My Value Trade

List of Stock Brokers Reviews:

My Value trade, a discount stockbroker, started its operations back in 1985 (as Master Capital Services) which is around a similar time when most of the other prominent stock trading companies intercepted. However, it pivoted to discount broking model in August 2014 only.

Here is a detailed review with information related to all the important aspects that you need to know before opening your trading account.

My Value Trade Review

This Ludhiana-based group claims a turnover of INR 4500 Crore on a daily basis. Without a doubt, however, My Value Trade is a discount broker with one of the lowest brokerage charges (more about this when we talk about Pricing).

It’s trading and investment services include all segments namely:

“My Value Trade’s parent Master Capital has an active client base of 46,061 at the National Stock Exchange (NSE).”

My Value trade Trading Platforms

Clients get access to trading platforms across Web, Desktop as well as Mobile. Open the My Value Trade Demat account or Trading Account to get the login details. Here are the details:

MVT Trader – Desktop

This is a desktop-based application that comes with features such as:

- Advanced charting with 40+ technical indicators signaling. This indicates to the user about when is the best and worst time to buy or sell.

- A unique feature of social media integration by which you can view the Twitter feed of your account within the MVT Trader tool itself, post integrating it with your Twitter account.

“The trading platforms of My Value Trade provide decent reliability with exchange connectivity of 240 orders/second for sending and execution of orders.”

- Real-time updates available for all NSE stocks cutting through their 52 weeks high/low, Day high/low and the ones that are approaching their upper and lower circuit levels

- View 4 business channels LIVE while trading within the tool itself

- Personalize & customize the trading platform as per preferences including complex charting functions

MVT Classic – Web

This is a browser-based application that can be accessed from anywhere using your login credentials. It comes loaded with the following features:

- Single Sign-On provides ease of use and flexibility to its users so that they can access trading, back-office reports or analytics without having to sign into multiple applications

- Compatible with all kinds of web browsers

- All markets can be accessed using this browser-based application across equity, currency, commodity or derivative segments with all kinds of technical charts

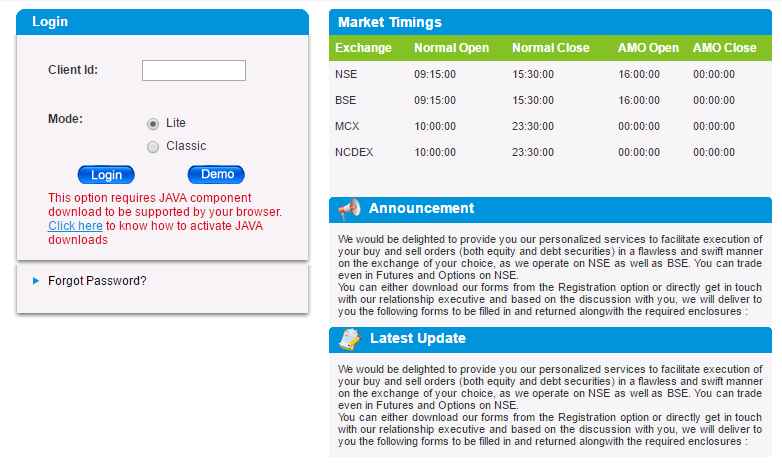

This is how the application looks like:

This is not a responsive application so the user experience may get compromised if clients access the application through a mobile or tablet device.

My Value trade – MVT Mobile App

Having a mobile presence is more of a necessity than being an advanced feature these days.

The discount broker does have a presence on mobile via its MVT – Mobile app that allows you to trade on the go. Here are its features:

- Dual security with login as well as a trading password provides an extra level of security to the customer’s data.

- Availability of Real-time quotes of scrips across different trading segments with quick notes on last traded price, bid size, percentage change. This gives users access to minute-level important information that can help him/her to make a decision.

- The mobile app comes with all sorts of notifications based on your preferences and your trading patterns.

- Market watch sync feature allows a user to save lists created on MVT Trader or Classic platforms.

Also Read: Best Online Trading Platforms in India

Here are the stats of this mobile app from Google Play Store:

| Number of Installs | 1,000 - 5,000 |

| Mobile App Size | 23 MB |

| Negative Ratings Percentage | 43.3% |

| Overall Review |  |

| Update Frequency | > 2 Years |

As seen in the ratings above, the app has been completely rejected by the users in regards to performance, a number of features, overall usability etc. Users are advised to go through a detailed demo of the trading platforms, including the mobile app before committing themselves to this particular stockbroker.

My Value trade Customer Service

My Value Trade provides support through the following communication channels:

- Phone

- Web Chat

- Social Media

The broker offers reasonable customer service quality through its small team based out at the headquarter office in Ludhiana, Punjab. Overall the customer service is “salsy” in nature and does not really focus too much on providing a decent experience to its clients.

The resolutions are copy-pasted and are completely generic in nature. Thus, the clients don’t go through a deserving experience while using the service of this discount stockbroker.

In a sense, the overall quality of customer service is below average.

My Value Trade Pricing

The pricing aspect of the discount broker includes a flat rate brokerage rate, transaction charges, taxes (GST), stamp duty etc. Users are advised to be very sure of the pricing levied from multiple aspects and understand these charges.

Once pricing gets finalized, users must get it documented or get it emailed from the official email id of the broker.

My Value trade Account Opening Fees

To open an account with My Value trade, clients are required to provide the following charges as shown in the table below:

| Trading Account | INR 0 |

| Demat Account | INR 555 |

| Commodity Account | INR 555 |

| Annual Maintenance Charges | INR 400/Year |

“My Value Trade has pretty straight-forward brokerage plans at the order level and monthly or yearly levels.”

My Value trade Brokerage Plans

This discount stock broker offers two kinds of brokerage plans for the users to choose from depending on their preference.

- Per Order Level (like a generic discount broker)

- Fixed brokerage

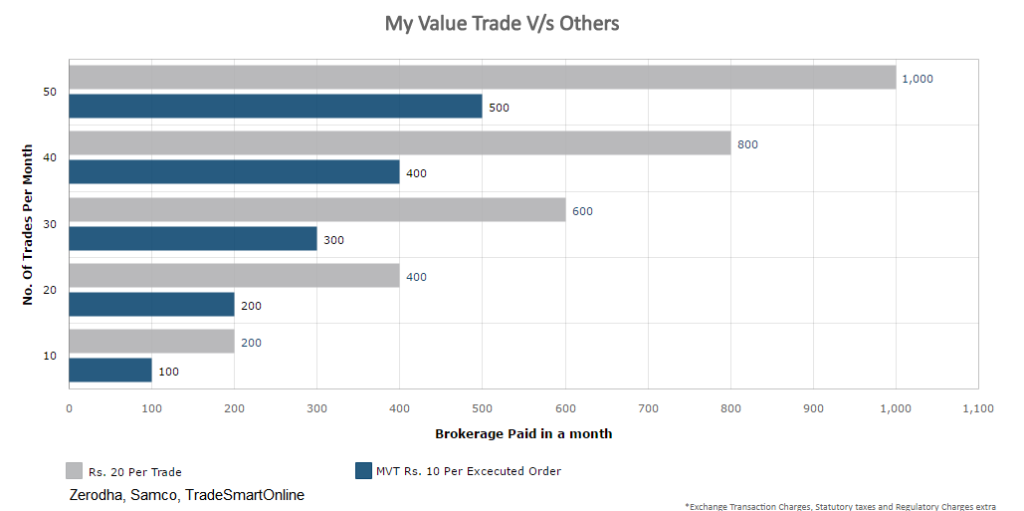

At the per executed order level, My Value Trade is one of the cheapest discount stockbrokers in India costing INR 10 per executed order. There is no extra flat fee or a monthly brokerage you need to pay as a trader.

Depending on the number of executed orders, you will be charged a flat price of INR 10 per executed order across all categories including Equity Delivery, Equity Intraday, Equity Futures, Equity Options, Currency Futures, Currency Options as well as Commodity.

Here is how it looks like when compared with other discount brokers in terms of how much total brokerage you need to pay in a month:

My Value Trade also offers a fixed brokerage plan for its customers without any hidden charges irrespective of the number of executed orders across the month. My Value Trade charges a total of INR 1000 as a fixed brokerage cost for 1 month for unlimited trades across all segments.

For more information, check this detailed review on Zero Brokerage Unlimited Trading plans.

Use this My Value Trade Brokerage Calculator for complete calculation of all sorts of charges and your profit at the end of each trade.

“Clients can avail the Call and Trade facility at INR 20 per executed order from the discount stock broker”

This stockbroking company also offers a plan of INR 10,000 instead of INR 12,000 if a customer is looking for a 1-year plan.

Here are all the plans with quick summary again:

| Brokerage Plan | Brokerage Rate |

| Per Executed Order | ₹10 |

| Per Month | ₹1000 |

| Per Year | ₹10000 |

My Value trade Transaction Charges

Apart from the brokerage charges, clients need to pay transaction charges from their pocket as well. And transaction charges depend on the trade value. Here are the charges listed:

| Segment | Transaction Fee |

| Equity Delivery | 0.00325% |

| Equity Intraday | 0.00325% |

| Equity Futures | 0.00300% |

| Equity Options | 0.0600% |

| Currency Futures | 0.00120% |

| Currency Options | 0.04200% |

As per industry standards, this discount stock broker charges relatively high transaction charges at a marginal level. These transaction charges are a percentage of your trade value and thus, the higher the trade value, the higher is the overall transaction charge levied on you.

Thus, try to negotiate these charges while you have a discussion with the executive of the stockbroker.

My Value trade Margin

The discount broker offers pretty reasonable exposure, especially in the equity intraday segment:

| SEGMENT | MARGINS |

| Equity (Intraday) | Upto 33X Intraday |

| Equity Futures | Upto 2X Intraday |

| Equity Options | No |

| Currency Futures | Upto 2X Intraday |

| Currency Options | No |

| Commodites | Upto 2X Intraday |

The broker provides one of the highest exposure values among the complete stockbroking fraternity. At more than 30 times the exposure for equity intraday, users have a great option to capture huge returns from their capital.

Having said that, we would like to suggest that in case you don’t have a complete understanding of how exposure works, it’s best you stay away from it. Its certainly a lucrative option but it comes with big risks as well.

My Value trade Disadvantages:

Here are some of the concerns about using the trading services of My Value Trade:

- Does not provide any tips or recommendations

- No provision of Automated trading

- No 3-in-1 account provision

- My Value Trade doesn’t offer the facility to invest in IPOs

“My Value Trade clients have raised 6 complaints about the financial year 2019-20. Overall it is 0.01% of its active client base whereas the industry average is also 0.01%. “

My Value trade Advantages:

At the same time, here are some of the merits of this discount stockbroker:

- NRI Account Opening allowed

- Multiple types of orders such as AMO (After Market Orders), Cover orders etc available with My Value Trade.

- Provision to choose from 45 bank accounts to link with the demat account

- Fund payout process takes 1 working day

- Only discount broker with a flat yearly rate plan.

Conclusion

My Value Trade seems to be a jack-of-all stockbroker where it provides reasonable value across multiple facets such as trading platforms, customer service, pricing, exposure etc., however, there does not seem to be even a single major USP (Unique Selling Point) where My Value Trade beats any of the Industry leader (in that particular aspect).

So if you want something of everything, then My Value Trade is the broker for you. But if you have some specific expectations, then, you need to compare those expectations in a direct one-to-one way with other stockbrokers in the country.

How to Open an account?

Enter Your details here to get a Callback.

Next Steps:

Post this call You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

My Value Trade Membership Information:

Here is the membership information of the broker with different exchanges and intermediate parties:

| Entity | Membership ID |

| BSE | INB/F 010643634 |

| NSE | INB/F/E 230643634 |

| CIN | U67190MH1994PLC147882 |

| MCX | MCX/TCM/CORP/0472 |

| NCDEX | 00092 |

| Registered Address | C-1, Jeevan Jyot Building, 18/20, Cawasjee Patel Street, Fort, Mumbai - 400001 |

The details can be verified from the corresponding websites of the exchanges.

My Value Trade FAQs:

Here are some of the most frequently asked questions about My Value Trade you must be aware of:

Is My Value Trade a reliable stockbroker? Is it safe?

Starting as a full-service stockbroker, this broker has seen various transitions in its lifetime. It is recently pivoted to discount broking in 2014 and is gradually growing in that direction.

Safety-wise, this stockbroker falls in that particular grey area wherein one place it is showing gradual growth over time but when it comes to providing value to its clients, there are few concerns. These doubts are about the performance of their trading platforms, customer service specifically.

Furthermore, the broker has received complaints from 0.09% of its active client base this year which is 50% more than the industry average.

Thus, when it comes to reliability or safety, we think the broker needs some time to get mature enough and therefore, users are advised to use their discretion while making their choice.

What is the account opening charge in My Value Trade?

If you are looking to open Demat or Commodity account with this discount stock broker, then you will be required to pay ₹555 each for both the account. Opening the trading account is free.

What are the brokerage charges at My Value Trade?

There are multiple types of plans offered by this discount stockbroker when it comes to brokerage charges and depending on your trading style or preference, you can pick a specific brokerage plan.

For instance, if you are looking to lower your brokerage charges and do not trade so much, then you can go for the flat rate brokerage plan.

Furthermore, if you trade heavily as far as the number of trades or the total trading turnover is concerned, then you can opt for the monthly or the yearly flat brokerage rate plans. For complete details, you can refer to the Brokerage Plans section above.

How is the customer service of My Value Trade?

Customer service is one of the weakest links of My Value Trade. Be it the number of communication channels or the quality of the service, the discount stockbroker has a lot to work upon. Some of the possible solutions may be the professional training of the support staff on a regular basis, improvement in the turnaround time etc.

What trading and investment product options are available in My Value Trade?

With the discount stockbroker, you can trade and/or invest in Equity, Commodity, Currency, Mutual funds and bonds. This is another area where the discount broker can improve its coverage in.

How is the mobile trading app of My Value Trade?

The mobile app for trading provided by the discount stock broker is way below average and users are warned NOT to use the mobile app for their trading. The app offers one of the worst user experiences, limited features and has not seen any update whatsoever in the last 2 years.

In fact, this mobile app can be termed as one of the worst mobile apps for trading in India.

Is My Value trade suitable for beginners?

Not really. The brokerage setup, customer service quality and overall trading experience do not match with the requirements of a beginner trader or investor.

The broker is primarily suitable for traders who are heavy traders and just want to save brokerage in their trading and have no further expectations from their stockbroker in any sense whatsoever.

Also Read:

More on My Value Trade:

Feel free to check related information pieces about this discount broker:

My Value Trade Review  |

My Value Trade Hindi Review  |

| My Value Trade Transaction Charges |

| My Value Trade Brokerage Calculator |

| My Value Trade Margin |

My Value Trade Comparisons  |

| My Value Trade Demat Account |

Great information. Thanks for providing us such a useful information. Keep up the good work and continue providing us more quality information from time to time.