Latin Manharlal

List of Stock Brokers Reviews:

Latin Manharlal is a veteran full-service stockbroker based out of Mumbai. Incorporated in the year 1989, LatiManharlal is known for it’s advisory and research services and is counted as one of the best in tips and recommendations.

Latin Manharlal Review

Latin Manharlal claims to serve around 40,000 clients along with its sub-broker and franchise network of around 200 branches, with 7 branches in Mumbai alone.

With its membership of BSE, NSE, MCX, NCDEX and MCX-SX, Latin Manharlal allows its clients to trade and invest in the following segments:

- Equity

- Commodity Trading

- Currency Trading

- Insurance

- Fixed Deposits

- Mutual funds

- IPO

- Portfolio Management Services

- Depository Services

- Wealth Management

Latin Manharlal provides multiple research products in the form of:

- Pre-market reports

- Commodity reports

- Trading Calls

- Investment Calls

Mr Latin Manharlal Shah – Founder and MD – Latin Manharlal Securities

Latin Manharlal Trading Platforms

The full-service stockbroker provides multiple trading applications, however, most of those are third-party investment softwares.

Here are the details:

ODIN Diet

Latin Manharlal allows its clients to trade through terminal based trading software ODIN. ODIN is a flagship trading software that users need to download and install onto their laptop or desktops. Majorly favourable for heavy traders, ODIN Diet has the following listed features:

- Access to real-time market data with minimal delay

- Customizable dashboard with provision to personalize themes as per user preferences

- In-built mutual fund and IPO modules

- Unlimited scrips allowed in market watch feature

- Highly secure trading experience with SSL enabled

Latin Manharlal Mobile Trading

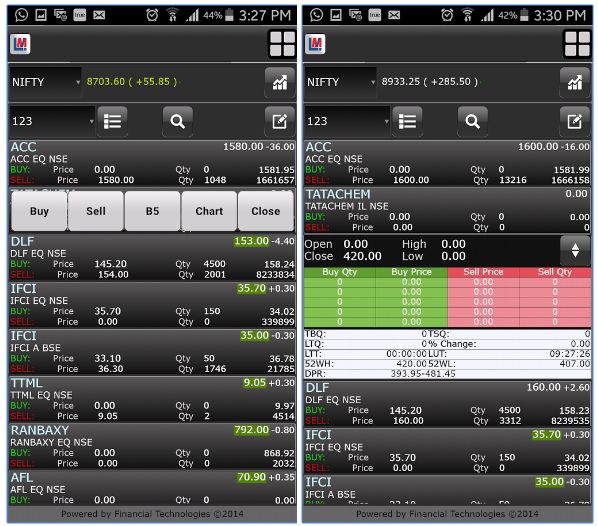

This mobile app is an attempt by the house of Latin Manharlal, however, it has not really been used much by clients. One of the major reason for the app not being used is its technology limitation. The app requires you to install Adobe air software for the smooth functioning of the app.

This is one little roadblock for users who have the option of using much better and leaner mobile apps these days.

Some of the features of Latin Manharlal Mobile App are:

- Market watch feature available in both refresh as well as streaming mode depending on your mobile internet speed.

- Real-time order tracking

- Inbuilt features to access market reports, tips, recommendations, trading calls

- Charting feature to help clients in technical and fundamental analysis

At the same time, here are a few concerns raised by the users of this mobile app:

- Issues with the user experience of the app have been reported by the app users.

- The number of features is limited.

- The app is only suitable for beginner level traders

This is how the app looks like:

Here are some stats of the mobile app at the Google Play store:

| Number of Installs | 500 - 1,000 |

| Mobile App Size | 37.4 MB |

| Negative Ratings Percentage | 0% |

| Overall Review |  |

Latin Manharlal Customer Service

The full-service stockbroker provides the following communication channels to its clients for support:

- Web-form

- Phone

- Offline branches

- Fax

- Web-chat (only for registered clients)

The number of communication channels provided by this stockbroker are pretty varied in nature and has an amalgamation of both offline as well as online methodologies. This aspect certainly places Latin Manharlal in good books.

At the same time, when it comes to the quality of customer support, the full-service stockbroker does an average-level job only. The support needs to certainly work on providing personalized solutions to their clients rather than going through a template-based response which is not helpful most of the times.

Latin Manharlal Research

When it comes to research, Latin Manharlal – like any other full-service stockbroker, provides assistance to its clients through various kinds of research reports and tips.

Here is a quick overview:

- LM’s Tricklet (bi-weekly report i.e. published every 2 weeks, majorly covering the technical research for that duration.

- LMSPL Weekend (published every Saturday with research done on the market news over the past week)

- Company Report (no specific timeline, generally covers mainstream IPO reports with a recommendation on buy/avoid etc)

- Commodity Pivot Table (published daily with pivot table data of promising commodities)

- Budget Report (published once a year with detailed research around the budget released by the Indian Government)

- Special Reports (published on specific instances that can directly/indirectly impact the Indian economy or the stock market in general)

- LM Bulls’ Eye (published once per month with information on specific stocks and corresponding recommendations)

- LM Trade Mantra (published every week with generic stock market trends)

These reports are accessible only to the clients of Latin Manharlal and not a generic user unlike in case of brokers such as Angel Broking that is pretty open in terms of their research and shares it with their website users.

Nonetheless, the research provided by this full-service stockbroker looks good for someone who is looking for relatively long-term investments. Short-term tips are not that accurate and need a round of self-analysis before you place the trade.

Having said that, the broker provides a reasonable quality of research overall.

Latin Manharlal Pricing

Let’s quickly have a look at the different charges this full-service stockbroker levies to its clients for using different sorts of services:

Latin Manharlal Account Opening Charges

To open an account with Latin Manharlal, there are no account opening charges but you are supposed to pay a specific charge an annual maintenance fee for your demat account:

| Demat Account opening charges | ₹0 |

| Trading Account opening charges | ₹0 |

| Demat Account Annual Maintenance Charges | One time ₹1200, No AMC for 10 Years |

| Trading Account Annual Maintenance Charges | ₹0 |

Latin Manharlal Brokerage

Being a full-service stockbroker, Latin Manharlal charges relatively high brokerage charges, as explained below:

| Equity Delivery | 0.4% |

| Equity Intraday | 0.1% |

| Equity Futures | 0.02% |

| Equity Options | ₹30 per lot |

| Currency Futures | 0.02% |

| Currency Options | ₹30 per lot |

| Commodity | 0.02% |

Always remember that whatever brokerage a full-service stockbroker quotes to you, it is open to negotiation. We advise you not to just confirm on a number that the executive quotes to you. Rather have a detailed discussion and try to reduce these charges as much as you can.

Check out this detailed Latin Manharlal Brokerage Calculator for complete calculation of different taxes, charges and the final profit you make from your trade(s).

Latin Manharlal Transaction Charges

Here are the different transaction charges levied on top of the brokerage charges by Latin Manharlal:

| Equity Delivery | 0.00350% |

| Equity Intraday | 0.00350% |

| Equity Futures | 0.00240% |

| Equity Options | 0.07150% |

| Currency Futures | 0.00165% |

| Currency Options | 0.06000% |

| Commodity | 0.00390% |

Latin Manharlal Margin

This full-service stockbroker provides some of the lowest margin values across the trading segments. Thus, if you are looking for high margin trading, well, you are in here for a huge disappointment.

Clients get the following margin across segments:

| Equity Delivery | No Exposure |

| Equity Intraday | 8 times for Intraday |

| Equity Futures | 3 times for Intraday |

| Equity Options | 3 times for Intraday |

| Currency Futures | NA |

| Currency Options | 2 times for Intraday |

| Commodity | 2 times for Intraday |

Latin Manharlal Disadvantages

Here are some of the concerns of using the services of this full-service stockbroker:

- Low focus on technology, especially looking at their trading platforms

- Relatively high brokerage charges

- Limited margin across trading segments is provided.

Latin Manharlal Advantages

At the same time, you get the following advantages while you trade through Latin Manharlal:

- A wide range of trading and investment products

- High-quality research, tips and trading calls at your disposal

- A dedicated relationship manager is mapped to each client

Interested to have a discussion?

Provide your details below and we will set up a free call back for you:

Next Steps:

Post this call You need to provide few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

More on Latin Manharlal:

If you wish to learn more about this full-service stockbroker, here are a few references for you:

| Latin Manharlal Review |

| Latin Manharlal Brokerage Calculator |

| Latin Manharlal Transaction Charges |

| Latin Manharlal Hindi Review |

| Latin Manharlal Franchise |