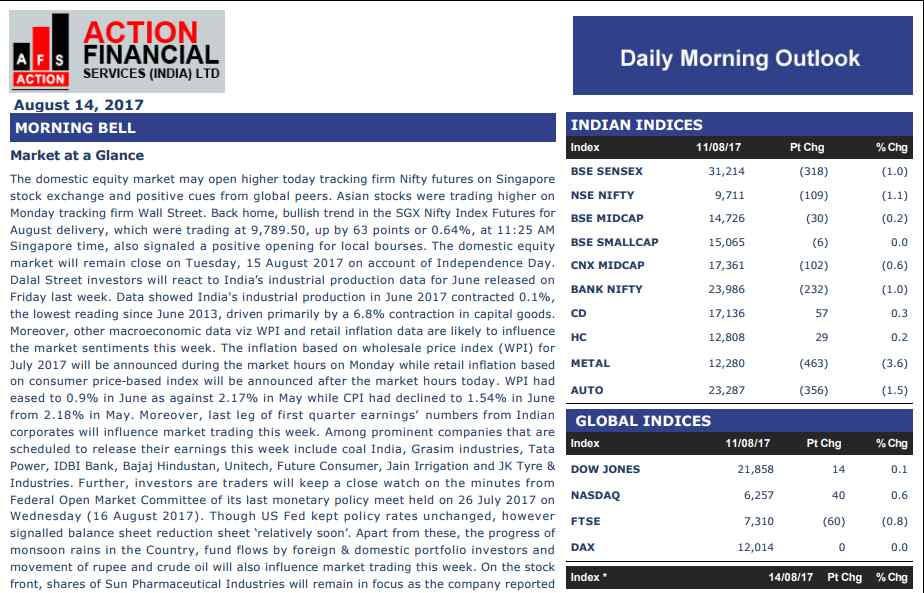

Action Financial Research

Although Action financial is a discount stock broker, it provides you with basic level research at both technical and fundamental level. These are the research products offered by the broker:

- Daily Morning Report

- Fundamental reports

- Stock Picks

- Sector Reports

- Currency reports

- Technical reports

- Equity and derivatives

- Currency

The reports are provided at the short, detailed and quarterly level. Thus, depending on your preferences, you can subscribe to the corresponding reports

This is how one such report looks like:

Although the broker provides you with such reports and analysis, our advice is to perform your own analysis as well. The accuracy, performance and regularity of these reports are mediocre and its safe to perform your own analysis or using an advisory service for research.

Action Financial Charges

When it comes to pricing, this discount stock broker asks for pretty low charges across entities at account or brokerage levels. Here are the details:

Action Financial Account Opening Charges

To open your trading and demat account, you do not need to pay anything to the broker.

In other words, the account opening costs are zero. There are few plans on annual maintenance charges (AMC) though, but it depends on your trading turnover for the whole year and the initial refundable deposit you can provide.

Thus, based on your trading behaviour, you can pick a corresponding plan. The details are mentioned below:

| Plan | Annual Turnover | AMC |

| Silver | Upto ₹50 Lakh | ₹500 |

| Gold | >₹50 Lakh & <₹2.5 Crore | ₹800 |

| Diamond | >₹2.5 Crore & <₹7.5 Crore | ₹1000 |

| Platinum | Unlimited | ₹1200 |

This needs to be understood that the turnover mentioned in the middle column is for the whole year and corresponding AMC charges are to be paid annually and thus, it’s a recurring cost. At the same time, if you are in plan A and your turnover crosses over to a value of plan B, then you will be required to pay the difference of AMCs as well.

Action Financial Brokerage

Brokerage in case of this discount stock broker is at a unique level. It is 0.01% of your trade value, irrespective of the trading segment. In other words, this is how the brokerage structure of Action Financial looks like:

| Equity Delivery | 0.01% of your Trade Value |

| Equity Intraday | 0.01% of your Trade Value |

| Equity Futures | 0.01% of your Trade Value |

| Equity Options | 0.01% of your Trade Value |

| Currency Futures | 0.01% of your Trade Value |

| Currency Options | 0.01% of your Trade Value |

Since the brokerage house does not allow trading in the commodity segment, thus, the brokerage values of that segment are not mentioned in the table above.

Use this Action Financial Brokerage Calculator for complete charges and your profit

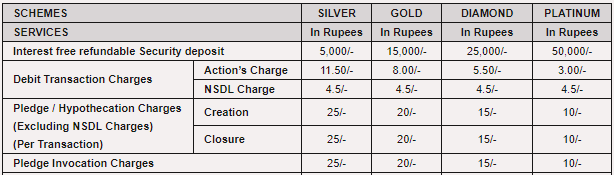

Action Financial Transaction charges

Apart from the account related or brokerage charges, you will be required to pay transaction and a few other charges. At the same time, these charges depend on the kind of plan you pick.

Here is a small snapshot for reference:

Action Financial Margin

The discount stock broker provides pretty okayish exposure or leverage as shown below:

| Equity | 6-8 times for Intraday, No exposure on delivery |

| Equity Futures | 2-3 times for Intraday |

| Equity Options | No Exposure |

| Currency Futures | 2-3 times for Intraday |

| Currency Options | No Exposure |

Thus, as mentioned above, the exposure values are not so high and with such low brokerage and corresponding plans, you broking house simply negates any chances to increase these values in the future as well.

Conclusion

Well, the discount stock broker has certainly been able to understand the vibe of the industry and has taken appropriate action as well by bringing a flat percentage based brokerage rate.

Now, it certainly has to work upon areas such as better trading platforms, customer support (increase the number of communication modes to start with).

Furthermore, the broker needs to bring in commodity trading along with IPO investment provision for its clients. Users do want a range of the trading/investment products from the broker and Action financial certainly seems to lack in that aspect.

Action Financial Advantages

Here are a few advantages of using the services of this stockbroker in your trading:

- Free Demat and trading account opening

- Low brokerage charges

- Multiple plans based on trading turnover

- Pretty old in the financial space, trustable to an extent

Action Financial Disadvantages

At the same time, you must know some of the concerns that you may face as well”

- Investment in IPOs or Commodity segment not possible

- Low visibility, limited active clients

- Limited number of communication channels for customer support

Looking to have a discussion with the executive and open Trading account?

Just provide your details in the form below and we will set up a callback for you, right away:

Membership Information of Action Financial

Here are the details of the discount broker in terms of its membership with different stock market entities:

| Entity | Membership ID |

| BSE | INB010749233 |

| NSE | INB230749237 |

| NSDL | IN-DP-NSDL-21-97 |

| Registered Address | Action Financial Services (India) Limited (AFSIL), 46/47, 6th Floor, Rajgir Chambers, 12/14, S.B.Road, Fort, Mumbai-400 001, Maharashtra |

More on Action Financial:

If you are looking to know more about Action Financial, here are a few reference links for you:

| Action Financial Review | Action Financial Transaction Charges |

| Action Financial Brokerage Calculators | |

Video Review Video Review |