HDFC Securities

List of Stock Brokers Reviews:

HDFC securities, a subsidiary of the renowned HDFC bank, was launched almost 2 decades back in April 2000 as a bank-based full-service stockbroker.

Let’s try to understand what all value propositions this broker has to offer and whether it makes sense for you to open your trading account with it.

HDFC Securities Review

HDFC securities due to its banking services from the parent brand offer a 3-in-1 account that includes your banking, demat and trading services.

This feature is only available with stockbroking companies that have the leverage of a banking services parent company.

The advantage of having a 3-in-1 account is that you get a seem-less trading experience since your bank account is directly integrated into your trading account which helps in instant money transfer.

In case of non-banking financial companies (NBFCs) such as Ventura Securities, India Infoline, Religare Securities money transfer from your bank account to your trading account takes some time that might elude you from making money at specific lucrative opportunities.

“HDFC Securities has around 6,38,425 active clients by 2021-22 for this financial year, making it the one of the largest stockbrokers in India.”

With more than 260 branches across the country, the full-service stockbroker has an okayish offline presence.

HDFC Securities Products

If you are looking to partner with the broker, here is a quick review of the HDFC Securities Sub Broker business. This bank-based stockbroker offers its customers to trade in the following segments:

- Equity

- Currency Trading

- Mutual Funds

- IPO

- HDFC PMS

- HDFC Securities Call and Trade

- ETFs

- Bonds

- Fixed Deposits

- Insurance

Mr Dhiraj Relli, Managing Director & CEO, HDFC securities Limited

HDFC Securities Trading Platforms

The full-service stockbroker provides online trading applications at Web, desktop, and mobile platforms.

The good part about these trading platforms is that all of these softwares are developed and maintained in-house by the bank-based broker.

Here are the details:

HDFC Securities Trading

HDFC Securities provides web trading through its browser-based application “Trade.HDFCSec”.

This browser-based application can be accessed from anywhere through your desktop, laptop or mobile with an internet connection.

And since it is a responsive application, the user experience across devices says intact and optimal.

Some of the features this application has are:

- A highly customizable trading system where you can personalize your trading experience as per your preferences

- Advanced and interactive charts for your technical analysis

- Research reports, news and market tips within the application

- Personalized watch lists feature

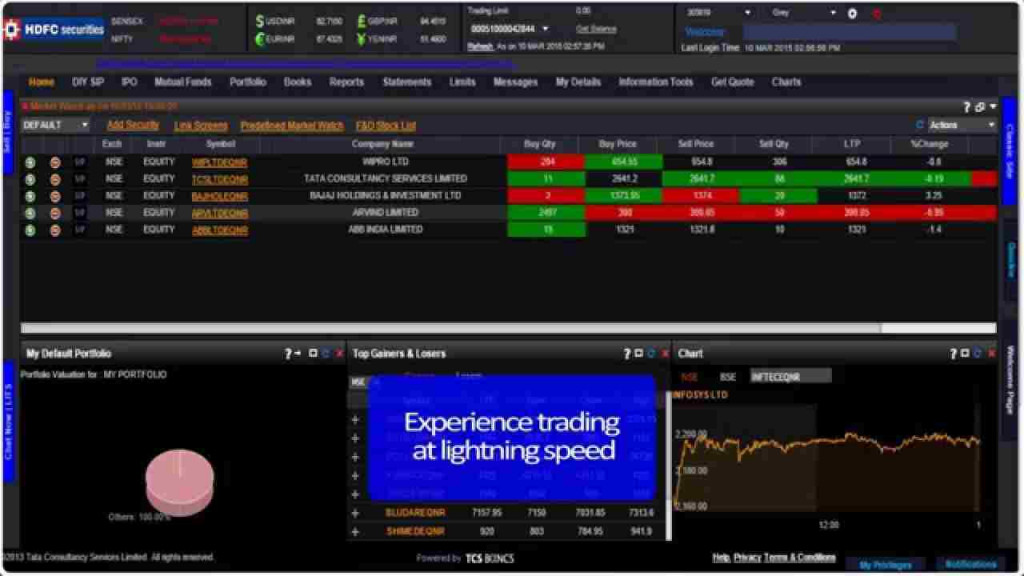

Here is how the application looks like:

The application can be accessed from here.

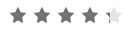

HDFC Securities Blink

Blink is a terminal-based trading application and is known for its high-speed trading edge as compared to the rest of the trading platforms.

Some of the other prominent features of the trading software are:

- Observe real-time price movement and make your move

- Transaction monitoring with the order book, trade book, and net position

- A single user interface for placing an order in Equity and Futures & Options

- Shortcuts for functions such as Buy, Sell, Order book etc

The only concerning area with BLINK is that it comes with a subscription price and is not for free.

The subscription price for 6 months is ₹2999 and ₹3999 for 1 year.

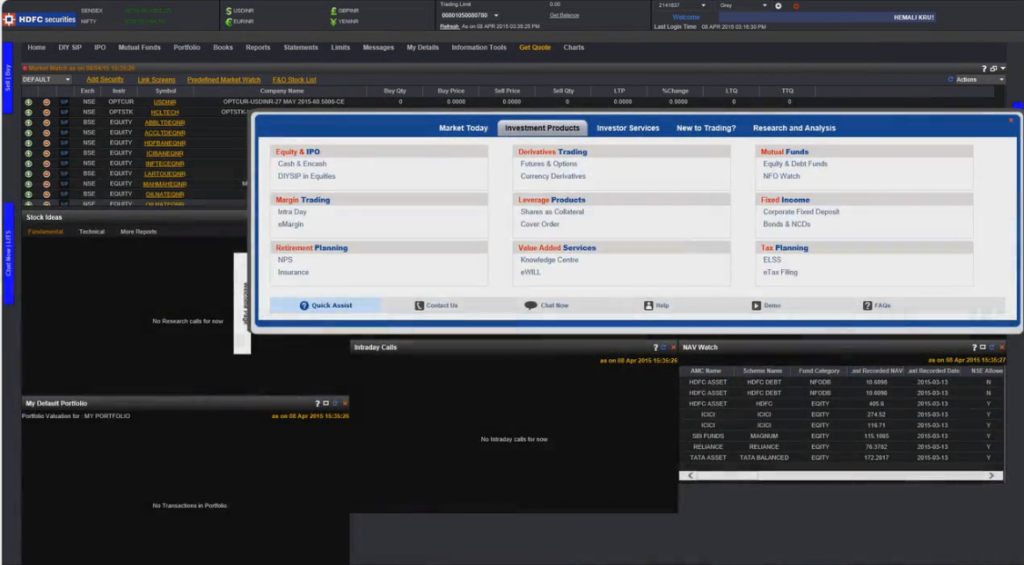

HDFC Securities App

The mobile trading app comes in English and 11 Indian regional languages. It is available across Android, iPhone, iPad and Blackberry platforms.

Some of the top features of the mobile app are:

- Intra-day real-time interactive charts for quick technical analysis

- Access to investing ideas, market tips, research reports – at both technical and fundamental levels

- Allows to trade in Equity and Derivatives with instant details of the stocks in a single click

Here are some of the screenshots of the mobile app:

Here are the Mobile App requirements:

Minimum Android Version: 2.3.3 and up

Android App Size: 6.52 MB

Minimum iOS Version: 5.1.1. and up

Few concerns with this mobile app are:

- Trading calls and tips do not get updated regularly and automatically.

- The data feed is delayed at times

- HDFC Securities Login issues faced by multiple clients.

Here are the details on the stats of this mobile app from the Google Play Store:

| Number of Installs | 500,000+ |

| Mobile App Size | 23 MB |

| Negative Ratings Percentage | 10% |

| Overall Review |  |

| Update Frequency | 4-6 weeks |

Make sure you check the reviews and ratings before moving ahead as most of the existing customers usually complain about HDFC Securities mobile app not working.

HDFC Securities Research

HDFC Securities is a full-service stockbroker and regularly provides tips and recommendations to its clients through research calls and reports on a regular basis. These communications are generally done through:

- SMS

- Trading Platforms

As far as the quality of research is concerned, the trading calls and tips at the intraday level are better than the Industry average in nature while the fundamental research is pretty thorough.

So, depending on your trading behaviour, you may choose to follow the research offered by the broker.

Nonetheless, the best way is to make sure you perform some analysis in one form or other on your own as well. By doing this, you will be able to back the research provided by the broker and put your money in much more comfort.

HDFC Securities Customer Care

The bank based stockbroker provides the following communication channels to its clients as shown:

- Offline Branches

- Phone

- Online assistance through web form/chat

One of the differentiating aspects of HDFC Securities customer care is its chat-bot tool called ‘Ask Arya’. This chatting tool is automated in nature and can assist you in areas such as:

- Investing with HDFC Securities

- Checking Portfolio

- Stock Market Quotes

- Research calls and tips

- Mutual fund redemption

Although the quality of resolution is better than average HDFC is known for delayed responses to its clients, be it any form of communication.

Thus, if you are looking to open a trading account with the bank, then you must consider this particular aspect while making this decision.

HDFC Securities Charges

When understanding the broker services, it becomes vital to evaluate or consider the charges imposed by the broker for offering different services like:

- Account opening fees

- AMC charges

- DP charges

- Brokerage charges

- Transaction charges

- Hidden Fees

Let’s have a quick glance at how much the broker charged to offer different services.

HDFC Securities Demat Account Charges

HDFC is one of the premium stockbrokers of the country, with high account opening, maintenance and brokerage charges.

Thus, you have to understand that although you might “think” that opening a trading account with a bank is “safe” for you but the fact of the matter is, it is definitely one of the most expensive ones.

Here are the details:

HDFC Securities Account Opening Charges

To open a 3-in-1 account, here are the opening charges that a client needs to bear:

| HDFC Securities Account Opening Charges | HDFC Securities Account Opening Charges | HDFC Securities Demat Account Opening Charges |

| Account Opening Charges | Default Plan | NIL |

| Classic Plan | ₹750 | |

| Preferred Plan | NIL | |

| Imperia Plan | NIL |

HDFC Securities Brokerage

The HDFC Securities brokerage charges vary from different aspects. At a general level, these are the HDFC Securities Brokerage plans:

| HDFC Securities Brokerage | |

| Segment | Brokerage |

| Equity Delivery | 0.5% or ₹25 whichever is higher |

| Equity Intraday | 0.05% or ₹25 whichever is higher |

| Equity Futures | 0.05% or ₹25 whichever is higher |

| Equity Options | 1% of the Premium or ₹100 per lot whichever is higher |

| Currency Futures | ₹23 per contract |

| Currency Options | ₹20 per contract |

| Commodity Futures | 0.025% or min Rs.20/- whichever is higher |

| Commodity Options | ₹100 per lot |

Use this HDFC Securities Brokerage Calculator for complete charges and your profit. In this calculator, you will also find HDFC Securities transaction charges but do not go into the pocket of the stockbroker.

HDFC DP Charges

The depository charges are originally levied by Depositories such as NSDL or CDSL to Depository participants such as HDFC Securities.

These charges are further transferred to the traders by the broker.

You need to pay a specific amount every time you sell a share in the market, which is then called a depository charge.

In the case of HDFC Securities, you need to pay ₹13.5 per scrip (GST separate).

Thus, while making your profit/loss calculations, make sure you consider this cost as well.

HDFC Securities Margin Calculator

If you are looking to use some exposure on top of your trading account balance, then this full-service stockbroker offers you the following margin values:

| Equity | Upto 20 Times for Intraday & 2 Times for Delivery |

| Equity Futures | NA for Intraday |

| Equity Options | NA for Intraday |

| Currency Futures | NA for Intraday |

| Currency Options | NA for Intraday |

| Commodities | NA |

HDFC Securities has recently introduced a leverage-based trading facility called “HDFC Securities e margin“, where broker’s clients are provided with a couple of benefits:

- The extra margin on their trades

- Hold those bought stocks for up to 180 days and clear your dues by T + 180 days where T is the trading day.

The way it works is pretty simple!

Once you login to any of the trading platforms of HDFC Securities, select Product as ‘E-Margin‘ post selecting the stock you are looking to buy.

This needs to be noted that you will be required to pay an interest of 0.05% per day till you clear your outstanding amount with the broker.

HDFC Securities Intraday Leverage

For Intraday trading, HDFC Securities provides a reasonable margin across 465 stocks listed in the major indices. The margin range, however, may vary from 5 times to 20 times.

This needs to be understood that the orders placed for intraday are to be squared off within the same trading session. If not done manually, the trade can be automatically squared off by the trading app.

Furthermore, users are advised to use the concept of exposure very cautiously and unless you understand its intricacies or implications, it is advised not to be used.

It can be risky and may even eat up your trading capital as well.

HDFC Securities Overseas Trading

If you are an Indian citizen living outside India, you can still open your trading account with this stockbroker.

There are specific formalities in terms of regulation, documentation and pricing that need to be taken care of. For instance, the account opening fee is kept at ₹2,500.

Even the brokerage is a tad higher than what the normal Indian resident trader pays (0.75% vs 0.50% for delivery trades).

In the documentation, apart from the regular identification and financial documents, you’d be required to provide your visa copy as well as the address proof of your overseas address.

HDFC Securities Disadvantages:

Some of the concerns of opening an account with this bank based full-service stockbroker are:

- The biggest concern is the charges it takes for using its terminal-based trading platform BLINK

- No trading is possible in the Commodities segment

- SMS based research and tips services are paid in nature

- Some hidden charges have been observed being levied against customer accounts.

HDFC Securities Advantages:

At the same time, here are some positives of opening an account with the broker:

- Enjoys the brand equity and trust built by its banking services provider HDFC bank

- Provision of a 3-in-1 account that allows easy fund transfers between your bank and trading account

- Helps you in trading education throughout your experience with HDFC securities

- Offers NRI account which is one of the rarest features among stockbrokers

- Comes up with the HDFC Securities refer and earn that provides you the unique opportunity to earn additional money in the form of rewards.

HDFC Securities Account Opening

If you are looking to open an account and start trading, then you can visit the closest HDFC Securities branch in order to get started with your account opening with this stockbroker.

In case, you want to open your HDFC demat account with one of the top stockbrokers in the country, then you can enter your details below to get a call back NOW.

Next Steps:

Post this call, you need to provide a few documents to start your HDFC Securities Sign Up process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months, cancelled cheque

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

With the broker, you can also avail of the benefits of opening an HDFC Free Demat Account. This facility is available only under certain schemes and plans.

For more information, you can check this detailed review of documents required for demat account and HDFC Securities AMC Charges.

HDFC Securities Membership Information

Here is the membership information of the broker with different exchanges and intermediate parties:

| Entity | Membership ID |

| BSE | INB011109437 |

| NSE | INB231109431 |

| NSDL | 11094 |

| CDSL | 393 |

| Registered Address | HDFC securities, I Think Techno Campus, Building B, Alpha, Office Floor 8, Near Kanjurmarg Station, Kanjurmarg (East), Mumbai - 400 042 |

The details can be verified from the corresponding websites of the exchanges.

HDFC Securities FAQs

Here are some of the most frequently asked questions about HDFC Securities along with their corresponding answers:

How is HDFC Securities better than discount brokers such as Upstox or Zerodha?

HDFC Securities, being a bank-based full-service stockbroker, provides its clients with a 3 in 1 demat account.

Using such an account, you don’t need to perform fund transfers manually. The transfer between your demat and trading account (& vice versa) happens automatically and takes away any potential hassles from you.

Furthermore, account opening with HDFC brings a “sense” of security of your funds and shares with the broker.

Having said that, prominent discount stock brokers of the country are reasonably trustable to an extent and are very much part of the regulations set up by SEBI.

As a beginner, shall I opt for HDFC Securities trading account?

It’s your choice at the end of the day. As a beginner, yes the bank based full-service stockbrokers bring a sense of trust but SEBI regulates each stockbroker in a very precise way.

For a beginner, its advisable to look for a broker that can potentially assist in stock trading education, tips/research, to go along with reasonable brokerage charges.

Thus, HDFC Securities is a good stockbroker but certainly one of the most expensive ones too.

Users are advised to use their own discretion in stockbroker selection.

You can also check out this Free Stockbroker selection service.

How can I close my HDFC Demat Account?

To close your trading account, you are required to follow a few basic steps.

The stockbroker cannot levy any charges to close your demat account. To know the complete process, you can check out this detailed step by step guide to closing the Demat account.

What are the account opening charges at HDFC Securities?

As mentioned above, HDFC is a premium bank-based full-service stockbroker brand and charges ₹999 for opening the trading account.

Furthermore, the broker charges another ₹750 for maintaining your Demat account with the broker as well.

If you are looking for some low-cost stock brokers, you can check out this detailed review on the Demat and trading charges for different stock brokers in India.

How the Intraday brokerage charges are calculated by HDFC Securities?

Although it depends on factors such as Initial deposit, overall turnover (and your negotiation skills), the general HDFC Securities intraday brokerage charges for intraday trading at HDFC are 0.1%.

In other words, if you trade for ₹1,00,000 at an intraday level, then you are supposed to pay 0.1% of ₹1,00,000 i.e. ₹100 as brokerage.

This is a pretty high number, especially with the advent of discount brokers that charge ₹9, ₹20 as brokerage charges.

I already have a Demat account with HDFC Securities, Can I have more than 1 Demat Accounts?

Yes, you can have any number of demat accounts as you want.

There is no legal limitation or cap on the number of demat accounts one can have.

However, you need to realize that most of the stockbrokers do levy annual maintenance charges (AMC) in the range of ₹300 to ₹1000 that you are supposed to pay every year.

Thus, although you may choose to have multiple demat accounts you will be required to pay multiple AMCs as well.

What is the minimum brokerage charge at HDFC Securities?

Irrespective of your trade value, you will be required to pay ₹30 as the minimum brokerage charge with this broker.

Can I open my Demat account with HDFC Securities and Trading account with some other broker?

Yes, you may choose to do that. However, you will be required to integrate your Demat account with the trading account so that whatever stocks you are buying from the market, get stored in the demat account as well.

How is the research quality of HDFC Securities?

Although HDFC is a renowned full-service stockbroker, when it comes to their research quality both at the fundamental and technical level, the overall quality is average.

You are advised to perform your own analysis as well to back the tips provided by the broker.

HDFC Securities Trading Account Closure Form

If you are looking to close your trading account with this stockbroker, first of all, you need to download this form.

Once downloaded, you need to carefully fill in the requisite details including your demat account number, your linked ID, corresponding signatures etc.

Post filling the form, you can submit the HDFC Demat account opening form to your nearest HDFC Securities or HDFC Bank branch. You may also choose to courier this form to the HDFC Securities headquarters (address mentioned below).

More on HDFC Securities

In case you are looking to know more about this full-service broker, here are a few reference links for you:

Also Read:

HDFC Securities Address

If you wish to visit the corporate office or the headquarters of this stockbroker, here is the address for your reference:

HDFC securities Limited,

iThink Techno Campus Building-B,

‘Alpha’, 8th Floor, Opp. Crompton Greaves,

Near Kanjurmarg Station,

Kanjurmarg(East), Mumbai 400 042

India

Furthermore, we discuss regional branches of this stockbroker up next.

HDFC Securities Branches

This bank based full-service stockbroker has a presence in the following locations in India:

| States/City | ||||

| Andhra Pradesh | Vizag | Kakinada | Warangal | Ongole |

| Rajahmundhry | Vijayawada | Tirupati | Nellore | |

| Guntur | Anantpur | Cyberabad | Hyderabad | |

| Karimnagar | Khamman | Kurnool | Secundrabad | |

| Assam | Guwahati | Jorhat | ||

| Bihar | Patna | Gaya | Muzzaffarnagar | |

| Chhatisgarh | Bhilai | Bilaspur | Raipur | |

| Goa | Mapusa | Madgaon | Panaji | |

| Delhi/NCR | Gurgaon | Noida | Faridabad | New Delhi |

| Gujarat | Ahmedabad | Jamnagar | Anand | Vadodara |

| Vapi | Gandhinagar | Navsari | Palanpur | |

| Rajkot | Nadiad | Surat | Surendernagar | |

| Porbandar | Bhuj | Bharuch | Bhavnagar | |

| Gandhidham | Himatnagar | Junaghad | Mehsana | |

| Veraval | ||||

| Haryana | Panchkula | Karnal | Faridabad | Rohtak |

| Panipat | Ambala | Hisar | Gurgaon | |

| Mandi Gobindgarh | Rewari | Yamunanagar | ||

| Himachal Pradesh | Shimla | Dharamshala | Mandi | |

| Jammu & Kashmir | Jammu | Kashmir | ||

| Jharkhand | Ranchi | Dhanbad | Jameshedpur | |

| Karnataka | Bangaluru | Belgaum | Hubli | Mangalore |

| Udupi | Dharwad | Mysore | Bellary | |

| Kerala | Kochi | Ernakulam | Angamali | Calicut |

| Chalakudi | Palakkad | Thalassery | Thrissur | |

| Tiruvela | Trivandrum | |||

| Madhya Pradesh | Bhopal | Jabalpur | Indore | Gwalior |

| Hoshangabad | Ratlam | Satna | ||

| Maharashtra | Nashik | Pune | Nagpur | Kolhapur |

| Aurangabad | Mumbai | Solapur | Thane | |

| Vasai | Kolhapur | Dhule | Kalyan | |

| Latur | Ahmednagar | Akola | Amravati | |

| Ichalakaranji | Jalgaon | Jalna | Karad | |

| Meghalaya | Shillong | |||

| Orissa | Bhubaneswar | Sambalpur | Cuttack | Rourkela |

| Angul | Balasore | |||

| Punjab | Amritsar | Chandigarh | Jalandhar | Ludhiana |

| Bathinda | Mohali | Hoshiarpur | Gobindgarh | |

| Patiala | ||||

| Rajasthan | Ajmer | Jaipur | Bhiwandi | Kota |

| Udaipur | Jodhpur | Sriganganagar | ||

| Sikkim | Gangtok | |||

| Tamil Nadu | Chennai | Coimbatore | Erode | Madurai |

| Trichy | Kanur | Vellore | GobichhetiPallayam | |

| Didigul | Hosur | Kanchipuram | Karaikkudi | |

| Kumbakonam | Namakkal | Ooty | Salem | |

| Tirunveli | Tiruppur | Tuticorin | Udumalpet | |

| Uttar Pradesh | Agra | Allahabad | Bareilly | Ghaziabad |

| Lucknow | Meerut | Varanasi | Unnao | |

| Aligarh | Barbanki | Kanpur | Moradabad | |

| Noida | ||||

| Uttarakhand | Dehradun | Haldwani | Haridwar | |

| West Bengal | Durgapur | Kolkata | Siliguri | Asansol |

| Barasat | Hooghly | Murshidabad |

very worst services, no customer support, heavy brokerage charges, all failure recommendations