Reliance Money

List of Stock Brokers Reviews:

Reliance Money, also known by the name Reliance Smart Money, a full-service stockbroker, is a trading arm of Reliance Capital.

Founded in the year 2005, the company claims to have around 8 lakh client base in 1700 cities across the nation.

Here is the detailed review of the broker.

Looking forward to availing its brokerage services, then dive in to grab its complete details.

Reliance Smart Money Review

Although not as exhaustively as Zerodha Varsity, but Reliance Money has tried to come up with a knowledge repository for beginner traders on its website.

No doubt, Reliance Money is one of the largest retail broking houses in India.

It contains detailed information on stock trading jargon and explanation on how market dynamics work.

Reliance Money, as a full-service broker and with its membership with BSE and NSE, MCX, MCX-SX, NCDEX, NMCE allows its clients to trade across the following segments:

- Equity

- Derivative Trading

- Currency Trading

- IPO

- Mutual Funds

- Bonds

- Commodity Trading

- Corporate Fixed Deposits

Reliance Money earlier known by the name Reliance Securities has already gained good fame.

All this popularity is due to the sophisticated trading platform, diversified margin and payment option for t+5 days and a lot more.

Here are the major points that give you the reason to trade with the Reliance Money:

- With the inauguration of its new, consolidated platform, Reliance Smart Money, it will now put important aspects in one place. So now it becomes easy for clients to find anything related at any time.

- Reliance Money offers the best and a hassle-free trading option to its clients giving them access to trade in almost every other available platform like Equity, Derivative, Forex, MF, etc. This benefits the client and enhances the activity of account maintenance of traders.

- Also, it offers great customer support services. If you are a client then you can reach customer services and get a quick response.

- It has diversified brokerage plans that let the traders choose the one that goes best for trading.

- It has diverse and advanced trading platforms that simplify the process of trade.

“Reliance Securities has a total of 1,20,292 active clients for 2019-20.”

B. Gopkumar, CEO – Reliance Securities

Reliance Money Trading Platform

There is ample trading software provided by Reliance Money across devices, be it a mobile app, terminal software or web-based applications.

At the same time, quality-wise, there are a few aspects that can be improved in each of these trading platforms. Complete details are mentioned below:

Reliance Securities Tick

Tick is a trading platform based on Big data analytics and provides automated robot insights to clients.

The idea behind Tick is to provide real-time recommendations to clients based on their personal portfolio so that there is minimum wastage for order placement.

Some of the features of the platform are:

- Multiple model screeners with derivative strategies, options strategies, recommendations, etc.

- Information on Put call ratio, market sentiment, rollover costs, heat maps and more

- Technical alerts and signals on a real-time basis

- Watchlists across multiple asset classes on the same screen

Here is a basic introductory video of Reliance Tick:

Reliance Securities Tick Pro

Tick Pro is an advanced mobile trading app from Reliance Securities for trading specifically in Derivatives. It comes loaded with the following features:

- Market snapshot

- Options calculator

- Interactive charts with technical indicators

This is how Tick Pro is reviewed on Google Play Store:

| Number of Installs | 100,000+ |

| Mobile App Size | 19 MB |

| Negative Ratings Percentage | 22.7% |

| Overall Review |  |

| Update Frequency | 3-4 Months |

Here is an introductory video of the Tick Pro mobile app:

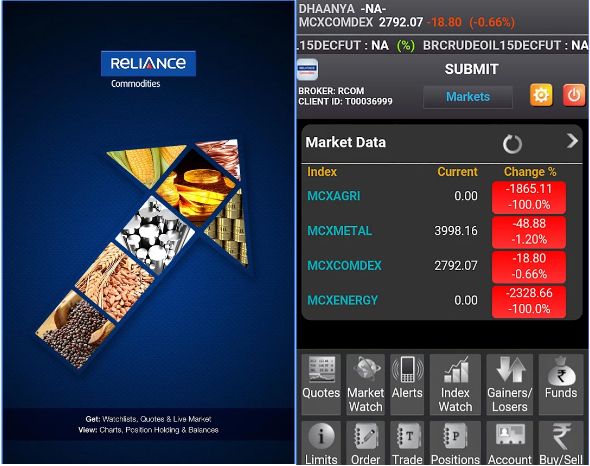

Reliance Commodities

This mobile app from Reliance Securities allows you to trade specifically in the commodities segment. This app allows you to trade along with the following mentioned features:

- Customizable market watch lists

- Live streaming of commodity quotes

- You can place Good till date, Good till cancel orders

- Real-time charts from MCX and NCDEX

- Allow you to view your order status in a real-time

- It helps you to convert and square off your open position.

This is how the mobile application looks like:

These are the stats from Google Play Store:

| Number of Installs | 10,000 - 50,000 |

| Mobile App Size | 18.1 MB |

| Negative Ratings Percentage | 13.15% |

| Overall Review |  |

Reliance Securities Insta-Plus

Insta plus is a browser-based trading platform from Reliance securities where the client just needs to enter valid login credentials to start trading. Clients can trade across multiple asset classes with the following features enabled:

- Market watch

- Market reports and tips available on the platform

- Heatmaps

- Trend matrix

The trading platform is not mobile responsive and thus, is not developed for mobile trading.

Reliance Securities – RMobile Express

RMobile Express is a mobile trading application for trading across multiple asset classes including equity, derivative, currency, etc. The mobile app allows clients to:

- View intraday charts

- Trade directly across NSE and BSE

- Check order status with information on net positions and holdings

Here are the stats of the mobile app from Google Play Store:

| Number of Installs | 10,000-50,000 |

| Mobile App Size | 61 MB |

| Negative Ratings Percentage | 12.5% |

| Overall Review |  |

Reliance Money Login

Reliance Money is the emerging brokerage firm that has recorded a good customer base.

It is working to enhance the organization structure by offering more products and services to its clients.

Anyone looking ahead to avail its services, need to start by logging in to the website through its BackOffice login page.

The Reliance Money Customer Care login is followed by a 2FA password that you can use to login to different platforms like Website log in, Android app, iOS app, back-office app.

Reliance Money Demat Account

The Relaince Free Demat Account is one that provides a safe, secure, and online way to keep track of the investment.

It holds your account in an electronic form and allows you to invest in stocks, mutual funds, bonds, and ETFs.

To open a Demat Account with Reliance Securities you can apply for it online.

- Login to the website of Reliance money and follow the steps below:

- Choosing an intermediary

- Filling up the form

- Submitting Document (PAN Card, Passport Size Photograph, Address Proof, income proof, Cancelled Cheque)

- In-Person Verification

You will get your Demat account number

Reliance Money gives you many reasons to open a Demat Account with it:

- Offer many benefits

- Free Account Opening

- Powerful Platform

- Good Customer Support

Reliance Money Customer Care

The full-service stockbroker offers multiple communication channels such as:

- Phone

- Offline locations

- Web assistance

- Webchat

With limited communication channels, the full-service stockbroker tries to provide reasonable customer service to its clients. The turnaround time for different kinds of tasks is also specified, for instance:

- Demat Account re-activation – 1 Business day

- Fund transfers – 2 Business days

- Account related information – 2 Business days

- Account updations – 3 Business days

This stipulated time period provides a sense of trust among the client base that the broker follows a specific process and their issue/concern will get resolved within a specific duration.

Reliance Money Customer Care Number

If you want to reach the Reliance Money Customer Care then you can opt for any of the methods mentioned above.

To make a call, contact them at 022 39896789, or email at customer.support@rsec.co.in

Call the customer support executive from Monday to Saturday between 8 AM to 9 PM.

For NRI customers, holding Demat Account with the Reliance Money they can raise their queries by contacting the customer care executive at +91-022-39886000 or by sending an email at nrihelp@relianceada.com

Reliance Money Research Reports

Being a full-service stockbroker, Reliance Securities provides research at multiple levels to its clients and depending on their preferences, users can pick the recommendations to use for their trades.

Specifically, this is how the broker provides research to its clients:

- Investment summaries

- Research reports (Fundamental call, trade edge, model portfolio, option strategy)

- Pre-market reports

- Future & Option calls

- R-Model portfolio (proprietary service)

Also Read: Reliance PMS

Furthermore, as far as the accuracy of these recommendations or tips is concerned, it is somewhere around average and can certainly be improved from multiple dimensions.

At the same time, the timing of these tips can be improved as well.

If you become a client of this stockbroker, notifications will be sent via SMS, email and within the trading platforms.

Reliance Smart Money Charges

Here we discuss different prices charged directly and indirectly by the full-service broker, including the ‘hidden’ charges that are not explicitly mentioned by the broker.

Here are the details:

Reliance Securities Account Opening Charges

The stockbroker charges the following amount for opening Demat and trading accounts:

| Demat Account opening charges | ₹0 |

| Trading Account opening charges | ₹950 |

| Demat Account Annual Maintenance Charges | ₹400 |

| Trading Account Annual Maintenance Charges | ₹0 |

Reliance Securities Brokerage

Here are the brokerage charges:

| Equity Delivery | 0.5% to 0.08% |

| Intraday Delivery | 0.05% to 0.005% |

| Equity Futures | 0.05% to 0.005% |

| Equity Options | ₹100 per lot |

| Currency Futures | 0.04% |

| Currency Options | ₹40 per lot |

| Commodity | NA |

Use this Reliance Securities Brokerage Calculator for complete charges and your profit.

Reliance Securities Transaction Charges

Apart from the account opening charges and brokerage, clients need to pay transaction charges as well. Here are the ones levied by Reliance securities:

| Transaction/Turnover Charges | |

| Equity Delivery | 0.0035% |

| Equity Intraday | 0.0035% |

| Equity Futures | 0.0033% |

| Equity Options | 0.063% on premium |

| Currency Futures | 0.004% |

| Currency Options | 0.06% |

| Commodity | NA |

Clients can also call and trade at ₹20 per executed order (the first 20 calls of the month are free, every time).

Other Charges

There are few other charges levied by Reliance Securities and users must be aware of these charges beforehand:

- Enquiry Charges – ₹5 per Enquiry (first 5 enquiries are free every month)

- Re-issue of welcome kit – ₹200 (Indian Resident), ₹1000 (NRI)

- Physical contract note – ₹40 per contract note

- Physical Ledger – ₹40 per statement

- Delayed Payment Interest – 21%

Reliance Securities Margin

This stockbroker provides the following margins or leverage to its clients for trading:

| Equity | Upto 10 times for Intraday, Upto 3 times for Delivery |

| Equity Futures | Upto 3 times for Intraday |

| Equity Options | No Leverage |

| Currency Futures | No Leverage |

| Currency Options | No Leverage |

| Commodities | NA |

As shown in the table above, exposure or leverage offered across segments is pretty low. Thus, users looking to exploit exposure across segments on top of their trading capital might get disappointed using the services of this full-service stockbroker.

Reliance Money Wealth Management

Reliance Money launched a wealth management service for Indian millionaires with an objective of offering 15% of its revenue from its new business.

With its services, it competed with other local firms like Motilal Oswal Financial Services, Kotak Securities, Edelweiss Capital and global firms like HSBC, Credit Suisse.

The offerings included

- Equity-Linked Portfolio Management

- Tax Planning

- Art Advisory

- Real Estate etc.

Reliance Money Disadvantages

You must be aware of some of the concerns of using the services of this full-service stockbroker:

- No trading in the commodity segment allowed

- Exposure or leverage offered is low

- Relatively expensive account opening, maintenance and brokerage charges

- Customers need to beware of some hidden charges

“There have been 8 complaints registered against the broker for this year. This converts to 0.01% of its active client base while the industry average is 0.01%.”

Reliance Money Advantages

At the same time, you get the following advantages while you open your trading account with Reliance:

- With a huge presence across the country, branches are available in almost all cities.

- Highly advanced trading platforms, especially Reliance Tick Pro.

- Aftermarket hours order placement allowed

- Quick Customer service with specified turnaround times.

Conclusion

“Reliance Securities is one of those stockbrokers that provides decent service and research along with the wide offline presence and trading products (especially Reliance Tick Pro, one of the top-performing trading applications in the country) but falls short when it comes to provides value for money services.

All the aspects the broker is good in, are available to other stockbrokers at a much cheaper price and thus, Reliance Securities has not been able to create a rapport in the market till date.

It is certainly one of the good ones but again, does not provide the kind of value you may expect upon paying such hefty charges.”

Interested to open an account? Enter Your details here and we will arrange a FREE Call back.

Next Steps:

You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of the documents required for demat account.

Reliance Securities Membership Information:

Here is the membership information of the broker with different exchanges and intermediate parties:

| Entity | Membership ID |

| BSE | INB 011234839 |

| NSE | INB 231234833 |

| SEBI | INH000002384 |

| NSDL | IN-DP-NSDL-363-2013 |

| CDSL | IN-DP-257-2016 |

| Registered Address | Reliance Securities Ltd., 11h Floor, R-Tech Park, Nirlon Compound, Western Express Highway, Landmark - Near Hub, behind Oracle Building Goregaon (East), Mumbai - 400063 Maharashtra, India. |

The details can be verified from the corresponding websites of the exchanges.

Reliance Securities FAQs:

Here are the most frequently asked questions about Reliance Securities you must be aware of:

What are the account opening charges at Reliance Money?

The full-service stockbroker is one of the expensive ones with ₹950 as account opening charges and ₹400 as annual maintenance charges. The industry standards are somewhere around ₹300 to ₹600 and thus, the broker is relatively expensive in this aspect.

What are the brokerage charges offered by Reliance Money?

In the case of the full-service stockbroker, the brokerage really depends on the kind of initial deposit you offer to the broker. Higher in the initial deposit, lower is the brokerage charge you are required to pay to your broker.

As far as numbers are concerned, you will be charged somewhere around 0.5% to 0.08% of your trade value for equity delivery trades. Mathematically, if you trade for ₹1,00,000 then your brokerage for that particular trade is ₹500.

How is the research quality of Reliance Money?

Although the broker provides multiple avenues of research at both the technical and fundamental level, the overall quality of research is just average and is not one of the tops ones as far as accuracy is concerned.

What is the customer service quality of Reliance Money?

The broker provides decent customer service with stipulated turnaround time set for different types of queries and concerns. Furthermore, the number of communication channels (both offline and online) are wide and easily accessible.

How is the mobile trading app of Reliance Money?

Reliance provides the ‘Tick Pro’ mobile app, one of the best performing mobile apps in India for trading. The app is known for its decent user experience and the number of features available in the mobile app. Check out the Trading platforms section for complete details.

Reliance Money Branch

The full-service stockbroker has a presence in the following locations through its sub-broker and franchise networks:

| States/City | ||||

| Andhra Pradesh | Vizag | Hyderabad | Guntur | Rajahmundry |

| Tirupati | Vijayawada | Bheemavaram | ||

| Bihar | Patna | Araria | Baisi | Bhojpur |

| Gopalganj | Saran | |||

| Chhatisgarh | Bilaspur | Raipur | Korba | |

| Delhi/NCR | New Delhi | Delhi | Faridabad | |

| Gujarat | Ahmedabad | Jamnagar | Bhavnagar | Vadodara |

| Surat | Junagadh | Rajkot | Dhoraji | |

| Amreli | Anand | Ankleshwar | Bhabhar | |

| Mehsana | Palanpur | Petlad | Surendernagar | |

| Haryana | Ambala | Yamunanagar | Hisar | Faridabad |

| Gurgaon | Hoshiyarpur | Rohtak | ||

| Himachal Pradesh | Bilaspur | Shimla | Solan | |

| Jammu & Kashmir | Jammu | |||

| Jharkhand | Dhanbad | Jamshedpur | Deoghar | Ranchi |

| Karnataka | Bangalore | Bagalkot | Belgaum | Bellary |

| Dhakshina Kannada | Gadag | Gajendragad | Hosur | |

| Hubli | Mangalore | Tumkur | Udupi | |

| Kerala | Trivandrum | Alappuzha | Kochi | Ernakulam |

| Idukki | Kottayam | Palakkad | Pathanamthitta | |

| Perumbavoor | Thrissur | Trichur | ||

| Madhya Pradesh | Bhopal | Indore | Damoh | Datia |

| Dewas | Gwalior | Jabalpur | Rewa | |

| Maharashtra | Nashik | Pune | Nagpur | Thane |

| Mumbai | Akola | Bhusawal | Kalyan | |

| Khed | Malegaon | Nanded | Palghar | |

| Parvai | Ratnagiri | Sholapur | ||

| Orissa | Bhubaneswar | Angul | Jharsuguda | Rourkela |

| Punjab | Moga | Patiala | Pathankot | Chandigarh |

| Amritsar | Jalandhar | Ludhiana | Rajpura | |

| Ropar | Sangrur | |||

| Rajasthan | Jhunjhunu | Jaipur | Bikaner | Kota |

| Udaipur | Jodhpur | Banswara | ||

| Tamil Nadu | Chennai | Coimbatore | Vellore | Tiruvarur |

| Erode | Kancheepuram | Kurur | Madurai | |

| Pondicherry | ||||

| Telengana | Bagalkot | Hyderabad | Karimnagar | Khammam |

| Medak | Mehboobnagar | Secundrabad | Wrangal | |

| Uttar Pradesh | Agra | Bijnor | Kanpur | Lucknow |

| Meerut | Varanasi | Allahabad | Badaun | |

| Balrampur | Banda | Bareilly | Faizabad | |

| Hathras | Jaunpur | Kanpur | Mau | |

| Noida | Pillipbhit | Rae Bareilly | Varanasi | |

| Firozabad | Ghaziabad | Gorakhpur | Hardoi | |

| Uttarakhand | Dehradun | Kashipur | ||

| West Bengal | Medinipur | Kolkata | Sodepur | Burdwan |

| Silguri | Adarpara | Asansol | Coochbehar | |

| Hojai | Howrah |

You can check out detailed comparisons of Reliance Securities Vs Othstockbrokersers:

More on Reliance Securities:

To learn more about this full-service stockbroker, feel free to check the below-mentioned links: