Interactive Brokers

List of Stock Brokers Reviews:

Interactive Brokers is a US-based stock broking company that has a presence in 100+ countries including India. The brokerage house was established back in the year 1977 by Thomas Peterffy and has recently completed its 40 years while the firm has an Equity capital in excess of $6 billion.

Interactive Brokers Review

Interactive Brokers was introduced in India as recent as 2009 and has memberships from NSE (National Stock Exchange) and BSE (Bombay Stock Exchange) with registered office in Mumbai.

In total, the broker employs around 1100 employees across the globe and works at multiple levels in different geographies. For now, the clients of Interactive brokers can trade only in the following segments:

- Equity

- Currency

- Derivatives

Thomas Peterffy, Chairman – Interactive Brokers

Interactive Brokers Trading Platforms

Interactive brokers sets pretty high standards when it comes to trading platforms. Overall performance/speed, user experience, usability and analysis exhaustiveness produce sheer optimal trading experience. Although, beginner traders might take some time in understanding how features flow but the broker seems to understand that aspect as well.

That is precisely why it has opened up the demonstration for all its trading platforms so that interested users may choose to get an understand (and feel) of the trading platform before committing themselves to the broker. Let’s talk about these trading softwares one by one now:

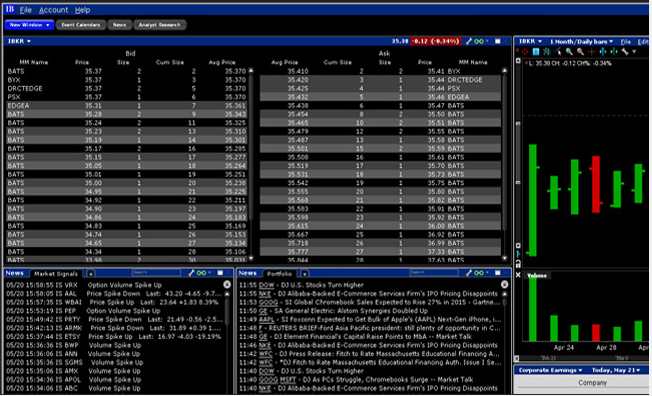

IB Trader Workstation

This is a terminal based solution where you are required to download and install an EXE file onto your computer, laptop and desktop. Once done, you will need to log in with your valid credentials – username and password. The application is suitable for intermediate to heavy level traders and offers reasonable speed and performance.

Some of the main features of this terminal based trading software are:

- Multiple types of charts available along with technical indicators and on-chart annotations for smoother technical analysis.

- Various watchlists allow you to monitor specific category of stocks separately making sure you don’t get overwhelmed or confused by data.

- Detailed reports and research provided within the trading applications along with a business summary, quarterly, yearly reports to perform an in-length fundamental analysis.

This is how the IB Trader Workstation looks like:

Interactive Brokers TWS

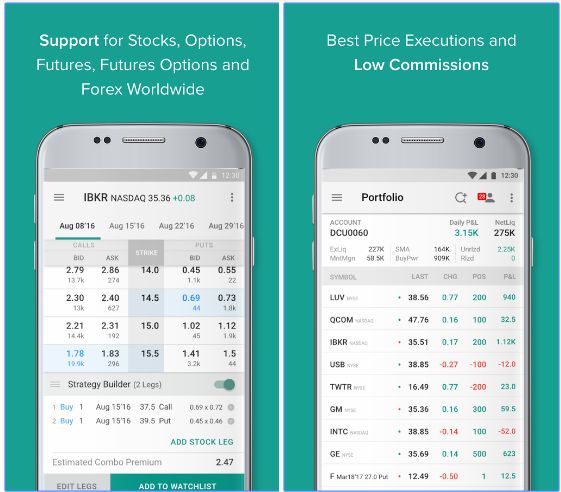

Interactive Brokers provides IB TWS mobile app for trading to its clients across different geographies. With this app, you can trade and invest in different segments such as Equity, currency, derivatives etc with reasonable speed and performance.

Some of the top features of this mobile app include:

- Employs ‘SmartRouting’ technology to get the best price available at the time of order placement

- Access to real-time data streaming for market monitoring

- Market scanners and alerts with email notifications

- Quick access to trade reports, portfolio and account information

- The app is available for both Android and iOS platform users

At the same time, there are few concerns as well that you need to consider:

- Order management can be a concern, especially for beginner level traders

- There are few concerns introduced with most of the updates performed; thus, regular traders must be wary of that fact

This is how the application looks like:

Here are some stats about the mobile app from Google Play Store:

More on Interactive Brokers:

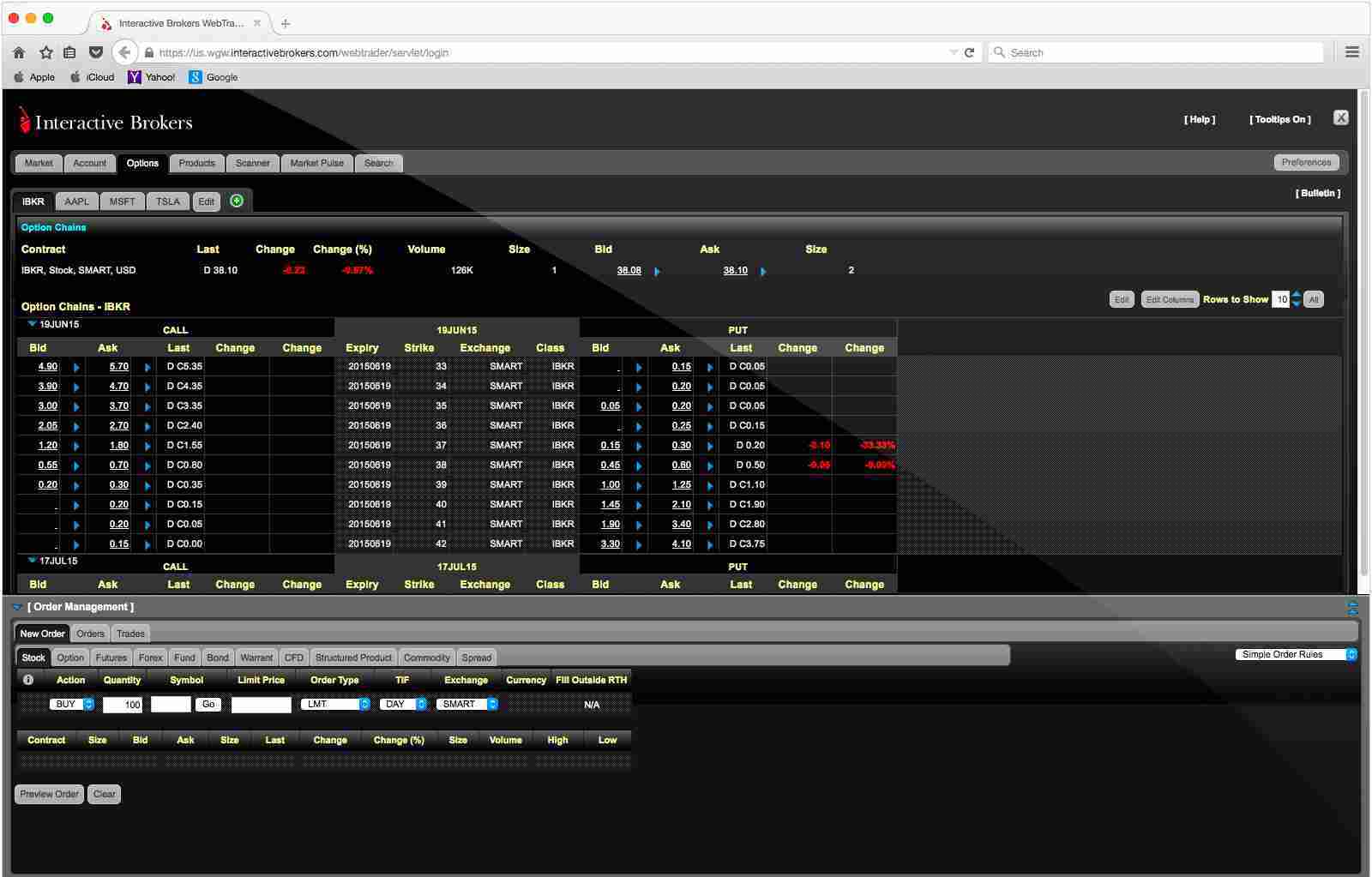

IB WebTrader

For users who prefer trading through a web browser with no dependency to carry an EXE file across different computers or limitation of the small screen of a mobile app, Interactive Brokers do have an option for them. With IB WebTrader, you are not required to download or install any application. You can just open up any prominent browser, run a web link and can start trading by entering valid username and password.

Some of the primary features offered by this trading platform from Interactive Brokers include:

- Sleek and modular design to keep the overall trading experience clean and smooth

- This web application is ideal for traders who work behind a corporate firewall since IB WebTrader runs through the Internet, so you can log in and trade from any Internet-ready computer, laptop, mobile or tablet.

- You can place spread orders based on the strategies already defined by you in the system or you may use the ones predefined in the platform.

- Interactive Flash-based charts available so that you can view market value and volume of specific stocks of your interest

- The overall interface is completely customizable so that you can have it your way when it comes to trading and setting up market strategies.

This is how Interactive Brokers Webtrader looks like:

Interactive Brokers Research

Interactive Brokers, although does not provide detailed research reports and recommendations, it still has some research products to offer to its clients that can help directly or indirectly.

Some of those include:

- Real-time News streaming

- Charts and alerts

- Market Quotes

- Fundamental business summary, financial statements, Analyst ratings, forecasts etc

At the end of the day, you will have to perform technical or fundamental analysis on your own if you choose to become a client of Interactive Brokers.

Also Read – Stock Market Advisory Companies in India

Interactive Brokers Service

Customer support or service is one of the most crucial aspects of stock trading. While most of the users overlook its importance initially, but sooner or later it comes on top with its urgency.

Interactive Brokers provides the following communication channels to its clients to reach back to them:

- Phone

- Chat

- Fax

- Webform

This aspect is one big challenge that Interactive brokers is passing through. Customer support has concerns in terms of localization. This needs to be understood that India is a very diverse country with different people having different backgrounds, language preferences and communication styles. Mostly, the local originated stock brokers get it implicitly while companies such as Interactive brokers need time and training to get accustomed to that fact.

Thus, keep your expectations low when it comes to customer support from Interactive Brokers.

Also Read – Top 5 Stock Brokers with Excellent Customer Support

Interactive Brokers Pricing

Pricing is important. In fact, a lot of users give this the utmost importance. But obviously, the cheapest or the most expensive service provider does not need to be the best in the business. All you need to analyze is whether the broker you are opening your demat/trading account with is “value-for-money” or not. Because if the broker is not, well there is no point going ahead with it.

Nonetheless, let’s talk about pricing set by Interactive brokers at different levels:

Interactive Brokers Account Opening Charges

To open an account with Interactive Brokers, you need to maintain a minimum balance of ₹1 Lakh (₹1,00,000) in your trading account as long as you are a client of this brokerage house.

There are no account opening charges.

However, there is a small catch.

You need to generate brokerage of minimum ₹200 per month. If you are able to do that, no additional charges will be levied in terms of maintenance. However, if you are not able to generate ₹200 worth brokerage for Interactive brokers, then the difference will be levied upon you.

For instance, if you are able to generate a total brokerage of ₹40 for the whole month, additional ₹(200 – 40) = ₹160 will be charged to your account.

Thus, in a sense, Interactive Brokers is not suitable for beginners or small investors and is generally suitable for existing traders.

Interactive Brokers Brokerage

When it comes to brokerage, Interactive Brokers charges a flat rate of up to ₹20 across the segments along with a minimum brokerage as well. Here are the details:

Use this Interactive Brokers Brokerage Calculator for complete charges and your profit.

Interactive Brokers Transaction Charges

Apart from account opening, maintenance and other related charges, you are required to pay some transaction charges and government-related taxes.

Here are the details:

Interactive Brokers Exposure

If you are using the concept of exposure or leverage from Interactive brokers on top of your trading account balance, you will be charged an interest rate of 12.7% on the loan amount.

For people who do not understand exposure, basically, its a short-term loan offered by your broker when you are looking to make higher gains (obviously by running relatively higher risk). In this case, you get the following exposure multipliers across different segments:

Interactive Brokers Disadvantages

Some of the concerns that are pretty obvious include:

- Limited range of trading products

- Limited research and recommendations capability

- Minimum balance of ₹1 Lakh is required and min. monthly brokerage of ₹200 is levied.

- Customer service can be improved

Interactive Brokers Advantages

At the same time, some of the merits of Interactive brokers include:

- Well designed and high-performance trading platforms

- Low brokerage rates

- One of the oldest international stockbroking houses

Interactive Brokers Membership Information

Here are the membership details of Interactive brokers with different exchanges of India:

If you are looking to open a demat and trading account, you can provide your details in the form below:

fightingscams at aol dot com recently recovered my funds to Interactive brokers. I am glad i contacted them on time.