Astha Trade

List of Stock Brokers Reviews:

Astha Trade is a discount stock broker based out of Bhopal, Madhya Pradesh. Established back in 2005 as a full-service stockbroker, Astha Trade has physical locations across 100+ cities of India through its sub-broker and franchise network.

The broker is known to provide high exposure or leverage to its clients across multiple segments.

Let’s find out more details about this broker is this review.

Astha Trade Review

Furthermore, funds transfers have been made pretty simple by the broker with a provision to use Paytm as well. Astha Trade has a membership with NSE, MCX-SX and NCDEX and allows its clients to trade across the following segments:

“Astha Trade has a total of 19,428 active clients for the financial year 2020-21.”

The broker does not have a huge client base, especially the “active” client base. Thus, from this perspective especially the broker needs to bring its tempo up to the mark.

Astha Trade Trading Platforms

Astha Trade offers multiple trading platforms across devices with most of these being third-party trading softwares. Here are the details:

Astha Trade ODIN Diet

ODIN Diet is a terminal-based trading application that can be downloaded and installed on a client’s laptop or desktop. This software has been developed by FinTech or Financial Technologies and is one of the most reliable terminal based trading softwares. Some of the features of the platform are:

- Real-time information and updates from multiple indices

- User interface themes open to customization

- Unlimited scrips can be placed under market watch

- Integration with Mutual fund and IPO investments

Here is how the software ODIN Diet looks like:

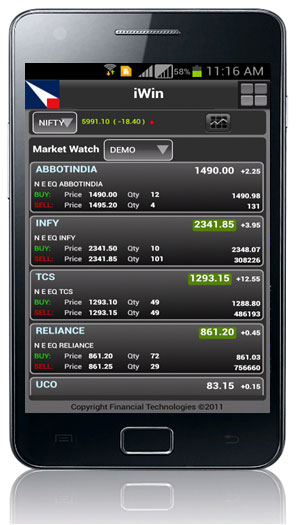

Astha Trade iWin Mobile Trading app

iWin Mobile App is another trading platform from the house of FinTech or Financial Technologies. It is an “okayish” mobile app with some decent features for trading. The app, however, has a lot to improve as far as user experience is concerned. Some of the features of the mobile app are:

- Unlimited Market Watch Option

- Charting for technical analysis

- Multiple order type placement

This is how the app looks like:

These are some of the stats around the mobile app from Google Play Store:

| Number of Installs | 5,000 - 10,000 |

| Mobile App Size | 37.4 MB |

| Negative Ratings Percentage | 21% |

| Overall Review |  |

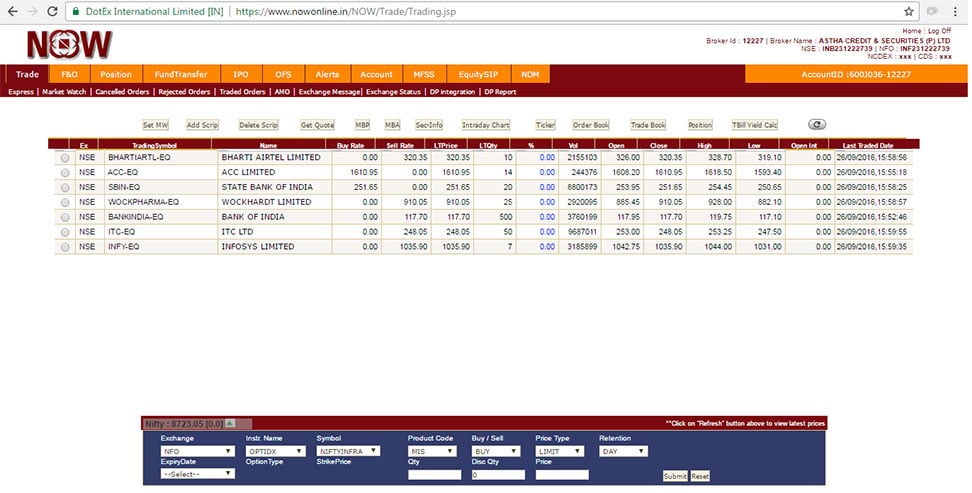

Astha Trade Web

This is the web-based trading application from Financial Technologies that Astha Trade has got the license to use by its clients. Users don’t need to download or install any software to access this application and the user just needs to enter his/her credentials to enter into the system and start trading. Some of the features of the application are:

- Highly secure to use

- Support across multiple languages

- Order placements across segments and exchanges available

This is how the application looks like:

Astha Trade NSE Now

NSE Now is a web-based trading application that can be accessed from a user’s browser. There are no downloads/installs required. The user just needs to hit a particular link, enter the credentials and get started with trading. The application has been developed by NSE and is licensed to brokers such as Astha Trade.

Users can access features such as:

- Smart order routing,

- Historical, real-time and intra-day charting tool for technical analysis

- A built-in risk management system that keeps the complete trading experience safe

This is how NSE Now looks like:

Astha Trade NSE Mobile

NSE Mobile app is a mobile trading app, developed by NSE that can be accessed across Android, Windows, iOS and Blackberry operating systems.

Here are some of the features of the mobile app:

- Easy to use interface

- Real-time market quotes and news streaming

- Charting features to perform technical analysis

Open the Astha Trade Demat Account and access the feature of the app.

This is how the app is rated at the Google play store (This app is used by multiple stockbrokers and NOT just Astha Trade):

| Number of Installs | 1,000,000 - 5,000,000 |

| Mobile App Size | 37.4 MB |

| Negative Ratings Percentage | 13.9% |

| Overall Review |  |

| Update Frequency Cycle | 1 year |

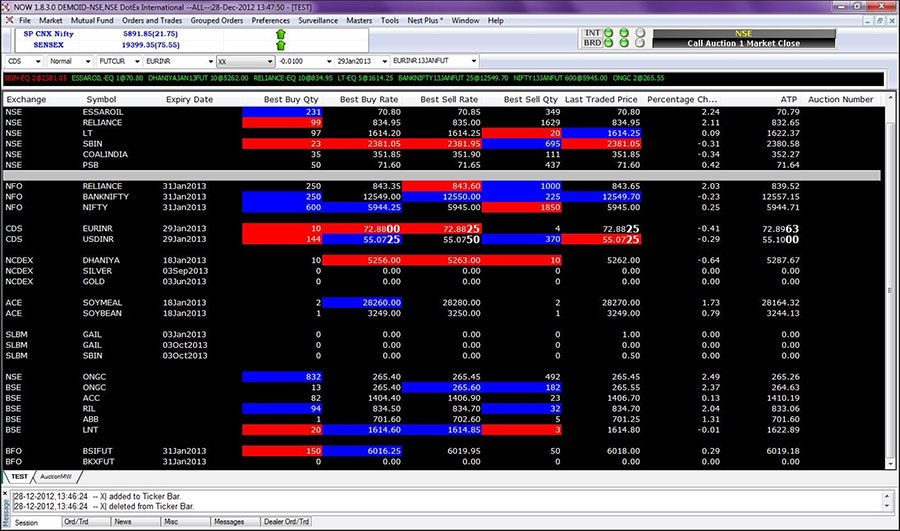

Astha Trade NSE Now

The Terminal software NSE Now is an installable file that needs to be downloaded and installed on the user’s machine. Suitable majorly for heavy traders, the software is majorly known for its high performance and speed in accessing features and order placement.

This is how the trading software looks like:

Thus, as far as quantity of trading platforms is concerned, there seems to be no doubt that Astha Trade has got that covered. However, when it comes to quality, only a handful of those look promising and reliable in nature.

Astha Trade Customer Care

As far as communication channels are concerned, with Astha Trade you can get in touch through:

- Web Support

- Toll-Free number

- Webform

- Offline branches

- Phone

It has done a good job as far as setting up the online self-help portal is concerned. Most of the queries generally asked by users have been answered in this portal. They also set up a forum for users to discuss, raise queries and get assistance from other users or Astha Trade support. But that has not flourished the way it might have been expected to.

When it comes to other communication channels, the overall quality is slightly above average and has a quick turnaround time with a valued response from clients.

Astha Trade Charges

Here are the different pricing details for Astha Trade:

Astha Trade Account Opening Charges

To open and maintain your demat and trading account, the following charges will be levied at the start:

| Trading Account Opening Charges | ₹500 |

| Demat Account Opening Charges | ₹150 |

| Trading Account Annual Maintenance Charges (AMC) | ₹0 |

| Demat Account Annual Maintenance Charges (AMC) | ₹300 |

Astha Trade Brokerage

Although the broker claims itself to be a discount stockbroker, the brokerage charges are still placed at percentage level with a maximum cap placed at a value depending on the trading segment.

| Equity Delivery | 0.1% |

| Equity Intraday | 0.01% |

| Equity Futures | 0.01% |

| Equity Options | ₹10 per lot for buying, ₹30 per lot for selling |

| Currency Futures | 0.01% |

| Currency Options | ₹10 per lot for buying, ₹30 per lot for selling |

| Commodity | 0.01% |

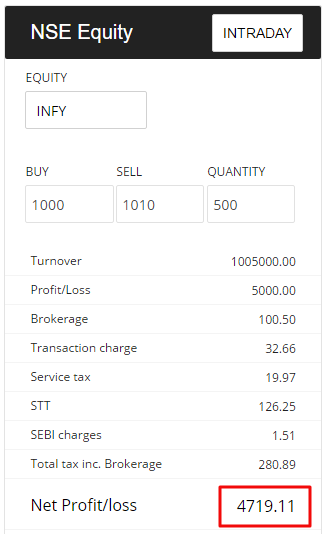

To get a detailed idea about the actual profit after all kinds of charges are deducted from your trade, check out this screenshot for reference:

Use this Astha Trade Brokerage Calculator for complete charges and your profit.

Astha Trade Transaction Charges

Apart from account opening, maintenance and brokerage charges, You are required to pay a few other charges such as Transaction charges, stamp duty, taxes etc. In this case, the transaction charges are as follows:

| Equity (Cash & Delivery) | 0.00490% |

| Equity Futures | 0.0045% |

| Equity Options | 0.089%(on Premium) |

| Currency Futures | 0.0045% |

| Currency Options | 0.089%(on Premium) |

| Commodities: MCX | 0.0045% |

| DP Transaction charge | ₹25 /Debit Transaction |

| Dial & Trade | ₹25 per executed order |

Astha Trade Other Charges

Some other charges levied by this stockbroker are as follows:

- Contract Note Charges: ₹30 Per Contract Note

- Margin Delay Payment Charges: 15% Per Year

- UPI Pay in: ₹10/transaction

- Pledging Charges: Higher of 0.04% or ₹50

- Unpledging Charges: Higher of 0.04% or ₹50

Astha Trade Margin

In case you are looking to trade above your trading account capital, then you may choose to use exposure or leverage in your trades. In this case, you can trade as per these multipliers:

| Equity Delivery | 4 times for Delivery |

| Equity Intraday | Upto 40 times |

| Equity Futures | 10 times for Intraday |

| Equity Options | 7 times for Intraday |

| Currency Futures | 3 times for Intraday |

| Currency Options | 2 times for Intraday |

| Commodity | 10 times for Intraday |

The way it works is simple. It is kind of a short-term loan offered by your stockbroker at a specific interest rate (generally 15%-20%). However, its a risky concept and unless you understand the intricacies and implications of it, we advice you not to use it.

It can potentially eat up your trading account balance if you do not use in an optimal manner.

Astha Trade Disadvantages

There are some concerns if you open an account with Astha Trade:

- Relatively much higher transaction charges

- No innovation with any in-house trading platform development

“Astha Trade has received 2 complaints from its clients for this financial year 2019-20 with a complaint percentage of 0.02% (Industry average: 0.01%).”

Astha Trade Advantages

At the same time, you enjoy the following values when you trade using the services of this stockbroker:

- Low brokerage charges within discount stockbroking space

- An overall reasonable number of trading platforms

- High exposure offered across segments, especially Equity Intraday.

- Better than average customer support

Conclusion

Astha Trade is one of those stockbrokers that have been able to make a name for themselves in the industry by concentrating on one specific field. In their case, it is exposure.

However, when it comes to aspects such as Trading platforms or customer service, there is a lot that the broker needs to work upon. Thus, if you are specifically looking for high exposure or leverage in your trades, you can definitely opt for Astha Trade. Otherwise, in most of the other aspects, it provides average value to its client base.

Looking to open an account and start trading?

Fill in your details below and get a Call back right away:

Next Steps:

You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

Astha Trade Membership Information:

Here is the membership information of the broker with different exchanges and intermediate parties:

| Entity | Membership ID |

| NSE (F&O) | INF231222739 |

| NSE | INB231222739 |

| NSDL | 287-2008 |

| MCX | 40000 |

| Registered Address | F-01, Usha Preet, 138/42, Malviya Nagar, Bhopal (MP) - 462003 |

The details can be verified from the corresponding websites of the exchanges.

Astha Trade FAQs:

Here are some of the most frequently asked questions about Astha Trade:

Is Astha Trade and Securities a genuine and well-servicing company as a broker?

The broker started as a full-service stockbroker in 1995 and has gradually pivoted towards discount broking in the recent past. It has received complaints from 0.22% from its client base while the industry average is as low as 0.06%.

Thus, from that perspective, there may be few doubts about its reliability.

What is the account opening charge at Astha Trade?

To open an account with this discount stockbroker, you are required to pay ₹650 to open Demat as well as a trading account. Furthermore, ₹300 are charged as an annual maintenance charge (AMC) every year. From account perspective, Astha Trade certainly is one of the expensive stock brokers in India.

How is Astha Trade providing high exposure or leverage?

Like any other broker!

However, in this case, the exposure values are pretty high. What happens is simple. Clients like you and others put in trading account balances with the broker.

Now, the broker with this lumpsum account balances is in a position where it can offer short-term loans to traders who are looking for quick profits with a higher degree of risk.

Then it depends on the broker on how much exposure (read risk) it itself is ready to take by providing loans to other traders. At the same time, brokers such as Astha Trade take too much liberty and offer 10 times, 20 times, 30 times exposure values to their clients.

What is the brokerage rate at Astha Trade?

With Astha, it really depends on your trade value. Higher the trade value, higher is the brokerage you are supposed to pay. For instance, if you trade in Equity Delivery, the brokerage applicable will be 0.1% of your trade value.

If you trade for ₹1,00,000 then your brokerage charges for that particular trade will be ₹100.

Does Astha Trade provide any research or tips?

Since the broker has gradually labelled itself as a discount stockbroker, it has ceased to provide any sort of tips or recommendations to its clients.

How are the trading platforms of Astha Trade?

There are multiple trading platforms offered by the discount stockbroker, a mixed bag of in-house developed trading platforms as well as NSE licensed ones.

As far as quality is concerned, it is advised to go ahead with the NSE based outsourced trading platforms and do not rely on the in-house trading applications as most of those are either outdated or struggle with performance-related issues.

You can check out detailed comparisons between Astha Trade Vs Other stockbrokers here:

More on Astha Trades:

In case you want to know more about this stockbroker, here are a few reference links for you:

Astha Trade Review  |

| Astha Trade Transaction Charges |

| Astha Trade Brokerage |

Astha Trade Comparisons  |

| Astha Trade Brokerage Calculator |

Astha Trade Hindi  |

| Astha Trade Margin |

| Astha Trade Demat Account |

is it our fund remain safe at ashta broker and any safety frm sebi is there if broker not give our fund

Astha trade r cheaters: They will charge minimum brokerage i.e. Rs. 30 per day, irrespective of your trade, and at no place, they show this charges, when i recived my first contract note, i was shoked. , it realy make me dissatisfied 🙁

Are they genuine? Are we get our profits/funds back without any issue?

Astha trader are doing cheat , They cant explain even brokrage charges and also cant explain contract notes details (Deducted appox 35-40 pecentage of your profit on every trade, I have trade another broker also to trade different broker like zerodha and upstox, Sharekhan, Fyers) and they guy are seating customer care support are not good approached , speak rudely about to explain (Gali galoch bhi kiya)

I am astha MCX account holder ,open account for high leverage for trial and testing but its totally failed.

I am doing trading lastly from 5 years, Even proof about ashta trader. Its totally bluffing broker.

Hi shrikanth, I am having plan to open account in astha, please suggest me, or share ur contact details