FairWealth

List of Stock Brokers Reviews:

Launched in the year 2005, FairWealth Securities is a full-service stockbroker based out of Mumbai along with its headquarters in New Delhi. This stockbroker has a strong offline presence in around 420 cities and 1800+ remisers across different parts of India.

At the same time, the broker has an active monthly client base of 11,293. Compared to other prominent stock brokers in India, this figure is quite low.

Let’s have a quick look at some of the features of this stockbroker along with areas such as pricing, brokerage, trading applications, margin and more!

FairWealth Review

Nonetheless, apart from this, we will talk about different features and aspects of a full-service stockbroker that can help you in making a calculative judgment. To start with, while using the services of Fairwealth securities, you can trade and invest in the following segments:

- Equity

- Institutional broking

- Depository services

- Commodity Trading

- Currency Trading

- Derivatives

- Mutual Funds

- IPOs

- Insurance

- Loans

Mr Dhirender Gaba – Founder & MD, FairWealth Securities

FairWealth Trading Platforms

This full-service stockbroker majorly relies on 3rd-party trading softwares for its clients and has minimal focus on in-house technology development. Nonetheless, the broker offers you trading applications across devices including a terminal solution, web-based browser application and a mobile app.

Here are the details:

ODIN Diet

This is a terminal based trading application that requires you to download and install an EXE software onto your computer or desktop. Although it is a little bulky application that requires a reasonable configuration of your machine, it still gives you an exhaustive number of features to access. The application provides you with the following features:

- Reasonable speed and performance

- Since Fairwealth is a full-service stockbroker, you will be provided with research and recommendations within the trading platform

- Around 6 types of charts along with 30 technical indicators are available to go with charting functionality for technical and fundamental analysis

- Important studies such as trend lines, cycle lines, Fibonacci arcs, Gann fan lines, inserting text etc. are available through drag and drop.

- Allows you to trade and invest in different trading/investment products including IPOs, mutual funds etc.

This is how the ODIN Diet looks like:

A couple of concerns with this licensed terminal solution from FairWealth Securities, including:

- Relatively bulky in nature and requires high configuration of your machine

- If you are a beginner level user, then you may face usability level issues where concerns such as understanding the application, navigation across features can be observed.

NetNetLite

This web-based browser application is another outsourced software that is provided by FairWealth to its clients. It does not require any download or installs, and you just need your credentials (username/password) to login into the application through any browser. Furthermore, it is a responsive application and can be used across different devices such as a computer, laptop, desktop, mobile or a tablet.

The application provides you with the following features:

- Real-time streaming quotes

- Relatively easier to use

- Okayish charting functionality for analysis

This is how the application looks like:

At the same time, you will realize that the number of features, in this case, are limited in number. Especially, if you are a medium to a heavy level trader, you’d like to switch to a much more exhaustive application soon.

Secondly, the application needs to improve its technical and fundamental analysis set up through indicators, chart types, heatmaps, strategies etc.

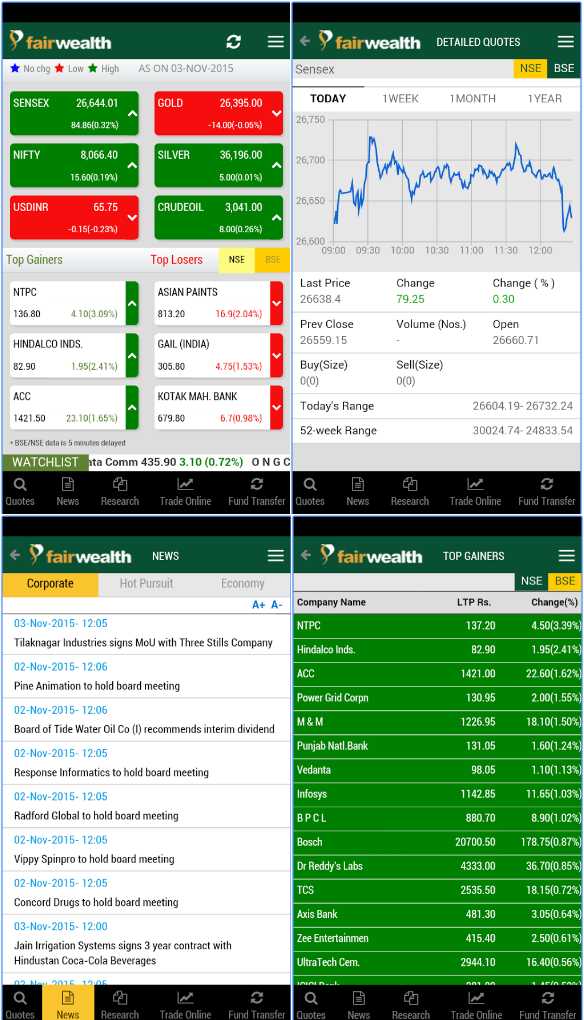

FairWealth Mobile App

This mobile app is the single and the only attempt by the full-service stockbroker towards in-house technology incorporation. This app provides the following features as listed below:

- Real-time indices information

- Customizable watch lists

- Research and tips available within the mobile app

- Charting for frequencies ranging from 1 day, 1 week, 1 month and up to 1 year

- Fund transfer

This is how the application looks like:

At the same time, there are few issues with the mobile app, including:

- Limited number of features

- Performance and speed related issues especially in smaller cities

- Irritating user experience with numerous alerts

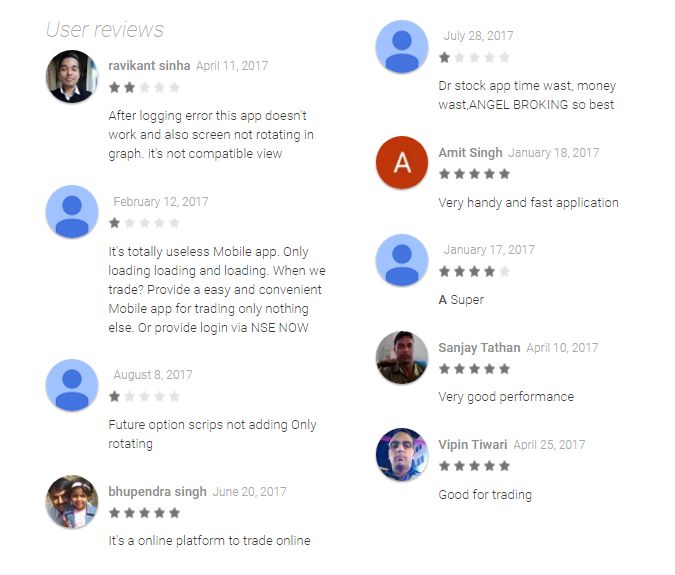

Here is how the app is rated at the Google Play Store:

FairWealth Customer Service

Although Fairwealth is a full-service stockbroker and generally, users expect high standards of customer service from such brokers but it still has a lot to improve in this aspect. The broker provides the following communication channels, as listed:

- Offline branches

- Phone

- Toll-Free Number

- Webform

Although the broker provides multiple communication channels when it comes to usage of user feedback, it seems FairWealth has not realized the value of feedback yet. For instance, this is how the Google Play store page looks like:

As shown above, there are an ample number of feedbacks provided by different clients of the broker. However, there has been almost no response whatsoever provided to any of the feedback. Furthermore, the broker needs to work on the technical and professional skill set of customer support executives.

The support staff is a little jumpy towards account opening, placing trades etc where there is something to gain for the broker monetarily.

The broker can also work on the turnaround time taken to resolve the issues raised by its clients.

FairWealth Research

When it comes to research, although the broker has limited visibility in the mainstream media, it provides the following research products to its clients:

- Equity reports

- Daily Derivative market outlook

- Commodity Research reports

- Currency Research reports

- IPO Reports

- Mutual fund analysis

- Special reports

- Sector reports

There seems to be clear segregation of different report types offered by the broker but when it comes to performance, accuracy and regularity of these reports, the broker stays somewhere around average. You are advised to perform your own analysis at both technical and fundamental levels along with getting a reasonable idea from the reports provided by the broker.

This is how one such report from the broker looks like:

FairWealth Pricing

Pricing is one of the most important factors users look out for. Here we have listed out all the primary costs associated with this full-service stockbroker in terms of opening, maintaining and trading on the stock market.

FairWealth Account Opening Charges

Here are the details of the account opening and maintenance charges:

When it comes to their annual maintenance charges, they have got a couple of options. Either you can opt for ₹300 plan where the first year AMC is free and from the second year, you will be required to pay ₹300 every year. Otherwise, you also have the option to pay ₹1000 upfront and your lifetime AMC is taken care of with that amount.

FairWealth Brokerage

Now unlike the account opening cost, brokerage charges are recurring costs. And that is why it becomes more important to understand and calculate how much you will end up paying the broker.

In case of FairWealth, the executives start with charges somewhere around the range of 0.4% to 0.5% of your trade value in the delivery segment, but the numbers can be lowered down a lot. All it requires is reasonable negotiation skills to go ahead with good initial margin deposit.

Here are the details of brokerage charges in this case:

Use this FairWealth Brokerage Calculator for complete charges and your profit

FairWealth Transaction Charges

Apart from account related costs and brokerage charges, there are few taxes, stamp duty etc that are added to the overall payment. Here are the details:

FairWealth Margin

Users looking to make some extra profits by employing the concept of exposure or leverage on top of their trades can do it using the services of this full-service stockbroker. At the same time, the exposure values offered are not so high and if exposure is one of the most important factors for you in your stockbroker selection, then you might be a little disappointed.

Here are the leverage details:

At the same time, exposure or leverage is a risky concept and must only be used if you understand the intricacies and risks associated with it.

Conclusion

FairWealth Securities although provides some reasonable values through its low brokerage, free account opening, exposure, trading products range, it still has a lot to work upon when it comes to areas such as customer trust, brand awareness, trading platforms, service, research quality and so on.

Having said that, if you are looking for average performing trading platforms at a reasonable cost, then yes, FairWealth securities can be a suitable stock broker for you.

FairWealth Disadvantages

Some of the concerns of opening an account with Fairwealth include:

- Low focus on technology with average performing trading applications

- Low brand visibility

- 0.14% of its clients have raised the concerns already whereas the industry average is 0.06% only. Thus, service issues are reasonably high.

FairWealth Advantages

Here are some of the positives of using the services of this stockbroker:

- Reasonable brokerage charges

- Wide offline presence

- Free account opening

- Wide range of trading and investment products

Looking to Get a callback for Account Opening?

Provide your details in the form below and we will set up a callback for you, right away:

Next Steps:

Post this call You need to provide few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

FairWealth Membership Information

Here are the membership details of the full-service stockbroker with different indices:

FairWealth Branches

The broker has a presence in the following locations across different parts of India through their sub-broker and franchise offices:

More on FairWealth:

If you wish to learn more about this full-service stockbroker, here are a few reference links for you: