SHCIL

List of Stock Brokers Reviews:

SHCIL or Stock Holding Corporation of India Limited is a full-service stockbroker and has been granted as the status of a government company.

This move brings in a multi-fold level of trust in the eye of a potential trader looking to enter in the stock market investments space.

Stock Holding Corporation of India was established more than 3 decades ago, back in the year 1986 and has its corporate office in Mumbai, Maharashtra.

The broker has a relatively limited offline presence, however, if you are interested to become a partner, you have an option to open a SHCIL franchise.

SHCIL Review

There are multiple investors in SHCIL including Life Insurance Corporation (LIC), General Insurance Corporation (GIC), IFCI Limited, SU-UTI, National Insurance Academy, National Informatics Centre, UIC, and TOICL.

SHCIL is one of the very few stockbrokers in India who can boast about zero debt financials with healthy stability. The broker publishes annual reports on a yearly basis.

“As per the latest records, Stock Holding Corporation of India has an active client base of 18,026.”

SHCIL services, a member of BSE and NSE, allows you to trade and invest in the following trading segments:

Shri Ramesh N.G.S., MD & CEO, Stock Holding Corporation of India

SHCIL Trading Platforms

The trading platforms provided by SHCIL are average in performance and have limited features.

Although, one of the good parts of these trading platforms is that all these applications are in-house developed and maintained.

Thus, in case you have any query or feedback around these applications, you can directly get in touch with the broker.

The above point is being highlighted for the reason that a lot of stockbrokers outsource the technology part of the overall trading experience and users are left with third-party trading applications only.

Nonetheless, coming back to these trading platforms, we are discussing a couple of those offered by the broker.

Here are the details:

StockHolding Mobile App

SHCIL provides an in-house mobile trading application which is pretty basic in the user flow, features and overall user experience.

You can the following features while accessing this mobile application:

- Different types of order placement allowed

- Charting facility provided for in-app technical and fundamental analysis

Some of the concerns raised by existing users of this mobile app from SHCIL are:

- Regular login related issues observed

- Connection timed out concerns

- Low update frequency, which is one of the biggest concerns of this mobile trading app

This is how the mobile app from SHCIL is rated at Google Play Store:

| Number of Installs | 5,000 - 10,000 |

| Mobile App Size | 12 MB |

| Negative Ratings Percentage | 38% |

| Overall Review |  |

| Update Frequency | 10-12 Months |

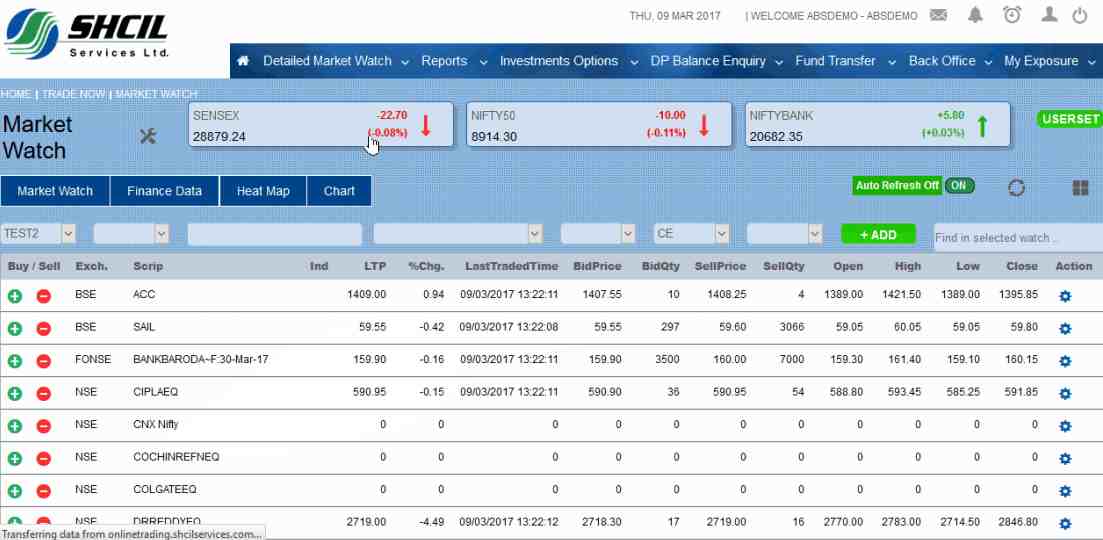

SHCIL Online Trading

You can perform online trading through the web-based application provided by SHCIL.

You don’t need to download or install any file for accessing this software – all you have to do it, click on the login link provided on the website of Stock Holding Corporation of India – enter your valid credentials and log in.

Some of the features provided in this trading application include:

- Real-time market information across indices

- Monitor stocks and investment assets using the market-watch feature

- Personalization allowed with features such as alerts and notifications as per your preferences.

- Order types such as Limit Order, SL Order, Market order allowed to be processed.

- You can view, edit or cancel different orders by using the Order Book feature.

- You can deposit, transfer funds between trading and demat accounts along with viewing the transaction report.

- Responsive web-application that allows you to use this application through a mobile phone or a tablet device.

Although, the application is pretty reasonable for beginner level traders, however, if you are an intermediate to a heavy level trader, you might hit a wall soon as far as the number of features is concerned.

Some of the problems with SHCIL Online trading are:

- A limited number of features

- Can be slow in case your internet bandwidth is low

SHCIL Customer Care

The full-service stockbroker provides the following channels of communication if you choose to be a client of this full-service stockbroker:

- Offline Branches

- Phone

- Toll-Free Number

- Fax

If you are someone who is happy with offline services by visiting the local branch or sub-broker office, then you will be satisfied with the customer support quality and turnaround time of the stockbroker.

However, if you are relying on channels such as Email or Phone, then you might have to wait quite a bit in order to get your concerns resolved.

At the same time, the technical support, especially in the case of the mobile app is mediocre in nature and it is better if you keep low expectations from the broker for such concerns.

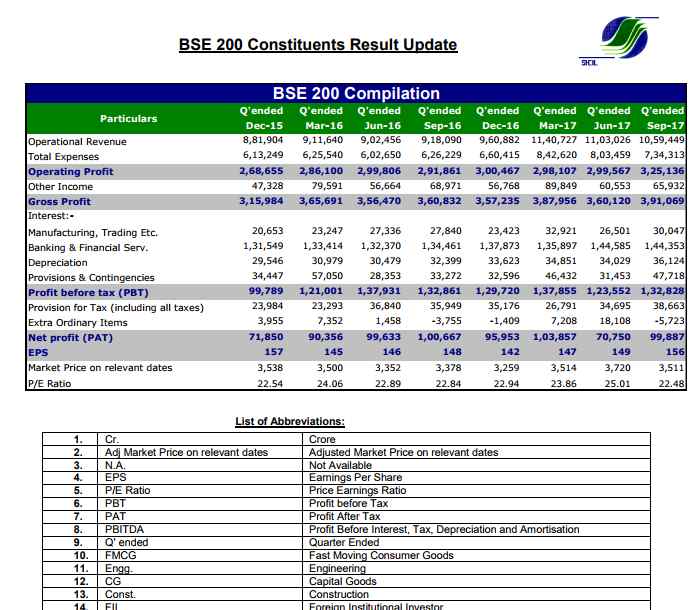

SHCIL Research

Since SHCIL is a full-service stockbroker, it will assist you with research reports and recommendations in the trades you place.

Whether you are an intra-day trader or a long-term investor, the broker provides you with all kinds of tips and reports. It’s up to you that to what extent you place your trust in the broker and makes your investments based on those tips.

One thing you always need to remember is that full-service brokers will send out a lot of tips and research to you since there is a direct benefit to them in doing that.

If you keep on trading based on most of the calls you get, you might not make a lot of profit for yourself but certainly, you will keep on generating brokerage for the stockbroker.

Nonetheless, SHCIL provides you research in the following areas:

- Upcoming Corporate Action

- FII Activities

- SHCIL Quarterly reports

The quarterly report from SHCIL looks like this:

Overall SHCIL provides average quality research and thus, users are advised to perform their own analysis before placing their money into investments.

SHCIL Pricing

This needs to be understood that whenever there will be a full-service stockbroker in question, the brokerage charges are going to be on a relatively higher side.

With the facet of services provided such as Research, Customer Support, Offline branches etc, the brokerage charges are bound to go up as the costs associated with their case are higher too.

As far as SHCIL is concerned, their brokerage is definitely on a higher side. Check out the below sections for complete details:

SHCIL Account Opening Charges

The full-service stockbroker offers you to open the demat and trading accounts for free. Furthermore, the AMC (annual maintenance charges) for the demat account is free as well.

For people who are beginners, AMC is a charge that you are required to pay on an annual basis to your broker. Some brokers charge AMC for a Demat account, some for Trading and others for both.

Here are the account related costs by SHCIL:.

| Trading Account Opening Charges (One Time) | ₹0 |

| Trading Annual maintenance charges (AMC) | ₹350 |

| Demat Account Opening Charges (One Time) | ₹0 |

| Demat Account Annual Maintenance Charges (AMC) | ₹0 |

SHCIL Brokerage

As mentioned above, the brokerage you pay to SHCIL is going to be heavy in your pocket, irrespective of the trading segment you put your money into.

Here are the brokerage details:

| Equity Delivery | 0.55% |

| Equity Intraday | 0.12% |

| Equity Futures | 0.05% |

| Equity Options | ₹100 per lot |

| Currency Futures | 0.05% |

| Currency Options | ₹100 per lot |

Understanding the way these brokerage charges work is simple.

For instance, if you trade in Equity Delivery segment for ₹1 Lakh, then with 0.55% brokerage charges you will end up paying ₹550 as brokerage charges only (and of course, there are other charges and taxes as well).

Feel free to check this SHCIL Brokerage Calculator for a complete 360-degree understanding of all the charges.

SHCIL Margins

When it comes to margins or exposure, SHCIL disappoints quite a bit. The stockbroker plays it safe and offers limited or no margin across most of the trading segments.

In fact, apart from equity intraday and delivery, you get NO leverage at all.

There is a possibility that you may negotiate with Stock Holding Corporation of India to get some leverage based on your profit patterns or initial deposit but at the upfront, you will get limited values.

Here are the leverage details:

| Equity | Upto 8 times for Intraday Upto 4 times for Delivery |

| Equity Futures | No Leverage |

| Equity Options | No Leverage |

| Currency Futures | No Leverage |

| Currency Options | No Leverage |

| Commodity | NA |

For beginner level traders, it is better to understand the way the concept of margins works. Because if you don’t and invest without much of an understanding of its risks and implications, there is a high chance that you might even lose out on your principal deposit.

SHCIL Disadvantages

Finally, let’s talk about some of the negatives (followed by positives) of opening your demat/trading account with SHCIL. Here are those listed:

- High Brokerage charges

- Low exposure or leverage provided across segments.

- Low-performance trading platforms across devices

- Customer support quality can be improved

- Commodity trading not allowed

SHCIL Advantages

At the same time, the full-service stockbroker offers the following advantages as well:

- Government-backed stockbroker and thus instils trust factor straight away

- Provides research and reports on a regular basis

- Free Demat and Trading Account provision

- Wide offline presence through sub-brokers and branches across different parts of the country

SHCIL Conclusion

SHCIL suits if you are someone who has almost no trust in any stockbroker in India and wants to play completely safe. However, in lieu of that, you must be ready to pay hefty brokerage charges, use low-performance trading platforms and customer support.

Otherwise, if you to invest once or twice for a long-term, for that case as well this full-service stockbroker suits just fine.

SHCIL Membership Information

Here are the official details of SHCIL as far as its membership with different exchanges is concerned:

| Entity | Membership ID |

| BSE | INB011253839 |

| NSE | INF231253833 |

| PMS | IN000001876 |

| CIN No. | U65990MH1995GOI085602 |

| Registered Address | Centre Point, Unit No.301, 3rd Floor, Dr. B. Ambedkar Road, Parel, Mumbai-400012 |

If you are looking to open an account, you can provide your details in the form below:

Next Steps:

You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review on documents required for demat account.

SHCIL Branches

When it comes to offline presence, SHCIL is well placed with multiple presences across different parts of India through its sub-brokers and franchise offices.

Here are the locations where this full-service stockbroker has a presence:

| States/City | ||||

| Andhra Pradesh | Tirupathi | Kakinada | Guntur | Kurnool |

| Rajahmundhry | Vijaywada | Vizag | Nellore | |

| Assam | Silchar | Guwahati | Jorhat | Tinsukia |

| Bihar | Patna | Muzaffarpur | Bhagalpur | |

| Chhatisgarh | Bilaspur | Raipur | Bhilai | |

| Chandigarh | Chandigarh | |||

| Goa | Panaji | |||

| Gujarat | Ahmedabad | Anand | Bharuch | Vadodara |

| Bhavnagar | Gandhidham | Gandhinagar | Jamnagar | |

| Junagadh | Mehsana | Navsari | Porbandar | |

| Rajkot | Patan | Surat | Visnagar | |

| Haryana | Ambala | Gurgaon | Karnal | Panchkula |

| Himachal Pradesh | Solan | Shimla | ||

| Jammu & Kashmir | Jammu | |||

| Jharkhand | Jamshedpur | Bokaro Steel City | Dhanbad | Hazaribagh |

| Ranchi | ||||

| Karnataka | Bangaluru | Belgaum | Hubli | Mangalore |

| Udupi | Davangere | Bagalkot | Bellary | |

| Dharwad | Hassan | Hubli | Gulbarga | |

| Karkala | Kundapur | Shimoga | Mysore | |

| Raichur | ||||

| Kerala | Kochi | Kottayam | Thrissur | Trivandrum |

| Kannur | Kollam | Kozhikode | ||

| Madhya Pradesh | Bhopal | Gwalior | Indore | Ujjain |

| Jabalpur | ||||

| Maharashtra | Amravati | Aurangabad | Chandrapur | Ichalkaranji |

| Nashik | Pune | Nagpur | Nanded | |

| Jalgaon | Kolhapur | Mumbai | Nashik | |

| Navi Mumbai | Sangli | Yawatmal | ||

| New Delhi | Delhi | |||

| Orissa | Bhubaneswar | Cuttack | Rourkela | |

| Punjab | Amritsar | Bathinda | Jalandhar | Ludhiana |

| Moga | Mohali | Patiala | Phagwara | |

| Rajasthan | Ajmer | Alwar | Bikaner | Jaipur |

| Udaipur | Jodhpur | Kota | Ganganagar | |

| Tamil Nadu | Chennai | Coimbatore | Erode | Madurai |

| Trichy | Karaikudi | Karur | Salem | |

| Pondicherry | Trichy | Tuticorin | ||

| Telangana | Hyderabad | Nizamabad | Secunderabad | Warangal |

| Tripura | Agartala | |||

| Uttar Pradesh | Agra | Allahabad | Ghaziabad | Gorakhpur |

| Lucknow | Meerut | Varanasi | Mughalsarai | |

| Noida | ||||

| Uttarakhand | Dehradun | Haldwani | Haridwar | |

| West Bengal | Haldia | Naihati | Kolkata |

More on SHCIL

For more information on SHCIL, here are a few references for you:

Sir,

With deep sorrow it is to mention that after a long persuation of 8 months through registered post by complaint letter, this SHCIL, Bhilai branch is not bothering to rectify the grievances of 20 year long associated customer in the case of NPS and their branch manager are thinking as if they are in govt job . So do not try to get associated with SHCIL .