Aditya Birla Money

List of Stock Brokers Reviews:

Aditya Birla Money, incorporated in 1994, is a full-service stockbroker based out of Chennai. For around 15 years from 1994, the broker was known as Apollo Sindhoori Capital Investments until 2009. This is when Aditya Birla Group bought 76% of it.

Since then, it has been part of the group and is known as Aditya Birla Money.

Let’s understand, through this review, whether Aditya Birla Money is an apt stock broker as per your trading requirements or not.

Aditya Birla Money Review

Aditya Birla Money has memberships with NSE, BSE, MSEI, MCX and NCDEX.

It allows its clients to trade across multiple financial segments such as:

“Aditya Birla Money has an active client base of 42,354 for the financial year 2020.”

Furthermore, the broker has a huge offline presence with more than 800 branches and franchisees across India. It also has an employee base of 17000+, assets worth ₹3,000 Billion, aggregated revenue worth ₹115 Billion which definitely places it among the top stockbrokers in India.

Sudhakar Ramasubramanian – Managing Director, Aditya Birla Money

Aditya Birla Money Trading Platforms

The full-service share broker provides multiple trading platforms across devices including Desktop, Laptop and mobile and here are the details:

Aditya Birla Money Express Trade

Express Trade from Aditya Birla Money is a terminal-based trading platform (NEST customized) that users can download and install on their laptops or desktops. Consequently, it is known to be a well-designed trading terminal with a lot of usable and unique features as listed below:

- Charting with 21-day intra-day charts and more than 50 indicators

- Market monitoring with information on top market movers

- Unique open Interest bar feature that graphically compares option strikes

- Livestock updates and recommendations on the trading screen

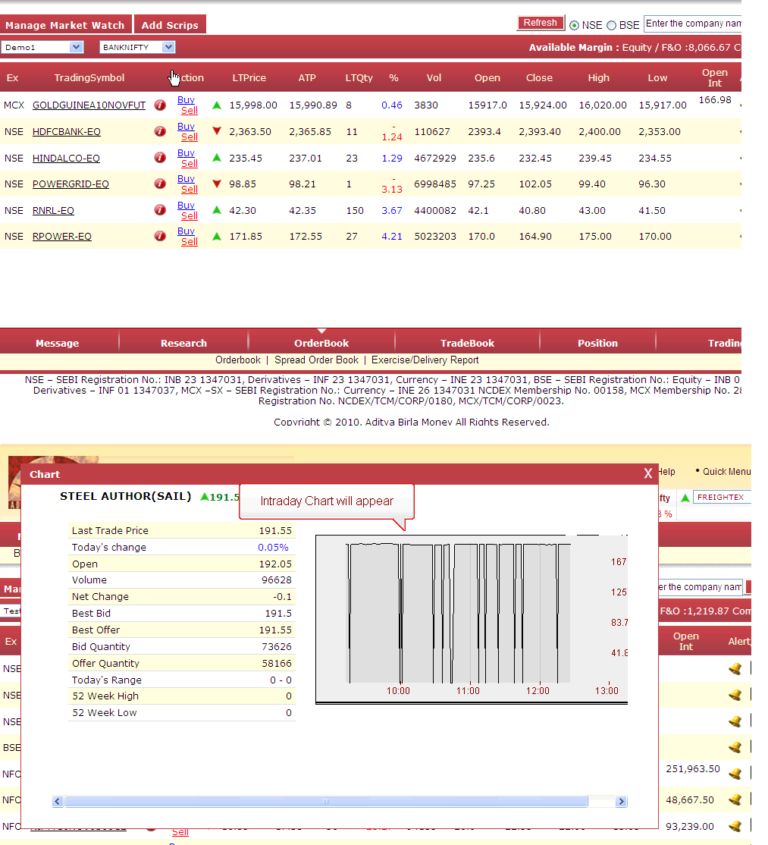

ETrade Aditya Birla

ETrade by this full-service stockbroker is the web trading platform that can be directly accessed through a browser. It comes with the following features such as:

- Market watch management

- Order Execution

- Order Book

- Trade Book

- Position Book

- Holdings and Trading Limit

- Funds management

- Charting

This is how the trading platform looks like:

Aditya Birla Advanced Web Trading Platform

This is the latest addition to the trading platforms from the house of Aditya Birla Money. In addition to it, this is an advanced version of the browser-based trading platform ETrade. Here are some of the unique features of this trading platform:

- Real-time portfolio tracking.

- Funds transfer possible with more than 15 banks.

- Detailed research reports, market tips available within the single click.

- Customizable market watch as per user preferences.

- Alerts and notifications available through email and SMS.

- Hotkeys available for users to customize and personalize.

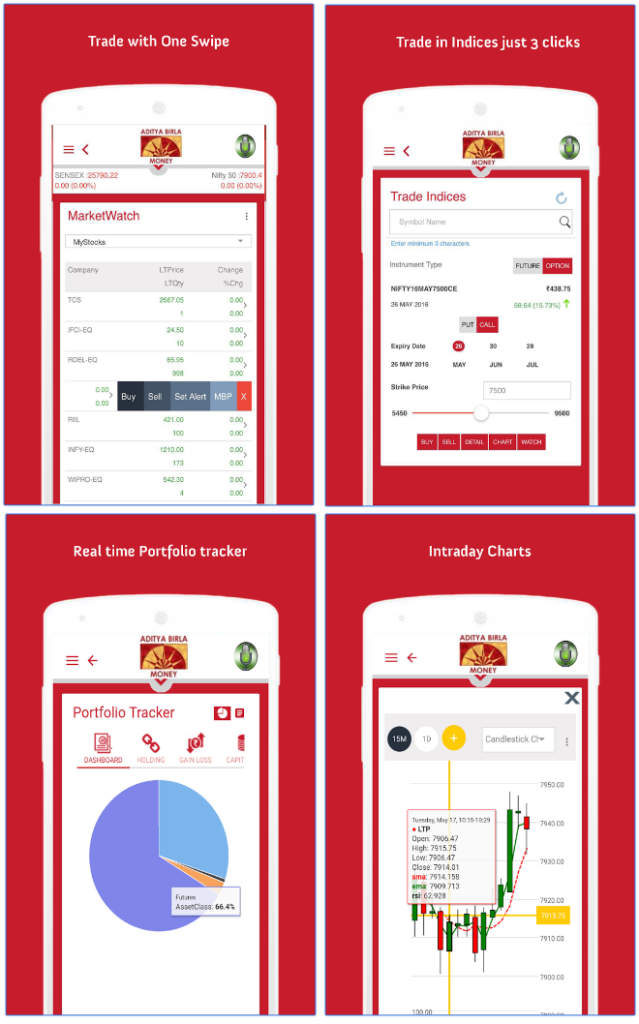

Aditya Birla Money Mobile Invest

Mobile Invest is the mobile trading app from Aditya Birla Money and comes with the following listed features:

- Funds transfer with more than 15 banks is possible.

- Trading can be done with a single swipe.

- 21-intraday charts with more than 50 indicators.

- Alerts and notifications can be set as per user preferences.

- High focus on authentication and security.

Some of the concerns raised by the users of this mobile app are as follows:

- App has been reported as not user-friendly, implying it might be difficult for you the different functionalities provided in the app.

- Login related issues are consistently seen by users.

- App performance/speed is relatively low.

Here is a generic mobile app review of Mobile Invest from Google Play Store:

| Number of Installs | 50,000-100,000 |

| Mobile App Size | 46.1 MB |

| Negative Ratings Percentage | 22.8% |

| Overall Review |  |

This is how the mobile app looks like:

Aditya Birla Money Research

Being a full-service stockbroker, it provides research at both technical as well as fundamental levels. You are entitled to receive research reports of listed companies, daily trading calls and recommendations for day to day trading. The reports include:

- Fundamental reports

- Technical reports

- Derivative reports

- Commodity reports

- Portfolio Analysis

All these reports are available online on the website of Aditya Birla Money with the following bifurcations. This segregation helps users to check reports that are used to them and not get confused with overwhelming information.

- Market Update

- Money Morning

- Money Weekly

- Fundamental Report

- Initiating coverage

- IPO notes

- Themantic reports

- Event updates

- Result update

- Monthly economic report

- Analyst Pick

- Technical Report

- Money Trend

- Derivative Report

- Money Derilook

- Money Deri-roll

- Portfolios

- Model Portfolio

- PMS

- Commodities

- Commodities World

- Commodity special report

- Commodity technical report

- Commodity

- Currency Report

- Daily Currency Report

- Currency Special Report

As you can see above, there are various types of reports and research documents available to the clients of Aditya Birla.

Also, know about Aditya Birla PMS in detail.

The accuracy of these reports is pretty good too and clients of this full-service stockbroker can certainly rely on the broker as far as decisions of buy and sell of different stocks are concerned.

Aditya Birla Money Customer Care

In order to get in touch with this full-service stockbroker, you have the option to use either of these communication channels:

- Webform

- Toll-Free Number

- Offline branches

If you are looking for online assistance, this full-service stockbroker has limited ways to communicate and the overall service is also pretty mediocre. However, when it comes to offline assistance through phone and sub-broker/franchise offices, the broker decent service at both quantitative and qualitative level.

There are more than 800 offline locations across India along with the provision of a toll-free number for users to get in touch with the broker.

Thus, it really depends on your preferred mode of service and accordingly, you can make a choice.

Aditya Birla Money Pricing

When it comes to pricing, there are different types of charges levied by stockbrokers. Let’s talk about these charges one by one:

Aditya Birla Money Account Opening Charges

This full-service stockbroker has the following charges for opening an account:

| Demat Account Opening Charges | ₹0 |

| Trading Account Opening Charges | ₹750 |

| Demat Account Annual Maintenance Charges (AMC) | ₹0 |

| Trading Account Annual Maintenance Charges (AMC) | ₹0 |

At this price of account opening, Aditya Birla Money is slightly above the market average in pricing.

Aditya Birla Brokerage

It charges these brokerage percentages as brokerage from clients:

| Equity Delivery | 0.3% |

| Equity Intraday | 0.03% |

| Equity Futures | 0.03% |

| Equity Options | ₹50 per lot |

| Currency Futures | 0.03% |

| Currency Options | ₹20 per lot |

| Commodity | 0.03% |

Use this Aditya Birla Money Brokerage Calculator for complete charges and your profit.

Within full-service stockbroking space, these brokerage values are somewhere in the middle. The brokerage charges are neither expensive nor cheap and thus, users are required to use their discretion when it comes to selecting a stockbroker.

“The minimum brokerage charged by Aditya Birla Money is INR 20 per Contract/1 paisa per share whichever is higher subject to a maximum of 2.5% per share.”

Interested users are advised to have a detailed negotiation with the executive of the broker in order to get better brokerage rates.

Aditya Birla Money Transaction Charges

Furthermore, apart from Account opening charges, AMCs and Brokerage, the client needs to pay transaction charges as well:

| Segment | Transaction Fee |

| Equity Delivery | 0.00325% |

| Equity Intraday | 0.00325% |

| Equity Futures | 0.0030% |

| Equity Options | 0.060% (on premium) |

| Currency Futures | NA |

| Currency Options | NA |

| Commodity | 0.0030% |

Aditya Birla Money Margin

Clients get the following leverage from Aditya Birla Money and can trade more than his trading balance:

| Equity | 15 times for Intraday and 5 times for Delivery |

| Equity Futures | 3 times for Intraday |

| Equity Options | NA |

| Currency Futures | NA |

| Currency Options | 3 times for Intraday |

| Commodities | 2 times for Intraday |

Users are advised to understand the implications and risks of using exposure on top of their capital amount. Unless you understand how it works, ideally you must not use the exposure.

Aditya Birla Money Disadvantages

Be aware of these concerns before you open your trading account with this full-service stockbroker:

- Brokerage charges are still high as compared to some of the full-service brokers

- No leverage in Equity options and currency futures

- NRI Trading not available

- Transaction charges are slightly high than the values set by regulatory bodies.

“Aditya Birla Money has received 10 complaints in total for this financial year 2019-20. This converts to 0.02% of the total active client base (industry average is 0.02%). Thus, the broker falls short of the industry standard on that aspect.”

Aditya Birla Money Advantages

You should also know about some of the benefits if you trade in the stock market through Aditya Birla Money:

- Huge offline presence helps the clients to keep a physical connection with the broker

- Call and trade facility is Free

- Trading and investing possible across multiple financial segments

- Part of a prominent finance group, thus, the trust factor is high when it comes to customer service

Conclusion

Aditya Birla Money is a conventional full-service stockbroker with all the ingredients at the right place, including research, service, trading products, platforms, brokerage, exposure and more. However, the broker is not a champion in any of these aspects and provides an average level of values in either of these components.

With huge competition coming from emerging discount brokers that is empowering the user base, Aditya Birla Money needs to take a quick stance on the kind of direction it wants to look forward to.

Thus, if you have specific requirements and you are looking for anything in particular, you are advised to have a detailed understanding of the quality provided. Of course, this review can help you to an extent but you can also have a word with us or the executive of the broker as well.

Looking to open an account?

Click on the button below and get a Free call back right away.

Next Steps:

Otherwise, you need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

Aditya Birla Money Membership Information:

Here is the membership information of the broker with different exchanges and intermediate parties:

| Entity | Membership ID |

| BSE | INB 01 1347037 |

| NSE | INB 23 1347031 |

| Currency | INE 23 1347031 |

| NSDL | IN-DP-17-2015 |

| AMFI | 5957 |

| PMS | INP 000003757 |

| MCX | 28730 |

| NCDEX | 00158 |

| Registered Address | Aditya Birla Money Limited Ali Centre, No. 53, Greams Road, Chennai – 600 006 |

The details can be verified from the corresponding websites of the exchanges.

Aditya Birla Money FAQs:

Some of the most frequently asked questions about Aditya Birla Money as discussed below:

Is Aditya Birla Money reliable as a stockbroker? Is it safe?

The full-service stockbroker has been around for more than 2o years and definitely, such a widely acclaimed brand name helps. Thus, as a brand, this full-service stockbroker is certainly is safe. However, when it comes to the reliability of trading platforms, there is a lot more that can be done in that space.

Although quantity-wise, the full-service stockbroker has quite a few trading platforms but quality-wise, yes, there is a room for improvement in terms of speed, user experience etc.

What is the account opening charge at Aditya Birla Money?

To open an account with this full-service stockbroker, you are required to pay INR 750 for your trading account. There are no charges to open the demat account nor the broker levies any maintenance charges on a yearly basis.

What is the exposure provided by Aditya Birla Money for Equity?

Exposure or leverage wise, the full-service stockbroker has minimal values to provide. If you are looking to trade at the intraday level in Equity segment, there is an exposure value of up to 15 times available but for delivery the exposure goes up to 5 times only.

In other trading segments as well, there is not much you can expect from the broker.

What is the research quality at Aditya Birla Money?

The full-service stockbroker provides multiple types of research reports at both the fundamental and technical level. The report names and types are mentioned in length in the ‘Research’ section above.

As far as the quality of these recommendations is concerned, users can rely on the accuracy of these tips and must religiously follow the research received on a regular basis.

How is the customer service at Aditya Birla Money?

There are a limited number of communication channels provided by the full-service stockbroker and the quality of service is not that great either. First of all, the online assistance takes a long time for the overall resolution process and further, the quality of resolution is very generic most of the times and the client stands unanswered with its query(ies) at the end of the day.

In what trading and investment products I can use with Aditya Birla Money?

Aditya Birla money, over a period of time, has been able to accumulate a wide range of trading and investment products. If you are a client or want to be the client of this full-service stockbroker, you can trade or invest in Equity, Commodity, Currency, IPOs, Mutual funds, Insurance and a few other products.

You can check out the detailed comparisons of Aditya Birla Money vs other stockbrokers:

Aditya Birla Money Branches

The full-service stockbroker has a presence in the following locations across India:

| States/City | |||

| Andhra Pradesh | Vizag | Vijayawada | Ongole |

| Secunderabad | |||

| Chhatisgarh | Bhilai | ||

| Delhi/NCR | New Delhi | ||

| Gujarat | Ahmedabad | Surat | Vadodara |

| Haryana | Gurgaon | ||

| Jharkhand | Ranchi | ||

| Karnataka | Bangalore | Mysore | Shimonga |

| Kerala | Kochi | ||

| Madhya Pradesh | Indore | ||

| Maharashtra | Nagpur | Pune | Mumbai |

| Punjab | Ludhiana | Chandigarh | |

| Rajasthan | Jaipur | ||

| Tamil Nadu | Chennai | Coimbatore | Madurai |

| Uttar Pradesh | Agra | Allahabad | Ghaziabad |

| Kanpur | Lucknow | ||

| West Bengal | Kolkata |

More on Aditya Birla Money:

In case you wish to learn more about this full-service stockbroker, here are a few reference links for you:

Nice post Thank you for sharing above information that is really beneficial for the trade as well investor to work on HNI Services according to your risk appetite go through