Finvasia

List of Stock Brokers Reviews:

Finvasia is a recent kid on the discount stockbroking block. Their proposition is simple – Zero brokerage across segments, pay for the trading platforms on a fixed basis (more on that later).

The brokerage model is termed as “Technology Costs” for clients and users do not to pay based on the number or amount of trades done on the stock market.

Finvasia Review

Launched in 2013, this discount broker is based out of Chandigarh (Punjab) and allows its clients to trade in the following segments:

- Equity

- Currency Trading

- Derivative Trading

- Commodities Trading

- IPO

- Bonds

- NRI Trading

It is backed by some of the leading venture capitalists including Intrinsic Investment Limited with the latest round received in August 2016.

“Finvasia has a total of around 5,318 active clients for this financial year.

This number is one of the least in the whole stock market industry in India.”

Natty Virk (CEO) and Sarvjit Singh Virk (Co-founder)

Finvasia Trading Platforms

The discount stock broker offers different trading platforms to its clients and is looking to launch 4-5 new trading and analysis based platforms.

Here are the details:

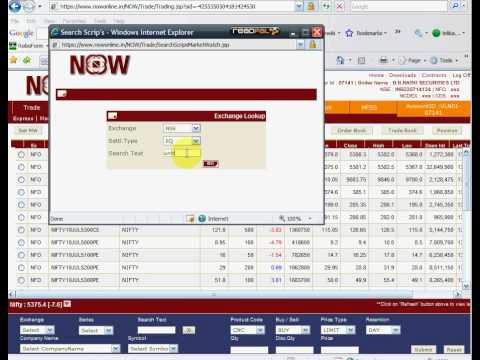

Finvasia – NOW

NSE NOW or Neat On Web is free to use web-based trading platform powered by NSE. It is a prominent tool by NSE licensed to Finvasia like other brokers along with the NSE mobile app. Users don’t need to download or install anything but just access using a browser from any desktop, laptop or mobile.

Some of the features of the platform are:

- Allows to trade across Equity, Derivatives, Currency and Mutual funds

- Aftermarket orders (AMO) allowed

- Customized screen layouts as per user preferences

- Accessible on mobile across iOS, Windows along with Android

For NSE, this is a FREE to use trading platform. But for BSE, the premium software comes at ₹120 per segment per month.

Finvasia NEST

NEST is a terminal base executable software that users can download and install on their laptops or desktops. It is also a tool from NSE itself with highly useful features such as:

- Provision of Online payment transfer

- Order placement across multiple asset classes and trading segments

- Interactive charting functionality with multiple indicators within the same screen

This is a paid platform where users pay at per segment and at the bracket order level. Here are the details:

| Standard Plan | Premium Plan |

| ₹149 per segment | ₹777 across segments |

| ₹99 for Bracket Order | No Charges |

Finvasia AMI Broker

AMI Broker is a technical analysis tool with all sorts of interactive charting functionalities. It also has inbuilt integration with the trading academy which displays users with scanning, custom indicators etc. Here are some of the features of AMI Broker:

- Interactive charts for technical analysis

- Helps to double-check the client’s investment strategy

- Personalized user interface

This is a paid platform priced at ₹299 per month. Here is the link to the tutorial.

Finvasia Scalpert

Scalpert from Finvasia is a web and mobile-based trading platform with a specific set of features in terms of market analysis and trading. The application is available in web form as well as an Android trading app as well. There are no charges attached to using this application and is free to use.

Some of the features of Scalpert include:

- Available with around 40 technical indicators and multiple chart types for detailed technical analysis

- Fund transfer facility provided

- You can place multiple types of orders through the application

- The overall design is a bit primitive and can certainly be optimized

This is how Finvasia Scalpert looks like:

Finvasia Presto

Presto provides API based solution to its clients for customized trading (something like Connect API from Zerodha).

Presto suits heavy traders who prefer to do their own technical analysis and take trading decisions themselves. This tool provides functionalities such as:

- Custom APIs for platforms including.NET, JAVA, Python, C#

- Real-time LIVE market data

- Multiple algorithm based strategies

- Customized request based strategies allowed

This is a paid platform and is priced at ₹1599 per month.

Finvasia Blitz

Blitz is another powerful trading platform from the house of Finvasia. Like Presto, Blitz is also API model-based platform which comes loaded with the following features:

- Multi-asset trading across different venues along with exhaustive risk management making sure the system stays safe.

- Some of the strategies that can be employed within this trading platform are – Option Twist Leg, Calendar Spread, Cash to Future.

- Complete automated trading with an end to end market feed, order management system, risk management etc

- Users can develop custom trading strategies where variables can be edited anytime

- The technical analysis allowed with more than 40 interactive indicators

This is a paid platform and is charged at ₹7777 per month.

Finvasia Customer Service

The discount stockbroker offers the following communication channels to its clients such as:

- Web Chat

- Web Form

- Phone

Since its a discount stock broker, thus, most of the communication channels are online in nature and there are no offline branches or offices in India and outside.

As far as the turnaround time is concerned, it is relatively quick and you will get the resolution of your concern within a stipulated time period.

The quality of the resolution can be unsatisfying at times. Furthermore, the skill set of customer executives can be improved by time through regular training and other relevant techniques.

Thus, don’t keep huge expectations but overall the service quality will stay on average.

Finvasia Charges

The pricing in this case, like in cases of other discount stockbrokers, is pretty competitive. There are multiple types of charges levied and users must get it documented (or emailed) before opening Finvasia Demat Account. Here are the complete details:

Finvasia Account Opening Charges

Following are charges for opening an account:

| Trading Account Opening Charges | ₹0 |

| Trading Account Annual Maintenance Charges | ₹0 |

| Demat Account Opening Charges | ₹0 |

| Demat Account Annual Maintenance Charges | ₹0 |

Thus, the broker does not charge its clients anything for account opening or maintenance. In a sense, it’s a good way to acquire clients by removing one potential hurdle, especially for beginners.

Having said that, our suggestion is to look beyond “free” accounts since there are multiple other factors that need to be looked upon by finalizing a stockbroker for yourself.

Finvasia Brokerage

The discount broker has a simply laid out pricing strategy with no fixed or percentage-based commission from its users. It charges its clients based on the trading platform he/she chooses for its trading needs.

Choice of the platform basically defines the kind of trader the client is, for instance – if the client chooses a basic NEST platform – the trader is light in its trading frequency while somebody using an exhaustive and comprehensive trading platform such as Presto is somebody who details out day to day trading strategy and is a heavy trader generically.

Here are the detailed charges based on the trading platform:

| Trading Platform Chosen | Charges |

| NOW | ₹0 for NSE, ₹120 for BSE per segment |

| NEST | Standard Plan - ₹149 per segment, ₹99 bracket order Premium Plan - ₹777 all segments, ₹0 bracket order |

| AMI Broker | ₹299 per month |

| Presto | ₹1599 per month (license cost extra) |

| Blitz | ₹7777 per month (taxes extra) |

Finvasia Transaction Charges

Apart from brokerage, the broker levies the following transaction charges:

| Equity Delivery | 0.00325% |

| Equity Intraday | 0.00325% |

| Equity Futures | 0.00190% |

| Equity Options | 0.05000% |

| Currency Futures | 0.00115% |

| Currency Options | 0.0400% |

| Commodity | 0.00260% |

The transaction charges are charged based on your trade value and in this case, the transaction charges go hand in hand with the industry standards.

This is being mentioned because there are few stockbrokers such as Samco, Wisdom Capital that charge much higher transaction charges from its clients by eluding them through the low brokerage proposition. Users are required to be very cautious of these small intricacies.

Finvasia Margin

Here are the details on the exposures provided:

| Equity Delivery | NA |

| Equity Intraday | Upto 10 times |

| Equity Futures | Upto 2 times |

| Equity Options | NA |

| Currency Futures | NA |

| Currency Options | NA |

| Commodity | Upto 2 times |

As shown above, you, as a client won’t really be offered much exposure across segments. These values are generally tough to negotiate at the very start and users looking to use leverage in their trades might get disappointed here.

Finvasia Disadvantages:

Here are some of the concerns if you use the services of Finvasia as your trading firm:

- A new name in the stockbroking space, so gaining brand trust will take time

- Relatively lower leverage provided across segments

- Usage of a few trading platforms is paid in nature

- The pricing model is not apt for beginner traders

- Customer service can be made better, especially in terms of quality of resolutions.

- Low exposure or leverage values offered across trading segments.

“The discount broker has already received 2 complaints in this financial year which is 0.22% of its active client base. The industry average is 0.06%, thus, the broker certainly needs to improve on service aspects.”

Finvasia Advantages:

At the same time, these are the merits of this discount stockbroker:

- A comprehensive range of trading platforms

- No account opening charges or trade based broking charges applicable

- Reasonable transaction charges

- Robo Advisory services at disposal for clients

Conclusion

Finvasia is looking to try something different in the stockbroking industry. With its emphasis on providing multiple trading platforms and brokerage entirely based on the kind of the trading platform chosen, the broker certainly is looking to create a sort of disruption.

However, to back it up, it certainly needs to improve its customer service, the performance of the in-house trading platforms and other values to come out as a promising name among the crowd of other stockbrokers.

Looking to Open an Account?

Enter Your Details and get a FREE call back!

Next Steps:

You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

Finvasia Membership Information:

Here is the membership information of the broker with different exchanges and intermediate parties:

| Entity | Membership ID |

| BSE | 4043 |

| NSE | INB231484636 |

| SEBI | INZ000020537 |

| MCX | 55135 |

| CDSL | 12084300 |

| Registered Address | Plot # 10, Netsmartz House (Level 3). Rajiv Gandhi Chd Tech Park. Chandigarh. India 160101 |

The details can be verified from the corresponding websites of the exchanges.

Finvasia Frequently Asked Questions:

Here are some of the most asked questions about Finvasia:

Is Finvasia a trustable stockbroker? Is it reliable?

The broker has been recently launched in the year 2013 in a full startup mode.

The broker has a small team based out of Chandigarh which is slowly shaping up. Furthermore, the broker does have the backing of prominent investment houses.

Thus, as of now, the broker operations look promising but its too early to call it reliable. For reliability, there are few discount stockbroking houses such as 5Paisa, Zerodha, Fyers that have made a decent impact on the industry in quick time.

How does Finvasia charge its clients?

The broker does not charge its clients any brokerage charges but clients are charged for using the trading platform(s). As per the choice of the client, the corresponding trading platform is made available to the client and requisite charges are levied on a monthly or yearly basis.

The client does not require to pay any brokerage at per trade, order or value level. In a sense, the broker’s brokerage model suits medium to heavy traders who are looking to have different options of trading platforms on a day to day basis.

How are the trading platforms of Finvasia?

Quantity wise, there are various trading platforms offered by Finvasia.

However, there are very few that qualify as high-performance trading platforms and most of these softwares are outsourced without much direct support from the discount stockbroker.

The broker provides platforms such as Omnesys Nest, Now, Blitz Trader, Ami Broker, Presto, Scalpert but most of them are required to improve their performance, user experience, usability etc.

It’s better to have a detailed understanding of your requirements from the trading platform and then take a calculative judgment. The best way is to get a demo of the trading platform from the broker before opening your account.

What are the account opening charges at Finvasia? Also, what are its annual maintenance charges (AMC)?

There are no account opening and maintenance charges at Finvasia and most of the process is free of cost.

In a way, it’s a marketing strategy to acquire as many clients as possible by offering free accounts. However, users are advised not to base their decisions just on the fact that the account opening is free.

There are a lot of other factors such as brokerage, platforms, customer service, exposure, trading products etc which are equally important in making a choice.

What trading and investment products does Finvasia offer?

The broker allows its clients to trade and invest in Equity, Commodity, Currency, IPOs, and bonds. One important thing to consider is that IPO investments are not directly possible through the broker. Thus, get in touch with the stockbroker to confirm about IPO investments methodology.

You can check out the detailed comparisons of Finvasia Vs Other Stockbrokers here:

More on Finvasia:

If you wish to know more about this stockbroker, here are a few references:

Finvasia Review  |

Finvasia Hindi Review  |

| Finvasia Scalpert |

Finvasia Comparisons  |

| Finvasia Transaction Charges |

| NEST Trader |

| Finvasia Margin |

Hi blogger, very well written info. Just to add… they are providing currency segment and MF, IPO etc. I am an Dubai based NRI recently invested in MF with them. For some reason, can not see previous comments. pl check.