Composite Edge Review – Stock Brokers in India

List of Stock Brokers Reviews:

Composite Edge Overview

Composite Edge is a prominent discount stockbroker with its establishment going as back as 1994 as part of Composite Investments Pvt. Ltd.(CIPL). It allows instant fund transfers from ICICI, Kotak, HDFC and Axis banks with transaction charges of ₹15, thus, making the funds’ transfer process a knot easier as compared to other non-banking stock brokers that might take a day or so to transfer funds.

It has an accreditation from BSE, NSE, MCX-SX and MCX to allow its clients to trade in the following segments:

- Equity

- Derivatives

- Currency

- Commodity

- Mutual Funds

“Composite Edge registered as Composite Securities Limited in SEBI has an active client base of 1,274 which is pretty low overall.”

Satish Kumar Dutt – CEO and Managing Director, Composite Edge

इस विश्लेषण को हिन्दी में पढ़ें

Trading Platforms

The trading platforms offered by Composite Edge are mostly out-sourced in nature and the stockbroker beers minimum responsibility when it comes to focus on technology.

The good part of the out-sourced softwares is that they are pretty exhaustive in nature and configuration while the concerns remain on the fact that the user experience is pretty bland and you might take some time in understanding how the application and navigation works.

Let’s talk about the ones provided by this discount stockbroker one by one:

NOW

NOW is the terminal based trading platform from NSE licensed to many stockbrokers including Composite Edge. The user needs to download and install this software on his or her laptop or desktop. This is generally suitable for heavy traders who have a dedicated machine just for trading and use stock trading as their primary living. Some of the features of the robust trading terminal are:

- Market Watch

- Options calculator

- Compare Scrip

- Heatmaps

- Charts with multiple indicators

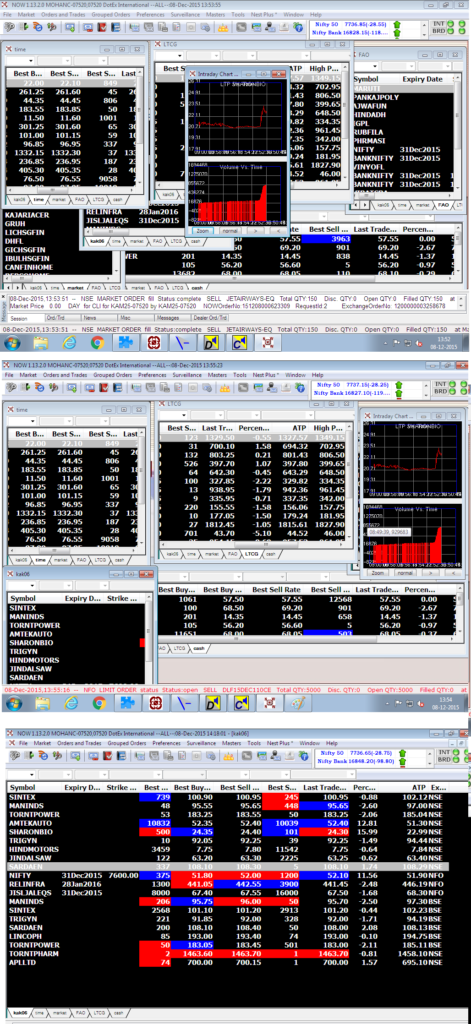

Here are some of the screenshots of the trading platform:

NOW Online

NOW Online is web trading application that can be accessed from anywhere using an internet connection. It is suitable for users that are light to medium level traders. This application does not require the client to download or install any software. Some of the features of this application are:

- Stock screener

- Market watch, live quotes

- Intra-day interactive charts

- Alerts and notifications via email and SMS

- Funds transfer

Here is how the application looks like:

ProTrader

ProTrader is a terminal based application that requires a download and then an installation on your laptop or computer. You cannot use this on your mobile or tablet devices. As far as the features are concerned, the application provides you with the following offerings:

- Customization allowed on the menu, widgets dashboard level along with set-up of alerts and notifications

- Short-cut keys or hotkeys, as they call it, are allowed to be set-up in order to place quick trades and order execution

- Multiple types of charts provided so that you can perform detailed technical or fundamental analysis

At the same time, you need to take care of the basic configuration of your computer before you start trading. Some of that is explained below:

- 2 GHz or higher processor

- 2 GB RAM (This value should be dedicated to the Desktop application only. For other tasks, you can have additional free RAM).

- 50 MB available disk space for installation and additional 500 MB for history cache.

- Operating Systems:

- Windows 7/ 8.1/ 10

- Microsoft .NET Framework 4.7 +

- MacOS version 10.11

Just make sure to discuss with the executive of the stockbroker on the point whether any of the trading platform provided is chargeable in nature. This will save you unnecessary waste of time and money later in case you are billed for usage of these trading platforms.

This is how ProTrader looks like:

NSE Mobile Application

This is a mobile-based trading application that can be accessed through mobile phones with any of the following operating systems:

- Android

- Java

- iOs

- Windows Phone 7

- Blackberry

This mobile application comes with the following features:

- Real-time streaming quotes and market trends

- View positions, browse charts

- Order placements

Here is the demo video of the NSE mobile trading application:

Composite Edge Customer Support

You can get in touch with the support team of this discount broker through the following communication channels:

- Phone

- Social Media

- Web-form

Even though the discount broker offers live chat support, which is a scarce channel, the customer support is pretty slow in their turnaround time. The executives take their own sweet time in responding (if they respond) and for people looking for quick resolutions, the experience can be pretty frustrating. Keep your patience cap on here!

Furthermore, it seems the support staff does not seem to understand some of the basic terms, if not jargons, of the stock market.

Thus, if you are expecting quick support from this discount stockbroker, be ready to get a bit disappointed.

Composite Edge Pricing

Overall pricing in stockbroking include:

- Account Opening Charges

- Brokerage charges

- Transaction Charges

- Taxes

Here are the charges explained for Composite Edge:

Composite Edge Account Opening Charges

Here are the account opening charges of Composite Edge:

| Demat Account opening charges | ₹50 |

| Trading Account opening charges | ₹350 |

| Demat Account Annual Maintenance Charges | ₹300 |

| Trading Account Annual Maintenance Charges | ₹0 |

Composite Edge Brokerage

In terms of brokerage, Composite Edge has devised the pricing in such a way that it incentivizes users who trade heavily. Here is how it works:

| First 1000 Orders | Next 1001 and above orders | |

| Equity Delivery | ₹18 or 0.06% whichever is lower | ₹15 or 0.06% whichever is lower |

| Equity Intraday | ₹18 or 0.006% whichever is lower | ₹15 or 0.006% whichever is lower |

| Equity Futures | ₹18 or 0.006% whichever is lower | ₹15 or 0.006% whichever is lower |

| Equity Options | ₹18 or 0.06% whichever is lower | ₹15 or 0.06% whichever is lower |

| Currency Futures | ₹18 or 0.006% whichever is lower | ₹15 or 0.006% whichever is lower |

| Currency Options | ₹18 or 0.006% whichever is lower | ₹15 or 0.006% whichever is lower |

| Commodity | ₹18 or 0.006% whichever is lower | ₹15 or 0.006% whichever is lower |

Use this Composite Edge Brokerage Calculator for complete charges and your profit

Composite Edge Transaction Charges

Apart from account opening and brokerage charges, here are the transaction charges levied on the client:

| Transaction/Turnover Charges | |

| Equity Delivery | 0.00325% |

| Equity Intraday | 0.00325% |

| Equity Futures | 0.00290% |

| Equity Options | 0.070% |

| Currency Futures | 0.0022% |

| Currency Options | 0.070% |

Composite Edge Exposure or Leverage

Clients get the following leverage from Composite Edge:

| Equity | Upto 5 times Intraday |

| Equity Futures | Upto 3 times for Intraday |

| Equity Options | Buying no Leverage, shorting upto 3 times for Intraday |

| Currency Futures | Upto 2 times for Intraday |

| Currency Options | Buying no Leverage, shorting upto 2 times for Intraday |

| Commodity | Upto 2 times for Intraday |

For users who don’t know the risks and implications of using exposure in their trades, we would suggest you understand how it works. Yes, it can amplify your profits but at the same time, usage of exposure can lead to huge losses as well.

More on Composite Edge:

| Composite Edge Review | Composite Edge Hindi Review |

Composite Edge Comparisons  | Composite Edge Transaction Charges |

| Composite Edge Brokerage Calculator | |

Video Review; Video Review; |

Disadvantages of Composite Edge

Make sure you understand some of the concerns before committing yourself to this discount broker with your trades:

- Very high account opening and maintenance charges as compared to other stock brokers

- Investing in mutual funds not possible

- No toll-free number support for immediate assistance

- Customer support, as an overall proposition, can be improved.

Advantages of Composite Edge

At the same time, here are some of the positives of using the services of Composite Edge as your broker:

- NRI services provided

- Reasonable brokerage charges

- A veteran and experienced management driving broking that understands the needs of clients

- Flexibility in brokerage with minimum charges applicable along with the incentive to heavy traders.

Looking to Open a Demat and Trading Account?

Provide your details in the form below and we will set a callback!

Thank You ...

You can check out detailed comparisons of Composite Edge Vs Other stockbrokers here:

Composite Edge is the worst broker I know in India. I have had accounts with Religare, India Infoline, Zerodha, and RKSV Securities (UPSTOX). I don’t understand how Composite Edge is even in the same business. They have the worst processes and systems. Definitely not worth the money.

Also, it is not secure at all. The customer service team can reset your passwords at any time without informing you. Your assets are definitely not safe with them. I am not saying they are there to commit frauds, but the system definitely facilitates malpractices if someone wishes to do it. Not safe.

Further, they have the worst processes of all brokers I know. For everything, you need to send them a courier. Emails and scans don’t work for anything. While every other broker is going forward, Composite Edge is going backward.