Jhaveri Securities

List of Stock Brokers Reviews:

Jhaveri Securities is a full-service stockbroker based out of Vadodara, Gujarat and was incorporated in the year 1992. The broker has multiple business associates (around 350 in total) that assist in providing offline assistance to the clients of the broker at local and regional levels.

In total, there are around 34,810 active clients (by 2019-20) to whom the broker provides services to.

Let’s learn more about this broker in this detailed review.

Jhaveri Securities Review

The broker has a total of around 300 professionals to handle its operations and has seen reasonable growth especially in the western regions of India.

The full-service stockbroker has memberships with NSE, BSE, MCX, NCDEX and NSDL allows its clients to trade and invest in the following segments:

- Equity

- Commodity

- Currency

- IPOs

- Mutual funds

- NRI Demat Account

- Depository services

- Equity SIP

- Institutional investment services

- Derivative Trading

As shown in the list above, the broker offers a wide range of trading and investment products for its clients, thereby giving you a single umbrella to latch upon for all your financial requirements.

Kamlesh Jitendra Jhaveri, Managing Director – Jhaveri Securities

Jhaveri Securities Trading Platforms

When it comes to trading platforms, the broker offers various in-house developed and maintained trading applications for its clients. There are a very few stockbrokers in India that provide you with their own trading applications while most of them rely on third-party applications such as ODIN Diet, NEST or NOW online.

Let’s talk about all these applications one by one:

Jhaveri Securities Mobile App – JeTrade

The full-service stockbroker provides a mobile app to its clients who prefer trading on the move. the application comes with the following features:

- Market watch streaming across multiple exchanges

- Provisions to trade across multiple indices

- Research and reports available on a real-time basis

- Basic charting functionality for analysis at both fundamental and technical levels

- Place, edit or cancel orders

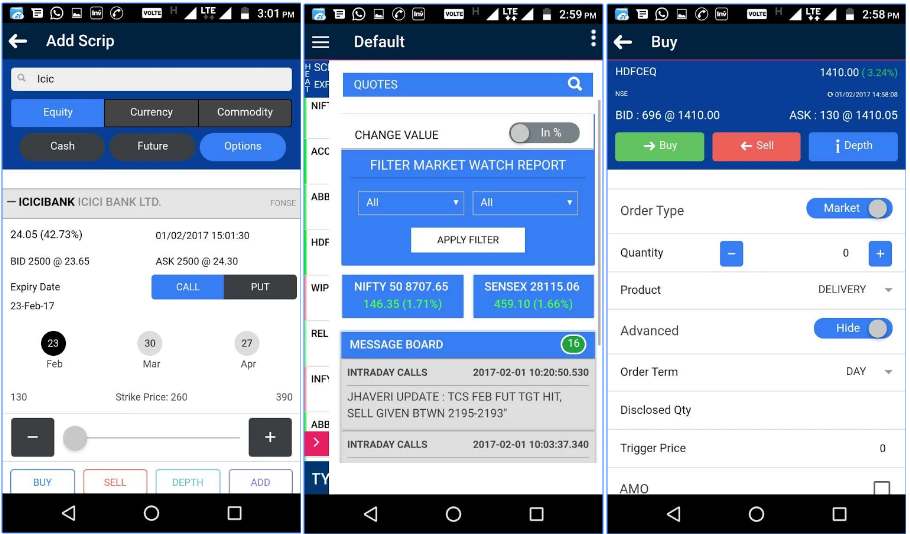

This is how the app looks like in its design:

Here are some of the concerns with the mobile app:

- Low update frequency cycle (once in few months)

- The app lacks decent design and is very primitive in its look and feel

- Performance and speed-related concerns

Here are the stats of the mobile app from Google Play Store:

| Number of Installs | 5,000 - 10,000 |

| Mobile App Size | 4 MB |

| Negative Ratings Percentage | 27.7% |

| Overall Review |  |

| Update Frequency | 4-5 months |

JetTrade

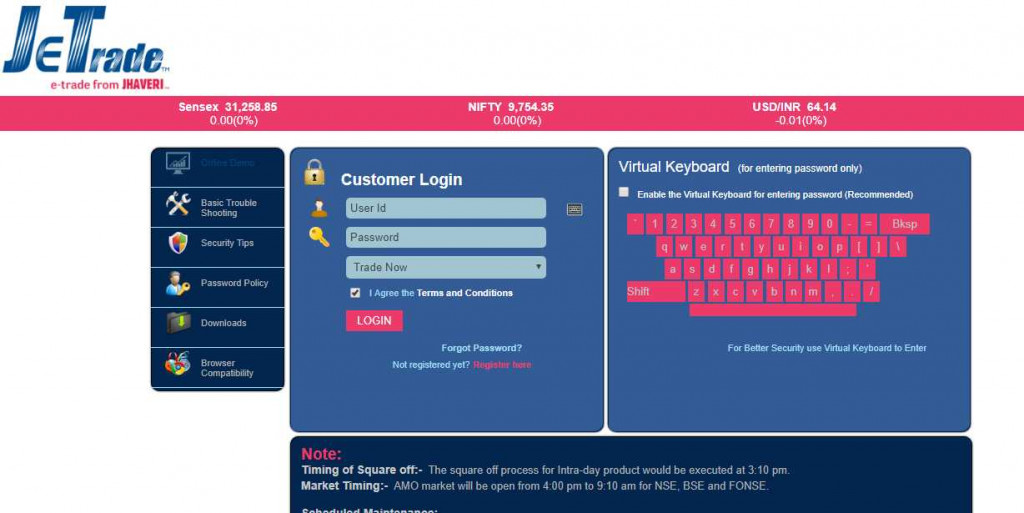

This is the web-based browser application provided to the clients of Jhaveri Securities. Users can directly browse this application through any device, be it a computer, desktop, laptop, mobile or tablet. There is no need to download or install anything to use this platform, and at the same time, it is responsive in nature. In other words, you can access this application through any device or browser.

Here are some of the features of the application for your reference:

- Funds transfers and withdrawal features available

- Backoffice access to multiple features such as trade log, DP holding reports, initial margin report etc.

- Lightweight application and can be easily accessible from basic configuration devices.

This is how the application looks like:

At the same time, there are few concerns with the web application as well, including:

- Limited number of features

- Bland design with no low usability, difficult to use

- Limited features to perform technical or fundamental analysis

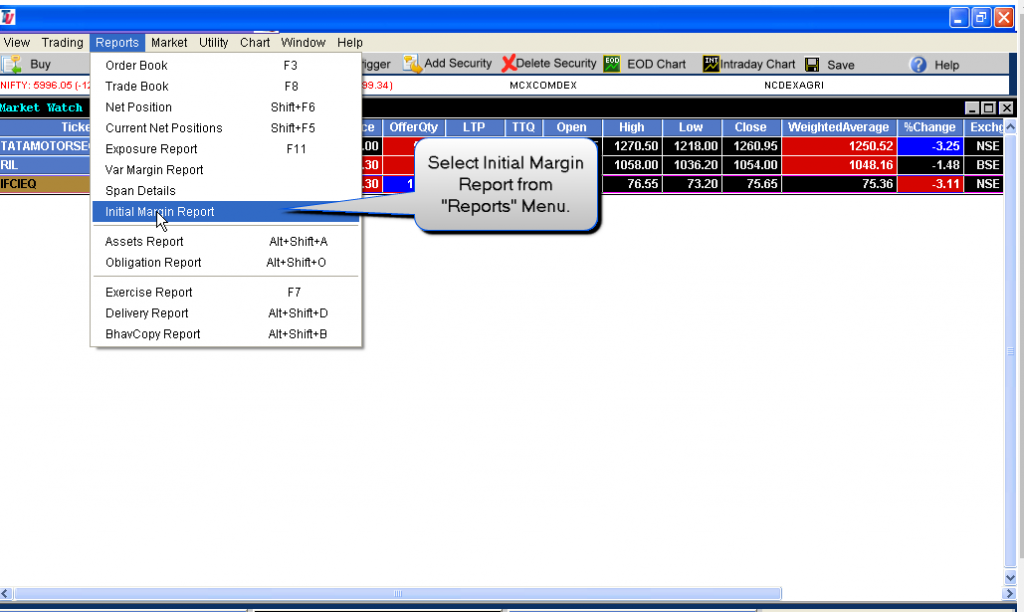

Trade Velocity

Trade Velocity is a terminal-based trading application that requires a download of a .msi file onto your computer or desktop. Once done, the application needs to be installed and then you are required to enter valid credentials into the trading software.

The software provides the following features:

- Provision to add multiple market watch lists

- Technical and fundamental reports and recommendations provided within the application

- A reasonable number of charts and heat maps available to perform technical and fundamental analysis

At the same time, there are few issues with the software as well:

- The platform is relatively bulky in nature and thus, requires you to have a reasonable configuration of your machine

- Mediocre user experience and it will be tough to use, especially for beginners.

Jhaveri Securities Customer Service

Customer service or support is an important aspect of full-service stockbrokers and you can have high expectations from this type of brokers. In the case of Jhaveri securities, it provides support through the following communication channels as mentioned below:

- Webchat

- Offline branches (sub-brokers, franchise, business associates)

- Phone

- Webform

Although the broker provides multiple communication channels and the turnaround time taken by the executives is also pretty quick, however, the broker lacks in one specific aspect when it comes to customer service and that is – Executive skillset.

While talking to some of the support staff, you would realize that either they lack training in customer service or they have limited professional expertise.

Furthermore, some of the staff might not even know about Jhaveri securities as a company in detail. Thus, the broker must certainly be working on making sure the support staff provides a consistent and satisfying experience to users and clients of the broker.

Jhaveri Securities Research

The broker provides research to its clients at multiple levels across different segments such as Equity, Commodity, Mutual funds, IPO at both technical and fundamental levels. Here are some of the information blocks that the broker provides on a regular basis:

- Equity

- Price movements

- Volume analysis

- Latest news

- Corporate news

- Hot Stocks

- Mutual funds

- Category return on equity, hybrid and debt levels

- NFO Updates

- MF News & trends

- Return and SIP calculators

- Derivatives

- Market report

- Most active calls/puts

- News

- Commodity

- Market Movers

- Value and volume toppers

- Information across MCX and NCDEX

- Currency

- Latest quotes

- Top volume and value-based exchange rates

- Spot charts

- IPOs

- New listings

- IPO analysis report

When it comes to the accuracy of these research reports and recommendations, the broker seems to have a good hold in the commodity segment. However, for Equity, currency and other segments, its better you perform your own analysis along with the recommendations of Jhaveri Securities.

You can also take assistance of professional research and advisory firm that can help you in providing tips for your trading and investments.

Jhaveri Securities Pricing

When it comes to pricing, the broker is somewhere around average – neither expensive nor cheap. Here are the details of the pricing for Jhaveri Securities:

Jhaveri Securities Account Opening Charges

To open an account with this full-service stockbroker, you have the following options of going ahead:

| Trading Account Opening Charges | ₹0 |

| Demat Account Opening Charges | ₹500 |

| Trading Account Annual Maintenance Charges (AMC) | ₹0 |

| Demat Account Annual Maintenance Charges (AMC) | ₹354 (first year free) |

| Demat Account Annual Maintenance Charges (AMC) - 10 Years | ₹1125 |

Thus, either you can go with a per year plan for AMC (Annual maintenance charges) where you are required to pay ₹354 from the second year (first year AMC) is free.

Or, you can opt for a 10-year plan where you pay a one-time cost of ₹1125 and maintenance charges for 10 years to get covered with that amount. It all depends on your trading preferences and commitment.

Jhaveri Securities Brokerage

Since it is a full-service stockbroker, it charges you a percentage based brokerage depending on your trade or investment value. Here are the details:

| Trading Segments | Offline Trading | Online Trading |

| Equity Delivery | 0.25% | 0.10% |

| Equity Intraday | 0.05% | 0.02% |

| Equity Futures | 0.05% | 0.02% |

| Equity Options | ₹80 per lot | ₹50 per lot |

| Currency Futures | 0.05% | 0.02% |

| Currency Options | ₹80 per lot | ₹50 per lot |

| Commodity | 0.05% | 0.02% |

As you can see in the above table, there are 2 different pricing options when it comes to brokerage rates. If you trade through offline channel i.e. call and trade facility, you will be charged much higher brokerage rates as compared to the case when you trade through the online trading platforms on your own.

You can make your choice as per your preference.

Use this Jhaveri Securities Brokerage Calculator for complete calculation of all sorts of charges and your profit from the trade.

Jhaveri Securities Transaction charges

Apart from brokerage and account related charges, you will be charged a few taxes, stamp duty and transaction charges. Here are the details:

| Segment | Transaction Fee |

| Equity Delivery | 0.00325% |

| Equity Intraday | 0.00325% |

| Equity Futures | 0.0021% |

| Equity Options | 0.053% |

| Currency Futures | 0.00135% |

| Currency Options | 0.044% |

Jhaveri Securities Margin

With the concept of exposure or leverage, you can place trades of valuations higher than your trading account deposits. The amount you get on top of your trading margin is given by the broker (Jhaveri Securities in this case) at a specific interest rate (in the range of 15% to 22%).

Here are the details for this broker:

| Equity | Upto 20 times for Intraday, & 4 times for Delivery |

| Equity Futures | Upto 3 times Intraday |

| Equity Options | Upto 2 times Intraday |

| Currency Futures | Upto 3 times Intraday |

| Currency Options | Upto 2 times Intraday |

| Commodity | Upto 3 times Intraday |

At the same time, this needs to be understood that exposure or leverage is a risky concept and can actually eat up your trading deposit and more if not used correctly and optimally. Thus, if you are a beginner or you do not understand the concept of leverage, it’s better to avoid using it in the first place.

Conclusion

“Jhaveri Securities, although has been around the full-service stockbroking space for quite a while now, still it has limited itself to few states of India only.

When it comes to value for money, the brokerage house certainly charges reasonable brokerage rates within the context of full-service broking space but Jhaveri Securities needs to work hard on research accuracy, trading platforms and few aspects of customer service.

The funny thing is, that users look for full-service stockbrokers primarily for the above-mentioned services and unfortunately the broker lags quite a bit in all of these areas.”

Jhaveri Securities Disadvantages

Be aware of these concerns before you open your demat and trading account with Jhaveri:

- Relatively low performance in its trading platforms

- Customer support executives need to be trained professionally

- Research accuracy is around average

Jhaveri Securities has received complaints from 0.006% of its active clients, which is certainly better than the industry standard of 0.01%.

Jhaveri Securities Advantages

At the same time, you get the following advantages while you use the trading services of this full-service stockbroker:

- Decent exposure for Equity intraday trades

- Wide range of trading and investment products

- Even if the quality of trading platforms is low, the broker still has managed to design and develop its own applications.

- Reasonable brokerage charges, especially if you trade online

- Different types of accounts for NRI’s including Non-resident (External) Rupee Accounts (NRE), Non-Resident (Special) Rupee (NRSR) Account, Ordinary Non-resident Rupee Accounts (NRO), Non-resident (Non-repatriable) Rupee deposit accounts (NRNR).

Looking to have a discussion with the executive?

Just provide your details in the form below and we will set up a callback for you:

Post this call:

You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review on documents required for demat account.

More on Jhaveri Securities:

Here are a few reference links that you can check in case you want to know more about Jhaveri Securities:

Jhaveri Securities Review  |

| Jhaveri Securities Transaction Charges |

Jhaveri Securities Brokerage Calculator  |

| Jhaveri Securities Franchise |