Prostocks

List of Stock Brokers Reviews:

Prostocks in one of the most recent discount broking entrants in the Indian stock broking ecosystem.

Founded in February 2016, the discount broker has its corporate office in Mumbai. It has a membership with NSE and BSE, thus, allowing its clients to trade across the following segments:

- Equity

- Derivatives Trading

- Currency Trading

- Depository Services

- NRI Demat Account

- Mutual funds

Prostocks Review

The discount broker is known to provide multiple brokerage plans and you can choose to use a specific plan depending on your trading preferences.

“Prostocks has an active client base of 2,430 up to 2019 for this financial year as per NSE Records”

Prostocks is known for its low overall charges including brokerage, stamp charges etc (more on that later). It is an online broker in the literal sense as it opens the account of its clients in a completely online way without any physical meet or courier of forms involved.

Like most of the stockbrokers in India, Prostocks provides you with the provision to open your trading account using your Aadhaar card.

The complete process is online in nature and you just need to provide specific details, upload the documents and pay the fees to go ahead with your trading account.

“It offers multiple unlimited trading plans which are directly suitable for medium to heavy volume traders who generally end up paying a huge chunk of brokerage charges to their brokers.”

SP Toshniwal, CEO – Prostocks

In this Prostocks Review, we will be talking about multiple aspects, such as listed below:

Prostocks Trading Platforms

Prostocks is pretty decently placed when it comes to trading platforms.

Users switching from other (full service) stockbrokers, who have the habit of using NSE based trading platforms (NSE Now Desktop, Mobile & Web) can use the same platforms while trading with Prostocks.

Thus, in a sense, the switching cost involved (time involved in learning and getting accustomed to new trading platforms gets taken care of).

“Users with Aadhar card can open accounts at Prostocks within a few hours using the eKYC feature.”

However, clients open to learning new trading platforms or the clients trading for the first time can also use in-house trading platforms developed by Prostocks.

At the same time, there are few areas where this discount stockbroker can work upon when it comes to bringing to maturing to the application, number of features, user experience etc.

Details of these platforms are listed below:

Prostocks Desktop

Prostocks Desktop is a terminal-based trading platform that this discount stockbroker has developed with some unique features. Users need to download and install this trading platform before trading. Here are some of the features of Prostocks Desktop:

- Users can customize the analysis screen for quicker technical analysis as per their preferences

- Unlimited scrips allowed in the market watch feature where up to 4 market watches can be added

- Real-time charting (using 6 types of charts) with updates at the intraday, minute, hour, day, week, month, half-yearly and yearly levels.

- More than 150 technical analysis studies for users looking to perform intraday trading.

- Customization in price and percentage alerts and notifications possible

- You can transfer funds using the trading application itself.

This application is suitable for regular traders who prefer high performance, various investment segments and speedy order executions.

Prostocks Web

Prostocks web is a secure web-based trading platform that clients can directly access through a browser from anywhere. The web application comes with the following features:

- Multi-level security keeps all sorts of hacking or phishing away

- Integration with leading payment gateways for fund transfer

- Access to online reports and real-time market updates

- Users can place orders directly from the charting feature

This is how the login screen of Prostocks Web looks like:

This browser-based trading application is lightweight in nature and requires minimal configuration of the device being used. Furthermore, the application moulds itself with the internet bandwidth so that traders get seamless and smooth user experience.

“The only concern with the web-based browser application of Prostocks is the limitation on the number of features, the application offers to its clients.”

Prostocks Mobile App

Prostocks recently introduced a mobile app which is relatively much lighter as compared to other mobile trading apps in India. Although there is still a lot that can be added to this mobile app, however, there are some features added, such as:

- Market Watch

- Real-time market updates and movements

- Watchlists

- Orders report

The discount broker provides a mobile app for both iOS and Android users. To make the best use of these apps open a Prostocks Demat Account or Trading Account.

Opening an account gives you the login credentials to access the app and its features.

“Prostocks does not indulge itself in Proprietorship trading, thus, the client’s funds are completely secure.”

At the same time, some of the bigger problems with the mobile app include issues such as:

- Mediocre UI (User Interface) design

- Delayed data feed

- Consumes high internet bandwidth

“The Prostocks mobile app certainly is one grey area or in a sense, a weak link among other offerings from the broker.”

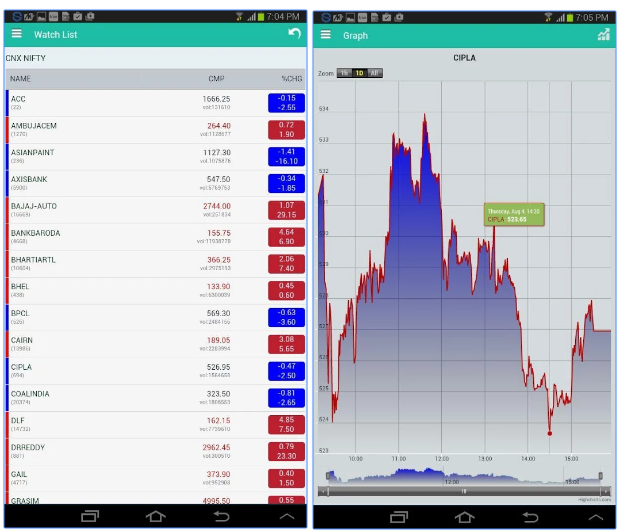

As of now, there is an only Android version of Prostocks mobile app available and iOs version is still to be released. This is how the app looks like:

Here is the snapshot from the Google Play Store that may give an idea about the mobile app:

| Number of Installs | 1000-5000 |

| Mobile App Size | 11 MB |

| Negative Ratings Percentage | 33% |

| Overall Review |  |

| Update Frequency | 8-10 weeks |

Thus, as shown, in the ratings and feedback above, there are few aspects that need immediate attention in order to bring much better values to their clients.

Apart from the above mentioned in-house trading applications, users are provided with the following trading application:

NSE NOW

This is third-party software and is maintained by the technical team of NSE. In other words, Prostocks does not have any control towards the implementation of this trading application.

Some positives of this application include:

- Exhaustive number of features

- Detailed set-up for technical and fundamental analysis of stocks using different charts and heat maps

- Customization in terms of dashboard widgets, alerts and notifications allowed

At the same time, few concerns of NSE NOW are:

- The user experience of this software is around and beginner level traders will have a hard time understanding the navigation of the platform

- Since Prostocks does not control the maintenance of the application, thus, in case there is any feedback you have or there is any concern – Prostocks will not be able to assist you in that.

Make sure you check with the executive of the discount broker on whether there are any separate charges in order to use this trading software. Generally, there are few charges involved when you use third-party software and most of the brokers are not explicit about these charges while account opening.

Prostocks Customer Care

This discount broker provides the following communication channels for customer service and management:

- Phone with IVR Support (a rare feature)

- Webform

- Email Support

Prostocks does an average job when it comes to customer service. It provides decent resolutions with personalized communications to its clients keeping the overall quality intact. However, the number of communication channels, which as of now looks limited, can be increased.

At the same time, the skill-set of the executives can be improved through professional training and providing a detailed understanding of the services offered.

Prostocks Charges

In pricing, a client needs to pay the following charges during trading:

- Account Opening Charges

- Brokerage Charges

- Transaction Charges of the exchange

- Govt. taxes

“Prostocks charges one of the lowest stamp duty charges with a maximum of ₹50 per day using their registered office at Daman and Diu.”

Prostocks Account Opening Charges

Here are the details of account opening and maintaining one with this discount broker:

| Trading Account Opening Charges (One Time) | ₹0 |

| Trading Annual maintenance charges (AMC) | ₹0 |

| Demat Account Opening Charges (One Time) | ₹0 |

| Demat Account Annual Maintenance Charges (AMC) | ₹0 |

Prostocks Brokerage

As mentioned above, the discount broker offers multiple brokerage plans to its clients. All these plans are fixed price in nature, irrespective of the trading segment.

Prostocks offers fixed brokerage plans at:

- Trade level

- Monthly level

- Yearly level

The periodic brokerage plans are irrespective of the value of the trade or the number of trades. By subscribing to these plans, users can perform unlimited trading depending on the segment.

Use this Prostocks Brokerage Calculator for complete calculation of all sorts charges and your profit in the trade.

Trade Level Brokerage Plan

This plan is at single trade level, implying you will be charged a specific brokerage rate at each trade you execute on the stockbroker (for both buy and sell):

| Equity Delivery | ₹15 per executed order |

| Equity Intraday | ₹15 per executed order |

| Equity Futures | ₹15 per executed order |

| Equity Options | ₹15 per executed order |

| Currency Futures | ₹15 per executed order |

| Currency Options | ₹15 per executed order |

“Physical copy of Digital Contract notes costs ₹50 per contract plus courier charges.”

Unlimited Monthly Level Brokerage Plan

In the monthly plan, you can trade for an unlimited number of trades without any limitation on the overall trade value. Your brokerage at the end of the month will be a fixed rate as shown below:

| Segment | Period | Brokerage Charges | Number of Trades |

| Equity and Equity Derivatives | 1 Month | ₹899 | Unlimited |

| Currency | 1 Month | ₹499 | Unlimited |

Unlimited Yearly Level Brokerage Plan

Finally, there are yearly plans that are suitable for traders who can commit for at least a year with the broker. Like in case of monthly plans, there are no limitations on the number of trades you do or the number of trades you place on the stock market. The total brokerage is to be paid once for the whole year as shown below:

| Segment | Period | Brokerage Charges | Number of Trades |

| Equity and Equity Derivatives | 1 Year | ₹8999 | Unlimited |

| Currency | 1 Year | ₹4999 | Unlimited |

“Apart from all brokerage plans, call and trade charges are at ₹10 per executed order.”

Prostocks Transaction Charges

Apart from account opening and brokerage charges, here are the transaction charges levied on the client:

| Segment | Transaction Fee |

| Equity Delivery | 0.00325% |

| Equity Intraday | 0.00325% |

| Equity Futures | 0.00190% |

| Equity Options | 0.050% |

| Currency Futures | 0.00110% |

| Currency Options | 0.040% |

From the industry perspective, the transaction charges mentioned above are pretty reasonable. This is being said since there are few stockbrokers such as Trade Smart Online and TradePlus that charge pretty high transaction charges after attracting users with a low brokerage.

Prostocks Margin

Clients get the following leverage from Prostocks:

| Equity | upto 7 times on Delivery, upto 5 times on Intraday |

| Equity Futures | Upto 1.5 times for Intraday |

| Equity Options | Upto 3 times for Intraday |

| Currency Futures | Upto 1.5 times for Intraday |

| Currency Options | Upto 3 times for Intraday |

As shown above, the exposure values are not so high. Thus, users looking for high exposure or leverage may get disappointed using the services of this discount stockbroker.

Prostocks Disadvantages

Here are some of the negatives of using the services of this discount stockbroker:

- Relatively lower margins across segments

- No trading in commodities or IPOs possible

- Performance of trading platforms can be improved, especially the mobile app.

- The mobile app from Prostocks can certainly be improved.

Prostocks Advantages

At the same time, these are the following merits of Prostocks:

- Well designed brokerage plans suiting both beginner and heavy traders

- Option to use both NSE and Prostocks in-house trading platforms

- The discount stock broker offers stamp duty, which can never go beyond 50 for a day

- Fund transfer provision available to more than 22 banks at ₹9 per fund transfer charge.

- Relatively lower transaction charges

- Pretty low call and trade charges

- Account opening process completely online in nature

Conclusion

“Prostocks certainly ticks most of the boxes when it comes to client requirements from a stockbroker. Be it the brokerage plans, customer service, overall charges – Prostocks seems to be a decently evolving discount stockbroker.

Having said that, it certainly needs to work on its mobile app and make sure users do get a consistent and seamless trading experience. Furthermore, the trust factor can be another area that will take some time to build the potential customer base.”

How to open a Demat and Trading Account?

Enter Your Details below and get a Free call back right away.

Next Steps:

Post this call, You need to provide few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months, cancelled cheque

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review on documents required for demat account.

Prostocks Membership Information

The broker is registered under the firm name – Sunlight Broking LLP at different indices. Here are the details of different licenses obtained by the broker:

| Entity | Membership ID |

| BSE | INDP2802016 |

| NSE | 90084 |

| MSEI | 6635 |

| AMFI | 119535 |

| CDSL | 12083200 |

| Registered Address | B-50, Pravasi Estate, Goregaon (East), Mumbai - 400063 |

Prostocks FAQs

Here are some of the frequently asked questions asked about this discount stockbroker:

Is Prostocks a trustable stockbroker? Is it Safe?

This discount stockbroker is a venture from Sunlight Broking LLP, which has been around for a while in the stockbroking space. Thus, although Prostocks itself is a relatively new name in the industry, it has the backing of a mature player. So you can certainly trust the broker.

Does Prostocks allow investing in Mutual funds?

Yes, apart from investing and trading across Equity and Currency, the discount stock broker allows its clients to invest in the mutual funds’ segment as well.

What are the account opening charges at Prostocks?

There are no account opening charges for this discount stock broker, neither for the trading nor for the demat account. However, the broker places a condition of ₹1000 refundable deposit. Since it’s refundable, you get it back once you close your account with the broker.

Does Prostock provide research, tips, and recommendations?

Like other conventional discount stockbrokers, Prostocks does not any research reports or trading calls to its clients.

How are the brokerage charges at Prostocks?

There are multiple plans offered by the discount stockbroker. Apart from the ₹15 per executed order plan, there are monthly as well as yearly plans offered by the broker which are fixed price in nature.

Does Prostocks provide NRI Trading?

Yes, you can certainly use NRI Trading services from this discount stockbroker with brokerage charges of ₹100 per executed order, irrespective of the trading segment or size of the trade.

Is there any minimum balance I need to maintain with Prostocks?

No, like most of the other discount stockbrokers, this discount stock broker also does not put any limitation on its clients to maintain any specific minimum balance.

You can check out detailed comparisons of Prostocks Vs Other stockbrokers here:

More on Prostocks:

If you wish to learn more about this discount broker, here are a few references for you:

Prostocks Review  | Prostocks Hindi Review  |

Prostocks Comparisons  | Prostocks Brokerage Calculator |

| Prostocks Transaction Charges | Prostocks Demat Account |

Video Review; Video Review; |