Inditrade

List of Stock Brokers Reviews:

Inditrade is a Kochi (earlier Cochin) based full-service stockbroker and was established in the year 1994 (in the name of JRG Securities). The broker has gone through various transformations, especially in equity and commodity segments.

If you are confused about in which segment to choose among equity and commodity. You can review the article Equity vs Commodity in detail.

It has recently been acquired by Choice Broking, another prominent full-service stockbroker.

This was an all-cash deal and the complete bought-out was done at ₹32 Crore. With this, the broking, demat services, franchise network, clients/employees and related assets of Inditrade got transferred to Choice Broking.

Post the buy-out, Inditrade has pivoted its business model towards Housing finance.

Inditrade Review

As of now, the brokerage house has a relatively stronger hold in southern parts of the country and has 25 branches and 440 franchise offices/business associates in these areas.

If you choose to become the client of this broker, you will get access to regular research reports, recommendations and tips on a daily basis from the broker.

The details of the research are discussed in the ‘Research’ section in this review later. At times, traders find it hard to transfer funds between trading and bank accounts.

To ease that particular concern, the broker has availed fund transfer facility through 28 prominent banks of the country.

The broker is a member of NSE, BSE, MCX, MCX-SX and NCDEX, IPSTA and allows its clients to invest and trade across the following segments:

- Equity

- Commodity Trading

- Currency Trading

- Derivative Trading

- Depository services

- IPO

- Mutual funds

The broker currently has an active client base of 13,982 for the year 2019-20.

Mr.Brij Gopal Daga – Independent Director, Inditrade Capital

Inditrade Trading Platforms

Inditrade Capital provides different trading platforms at both out-sourced and in-house levels to its clients. Thus, you have the flexibility to pick a trading software as per your preference. Here are the details:

ODIN Trader Workstation

ODIN Trade workstation is a third party terminal-based application that requires you to download an EXE file from the website of the broker. Then, by following a few steps, you can install this software onto your computer or desktop.

It incorporates appealing features and works on advanced technology which facilitates higher accessibility, ensuring speedy performance and advanced risk management.

Here are some of the features of the application:

- Integrated Market Watch for Multiple Exchange and Exchange Segments

- Basket Trading

- Arbitrage Watch

- Spread Strategy Maker

- Expression Builder for Customized Formula Creation

- Heat Map, Charts and Graphs

- Panic Withdrawal for Bulk Square Off/Withdrawal of Trade/Orders with optimal risk management

This is how the application looks like:

At the same time, there are a couple of concerns with the application as well, including:

- The application is a little bulky in nature and requires a minimum configuration for smooth trading

- The limited update frequency with the last update happening in November 2016. This gives users a small chance to use newer features on a regular basis.

iTrade Web application

This is a web-based trading application from the house of IndiTrade and provides some basic features to trade, here are the details:

- Real-time streaming of different indices

- You can trade and invest in different segments such as Equity, currency, commodity etc.

- Lightweight application with minimal configuration required

- Features such as the market watch, charting available for easy and quick monitoring

- In-app chatting functionality where you chat on a real-time basis with the technical execution of Inditrade before placing your trade.

This is how the login screen of the web-based application from Inditrade looks like:

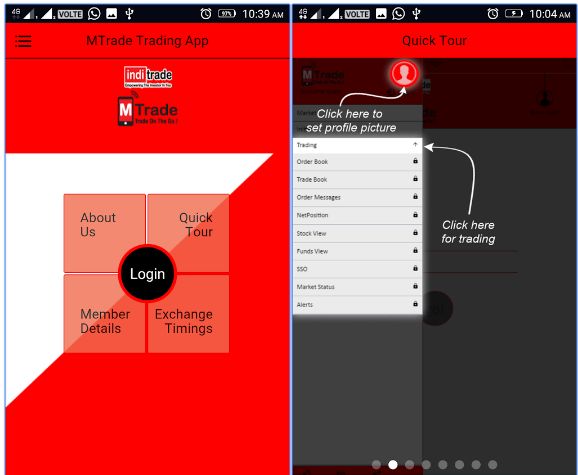

MTrade Mobile App

Inditrade Capital provides a couple of in-house designed and developed trading apps to its clients. Here are the details:

MTrade – Trade On The GO

This mobile app from the full-service stockbroker is available across different operating systems including iOS, Android, and Blackberry for compatibility across different devices. As far as the features are concerned, this application allows you to:

- Place, edit, cancel orders

- View complete details about the particular scrip along with charts for detailed analysis

- Add specific stocks to market watch lists for easy monitoring

This is how the mobile app looks like:

At the same time, some big concerns with the application include:

- Bland and primitive user interface and design

- Low update frequency cycle (the last one was done in December 2015)

- Limited number of features, thus, not suitable for medium to heavy level traders

- Multiple server related errors reported

Here are the stats of the mobile app from Google Play Store:

| Number of Installs | 5,000 - 10,000 |

| Mobile App Size | 8 MB |

| Negative Ratings Percentage | 9% |

| Overall Review |  |

| Update Frequency | almost 2 years |

MTrade – Trade On The GO Pro

This mobile app is an updated version of the mobile app – Mtrade – trade on the Go. Apart from better design and navigation flow, this mobile app provides the following features:

- Better look and feel

- A wide range of features

- Allows you to trade and invest in multiple trading segments (Equity, commodity, currency etc)

- Better charting functionality for technical and fundamental analysis

Interested in Commodity trading? Opt for commodity trading courses in India.

This is how this updated application looks like:

However, there are still a few areas where the mobile app can be potentially improved:

- Charting can be made much smoother

- Usability is still a concern, especially for beginners

Here are the stats of the mobile app from Google Play Store:

| Number of Installs | 1,000 - 5,000 |

| Mobile App Size | 11 MB |

| Negative Ratings Percentage | 8% |

| Overall Review |  |

| Update Frequency | 4-5 weeks |

Inditrade Customer Care

The full-service stockbroker provides the following communication channels to its clients:

- Toll-free number

- Phone

- Offline branches

- Webform

As a full-service stockbroker, Inditrade does a reasonable job when it comes to the quantity part as the number of communication channels is pretty wide. However, when it comes to quality, things like first callback post details insertion, the response at social media and Google play store or skill sets of the executives, the broker has a lot to improve upon.

The thing is, different kinds of users are at a different level of expertise in terms of trading and investing knowledge. However, there is no flexibility shown by the executives and the communication pattern stays pretty rigid. This takes away any room of satisfaction for multiple users.

In simple words, customer service of Inditrade is around average and can be improved a lot.

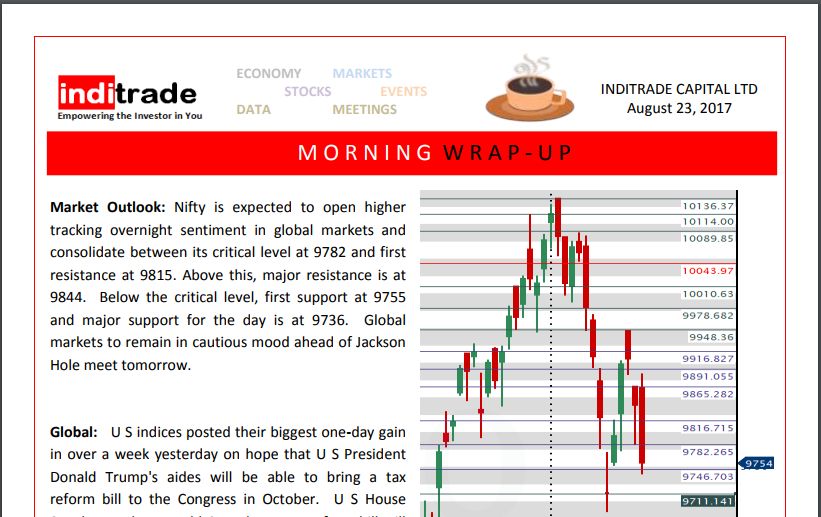

Inditrade Research

If you are looking for research, recommendations, and tips, then Inditrade certainly fulfils that requirement for you. At the same time, the broker has done clean segregation of different types of reports across segments to avoid any confusions to the users.

These are the different reports that the broker provides to you:

- Equity

- Daily morning notes – Morning wrap-up

- Derivatives trade

- Derivatives

- Derivatives trade report

- Commodity

- Chart picks

- Evening newsletter

- Gold – short-term outlook

- Weekly reports

- Currency

- Forex daily reports

- Currency Market news – domestic and global

- IPO

- IPO analysis

Here are a couple of sample report templates that are directly accessible to users:

The research reports look good when it comes to the totality and exhaustiveness. Users are advised to go through these reports completely, perform some analysis on top of it and then place their trades. The accuracy is certainly better than average but it’s always sensible to be cautious at your end.

Inditrade Charges

Now, let’s talk about the meat of the discussion – Pricing.

Before you finalize a broker for yourself, it needs to be understood that whether the service provided by the broker is value for money or not. And when it comes to money, there are ample types of charges that you are required to pay. The details have been discussed below.

Inditrade Account Opening Charges

Here are the different account opening and maintenance charges the broker asks its clients to pay upfront:

| Trading Account Opening Charges (One Time) | ₹400 |

| Trading Annual maintenance charges (AMC) | ₹0 |

| Demat Account Opening Charges (One Time) | ₹0 |

| Demat Account Annual Maintenance Charges (AMC) | ₹500 |

| Commodity Account Opening Charges | ₹300 |

Looking at the charges above, the broker certainly looks on the expensive side to start with. Thus, users looking to start trading for the first time might find it a turnoff since the entry cost set by Inditrades is pretty high.

Inditrade Brokerage Charges

Like other full-service stockbrokers, Inditrade charges you a percentage based fees as brokerage rate. The monetary value of the total brokerage depends on your investment or trade value and correspondingly the percentage rate is multiplied by the value.

At the same time, Inditrade has multiple plans at both Equity and commodity levels and mostly these plans vary in terms of the subscription price you pay at the start.

Here are the details:

Equity Freedom

| Segment / Plans | Plan A | Plan B | Plan C |

| Equity Delivery | 0.3% | 0.25% | 0.2% |

| Equity Intraday | 0.03% | 0.025% | 0.02% |

| Equity Futures | 0.03% | 0.025% | 0.02% |

| Equity Options | ₹60 per lot | ₹50 per lot | ₹40 per lot |

| Currency Futures | 0.03% | 0.025% | 0.02% |

| Currency Options | ₹60 per lot | ₹50 per lot | ₹40 per lot |

| 1 month Subscription (₹) | ₹1000 | ₹2000 | ₹3000 |

| 3 month Subscription (₹) | ₹2500 | ₹5000 | ₹6000 |

| 12 month Subscription (₹) | NA | ₹18000 | ₹22500 |

Equity Executive Pack

| Segment / Plans | Plan D | Plan E | Plan F | Plan G |

| Equity Delivery | 0.2% | 0.18% | 0.15% | 0.15% |

| Equity Intraday | 0.02% | 0.018% | 0.015% | 0.01% |

| Equity Futures | 0.02% | 0.018% | 0.015% | 0.01% |

| Equity Options | ₹30 per lot | ₹30 per lot | ₹25 per lot | ₹20 per lot |

| Currency Futures | 0.018% | 0.015% | 0.01% | 0.01% |

| Currency Options | ₹30 per lot | ₹30 per lot | ₹25 per lot | ₹20 per lot |

| 1 Month Subscription (₹) | ₹5000 | ₹10000 | ₹15000 | ₹20000 |

| 3 Month Subscription (₹) | ₹10000 | ₹25000 | ₹40000 | ₹55000 |

| 12 Month Subscription (₹) | ₹25000 | ₹50000 | ₹75000 | ₹100000 |

The point here is simple, depending on the subscription amount you are open to paying, corresponding plan and duration are pointed to your account.

Use this Inditrade Brokerage Calculator for complete calculation of charges and your profit.

At the same time, Inditrade provides similar brokerage plans at Commodity levels.

Here are the details:

Commodity Freedom

| Segment / Plans | Plan A | Plan B |

| Intraday | 0.025% | 0.02% |

| Carry Forward | 0.025% | 0.02% |

| 1 Month Subscription (₹) | ₹2500 | ₹5000 |

| 3 Month Subscription (₹) | ₹5000 | ₹10000 |

| 12 Month Subscription (₹) | NA | ₹20000 |

Commodity Executive Pack

| Segment / Plans | Plan C | Plan D | Plan E | Plan F |

| Intraday | 0.018% | 0.015% | 0.01% | 0.0075% |

| Carry Forward | 0.018% | 0.015% | 0.01% | 0.0075% |

| 1 Month Subscription (₹) | ₹10000 | ₹15000 | ₹20000 | ₹40000 |

| 3 Month Subscription (₹) | ₹25000 | ₹40000 | ₹55000 | ₹100000 |

| 12 Month Subscription (₹) | ₹50000 | ₹75000 | ₹100000 | ₹200000 |

Apart from the above-mentioned charges, you are required to pay the following payments as well:

| Handling / processing charges- Physical Contract Note | ₹12.5 + service Charge |

| Handling / processing charges- Physical Contract Note (Bounced) | ₹25 + service Charge |

| All quarterly & Monthly Statements | ₹12.5 + service Charge |

| Handling / processing charges- Physical Statement (Bounced) | ₹25 + service Charge |

Inditrade Transaction Charges

Here are the transaction charges levied on your trades by the broker:

| Equity (Cash & Delivery) | 0.00325% |

| Equity Futures | 0.0020% |

| Equity Options | 0.053%(on Premium) |

| Currency Futures | 0.00125% |

| Currency Options | 0.0435%(on Premium) |

| Commodities: MCX | 0.0030% |

| DP Transaction charge | ₹15 /Debit Transaction |

| Dial & Trade | ₹20 per executed order |

Inditrade Advantages

Here are some of the positives of using the stockbroker:

- Multiple brokerage plans

- Reasonable quality of research provided

- Overall brokerage values look reasonable

- Wide range of trading and investment products

- Old name in the stockbroking space

Inditrade Disadvantages

At the same time, you might have to go through these concerns if you use their services for your trading:

- Below average customer support

- No cutthroat trading platform yet. Most of the ones provided provide an average performance

- High account opening/maintenance charges overall

- Low brand awareness factor

Are you looking to have a word with an executive?

Just provide your details in the form below and we will set up a callback for You:

Post this call, there are 2 ways to get started.

- If you have an Aadhar card, then the account opening process can be completed in a few minutes.

- Otherwise, you need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review on documents required for demat account.

Inditrade Membership Information

Here are the details on the membership of Inditrade with different stock market entities:

| Entity | Membership ID |

| BSE | INB000093831 |

| NSE | INZ000093831 |

| NSDL | IN-DP-285-2016 |

| NMCE | CL0101 |

| IPSTA | 351 |

| MCX | INZ000078230 |

| NCDEX | 00224 |

| Registered Address | XXXVI – 202, J J Complex, Dairy Methanam Road, Edappally, Kochi – 682 024 |

More on Inditrade:

If you wish to learn more about this full-service stockbroker, here are a few reference links for you: