Prabhudas Lilladher

List of Stock Brokers Reviews:

Prabhudas Lilladher or PL India is one of the oldest stockbroking houses in India. Registered in the year 1944, Prabhudas Lilladher has seen a decent growth on a gradual basis within full-service stockbroking space.

Now with its headquarters in Mumbai, it has a presence in 30+ cities of India with an overall employee strength of more than 350.

Prabhudas Lilladher Review

A major chunk of the revenue for Prabhudas Lilladher comes from institutional trading that includes more than 150 clients from India, Singapore, HongKong, USA and UK.

At the retail level, the full-service stockbroker has around 20,498 active clients from different parts of India.

The broker allows you to trade through its offline branches as well as through different trading platforms on web and mobile.

With its membership from BSE in the 1980-90 era, Prabhudas Lilladher now enjoys memberships with BSE, NSE, MCX-SX and allows its clients to trade across the following segments:

- Equity

- Commodity Trading

- Currency Trading

- Derivative Trading

- Mutual Funds

- IPO

- Margin Trading

- NRI Demat Account

- Real Estate

- Portfolio Management Services or PMS

Ajay Bodke, CEO – Prabhudas Lilladher

Prabhudas Lilladher Demat Account

Prabhudas Lilladher offers a two in one account, i.e., Demat account and trading account. The Prabhudas Lilladher Demat Account Charges are Nil but has ₹300 as the Annual Maintenance Charges (AMC).

Prabhudas Lilladher Demat account can be opened either online or offline. To open the account online, you can access their official website.

If you wish to open the account offline, you can either download the form, fill it and submit it to the nearest branch or visit the branch, and the branch executives will guide you with the further process.

To access the account, the broker provides you with a set of credentials that can be used to login to the portal and trade with ease.

Prabhudas Lilladher Trading Platforms

Prabhudas Lilladher provides multiple trading platforms across devices including Web, Desktop, Mobile, Tablet as discussed below. Follow the Prabhudas Lilladher login process to access all the platforms efficiently.

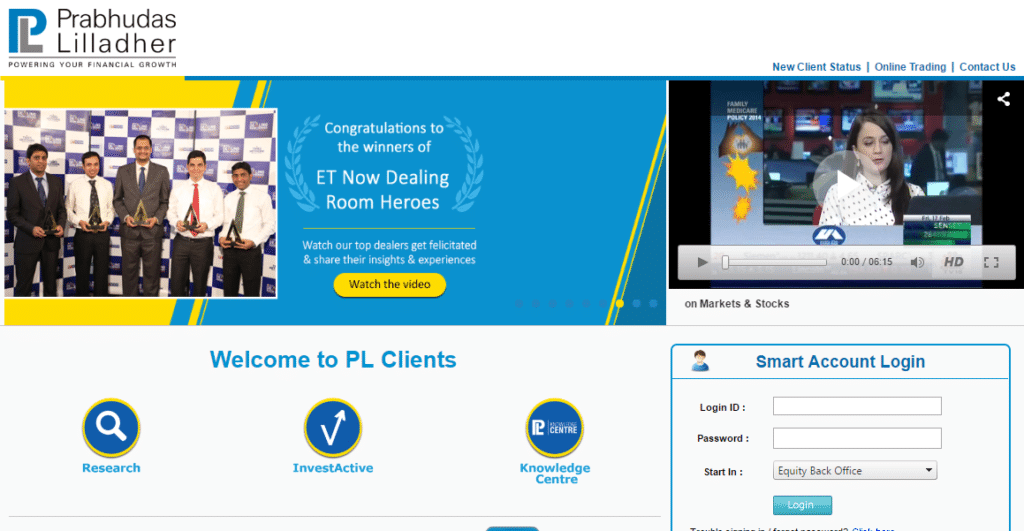

Prabhudas Lilladher Online Trading (PL Clients)

Prabhudas Lilladher Trading provides web trading to its clients through its online trading portal and provides the following features:

- Responsive web trading platform allows you to access trading across devices.

- Customizable multiple market watch lists

- Provision to transfer funds from 15+ prominent banks of India

- Charting feature with technical indicators allow you to perform technical analysis

- Get access to intra-day, short and long-term calls within the trading platform

- You get access to Advisory & Portfolio Restructuring which is provided on a daily basis by a Relationship Manager

Here is the login screen of the web trading platform of Prabhudas Lilladher (PL Clients):

At the same time, the application can be improved from the below-mentioned perspectives:

- Number of charts can be increased for intermediate to expert level traders

- Speed and performance can be optimized for smaller towns and cities

- High level of personalization and customizations

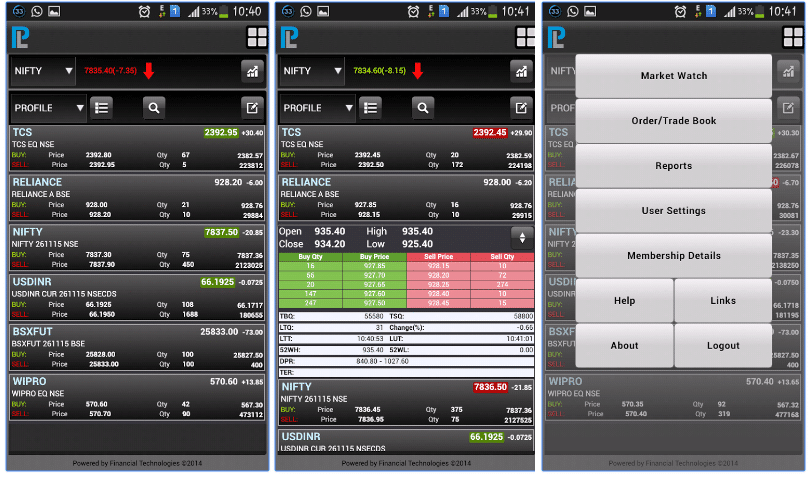

PL Mobile App

PL Mobile app is the trading app from Prabhudas Lilladher. It is a light-weight trading app with speed and security as its propositions. Some of the features of the app are:

- Auto-customized app based on the internet bandwidth

- Multiple market watch feature with customization available

- Charting with seamless integration with order placement feature

- Order placement possible through any screen across the mobile trading app.

- Market Scanners, analytics available for the quick stock-filtering

- Users can manage trade book, order book, net position, funds view and stock portfolio.

Here are some of the screenshots of the mobile app PL Mtrade:

At the same time, here are some of the concerns of this application that you must be aware of:

- You are required to add Adobe Air plugin for this app to work optimally

- Low-quality user design and trading experience

- Limited number of features, not suitable for intermediate and advanced level traders.

For more information about Desktop, read Prabhudas Lilladher Desktop App in detail and reap its benefits.

Here are some of the Google Play Store stats on this mobile app from Prabhudas Lilladher:

PL Traders Edge

The full-service stockbroker has recently introduced an algo trading based engine that runs on specific algorithms. These algos are designed and developed keeping both bullish and bearish market behaviours.

As per the broker, PL Traders edge provides verified trading calls that can be used at both manual as well as automated levels.

The tool gives you a provision to switch on or off the automated trading mechanism as per the trader’s preference.

Some of the top features of this tool are:

- Auto-generated strategies for indices that are of prime importance such as Nifty & Bank Nifty.

- SMS based alerts feature keeps you notified of the latest tips generated by this tool.

- Sents specific alerts on when to avoid trading, especially in volatile market situations.

- 3 to 4 such trading opportunities are generated per month by this tool

- Sizing of the position is done based on the risk appetite of the investor/trader.

At the same time, here are a few set conditions you need to take care if you are interested in algo-trading using PL Traders edge:

Also Read: Top Algo Trading Platforms

The engine comes up with 3 or 4 trading opportunities in a month.

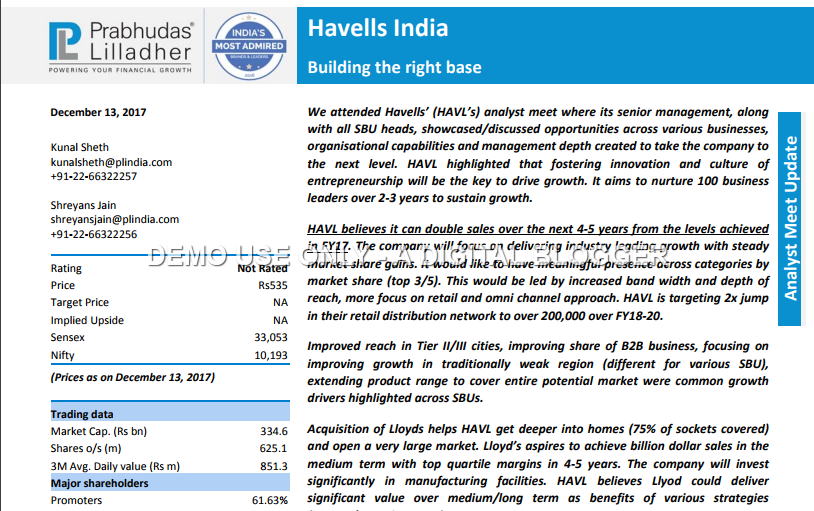

Prabhudas Lilladher Research

The full-service stockbroker houses a team of around 35 research experts who perform detailed analysis across different trading and investment segments.

Covering around 20 mid and large Industry sectors, Prabhudas Lilladher’s research team works on more than 150 stocks across indices.

If you are a client or want to be a client of this full-service stockbroker, you will get access to the following report types at both the fundamental and technical level:

- Company Reports

- Idea Research

- Sector Reports

- Themantic Reports

These research tips and recommendations are communicated to the clients through email and SMS/Whatsapp.

This is how one of the company reports from Prabhudas Lilladher looks like:

Apart from that, the broker has recently come up with a stock research-based initiative titled ‘InvestActive‘. The product works for both long-term investors as well as for short-term traders with a basic idea of adding balance to the portfolio and increase the returns.

This is how the overall portfolio segregation is done:

- 70% allocation is done based on the research ideas across small, large and mid-cap stocks.

- 20% of stocks are based on the technical calls

- 10% of stocks allocation is made of those stocks that have a medium-term investment horizon and are expected to jump up quickly.

In order to activate this service, here are a few provisions you need to take care of:

- Provide a cash margin of ₹5 Lakh

- Stocks in your demat account are not accepted as margin

- Email and phone communications will be made to you on the rest of the process.

Prabhudas Lilladher Customer Care

You can get in touch with this full-service stockbroker using the following communication channels:

- Toll-Free Number

- Phone

- Branches

You can visit the branches of Prabhudas Lilladher at the following locations in India:

- Ahmedabad

- Bangalore

- Baroda

- Bharuch

- Chennai

- Hyderabad

- Kolkata

- Mumbai

- New Delhi

Although the number of communication channels seems to be reasonable, the presence of the offline branches is limited to metro cities only. Thus, if you are living in a tier-2 or below kind of a city, you will have to reach out to the broker through channels such as Email or Phone.

Furthermore, the quality of support provided by this full-service stockbroker has its own concerns too. The turnaround time for technical issues is high and the skill-set of the executives seems to be mediocre as well. In other words, keep your expectations low from Prabhudas Lilladher when it comes to customer service.

Prabhudas Lilladher Charges

Check out the details on Pricing levied by this full-service stockbroker:

Prabhudas Lilladher Account Opening Charges

Prabhudas Lilladher is one of the very few full-service stockbrokers that provides a free demat account in India as well as trading account opening. In other words, you don’t need to pay any upfront cost to start our trading apart from your initial trading account deposit.

Here are the details on account opening and maintenance charges you must be aware of:

Prabhudas Lilladher Brokerage Charges

When it comes to brokerage, this is how you will be charged across different segments:

The overall brokerage charges are around average, especially if you are into derivatives trading.

To give you an idea, let’s take a quick example.

Let’s say you bought 100 shares of ICICI Bank at ₹550 per share and then sold all those shares at a price of ₹600. The overall trading turnover in this buy and sell would have been ₹(550 + 600) X 100 i.e. ₹1,15,000.

As per the brokerage table, Prabhudas Lilladher charges 0.2% brokerage for the Equity delivery segment.

Thus, in this case, this full-service stockbroker will levy ₹1,15,000 X 0.2% i.e. ₹230 as brokerage charges. Apart from the brokerage, there will be other taxes, charges levied on your trades.

To know all sorts of charges and your profit/loss at the end of the trade, you may use this Prabhudas Lilladher brokerage calculator here.

Having said that, full-service stockbrokers always have a room for negotiation and thus, when you talk to the executive of the broker, make sure that you negotiate well. You can get much cheaper brokerage rates fixed for yourself, especially if you are starting with a decent initial trading account deposit.

Prabhudas Lilladher Transaction Charges

Here are the details on the transaction charges levied by different parties including SEBI, the Indian government, exchanges and more.

Prabhudas Lilladher Margin

These are the leverage values you will be provided with when you use the services of Prabhudas Lilladher for your trading:

This full-service stockbroker provides margin at a pretty mediocre range across the trading segments. Thus, make sure you are aware of this particular limitation of Prabhudas Lilladhar while opening your account with this broker.

At the same time, we would like to suggest that exposure can be risky to use, especially if you are a beginner and do not understand the risks and implications of it. Thus, be cautious while using exposure as it can be hazardous to your trading account deposit.

Prabhudas Lilladher Disadvantages

Here are some of the concerns about using the services of Prabhudas Lilladher:

- Not much innovation in technology space as far as trading platforms are concerned

- Customer support can be improved

Prabhudas Lilladher Advantages

At the same time, you will be provided with some of the merits of this full-service stockbroker:

- A wide range of trading and investment products available for clients

- Decent exposure or leverage

- Free Account opening

- Research, tips and recommendations provided to clients

Interested in opening an Account?

Enter Your details here to get a callback!

Next Steps:

You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

More on Prabhudas Lilladher

If you wish to learn more about this full-service stockbroker, here are a few references for you: