Edelweiss Capital

List of Stock Brokers Reviews:

Edelweiss Capital services limited, a full-service stockbroker is a part of the Edelweiss Group, a leading financial services company that provides a range of products and services to its clients across Institutional, retail and corporations.

Let’s understand the different value propositions the brokers, where it passes, where it fails and then based on that you may decide whether or not to open Edelweiss Demat Account and know about Edelweiss Demat Account Charges.

The broker has recently gone for an NCD worth ₹5,000 Million; for more information, here is a detailed review on Edelweiss NCD.

Edelweiss Capital Review

With a membership from NSE, BSE, MCX-SX and MSEI, Edelweiss Capital’s clients can trade and invest in the following financial entities as listed below:

With an employee strength of around 6200, Edelweiss has a client base of around 9 lakhs serving across 237 locations in 120+ cities of India. In the recent past, Edelweiss acquired J.P. Morgan asset management company in March 2016 thus widening its coverage and hold in the commodities segment.

Furthermore, this 1995 established stockbroker has a sub-broker and franchise network of around 4300, making it one of the stockbrokers with the highest offline presence.

If you are interested to be a partner, here is a quick review on Edelweiss Franchise business.

“Edelweiss Capital has an active client base of 1,16,883 for this financial year 2020.”

Rashesh Shah – Founder, Chief Executive Officer (CEO) and Chairman, Edelweiss Financial Services Limited

Edelweiss Capital Trading Platforms

This full-service stockbroker provides trading applications across devices be it terminal software, mobile app or web trading app. Once you open Edelweiss Demat Account you would be able to access the trading app and trading platforms provided to you by the broker. Here are the details:

Edelweiss Capital Xtreme Trader

Xtreme trader is a terminal-based trading platform by Edelweiss which users can download and install on their desktops or laptops. This mostly suits heavy traders who look forward to trade most part of their daily routine and have a dedicated machine just for this.

Some of the features of the Xtreme trader are:

- High-performance software with quick response time

- Shortcut keys can be customized as per the user’s discretion. This basically helps the user to cut down on any sort of time wastage at crucial order placing moments

- Research calls, reports and recommendations available and the user can set up triggers pretty easily.

- Customization and personalization of features allowed including shortcut keys, background colours, workspace widgets, alerts, and notifications etc.

- Interactive charts based on set triggers get displayed based on the research calls

- Margin funding available.

Here is a small intro-video of the trading platform:

The application comes with different variants separately for Commodity and Equity trading, thus, in a sense, you are required to download two different software.

Edelweiss Capital Traders Lounge

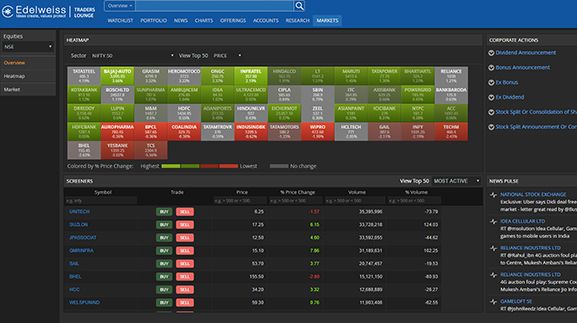

Traders Lounge is a browser-based trading platform that can be accessed from anywhere by just logging into the system. It does not require any download or install and can be used directly through a browser.

The platform is compatible with most of the leading browsers with complete responsiveness and adaptability. Some of its features include:

- Clients can dig deep into data, compare stocks, visualize trends into their technical analysis with all sorts of advanced features such as live option chain, heat maps in place.

- A well-designed user-interface with most of the relevant information including market trends, charts, stock updates, charting, broker calls within a single screen.

- Along with market news, the tool also provides a generic market sentiment towards the news that can impact the stock value on either side.

Here is a playlist of Trader’s lounge features explained in length:

Edelweiss Mobile Trader App

Mobile Trader is one of the widely used among all the trading platforms of Edelweiss. It comes loaded with a lot of useful features that allow the client to place the orders just at the right time. Some of the features are explained below as:

- Allows the clients to track holdings, watch market lists while monitoring market trends

- 17 technical indicators allow the clients to make the right judgment without time wastage

- The simple and intuitive User interface helps the user to navigate and access through different features provided within the application.

- Placing an order takes 3 clicks including entering all details and confirmation screens.

Here is a demo video of the mobile app (with all features explained) for reference:

Here is the client rating for the Edelweiss Capital Mobile trader app from Google Play Store:

| Edelweiss Mobile App | |

| Number of Installs | 10L+ |

| Mobile App Size | 52MB |

| No. of Charts | 6 |

| No. of Indicators | 100+ |

| Review |  |

Edelweiss Capital Customer Care

The full-service stockbroker provides the following communication channels for its clients:

- Toll-free number

- Phone

- Offline branches

- Web self-help & FAQs

Being a full-service stockbroker, Edelweiss Trading has relatively higher expectations from its clients base when it comes to the quality of customer service.

It does a good job of providing multiple communication channels but there have been few concerns reported by the clients around the quality of response provided back by the customer service team. Having said that, these issues have been seen by a small set of the client base.

Edelweiss Capital Pricing

Overall pricing in stockbroking include:

- Account Opening Charges

- Brokerage charges

- Transaction Charges

- Taxes

For Edelweiss Capital, here are the charges explained:

Edelweiss Capital Account Opening Charges

For Edelweiss Capital, clients need to pay the following charges while opening an account:

| Trading Account Opening Charges (One Time) | ₹1000 |

| Trading Annual maintenance charges (AMC) | ₹0 |

| Demat Account Opening Charges (One Time) | ₹0 |

| Demat Account Annual Maintenance Charges (AMC) | Free for 1st year, ₹500 from 2nd year |

Edelweiss Capital Brokerage

Edelweiss is pretty smart in terms of its brokerage plans making sure a potential client can make a choice of the plan as per his or her requirements. It has divided its brokerage plans into Trader and Investor segments and within these segments, there are further segregations based on the kind of investor or trader a user is.

Use this Edelweiss Brokerage Calculator for complete charges and your profit.

How is Brokerage calculated?

The brokerage calculation depends on your trade value. For instance, if you trade for ₹1,00,000 in Equity Delivery and are being charged brokerage rate of 0.4%, in that case, your brokerage for that particular trade will be ₹400.

Full-service stockbrokers generally charge high brokerage and users are advised to use their discretion while choosing a stockbroker for themselves.

For an investor, there are 2 plans as shown:

Investor 1

Investors looking to invest in Equity using the delivery service may opt this plan where relatively lesser brokerage charges are applied:

| Equity Delivery | 0.45% |

| Equity Intraday | 0.06% |

| Equity Futures | 0.06% |

| Equity Options | ₹150 per lot |

| Currency Futures | 0.050% |

| Currency Options | ₹50 per lot |

Investor 2

However, if the user is looking to invest across multiple segments, except Equity Delivery, then he/she may choose this particular plan with reasonable charges:

| Equity Delivery | 0.55% |

| Equity Intraday | 0.04% |

| Equity Futures | 0.04% |

| Equity Options | ₹120 per lot |

| Currency Futures | 0.035% |

| Currency Options | ₹30 per lot |

At the same time, for a trader user, there are 4 plans wherein a subscription amount needs to be paid which has a 1-year expiry period. Brokerage getting generated for the trades placed by the user gets deducted from the paid subscription charges.

Once the subscription amount gets exhausted, the client starts getting the original non-discount brokerage percentage.

Based on how much subscription amount is paid, the brokerage charges vary as shown:

Trader 1

So if you start with a subscription amount of ₹12,000 (excluding taxes), then your brokerage delivery goes down to 0.3% from 0.45% i.e. a drop of 33%. Details here:

| Subscription Fees | ₹12,000 |

| Taxes | ₹1,800 |

| Total Amount | ₹13,800 |

| Equity Delivery | 0.30% |

| Equity Intraday | 0.03% |

| Equity Futures | 0.03% |

| Equity Options | ₹90 per lot |

| Currency Futures | 0.04% |

| Currency Options | ₹22 per lot |

Trader 2

Similarly, for a subscription of ₹24,000 the brokerage details are here:

| Subscription Fees | ₹24,000 |

| Taxes | ₹3,600 |

| Total Amount | ₹27,600 |

| Equity Delivery | 0.22% |

| Equity Intraday | 0.02% |

| Equity Futures | 0.02% |

| Equity Options | ₹60 per lot |

| Currency Futures | 0.03% |

| Currency Options | ₹15 per lot |

Trader 3

Then taking the notch to ₹54,000 – the brokerage for delivery drops to 0.17% for Equity delivery:

| Subscription Fees | ₹54,000 |

| Taxes | ₹8,100 |

| Total Amount | ₹62,100 |

| Equity Delivery | 0.17% |

| Equity Intraday | 0.02% |

| Equity Futures | 0.02% |

| Equity Options | ₹40 per lot |

| Currency Futures | 0.02% |

| Currency Options | ₹10 per lot |

Trader 4

Finally, for heavy traders, there is a subscription plan of ₹1,12,000 and they just need to pay a brokerage as low as 0.10% for delivery:

| Subscription Fees | ₹1,12,000 |

| Taxes | ₹16,800 |

| Total Amount | ₹1,28,800 |

| Equity Delivery | 0.10% |

| Equity Intraday | 0.01% |

| Equity Futures | 0.01% |

| Equity Options | ₹25 per lot |

| Currency Futures | 0.01% |

| Currency Options | ₹6 per lot |

Having seen all the plans for all kinds of traders and investors, it can be concluded that overall Edelweiss brokerage is reasonably high as compared to other full-service stockbrokers.

Furthermore, with the advent of discount stockbrokers, getting a client base that can pay that high brokerage charges are going to be only difficult.

Edelweiss Capital Transaction Charges

Apart from the account opening and brokerage charges, a client needs to pay the following transaction charges:

| Transaction/Turnover Charges | |

| Equity Delivery | 0.00325% |

| Equity Intraday | 0.00325% |

| Equity Futures | 0.00190% |

| Equity Options | 0.05% |

| Currency Futures | 0.00115% |

| Currency Options | 0.04% |

Edelweiss Capital Margin

Edelweiss Capital provides the following margins to its clients depending on the traded segment:

| Equity | Upto 20 times for Intraday, Upto 4 times for Delivery @interest |

| Equity Futures | Upto 3 times for Intraday |

| Equity Options | Buying No Leverage, Shorting upto 3 times for Intraday |

| Currency Futures | Upto 2 times for Intraday |

| Currency Options | Buying No Leverage, Shorting upto 2 times for Intraday |

| Commodity | Upto 3 times for Intraday |

Looking at the numbers, Edelweiss certainly offers decent exposure or leverage for Equity Intraday, however, in other segments, the exposure values are pretty low.

Thus, if you are looking to trade across different segments and are looking for exposure, then Edelweiss Capital might disappoint you a bit.

Edelweiss Capital Disadvantages

You might face some of these concerns if you go ahead with this full-service stockbroker as far as your stock market trading is concerned:

- Relatively high account opening and maintenance charges as compared to other stockbrokers

- Customer service feature can be improved especially from the quality of messaging and communication perspective.

- Relatively high brokerage charges.

- Investment in IPOs can be a complicated process sometimes.

- Pricing plans can be complicated to understand. Users are advised to understand how these plans work before opting for one.

“Until 2019, Edelweiss Capital has received 18 complaints from its clients in this financial year 2019-20 which is 0.01% of its client base. The industry average is 0.01%.”

Edelweiss Capital Advantages

Here are some of the positives of opening your trading account with this full-service stockbroker:

- Well defined brokerage plans allow flexibility and freedom to clients to choose the one that suits their specific requirements

- Reasonable offline presence with around 4300 sub-broker and franchise offices across India.

- A decent array of trading platforms across all devices

- A wide range of trading and investment products for its clients

- Free call and trade facility, a rarity among stockbrokers

- Habitats one of the most prominent research and advisory team at the client’s disposal

Interested to open an account?

Enter Your details below and you will receive a callback right away.

Post this call, there are 2 ways to get started.

- If you have an Aadhar card, then the account opening process can be completed in a few minutes.

- Otherwise, you need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for Demat account.

Edelweiss Capital Membership Information:

Here is the membership information of the broker with different exchanges and intermediate parties:

| Entity | Membership ID |

| BSE | INB011311637 |

| NSE | INB231311631 |

| SEBI | INH000000172 |

| NSDL | IN302201 |

| MCX | 10425 |

| NCDEX | 00205 |

| Registered Address | Edelweiss House, Off CST Road, Kalina, Mumbai - 400098 |

The details can be verified from the corresponding websites of the exchanges.

Edelweiss Capital FAQs:

Here are some of the most frequently asked questions about Edelweiss Capital you must be aware of:

- What are the account opening and maintenance charges at Edelweiss Capital?

The Edelweiss charges for account opening are ₹1000 for the trading account. To maintain your account with the broker, you are required to pay ₹500 starting the 2nd year with 1st year AMC being free.

- Is there a mandate of opening an Edelweiss Free Demat account?

Yes, users looking to open a trading account with Edelweiss Capital must open the demat account as well with the broker. This, in a sense, is a mandate set up by the full-service stockbroker.

- How can I apply in IPOs using Edelweiss Capital services?

Applying for an IPO using Edelweiss Capital can be a bit cumbersome at times. One option is to use ASBA facility where the user is required to apply to public issues using their bank account.

Further, the user needs to submit the form and provide details such as Applicant Name, PAN number, Demat account number, Bid quantity etc.

If the user is allocated issues, the corresponding amount will be deducted from the account in lieu of shares.

Otherwise, the user may check with Edelweiss Capital on any other smoother way of IPO investment, since the one prescribed through their trading platform is a little tricky and should be avoided.

- What are the features of Traders’ Lounge – the trading platform from Edelweiss Capital?

The web-based trading platform from Edelweiss Capital called Traders’ Lounge comes with the following features:

- It’s a responsive application and can be used across multiple devices including mobile, laptop, desktop or tablet.

- It is lightweight in nature and requires a basic configuration of the device being used.

- Provides multiple features such as charts, technical indicators, heatmaps, market trends etc for technical and/or fundamental analysis.

- Since Edelweiss Capital is a full-service stockbroker, you get to access different research reports, tips and recommendations within the trading application.

You can check further details about this trading application in the ‘Trading Platforms’ section above.

- What are the products and services offered by Edelweiss Capital?

Edelweiss Capital, being a full-service broker, provides an array of trading and investment products to its clients so that major financial investment needs are taken care of by the same financial house.

Different products and services include Equity, Commodity, Currency, Mutual funds, ETFs, Bonds, Insurance etc.

- Is there any product of Edelweiss Capital Ltd. for long-term investors?

Edelweiss Broking has a long-term investment product called GPS or Guided Portfolio System.

This is a Robo-advisory set up where the system asks you a few basic questions such as your investment capital, risk appetite and creates mutual funds SIP for your long-term investment plans.

To come up with these recommendations, the system runs through multiple data points and comes back with corresponding solutions.

You can check out the detailed comparisons of Edelweiss Broking Vs Other Stock Brokers:

Edelweiss Capital Branches

The full-service stockbroker has a presence in the following locations across different parts of India, including

| States/City | ||||

| Andhra Pradesh | Vizag | Hyderabad | Warangal | Secundrabad |

| Tirupati | Vijayawada | Bheemavaram | ||

| Bihar | Patna | |||

| Chhatisgarh | Bhilai | Raipur | ||

| Goa | Panaji | |||

| Delhi/NCR | New Delhi | Delhi | ||

| Gujarat | Ahmedabad | Jamnagar | Bhavnagar | Vadodara |

| Surat | Junagadh | Rajkot | ||

| Haryana | Ambala | Karnal | Hisar | |

| Jharkhand | Dhanbad | Jamshedpur | ||

| Karnataka | Bangalore | |||

| Kerala | Trivandrum | |||

| Madhya Pradesh | Bhopal | Indore | ||

| Maharashtra | Nashik | Pune | Nagpur | Kolhapur |

| Mumbai | ||||

| Orissa | Bhubaneswar | Cuttack | Jajpur Town | Rourkela |

| Sambalpur | ||||

| Punjab | Ludhiana | Patiala | Mandi Gobindgarh | |

| Rajasthan | Ajmer | Jaipur | Alwar | Kota |

| Udaipur | Jodhpur | |||

| Tamil Nadu | Chennai | Coimbatore | Salem | Tiruchirappalli |

| Uttar Pradesh | Agra | Bijnor | Kanpur | Lucknow |

| Meerut | Varanasi | |||

| Uttarakhand | Dehradun | Haldwani | Nainital | |

| West Bengal | Medinipur | Kolkata | Serampore | Bardhaman |

| Silguri |

More on Edelweiss Capital

If you wish to learn more about Edelweiss Capital, here are a few reference links:

its all a scam, i traded with different brokers, most of them disappear when I make withdrawal request, some of them will try to convince you not to withdraw and instead invest more while others will actually allow you withdraw a little amount so they can build your trust and after that they begin to make large requests. i lost a lot to these fraudulent brokers, i was depressed for months until i was recommended to a Binary options trade funds recovery expert Mr David Miller when i met them i didn’t believe they could get back my money because i have been scammed a lot already and didn’t know what to believe, but my gut feeling told me to give it a try and i did, feel free to contact them via their email address: davidmillerper@gmail.com, and they will help you to claim back your lost investment from your scam broker, i was obligated to recommend them for the good service which they offered to help my issue with my broker.