How to Transfer Shares?

Check All Frequently Asked Questions

How to Transfer Shares from one Demat account to Another is one of the most intriguing questions one may have if he or she is looking to transfer his/her shares.

Many individuals prefer holding shares in the electronic form, as opposed to the paper form. Holding shares in an electronic form, through a dematerialization account, offers a high degree of flexibility and convenience.

It eliminates various risks associated with physical certificates, such as theft, fake certificates, and bad delivery, besides others. Another major benefit of holding shares in a dematerialization account is the ability to transfer the shares from one account to another quite easily.

Non-Resident Indians (NRIs) holding an NRI Demat Account too may transfer their shares to another account holder. Some online trading platforms provide the benefit of transferring shares from NRI DP accounts in a simplified manner.

These transfers may happen from one demat account to another in a couple of ways.

And honestly, the process is not that difficult, however, if your existing broker support team is relatively lazy, then yea, it could be a problem!

Let’s discuss how it can be done.

Transfer Shares from one Demat account to Another

Since you are looking to transfer shares from your current stockbroker (or DP) to another, it is most likely that either:

- You have had pretty nasty experiences with your stock broker, or

- You want to try your hand at a full-service stockbroker (research reports and tips are need of the hour), or

- Check out Discount brokers to save some decent brokerage you have been paying

- Multiple Demat accounts don’t really hurt, right?

99% of cases are most likely to fall in one of the reasons above. If your reason does not fall in the above ones, please let us know in the comments below.

Coming back to the topic, how can you transfer shares from one Demat account to another. Well, there are two ways to do it – Manually and Online. that allows you to Demat Account Transfer Shares.

Let’s discuss both one by one:

Transfer Shares Manually

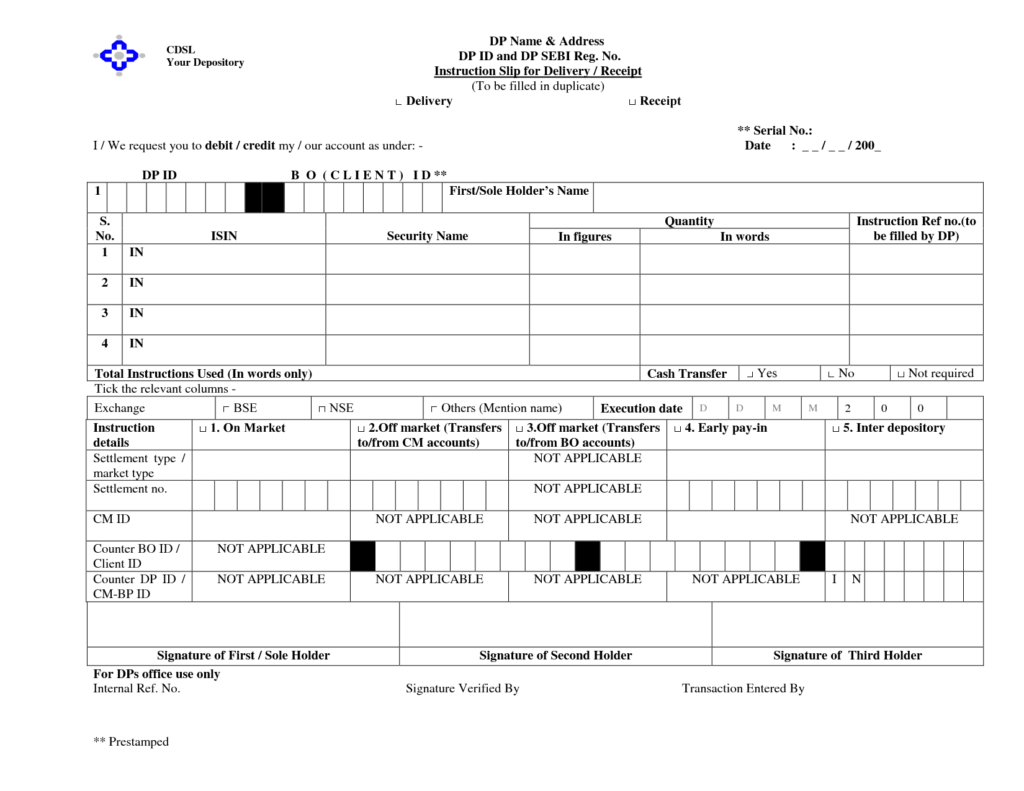

When you open a demat account with a stockbroker, you are provided with a Delivery Instruction Slip or DIS as part of the welcome kit. Here is how it looks:

Some of the important fields you need to take care of are:

- Target Client Id – This is a 16 digit identification number allocated to you.

- ISIN – ISIN abbreviates for International Securities Identification Number and is a 12 digit code that assists in identifying securities such as stocks, equities, notes, bonds, debt, funds, and more. Here you have to mention to individual shares with quantities and other details.

- DP Name – Name of the stockbroker

- Inter Depository – this will be required to be filled in, in case you are transferring shares to some other depository

- Off Market – this will be required to be filled in, in case you are transferring shares within the depository

Once you are done with filling the DIS slip, these are the next steps forward:

- Submit this signed DIS slip to the current broker

- Take the due acknowledgment slip of the filled DIS slip

- Your broker will take 1-2 business days to transfer these shares to your Demat account with the target stockbroker.

Things to consider

- Some charges may be applied by your current stock broker for this procedure. Actual charges vary from one broker to another.

- If you are closing the demat account with the current broker, this process is free of cost and by law, the stockbroker cannot charge you anything for this transfer.

- If you are closing the demat account, you are supposed to return the unused DIS slips back to the broker

Transfer Shares Online

This can be done using the EASIEST by CDSL. It makes the transfer to shares as simple as transferring money from one bank account to another.

All you have to do is register on this web tool by visiting the CDSL website and registering yourself and then submitting the form to the DP. Once verified by DP, you can do all the future transfers on your own.

Here are steps explained briefly:

- Register on the CDSL website by clicking on the ‘Register Online’ link

- Select the facility as ‘Easiest’

- Provide your details

- Take the print of the form and submit to your DP

- Once verified, you will get a password to your email

- Once logged in, you can start transferring shares on your own

All you have to make sure that the stockbrokers you are transferring your shares from and to, offer a CDSL Demat Account.

You can choose whichever way to transfer the funds that suit you well. The only advantage of doing it online is that it takes away any dependency on the broker or any manual effort in the future.

Let us know whether this article was helpful to you in the comments below.

Check out more such questions related to the Stock market here.

Still not sure on how to transfer your shares? Why don’t you send your details and we will arrange a Free call back for further help!

“take the printout of the form and submit to DP”

I am not sure where to submit here?? what is DP??

I want to transfer my shares from ICICIDIRECT to ZERODHA.

Also let me know , if you are aware of the charges ICICI will apply if i want to transfer the portoflio of 8 lakh rupees.??

These form needs to be submitted back to your current stock broker. Charges differ from broker to broker.

Thanks for the reply.

One more question. I am trying to do it by online option .However i cannot find this option called as “Select the facility as eaisiest”

i am not able to find that option on CDSLINDIA website?

Can you tell me where exactly that option is ??

Just google CDSL and Easiest in a search, you will find the portal link. All the best.

Hi pl same way I also need pl advise

I want to transfer my Demat account from ICICI to 5paisa, main reason for same is –

a. ICICI really sucks blood from individual investors in name of brokerage and AMC charges. So that customer runs away they slap AMC charges in advance and they are in tune of 550-800 Rs. (inclusive taxes).

b. There tips and advisory sucks. They will assing you an RM in 3-in-1 link account but that RM will not know anything. Moment any of your share foes even 1 Rs. high he will start calling you and asking you to sell. IF THERE IS SOME NEWS you read in newspaper about an IPO your RM will call you to buy it, with no sound logic of why. IF YOU ASK them about any company, they will tell you 2-3 year trend of how the share price has moved (WHICH i can also know by simple GOOGLING THE COMPANY NAME suffixed with share price).

c. THEY WILL HAVE SHADY PRACTISES LIKE asking you to submit 1 lac check for a day and give you measly free brokerage.

ANYWAYS,

WHAT I WANT TO KNOW IS… If i close the demat account with a DP, and i have no other DP where to transfer my shares, what happens of my shares?

You will have to maintain a demat account to keep your shares in a non-physical format. Like you mentioned, you are going to open an account with 5Paisa, you can get your shares transferred to that account. Otherwise, you still have the option to go back to the primitive way of materialized physical format based stocks (not recommended), else you can exit your holdings.

How can I transfer Shares from Sharekhan to Zerodha Online?

I can’t find the online form to submit.

Appreciate your help.

Thanks

also is transfering share form ICICIDIRECT to ZERODHA is inter depository or off market??

Current Broker Sharekhan doesnt support Online Transfer method. They say submitting DIS Slip is the only way to go about it.

what happens when my shares in NSDL not in CDSL? Does NSDL provide the same online share transfer facility?

Thanks

Yes, its possible now. However, the security to be transferred must be listed on both the exchanges. Look out for NSDL eServices for this transfer.

Hi,

I am an NRI and holding DEMAT Account with SBICAPSEC, and PIS account with SBI. I am not happy with the service and I would like to switch DEMAT Account to IIFL and PIS Account to Yes Bank.

I am already registered in CDSL myeasy portal.

Can you please advice me the detailed procedure for this switching?

I want to transfer shares from IIFL(NSDL) to ZERODHA(CDSL)? Is it possible to transfer shares ? If possible , thru online, I tried adding IIFL Account details in easiest (CDSL) but unable to do so. Because IIFL(NDSL) DP Id will be in format INXXXXXX (IN302296 to be precise) but CDSL accepts 16 digit numbers.Can you please guide me on the above scenario.Thanks in Advance.

Inter-depository transfer through easiest or SPEED-e is possible only in a/c of choice transfer using digital certificate.

Hi pl same way I also need pl advise

Keep this going please, great job!