Shriram Insight

List of Stock Brokers Reviews:

Shriram Insight is a retail full-service stockbroker based out of Kolkata along with a registered office in Chennai. Established under the Shriram group back in 1974, Shriram Insight has a presence in around 200 cities of India with 700 overall locations.

Looking at the size of the business revenue, the offline coverage of the broker is pretty solid. If you are interested to become a part of this business, you could join in as Shriram Insight Franchise.

Nonetheless, let’s have a quick look at how this full-service stockbroker works, it’s trading applications, brokerage charges, margin values, branches and other related information.

Shriram Insight Review

The full-service stockbroker has an active client base of 30,619 from multiple cities of India with an overall base of 185,000.

Furthermore, it has running memberships with BSE, NSE, MCX, CDSL, NSDL, RTA and allows its clients to trade and invest in the following segments:

- Equity

- Derivative Trading

- Margin Trading,

- Commodity Trading

- Depository services

- Distribution of financial products

- Mutual funds

- IPO

- ETFs

- Currency Trading

- Fixed Deposits

As you can observe, there is a wide range of trading and investment products offered by Shriram Insights and that basically helps to keep all your financial requirements with this financial house itself, without running any chaos of managing multiple accounts.

Shriram Insight Trading Platforms

The full-service stockbroker offers different trading softwares across devices. Here are the details:

Shriram Netpro Desktop platform

This desktop-based trading platform needs to be downloaded and installed on your computer or laptop. Once you download the EXE file, you need to follow few steps to install the software.

Once done, put in your valid credentials and you can start trading. Some of the features of this trading application include:

- Streamline real-time market data

- Personalized market watch with an option to add stocks, commodity, futures and options in a single watchlist

- Different types of intraday charts to perform technical and fundamental analysis

- You can set alerts and notifications to get info on your email or phone

- Access to research and recommendations across sectors, industries, indices etc.

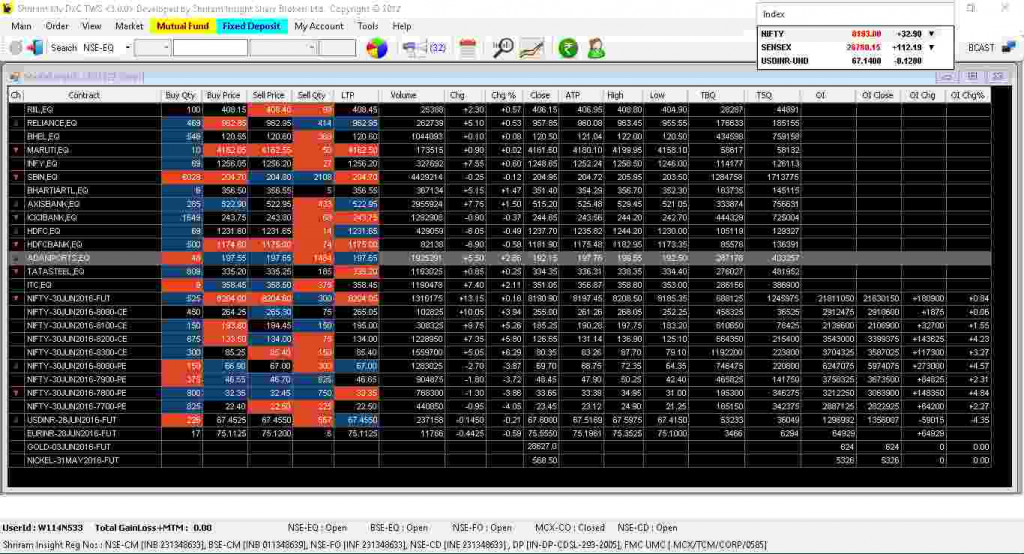

This is how the application looks like:

Shriram Netpro Browser platform

This web-based browser application is pretty lightweight and gives you a decent trading experience for your investments across segments. At the same time, this is a responsive application allowing you to use the software across devices including mobile or tablet devices.

Some of the features of this application include:

- Multiple types of order placement possible

- Works well even with basic machine configuration through browsers such as Google Chrome, Mozilla, Safari etc.

- Investing in mutual funds, IPOs allowed along with other mainstream investment products.

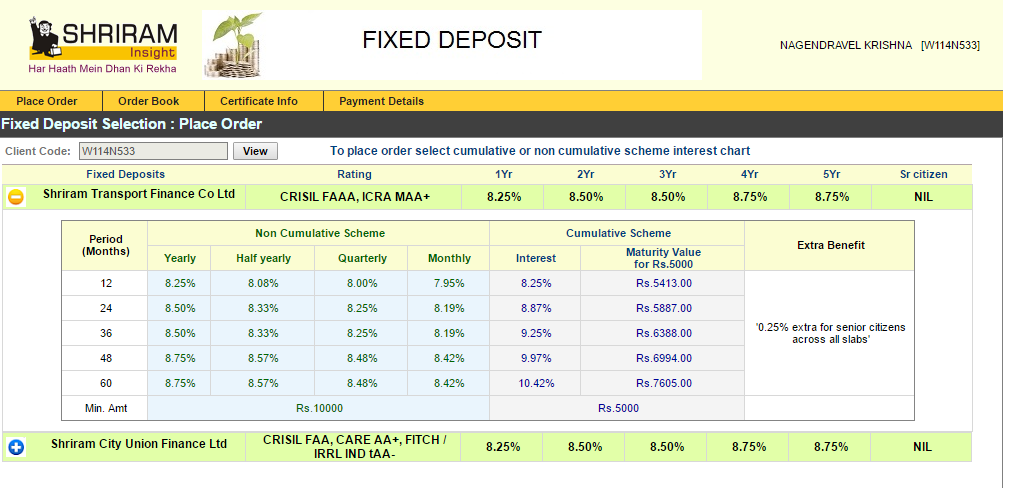

This is how this web-based browser application from Shriram insights looks like:

Shriram Netpro

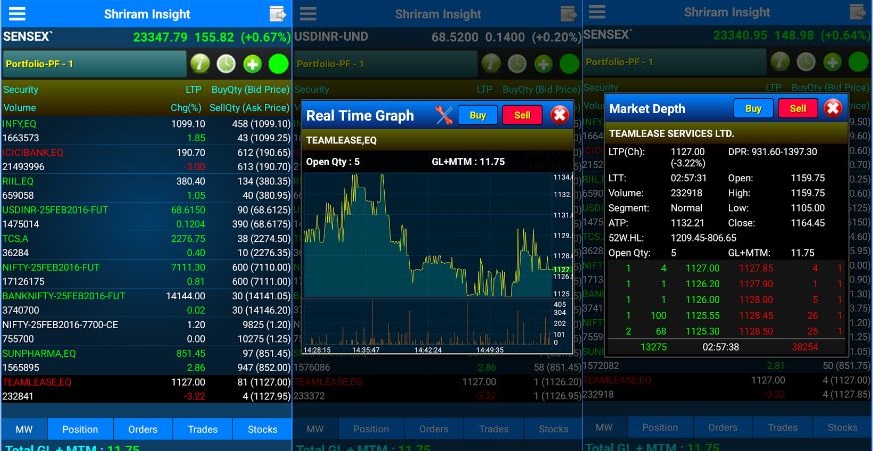

The full-service stockbroker also provides a mobile trading app to its clients that come with the following aspects:

- Easy order execution

- Basic charting functionality for technical and fundamental analysis

- Marketwatch with a provision to add up to 20 scrips in each MarketWatch

- Portfolio tracking

At the same time, some of the concerns of this mobile app include:

- Low-quality user experience and design

- IPO investments or commodity trading not allowed through the mobile app

- App hangs or crashes at times

Here are the stats of the mobile app from Google Play Store:

| Number of Installs | 50,000+ |

| Mobile App Size | 2.10 MB |

| Negative Ratings Percentage | 10.7% |

| Overall Review |  |

| Update Frequency Cycle | 2-3 months |

Shriram Insight Customer Service

The full-service stockbroker provides you with the following communication channels, including:

- Phone

- SMS

- Offline locations

- ‘Ask Your Query’ web form

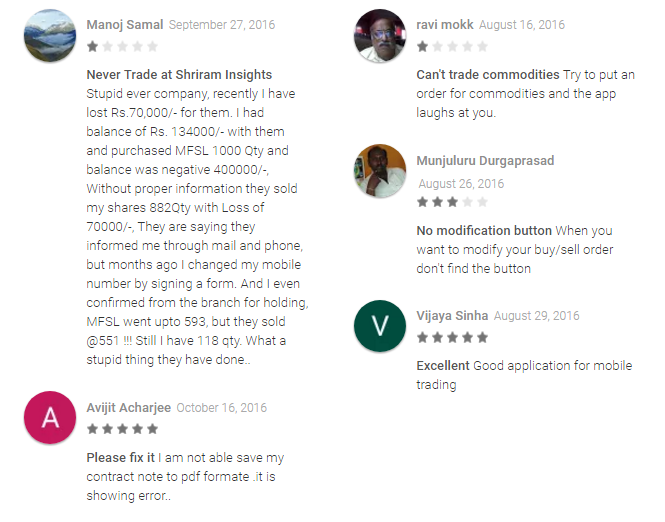

Response and turnaround time are two big issues with the customer service aspect of Shriram Insight. For instance, here is a reference from Google Play store feedback page for this broker:

As shown in the screenshot above, there is not even a single instance where the broker’s customer service team has even cared to respond to the crucial feedback provided. This is not a small gap in the proceedings and the broker must realize the importance of the voice of the customer.

Similarly, other communication channels such as a Toll-free number, a quick web chat facility can be added, especially when there are stock brokers in India that are utilizing advanced service concepts such as automated bots (MO genie for instance).

Therefore, as of now, it will not be wrong to tag the customer support aspect of this broker to be somewhere around mediocre, if not below average.

Shriram Insight Research

This full-service stockbroker provides the following technical and fundamental research products to its clients across different trading segments, as shown:

- Latest Research Update

- Equities

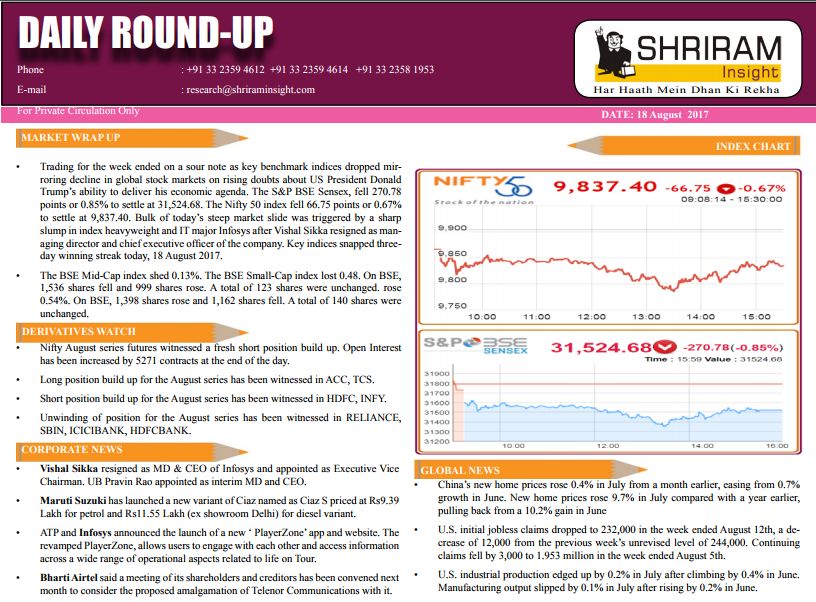

- Daily roundup

- Weekly roundup

- Monthly report

- Special report

- Quarterly report

- Economist view

- Commodities

- Daily roundup

- Weekly roundup

- Special report

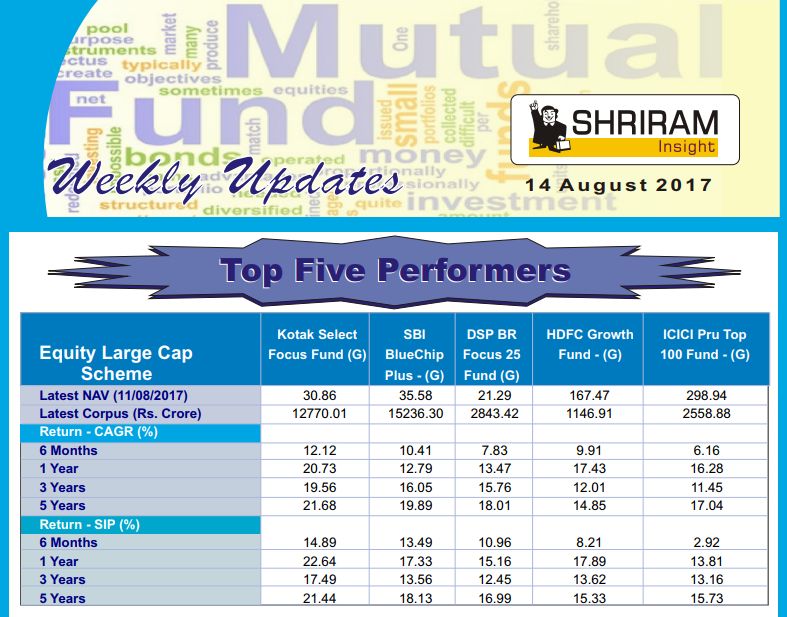

- Mutual Funds

- Weekly roundup

- Monthly report

Here are a couple of samples of such reports for your reference:

The broker does a decent job when it comes to the regularity of these research reports and recommendations and makes sure users get access to these reports at the right time. However, the accuracy of these tips can be improved to go along with the visibility of their research team. Once the latter point gets better, it can potentially improve the trust factor among the user base.

For now, it’s advised to perform your own analysis to go along with the research provided by the full-service stockbroker.

Shriram Insight Pricing

When it comes to pricing, Shriram Insight a pricing structure based on your initial margin amount and certainly, your negotiation skills. Let’s talk about different charges one by one:

Shriram Insight Account Opening Charges

Opening an account with this full-service stockbroker is free while there are few charges to maintain your Demat account with the broker. Also, there are few other charges too as mentioned below:

| Trading Account Opening Charges | ₹0 |

| Demat Account Opening Charges | ₹0 |

| Commodity Account | ₹0 |

| Annual Maintenance Charges | ₹290 |

| Dematerialization Charges | ₹3 per certificate |

| Rematerialization Charges | CDSL Charges + ₹100 per request |

| Pledge | 0.02% of Trade value (minimum ₹25) |

Shriram Insight Brokerage

When it comes to brokerage, although the executives initiate the conversation from 0.5% for delivery trades and 0.05% for intraday trades. However, following are the brokerage charges generally charged by the broker across the segments:

| Equity Delivery | 0.3% |

| Equity Intraday | 0.03% |

| Equity Futures | 0.03% |

| Equity Options | ₹50 per contract |

| Currency Futures | 0.03% |

| Currency Options | ₹50 per contract |

| Commodity | 0.03% |

These values can still be further lowered if you start with a higher initial margin and use your negotiation skills on top of it.

In order to give you a quick idea of how these brokerage charges work, let’s take a quick example. For instance, you placed a trade of 50 shares of Alpha Tech. Each share of Alpha Tech costs ₹1000,

Total transaction value would be ₹1000 X 50 i.e. ₹50,000.

To keep things simple, let’s say you placed this trade at an intraday trade level.

As mentioned above, the intraday brokerage charges are 0.03% of the trade value.

Total Brokerage: ₹50,000 X 0.03% i.e. ₹15 for that particular trade.

Remember, this is the brokerage charge for just the buy-side of the trade. A similar brokerage charge will be levied on the sell trade as well.

Use this Shriram Insight Brokerage Calculator for complete calculation of charges and your profit.

Shriram Insight Transaction Charges

Apart from the above-mentioned charges, the full-service stockbroker charges the following payments from its clients (however, most of these are the index, DP or government based taxes):

| Segment | Transaction Fee |

| Equity Delivery | NSE: 0.00325% | BSE: 0.00325% |

| Equity Intraday | NSE: 0.00325% | BSE: 0.00325% |

| Equity Futures | NSE: 0.0025% |

| Equity Options | NSE: 0.065% (on premium) |

| Currency Futures | NSE: 0.00165% |

| Currency Options | NSE: 0.06% |

| Commodity | Non-Agri: 0.0031% |

Shriram Insight Margin

You can use the concept of exposure on top of your trading margin, however, with Shriram insight, the leverage values provided are pretty low. Here are the details:

| Equity | Upto 2 times for Intraday |

| Equity Futures | Same as Trading account margin |

| Equity Options | Same as Trading account margin |

| Currency Futures | Same as Trading account margin |

| Currency Options | Same as Trading account margin |

| Commodity | Same as Trading account margin |

At the same time, exposure or leverage is pretty risky a concept and it is advised that in case you do not know or understand the intricacies of it, it’s better to avoid its usage at all.

Conclusion

Shriram Insight gives decent trading platforms at a reasonable price, however, the broker seems to be missing the trick when it comes to customer service, exposure and research. And all these gaps are the potential strengths of a full-service stockbroker.

Shriram Insight Disadvantages

Here are few concerns about opening an account and trading through Shriram Insight, as listed below:

- Low exposure offered

- Research accuracy can be improved

- Low-quality service

Shriram Insight Advantages

At the same time, here are the pros of opening your account through this full-service stockbroker:

- Free account opening

- Reasonable brokerage charges

- Decent performing trading platforms

- Good focus on technology

- Wide range of trading and investment products

- Funds transfer facility available to more than 40 prominent banks of India

Looking to Open an account?

Provide your details in the form below and a callback will be set up for you, right away:

Once you get the callback, the following documents will be required to carry forward the account opening process:

- Bank account proof (cancelled cheque, bank statement, passbook)

- Copy of PAN card

- Passport size photographs

- Address proof

- Account Opening Form

For more information, you can check this detailed review of documents required for Demat account.

Shriram Insight Membership Information

Here are the details of the membership of Shriram Insight with different stock market entities:

| Entity | Membership ID |

| BSE | INB 011348639 |

| NSE | INF 231348633 |

| SEBI | INB 231348633 |

| NSDL | IN-DP-NSDL-311-2009 |

| CDSL | IN-DP-19-2015 |

| RTA | INR000004132 |

| MCX | INZ000078739 |

| SISBL | U67120TN1995PLC031813 |

| Registered Address | Mookambika Complex, 4 Lady Desikachary Road, 4th Floor, Mylapore, Chennai-600004 |

More on Shriram Insight:

If you wish to know more about this full-service stockbroker, here are a few references for you: