Globe Capital

List of Stock Brokers Reviews:

Globe Capital is a full-service stockbroker based out of New Delhi and has been around for a while now. Since its establishment in 1994, the broker has been able to gather memberships from NSE, BSE, MCX, NCDEX, MCX-SX and ICEX.

The broker is a depository participant with both NSDL as well as CDSL.

Thus, Globe Capital has taken care of all sorts of affiliations and membership a broker may need to set it up in the stock market and create a sense of trust factor among its potential client base.

However, that is not the only aspect a broker needs to consider. In fact, that can be seen as a mere formality.

The challenging parts are areas such as research, offline presence, customer support, margin at a reasonable brokerage. Does Globe Capital manage to take care of all these aspects? Let’s find out in this detailed review.

Globe Capital Review

As per the latest numbers, Globe Capital has an active client base of 26,531 which is not so large honestly and the broker certainly needs to up the tempo as far as client acquisition is concerned.

The broker claims to have more than 3000 representative offices across 400 cities and towns of India. The broker serves at both institutional and retail broking level and that could be one big reason for their low retail client base number.

If you are interested to be a partner, check out this detailed review on Globe Capital Franchise before making a choice.

Anyway, looking at the currently active client base, the broker is certainly one of the average ones when it comes to prominence, but still, it provides in-house developed trading platforms.

This is something which can work as a differentiating factor for the broker if they are able to provide value to their client base, consistently (more on this later).

The full-service stockbroker has a presence outside India as well as a running membership with Dubai Gold and Commodity Exchange (DGCX) along with corporate finance and International Broking business in London.

As far as Indian operations are concerned, Globe Capital allows you to trade and invest in the following listed financial segments:

- Equity

- Commodity Trading

- Currency Trading

- Derivative Trading

- Mutual funds

- IPO

- Insurance

- Portfolio Management Services

Furthermore, Globe Capital indulges quite a bit into the Institutional trading form where the broker works with corporate businesses and handles their investments.

Let’s move ahead and talk about how Globe Capital fares in some of the most crucial aspects when it comes to stockbroking in India.

Globe Capital Trading Platforms

As mentioned above, Globe Capital provides in-house trading platforms across devices.

What has been observed on a general basis is that stockbrokers enter into the industry by providing third-party applications such as NEST or NSE Now and dump away this major responsibility based on technology.

Let’s talk about all these software one by one:

Globe Connect Pro

Connect Pro is a web-based trading application that can be accessed from any specific browser such as Google Chrome, IE, Firefox or Safari.

To use this responsive application, you are not required to download or install any software to use this application.

Some of the features the application provides, include:

- Allows you to trade across Equities, Commodity, Currency, Derivatives, Mutual funds and IPOs

- Provides charting styles such as Candlesticks, line charts along with multiple technical indicators so that you can perform real-time Intraday and historical analysis.

- Access to research reports and recommendations on a regular basis

- Gives information on real-time news at a global level that can directly or indirectly impact specific sectors or stocks.

- Fund transfers across 25 prominent banks allowed

Here are the details on the configuration you need to have a smooth trading experience while using Globe Connect Pro:

| Component | Requirement |

| Operating System | Windows XP/Vista/Win7/Win8 |

| Processor | Intel(R) Core (TM)2 Duo CPU @ 2.20GHZ |

| Memory | 4GB RAM |

| Hard Disk | 80GB HDD, GB Eth NIC |

| Other | High-speed Internet or LAN connection |

Globe Trade Smart

Globe Trade Smart or Trade Architect is a terminal-based application where you are required to download and install this application on your computer, laptop or desktop.

Primarily suitable for heavy traders, Global Trade Smart provides a blend of efficient trading tools, research and risk management, and through its effective market data streaming provides most advanced features for rich user experience and convenient trading.

Some of the top features of this application include:

- Integrated and highly configurable market watchlists and provides real-time market information

- Advanced charts with technical indicators and drawing tools provided for detailed technical and fundamental analysis

- Real-time research calls, discussions and market reports

- Export complete market watch to excel with live streaming so that you can apply formulae on top of it

- Pay-in and Payout options available

- Conditional alerts and notifications at Price, Volume, High crossovers, Percent crossovers levels.

- Bulk orders allowed

Here are the configuration details for using Globe Trade Smart:

| Component | Requirement |

| Operating System | Windows XP/Vista/Win7/Win8 |

| Processor | Intel(R) Core (TM)2 Duo CPU @ 2.20GHZ |

| Memory | 4GB RAM |

| Hard Disk | 80GB HDD, GB Eth NIC |

| Other | High-speed Internet or LAN connection |

Globe Connect Mobile

This mobile app from Globe Capital is basically a customized version of NSE NOW. NSE NOW comes in different versions and this one is a mobile trading app developed by Financial technologies and is outsourced to stockbrokers of India.

Most of those brokers buy the license of this application as it is while there are a few who customize the mobile app a bit and then offer to their client base.

Globe Capital is one of those and this mobile app is one of those customized versions:

Some of the features of this mobile app include:

- Real-time charts

- Market depth and integrated market watch

- Research tips and recommendations

- Trading across multiple segments

At the same time, some of the major concerns raised by this app’s users are as follows:

- Issues reported in the alerts and notifications feature.

- Technical charts can be increased for an even detailed analysis.

- Limited data points, might not be useful for an expert trader.

This is how this mobile app is rated at the Google Play Store:

| Number of Installs | 10,000-50,000 |

| Mobile App Size | 16 MB |

| Negative Ratings Percentage | 11% |

| Overall Review |  |

| Update Frequency | 12-14 months |

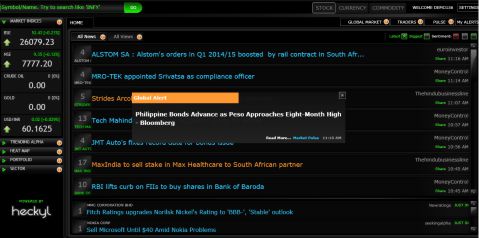

Globe Capital News Connect

This specific application is useful for traders who are looking for real-time Financial Information, News Analytics and Heat Maps.

Although there are very limited applications of such kind available with stockbrokers, however, even Globe Capital has not been able to market the product well enough.

Due to this, the application has not really worked the way this full-service stockbroker might have anticipated for customer acquisition.

Some of the features include:

- Live news from different media types including TV channels, social media etc.

- Sentiment analysis of specific stocks and sectors

- Top news from the global perspective

- Heat maps available for a quick market glance

This is how the application looks like:

Apart from the trading platforms, the broker also has the channel of ‘Call and Trade’ where the clients can place a call at a branch or at the specific number provided by the broker. In this call, they can ask the executive to place a trade on their behalf.

There would be a few formalities involved in this call and once your details are validated, the trade request is passed and executed.

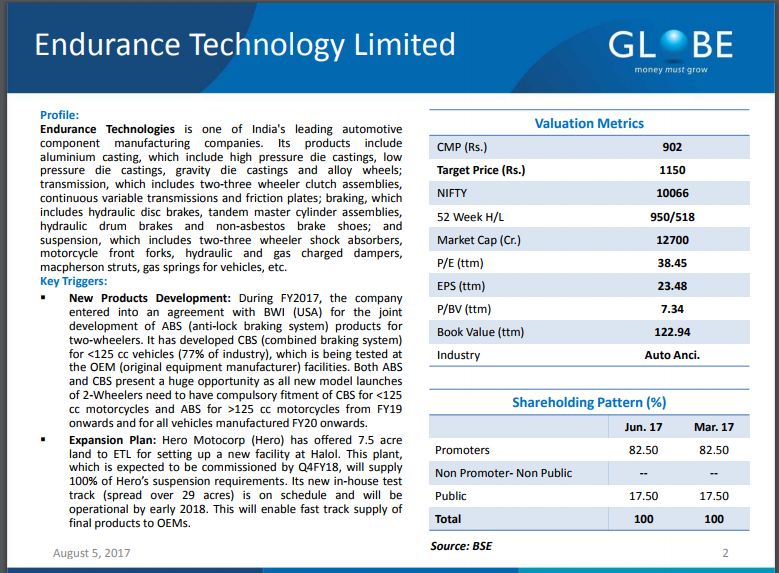

Globe Capital Research

Globe Capital provides research at multiple levels for both short and long-term levels. This is how the overall research set up at this brokerage house done:

- Equity Research

- Daily/Weekly

- Company reports

- Industry reports

- Theme based reports

- Commodity Research

- Daily call tracker

- Reports

- Investment ideas

- Performance reports

- Mutual fund Research

- Currency Research

Depending on your trading or investing preferences, you may choose the specific kind of research reports and recommendations offered by the stockbroker.

When it comes to regularity, the broker provides daily and weekly level reports and publishes all these reports within specific timelines. At the same time, the accuracy is one area that can be improved since the performance of these tips and recommendations is at an average level. This is how one of such reports from Globe Capital looks like:

Globe Capital Customer Care

The full-service stockbroker provides service to its clients through the following communication channels:

- Phone

- Offline locations

- SMS

The turn around time (TAT) is one of the biggest concerns when it comes to customer support quality of Globe Capital. If you are a client or want to be a client of this full-service stockbroker, then you will expect a callback from the broker against your request.

However, it takes a while for them broker support team to get back to you. This can certainly be annoying and frustrating for users who are stuck in crucial situations.

In case you get stuck with the customer support and are not able to figure out any solution to the issue raised by you, it is advised that you get in touch with the compliance officer of the broker for an escalation.

Globe Capital Pricing

Full-service stockbrokers such as Globe Capital charge a specific percentage of your trade value as brokerage. In every trade you place, you will be required to pay a certain price to the brokerage house that will be deducted from your overall gain from the trade.

Apart from brokerage, there are other charges you need to take care of as well in your overall trading and investments in the stock market. Let’s talk about all these one by one:

Globe Capital Account Opening Charges

To open an account and maintain the same, you are required to pay the following charges to the full-service broker:

| Trading Account Opening Charges | ₹0 |

| Demat Account Opening Charges | ₹450 |

| Trading Account Annual Maintenance Charges | ₹0 |

| Demat Account Annual Maintenance Charges | ₹300 |

Globe Capital Brokerage

As mentioned above, the brokerage rates are percentage-based and are as follows:

| Equity Delivery | 0.5% |

| Equity Intraday | 0.05% |

| Equity Futures | 0.05% |

| Equity Options | ₹70 per lot |

| Currency Futures | 0.05% |

| Currency Options | ₹30 per lot |

| Commodity | 0.05% |

Looking at the brokerage values, it can be said that Globe Capital is certainly expensive, especially when it comes to delivery trading. You are suggested to negotiate as much as possible while opening your demat account with the broker.

Use this Globe Capital Brokerage Calculator to understand complete charges and your profit post trades.

Globe Capital Margin

When it comes to exposure or leverage, the broker provides the following multipliers across different segments:

| Equity | Upto 10 times Intraday, Upto 4 times delivery @interest |

| Equity Futures | Upto 3 times for Intraday |

| Equity Options | Buying no Leverage, shorting upto 3 times for Intraday |

| Currency Futures | Upto 2 times for Intraday |

| Currency Options | Buying no Leverage, shorting upto 2 times for Intraday |

| Commodity | Upto 3 times for Intraday |

For people who don’t know about exposure, it is advised to get a detailed understanding of the concept first and only then put their hard-earned capital into it.

The exposure values are provided for a short term at a specific interest rate and can eat up the complete capital if not used wisely.

Globe Capital Disadvantages

Some of the concerns of using the services of Globe Capital are:

- Research quality can be improved

- Relatively high brokerage rates

- Customer support quality, especially in terms of turnaround time needs to be worked on

- Limited offline presence with a presence in only 10 locations

- Even though the broker has been around for a while now, it has not been able to make a mark in the retail trading segment yet.

Globe Capital Advantages

At the same time, here are some of the top reasons for using the services of Globe Capital:

- A wide range of trading products

- Multiple trading platforms and all of those are developed and maintained in-house

- An old brokerage house in the country with the establishment year 1994

- Reasonable exposure offered

Globe Capital Membership Information

Here is the membership information of Globe Capital with respect to different exchanges of the country:

| Entity | Membership ID |

| BSE | 010663731 |

| NSE | 230663732 |

| MSEI | 260663738 |

| NSDL | IN-DP-NSDL-97-99 |

| CDSL | 12020600 |

| SEBI | 270663732 |

| PMS | INP000002361 |

| Registered Address | Globe Capital Market Limited 609, Ansal Bhawan, 16, K. G. Marg, Connaught Place, New Delhi-110 001 |

Looking to have a word with the executive for a basic discussion around the demat and trading account?

Just provide your details in the form below and we will set up a callback for you:

Next Steps:

Post this call You need to provide few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review on Documents required for demat account.

Globe Capital Branches

When it comes to offline presence, Globe Capital is present in the following locations across different parts of India:

| New Delhi | Lucknow | Pune |

| Mumbai | Kolkata | Ahmedabad |

| Jaipur |

More on Globe Capital:

If you wish to learn more about this full-service stockbroker, here are a few reference links for you: