Anand Rathi

More on Online Share Trading

Anand Rathi is a full-service stockbroker based out of Mumbai with a presence in more than 1200 locations including Dubai.

Set up in 1994, Anand Rathi has something to offer for its Institutional, Retail as well as for high net worth individuals.

Let’s learn more about this stockbroker through this detailed review that talks about multiple facets related to it.

Anand Rathi Review

As per the latest numbers of 2019, Anand Rathi employs a workforce of 2500 people.

With a network of more than 350 branches and 1500 franchises across the nation, it offers full-service stock brokerage services.

“Anand Rathi has an active client base of 75,152 for this financial year 2019-20.”

With its membership of BSE, NSE, MCX, NCDEX and USE, Anand Rathi broker allows its clients to trade across the following asset classes:

- Equity

- Commodity Trading

- Currency Trading

- Derivatives

- IPO

- Mutual Funds

- Insurance

- Corporate Fixed Deposits

- NCD/Bonds

- Portfolio Management Services

Anand Rathi Financial Services Ltd

Established in the year 1994, Anand Rathi is one of the finest and most reputable financial service providers.

It offers various services like Wealth Management Services, Investment Banking, Brokerage Services under various sectors including Equities, Commodities, Mutual Fund, Bonds & Loans, etc.

Dig in to learn the financial services and the team of the leading financial firm of the nation.

Anand Rathi Financial Services

From the day of its establishment, the company operates with the philosophy of offering customer-centric services.

It keeps a clear focus on offering the long-term value services to the clients while maintaining the standard of excellence at the same time.

Thus the company has various goals, among which the most prominent are:

- Providing innovative financial solutions

- Becoming the first choice of potential customers.

- Offering innovative financial solutions.

Anand Rathi Wealth Management

Anand Rathi, the leading financial firm, is known to offer wealth management services to high and ultra-net-worth individuals (HNIs & UHNIs).

Its team of 120 financial strategists engages with clients at the national and international levels.

It provides custom-designed solutions thus offering the uncomplicated process of private wealth management to each of its clients.

The company has different tenets of wealth management, that focus on keeping the client first.

These include fearless advisory, data-backed recommendations, uncomplicated approach, and transparent implementation.

With this, it focuses on building long-term relationships with the clients.

To derive a more conclusive review of Anand Rathi Wealth Management, the effective and holistic wealth management facility covers three important aspects:

- Generating consistent and sensible returns that beat inflation

- Creating wealth-building safety nets to protect the wealth

- Building the estate plan to ensure zero transmission loss

In all, it spares no expense in its research and offers data-driven investment advisory thus able to gain more trust of its existing clients and grabbing the attention of new customers.

Anand Rathi Investment Banking

Over the years, the investment banking services of Anand Rathi have evolved into a leading partner for the Mid-Cap Companies.

With a highly experienced and professional team, the company moves forward to offer advice and solutions to its clients over the long term.

The team does thorough research to offer better strategies and customized solutions to its clients.

This helps the company in building formidable market credibility.

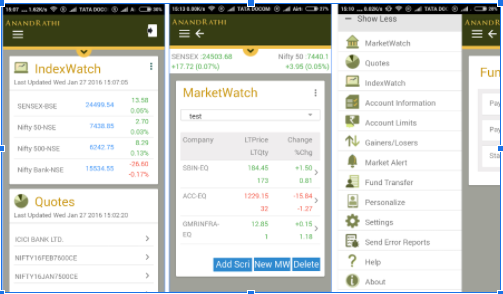

Anand Rathi Online Trading Apps

Anand Rathi provides ample trading apps to its clients across various devices so that clients can choose their preferred platform as per their requirements.

In total, the stockbroker has 7 online trading software to offer to its customers, ensuring them greater ease of trade and the possibility of trading without any hindrances.

The list is as follows:

ANAND RATHI TRADE X’PRESS+

Anand Rathi has a browser-based web trading platform by the name Trade X’Press+. Anand Rathi Trade X’Press+ can be accessed from anywhere without any downloads or installs.

The client just needs to browse a link, enter valid credentials, and select ‘Trade X’Press+‘ once logged in. Some of the features of this advanced platform are:

- Customized Dashboard – A user can customize the dashboard as per their preferences and also has the facility to set up multiple market watches.

- Advanced Charting Tools – Advanced charting options that will help better analyze the stock market

- Heat Map – This feature allows users to analyze the stocks which appreciated in value as well as the ones whose value depreciated Technical screener, web charting features

- Easy In Navigation – Trade X’Press+ is fairly easier to navigate

- User-Friendly Interface – The platform has a user-friendly interface which ensures a better user experience

Traders and investors also get access to Anand Rathi research reports, which are regarded to be the finest in the industry. Technical and fundamental research help traders in making better judgments of stocks for trading.

Anand Rathi Trade Lite

Anand Rathi Trade Lite is another web-based trading application that allows users to trade even with lower internet connectivity. Trade Lite is a lighter version of Trade X’Press+ and hence has fewer facilities on offer, still, it comes with the following features:

- Market Watch – This feature allows users to keep a track of as many as 30 stocks at a time. In addition, you can set up multiple market watches.

- Place Order – A trader can place orders through two methods – Quick Order Entry and Market Watch.

- Market Statistics – Access to market information such as top gainers, losers, quotes, intraday charts, etc

- Stock Price Alerts – A trader can set stock price alerts as per their preference

- Value Adds – Visibility of research reports and tips

This trading platform is suitable for users living in small cities or the ones using lower internet bandwidth.

Anand Rathi Trade Mobi

Anand Rathi Trade Mobi is the mobile application launched by Anand Rathi. It comes with some decent features as listed below, however, it is deemed as an average performance mobile app. Its features are:

- Live Market data

- Dashboard personalization

- Market watch

- Stock quotes, charts

- Easy, hassle-free order placement

This is the performance stats of Trade Mobi as per the Google play store:

| Anand Rathi Mobile App Ratings | ||

| Number of Installs | 50,000+ | |

| Mobile App Size | 23MB | |

| Negative Ratings Percentage | 36.5% | |

| Update Frequency | 4-6 Weeks | |

Here are some of the screenshots of the mobile app

Anand Rathi Trade X’Pro

Trade X’Pro is a desktop-based trading terminal that suits well for heavy traders who prefer high speed and exhaustive features. The user needs to download the .exe file and install the trading software on his/her desktop or laptop.

Anand Rathi Trade X’Pro is considered to be one of the high performing trading platforms in the industry. Some of its features are:

- Dynamic Charting – Advanced charting at the minute, day, week level with multiple indicators

- Options Strategy – Traders are provided with Option strategies daily, along with the provision to create your own

- Fully Customizable Display – Users can personalize the display of the application

- Lock Terminal Option – Highly secure with terminal locking feature

Anand Rathi Trade X’PRO is a relatively bulky software with decent security-based features as well. However, when compared with some of the mature terminal-based software, the number of features in Trade X’Pro is relatively much less.

Anand Rathi Trade On Move

For users who are not accustomed to trading platforms and/or are always on the move, they can use dedicated phone numbers that are opened by the broker.

With this facility, users can get access to their accounts, get information on the account updates without actually going through the process of placing the order by themselves.

This facility is majorly available in Equity cash and future segment trading.

Anand Rathi Trade Flexi

Anand Rathi Trade Flexi is an application dedicatedly catering to intraday traders. Through this app, intraday traders can take up positions in equity cash and future segments.

Trading through this application, a trader can intraday trade with minimum risk as the application automatically sets stop loss market and stop-loss limit orders.

The key feature of Trade Flexi include

- Equity Cash – The intraday trader can trade NIfty 50 stocks

- Equity Futures – Traders can intraday trade Nifty 50 stocks as well as other Nifty Next 50 and Nifty Sectoral Indices

- Minimized Risk – Traders can trade with reduced risk as automatic stop-loss market orders and stop-loss limit orders

ANAND RATHI TRADE X’PRO+

Anand Rathi Trade X’Pro+ is an advanced form of Trade X’Pro trading application. Loaded with the same features as Trade X’Pro, Trade X’Pro+ comes in both free and paid versions.

In the free version, the user can access the following features

- Intraday and Historical Charts – This feature will help traders, especially intraday traders to gain knowledge about a specific stock.

- Options Strategy – Traders are provided with tips to develop option strategies on a daily basis. Plus, there is also provision for a trader to devise his/her own strategies.

- Simulated Trading – Using Simulated Trading feature traders can practice the complete process of online trading. From stock selection to trying new trading strategies before trading in the real world.

- Technical Screeners – These are filters to help traders in-stock selection.

The paid version of the application comes with the ‘Plus Trading Plugin’. This plugin easily integrates with technical analysis programs such as Amibroker that allows performing technical analysis with advanced charts, back screening, and other features.

The pricing of this plugin is as follows

- Monthly – ₹299

- Quarterly – ₹716

- 6-Months – ₹1313

- Annually – ₹2150

Otherwise, there are few packs offered within this trading platform as well. Depending on your requirements, you may choose to subscribe to these packs. Here are the details listed

| Anand Rathi Trade X'pro+ Plans | ||

| Nest Starter Pack | Free | |

| Nest Premium | ₹150 per month or ₹1000 per year (first month free) | |

| Nest Pulse | ₹125 per month or ₹899 per year (first month free) | |

| Web Chart | ₹49 per month or ₹399 per year | |

| Mundu TV | ₹49 per month or ₹450 per year | |

| Heckly | ₹99 per month of ₹600 per year | |

Thus, as long as you are open to paying a specific price for using a trading terminal software, you can use this application.

Anand Rathi Login

In every kind of investment you make, the best part lies in making a decision.

This gets the best when you feel independent in making your trading decision.

This can be done with the Anand Rathi login to the app or website.

Anand Rathi app or the website offers you different trading procedures and the back-office login focus on maintaining a record of transactions being done by the client.

Here is the complete process of Anand Rathi login to the app, website, or Anand Rathi back office.

- To access the services, it is essential to have a Demat Account with Anand Rathi.

- Opening a demat account provides you with the client Id and Password.

- Proceeding this, choose the app link from the app store or Google Play Store or the web link or back-office link

- Download the app.

- Enter your login id and password.

- If required, you can change your password and set the password of your choice.

Interested to open an account?

Enter your details and we will arrange the Free Call Back!

Anand Rathi Charges

The complete list of Anand Rathi charges for extending various services such as a Demat account, Trading account which are required for carrying out trade includes the following –

- Account Opening Charges

- Brokerage Charges

- Transaction charges

- Margin

Anand Rathi Demat Account Charges

The list of charges associated with Anand Rathi online account opening is as follows:

| Anand Rathi Account Opening Charges | ||

| Trading Account Opening Charges | ₹750 | |

| Trading Account Annual Maintenance Charges | ₹0 | |

| Demat Account Opening Charges | ₹550 | |

| Demat Account Annual Maintenance Charges | ₹0 for first year, ₹299 from second year | |

Certainly, looking at the industry standards, the account opening charges by this full-service stockbroker are higher than its peer full-service brokers.

ANAND RATHI BROKERAGE

Anand Rathi offers its customers the option to negotiate brokerage charges. However, following is the list of Anand Rathi brokerage charges:

| Anand Rathi Brokerage Charges | ||

| Equity Delivery | 0.3% (can be negotiated further) | |

| Equity Intraday | 0.03% | |

| Equity Futures | 0.03% | |

| Equity Options | ₹50 per executed order | |

| Currency Futures | 0.03% | |

| Currency Options | ₹50 per executed order | |

| Commodity | 0.03% | |

The negotiation on brokerage can be difficult and slightly tricky with this broker. However, the users must give it a 100% try to bring down the brokerage percentage, especially if they are employing high initial capital.

Brokerage charges are negotiable, but a trader can use Anand Rathi Brokerage Calculator for the calculation of complete charges involved in trading and your profit.

ANAND RATHI TRANSACTION CHARGES

Apart from the account opening, maintenance, and brokerage charges, transaction charges as per levied by SEBI are to be paid by the client as follows:

| Anand Rathi Transaction Charges | ||

| Equity (Cash & Delivery) | 0.0035% of Turnover | |

| Equity Futures | 0.0035% of Turnover | |

| Equity Options | 0.07% of Premium Turnover | |

| Currency Futures | 0.0035% of Turnover | |

| Currency Options | 0.07% of Premium Turnover | |

| Commodities: MCX | 0.0035% of Turnover | |

Anand Rathi Margin

Anand Rathi provides the following margin values to its client while trading across different financial segments

| Anand Rathi Margin | ||

| Equity | Upto 10 times for Intraday, Upto 4 times for Delivery | |

| Equity Futures | Upto 2 times Intraday | |

| Equity Options | Buying no leverage, Shorting upto 2 times | |

| Currency Futures | Upto 2 times Intraday | |

| Currency Options | Buying no leverage, Shorting upto 2 times | |

| Commodities | Upto 2 times Intraday | |

If you compare the margin provided by Anand Rathi with most of the other competitive full-service stockbrokers in India, the margin provided is not that high.

For instance, the Angel Broking margin in Equity intraday is as high as 40 times whereas Anand Rathi goes up to 10 times at the highest in this segment.

You must consider this limitation while choosing your stockbroker.

Anand Rathi Customer Care

The following communication channels provided by the full-service stockbrokers for its clients to help them with their queries or concerns:

- Web Chat

- Toll-Free Phone

- Phone

- Offline Branches – The list can be found below

In case of any query, you can contact them at the Toll-Free Number: 1800 200 1002, 1800 121 1003

The customer care executive comes with the best solution to clear your doubts.

With multiple ways to reach out to the broker, the customer service offered is decent and better than average in quality. Although the focus with respect to each client is similar, you will be given resolutions much quicker turnaround time if you are a medium to heavy traders.

ANAND RATHI BRANCHES

The full-service stockbroker is present in the following locations across different parts of India through Anand Rathi franchise and sub-broker network, including:

Search:

| States/City | |||

| Andhra Pradesh | Vizag | Vijayawada | Wrangal |

| Vishakhapatnam | Hyderabad | Kurnool | |

| Assam | Guwahati | ||

| Chhatisgarh | Raipur | ||

| Delhi/NCR | New Delhi | Gurgaon | Noida |

| Goa | Panaji | ||

| Gujarat | Ahmedabad | Surat | Vadodara |

| Haryana | Ambala | Panipat | Rohtak |

| Jammu & Kashmir | Jammu | ||

| Jharkhand | Ranchi | ||

| Karnataka | Bangalore | Mysore | Shimonga |

| Belgaum | Bellary | Bijapur | |

| Devangere | Gulbarg | Hubli | |

| Mandya | Mangalore | Raichur | |

| Maharashtra | Nagpur | Pune | Mumbai |

| Ahmednagar | Aurangabad | Chandrapur | |

| Jalgaon | Kolhapur | Nashik | |

| Orissa | Bhubanshwar | Cuttack | |

| Punjab | Ludhiana | Chandigarh | Amritsar |

| Bathinda | Jalandhar | Patiala | |

| Rajasthan | Jaipur | Ajmer | Bikaner |

| Kota | Udaipur | ||

| Tamil Nadu | Chennai | Coimbatore | Erode |

| Karur | Trichy | ||

| Uttar Pradesh | Varanasi | Allahabad | Lucknow |

| Kanpur | |||

| West Bengal | Kolkata |

Anand Rathi Research

The research of Anand Rathi is known to be one of the best ones in the industry, at both fundamental as well as technical levels. As a client, it provides an access to:

- Daily Technical Outlook

- Trading Calls

- Investment Ideas

- Strategic Calls

It employs the research team with the aim of going deeper than others, delivering incisive insights and ideas that are accountable for results.

The research process of Anand Rathi incorporates quantitative and qualitative analysis, thus providing its clients the superior risk-adjusted returns for our clients.

It helps its clients to make a well-informed decision with higher chances of good returns.

Depending on what kind of investments or trading you are looking to employ in the stock market, you may choose to use these tips and recommendations.

As far as accuracy is concerned, the broker is known to provide better than industry average research tips and thus, can be trusted to an extent.

Anand Rathi Advantages

At the same time, you will be provided with the following benefits while using the services of this full-service stockbroker:

- Affiliation with Major Stock Exchanges – Clients allowed to invest and trade across multiple financial assets on both the national level stock exchanges of NSE, BSE

- Multiple Trading Options – A wide array of Anand Rathi online trading options available

- Physical Presence – A huge network of sub-broker branches and franchises

- Research and Advisory Facility – Anand Rathi research and advisory facilities are among the best in the industry.

- Compatibility to Low Bandwidth Connection – Their website, and one of their trading platforms – Trade Lite makes trading possible even on low bandwidth connections

Anand Rathi Disadvantages

Here are some of the major concerns of using the services of this full-service stockbroker:

- Charges For Trading Platforms – Traders will have to pay up for an amount for using a trading platform such as Trade X’Pro+.

- Performance – The mobile app can be improved from multiple aspects such as usability, user experience, and performance.

- Average Customer Service – Customer services are average and can be improved.

- High Transaction Rates – Transaction charges levied by Anand Rathi are comparatively higher than other stockbrokers.

- Call and Trade Facilities – The Call and Trade facilities by the stockbroker can be improved on aspects such as speed and accuracy.

“The broker has a complaint percentage of 0.02% matching the industry average with a total of 23 complaints this financial year.”

Conclusion

Anand Rathi definitely is a decent brand name and has been around for a while. They provide good research tips and recommendations and have a wide offline presence.

This kind of broker is suitable for users that are susceptible to trading as a concept and it definitely inculcates the trust factor into users through its values.

At the same time, there are some grey areas such as the performance of its trading platforms, optimal usage of customer service channels, relatively high brokerage, account opening and transaction charges, etc. Thus, be wary of a few of these factors unless you want to surprise yourself later.

Other than that, it is one of the decent stockbrokers and a trustable brand in the country.

Next Steps

Post this call You to need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

ANAND RATHI MEMBERSHIP INFORMATION

Here are the details on the different membership details of the full-service stockbroker:

| Entity | Membership ID |

| BSE | INB011371557 |

| NSE | INB230676935 |

| MSEI | INE260676935 |

| NSDL | IN-DP-NSDL-149-2000 |

| CDSL | IN-DP-CDSL-04-99 |

| PMS | INP000000282 |

| MCX | MCX/TM/CORP/0525 |

| NCDEX | NCDEX/TCM/CORP/0178 |

| Registered Address | 4th Floor, Silver Metropolis, Jai Coach Compound, Opp. Bimbisar Nagar, Goregaon (E), Mumbai 400 063. |

Here are some of the most frequently asked questions about this full-service stockbroker you must be aware of, before opening your account with it:

ANAND RATHI FAQS

Anand Rathi was established back in 1994, and thus, has been around for a while now. Furthermore, it has more than 60,000 active clients (total clients exceed a few lakhs) with more than 1500 sub-broker and franchise locations.

Therefore, from a brand perspective, this is definitely one of the trustable brands in the stockbroking space in India.

2. What are the account opening charges at Anand Rathi?

To open a trading account, you are required to pay ₹750 and for the demat account, another ₹550 will be required to be paid. If you look at the overall industry standard charges, generally, it’s in the range of ₹300 to ₹ 800. Thus, it will be valid to suggest that Anand Rathi is one of the expensive stock brokers in India as far as account opening charges are concerned.

3. How is the brokerage calculated at Anand Rathi?

Being a full-service stockbroker, Anand Rathi charges a percentage based brokerage rate from its clients.

For instance, for Equity Delivery, the customer pays 0.3% of the trade value. In other words, if you buy 100 shares of Infosys, priced at ₹1000 each for Delivery, then your trade value will be ₹1000 X 100 = ₹1,00,000.

For this particular trade, your brokerage will be 0.3% of ₹1,00,000 = ₹300

4. How does exposure work at Anand Rathi?

The broker provides okayish exposure values across segments to its clients. For intraday trading in the equity segment, you get exposure up to 10 times of your trading account balance while in other segments, it’s around 2 to 3 times.

The way exposure works are simple. For instance, if you have a trading account balance of ₹10,000 and you are looking to trade at the Intraday level in the Equity segment, you can trade up to ₹1,00,000 since the exposure offered is 10 times.

However, exposure or leverage, as a concept is pretty tricky & risky and users are advised to be very cautious before employing their capital in it.

5. What segments I can trade and invest in using Anand Rathi Demat account?

As a full-service stockbroker, Anand Rathi offers a wide range of trading and investment products to its clients including Equity, Mutual funds, Insurance, IPOs, Currency, Fixed deposits, PMS, Bonds etc.

Thus, for all kinds of financial needs, you can get it done through this full-service stockbroker itself.

6. What is the research quality at Anand Rathi?

Anand Rathi is known to be one of the prominent stockbrokers when it comes to research. In fact, it is listed as one of the top 3 research stock broking houses in India in this detailed review by us.

So, as far as accuracy and trust factor is concerned, you can certainly rely upon the broker for your trading and investments in the stock market.

To learn more about the stockbroker, feel free to contact us.

To learn more about the stockbroker, feel free to contact us.

You can check out the detailed comparisons of Anand Rathi vs other stockbrokers here:

More on Anand Rathi:

In case you wish to know more about Anand Rathi stockbroker, here are a few reference links for you:

Very informative content. Mr Anand Rathi is one of the most common faces in the finance sector. I really appreciate efforts & knowledge sharing inside this blog.