Trade Smart Online

List of Stock Brokers Reviews:

Trade Smart Online (or TSO) or called just Trade Smart is a discount stock broker based out of Mumbai and is a venture from VNS Finance.

VNS Finance has been around the financial block in the country for the last 20 years or so with a presence in Full-service broking as well, however, Trade Smart Online is their Discount Broking arm.

Trade Smart Online Review

Recently, the discount stock broker has come up with a couple of margin related products (more details below) and if you are looking to use exposure in your trading, those can certainly be a matter of interest to you.

It has a client base of around 21,179 and claims to do a daily turnover of ₹2500 Crore. The broking firm allows its clients to trade across different segments including:

- Equity,

- Derivatives Trading

- Currency Trading

- Commodities Trading

- Depository Services

“Trade Smart Online, under the parenthood of VNS Finance, has around 30,000 active clients by 2022.”

The broker is known for multiple brokerage plans for its clients with different variations. There are percentage-based plans, trade level flat-rate plans and zero brokerage unlimited trading plans. This allows flexibility for users to pick a specific plan based on their trading behaviour, frequency, and capital.

Vikas Singhania, Executive Director – Trade Smart Online

Trade Smart Online Trading Platforms

Trade Smart Online has an array of trading platforms in the form of NEST Trader (Omnesys supported), NOW (NSE supported) and SPIN (TSO in-house trading platform) along with the mobile app.

Open the TradeSmart Demat Account to make the best use of its trading platform.

Here we go into detail one by one:

NEST Trader

NEST is the conventional trading platform supported by Omnesys technologies. Like many other stockbrokers, Trade Smart Online is licensed to use it through its clients. It comes in all forms including an installable file, a browser-based version, and the mobile app.

In the EXE version, the clients can download and install the software on their desktops or laptops while in the browser-based version they can just visit a specific URL, enter their valid login details to start trading.

This terminal-based software comes with the following features:

- Multiple types of Charts available for technical and fundamental analysis along with different data points on the intraday and historical level.

- Various Market watch lists allowed for users to monitor specific stocks

- Users can set alerts and notifications based on different conditions as per user preferences.

- Decent speed and performance across different features of the application

This is how the application looks like:

At the same time, there are a couple of concerns using this application:

- Relatively bulky and requires decent configuration of the laptop or desktop you are going to use.

- The user experience of the application can be improved. It can be difficult to use initially, especially for trading beginners.

For the mobile app, NEST is available on both Android and iOs platforms to carry out trading on the go.

Trade Smart Online SINE Mobile App

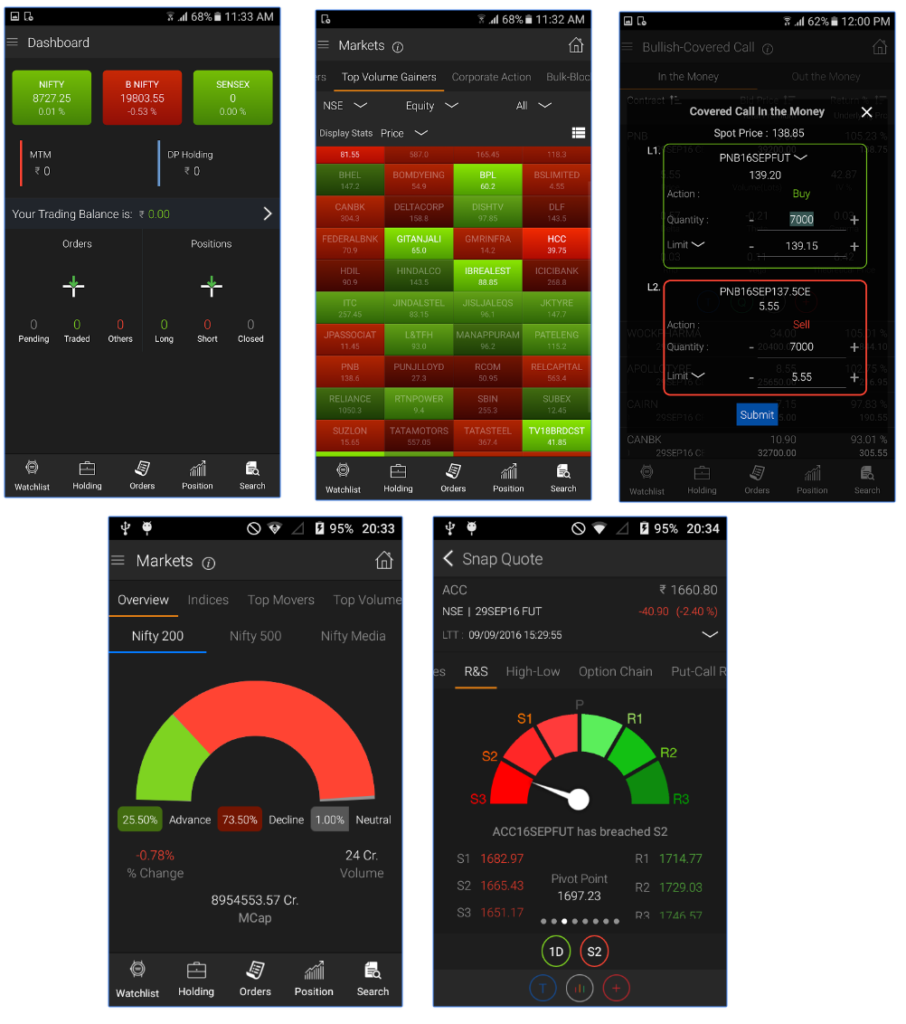

At the same time, there is a mobile app SINE that carries the following features:

- Trading across segments such as Equity, Futures and Options, Currency Derivatives and Commodities possible through the mobile app.

- Multiple types of market scanners and options strategies available within the mobile app

- For detailed analysis, you have the option to use technical indicators such as MACD, Moving Avg, RSI, Bollinger Bands, Parabolic SAR

- Fund transfers to 28 banks allowed

- Additional features such as Market Watch, Index watch, Interactive charts, Market Analytics

Screenshots (Mobile app):

There are a few concerns with this mobile application as well:

- A limited number of features

- App freezes or hangs at times, especially if you are using a basic configuration mobile device

- Some rare issues with the login functionality observed

Here are the mobile app stats from the Google Play Store:

| Number of Installs | 50,000+ |

| Mobile App Size | 11 MB |

| Negative Ratings Percentage | 28% |

| Overall Review |  |

| Update Frequency | 5-6 weeks |

| Android Version | 4.4 and Up |

| iOS Version | 9.0 and Up |

NOW

Much like NEST, Now is also an array of trading platforms across Desktop, Web and Mobile. NOW is supported by NSE itself and Trade Smart Online has been issued a license for its clients to use the same.

Again, clients can start trading either through the trading terminal by downloading and installing the EXE based version or can directly browse through the web version.

NOW also provides a mobile app version that carries the following features:

- Real-time streaming quotes are available instantaneously

- Highly user-friendly experience with top usable features

The app has been downloaded by more than 50,000 clients and is rated at 4.1 at the Android Play store.

Trade Smart Online Spin

Spin is one of the recent addition in software from the Trade Smart online in-house team. This is a terminal-based software that users can download and install on their desktops or laptops. This probably seems to be another step towards building in-house technology-based trading platforms after the SINE mobile app.

The trading platform has the following features:

- Trading directly from charts where clients can view, modify, cancel and place trades

- Advanced charting with more than 80 in-built technical indicators and 10 different charting styles including Bar, Renko, Candle-stick etc.

- Built-in pattern detection system with the power to recognize 19 different pattern styles

- Code your own strategy features lets you build your own strategy using visual studio

The terminal software is relatively bulky and lags quite a bit when it comes to user experience.

Trade Smart Online Customer Care

With TSO, you get the following communication channels:

- Phone

- Social Media

- Online support ticketing

As it can be seen that the communication channels are limited in number, however, the quality of service is also not that great. One major area that Trade Smart Online needs to push itself is the customer servicing department. The executives must be trained and the emphasis must be put on two things – Quick Turnaround time and high-quality resolution.

“At the end of the day, it is not just about acquiring new clients but also making sure the existing clients stay active and satisfied.

If that is not happening, the business is not looking for long-term growth and is just busy in completing monthly targets.”

Trade Smart Online Funds Transfers

There are three ways of funds transfers to your trading account:

- Payment Gateway – by using this option you can quickly transfer funds from your bank account to your trading account. This payment gateway can be used through NEST or NOW trading applications offered by the discount broker.

- Funds transfers using NEST will have a charge of ₹8 per transfer, with a minimum transfer value of ₹100 and a maximum of ₹5000.

- Similarly, funds transfer done using NOW are free of charge and have no minimum or maximum limitations.

- NEFT/RTGS – Like you make any funds transfers to other bank accounts using NEFT service, the same way funds can be transferred from any linked bank to your trading account.

- Cheque – then there is this slow and cumbersome way of depositing a cheque as well.

At the same time, for payouts, a request can be made using the trading platforms (either NEST or NOW) or through the back office. Your withdrawal request will be processed on the same trading day with the NEFT/RTGS service.

Trade Smart Online Pricing

When it comes to pricing, there are multiple components that you need to take care of. Let’s discuss all such components one by one:

Trade Smart Online Account Opening Charges

Here are the account opening charges levied:

| Demat Account Opening Charges | ₹200 |

| Trading Account Opening Charges | ₹200 |

| Demat Account Annual Maintenance Charges (AMC) | ₹300 (First Year Free) |

| Trading Account Annual Maintenance Charges (AMC) | ₹0 |

Looking at the charges, account opening and maintenance look at a reasonable level.

Trade Smart Online Brokerage

The discount broker has multiple brokerage plans depending on user trading habits and preferences. At a basic level, there is a VALUE Plan (Suitable for traders who trade less but do it at a higher trading capital) where the following brokerage charges are levied:

| Equity Delivery | 0.07% |

| Equity Intraday | 0.007% |

| Equity Futures | 0.007% |

| Equity Options | ₹7 per lot |

| Currency Futures | 0.007% |

| Currency Options | ₹7 per lot |

| Commodity | 0.007% |

“Call and Trade facility is available at ₹20 per executed trade.”

Then there is Power Plan (This plan is suitable for heavy traders who trade for larger volume as well as higher trading values):

| Equity Delivery | ₹15 per executed order |

| Equity Intraday | ₹15 per executed order |

| Equity Futures | ₹15 per executed order |

| Equity Options | ₹15 per executed order |

| Currency Futures | ₹15 per executed order |

| Currency Options | ₹15 per executed order |

| Commodity | ₹15 per executed order |

Finally, there is Infinity Plan (This plan is optimal for the traders who trade in small chunks of capital, no limitation on the number or volume of trades):

| Equity Delivery | ₹3999 per month for Unlimited Trades |

| Equity Intraday | ₹15 per executed order |

| Equity Futures | ₹15 per executed order |

| Equity Options | ₹15 per executed order |

| Currency Futures | ₹1999 per month for Unlimited Trades |

| Currency Options | |

| Commodity | ₹3999 per month for Unlimited Trades |

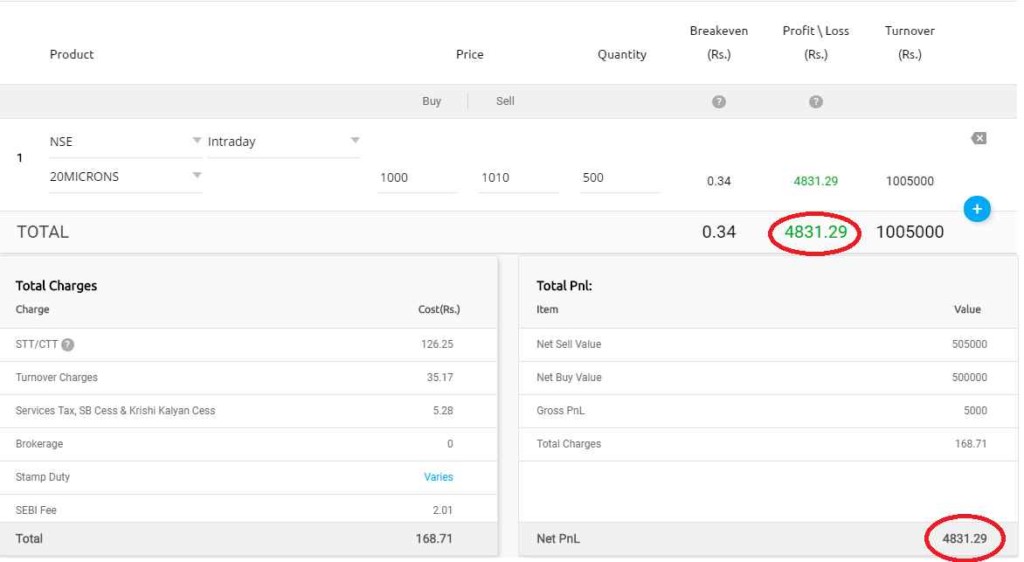

Use this Trade Smart Online Brokerage Calculator for complete charges and your profit

Trade Smart Online Transaction Charges

TSO charges you the following transaction charges as shown:

| Equity Delivery | 0.00350% |

| Equity Intraday | 0.00350% |

| Equity Futures | 0.00240% |

| Equity Options | 0.07150% |

| Currency Futures | 0.00165% |

| Currency Options | 0.06000% |

| Commodity | 0.00390% |

If you look closely and compare the transaction charges levied by the discount stockbroker, you would realize that Trade Smart Online unnecessarily charges higher transaction charges.

This is a practice followed by a few stockbrokers where they attract clients showing low brokerage charges and actually recover it by charging higher values elsewhere. In this case, the discount broker is charging at least 15%-20% higher transaction charges than the values set by the exchange.

Thus, make sure to have a detailed discussion and negotiation with the executive of the discount broker.

For complete details about TradeSmart brokerage and other charges. To give you an idea of the complete charges and your overall takeaway from a trade, here is a snapshot:

Trade Smart Online Margin

Here are the exposure or intra-day leverage details:

| Equity Delivery | Up to 4 times |

| Equity Intraday | Upto 30 times |

| Equity Futures | Upto 5 times |

| Equity Options | Upto 5 times |

| Currency Futures | Upto 3 times |

| Currency Options | Upto 3 times |

| Commodity | Upto 5 times |

Now within exposure set up, the discount stock broker has recently introduced a concept named – Equimax. With this, you can take leverage of up to 4 times. in other words, you can trade up to ₹40,000 with an initial capital of ₹10,000 itself. To use the facility of EquiMax, you have to take care of the following:

- It is currently available in the NSE cash segment only

- The offering is applicable for the value (0.007%) and power plans (₹15 per executed trade) only

- There is an annual subscription charge of ₹1000 to use this facility

- The account needs to be settled at least once in a quarter

- To avail this, you are required to have ₹25,000 as minimum ledger balance with a cap of ₹20 lakh available funding per client.

Equimax is one of its own kind of a leveraged product and can certainly be used if you understand the intricacies and risks associated with the concept of exposure.

At the same time, the discount stock broker also offers MAS (Margin Against Shares), another exposure-related product where you can use high leverage values by keeping your shares as collateral. Some of the features of MAS include:

- The collateral value of your shares will be calculated with a hair-cut

- The list of scrips available for pledging under MAS has about 850 stocks

- Cost of pledging is kept at ₹60 per scrip without any limitation on the number of stocks

- Like in the case of EquiMax, the offering is applicable for the value (0.007%) and power plans (₹15 per executed trade) only.

Trade Smart Online Disadvantages:

Here are some of the concerns when you use this discount stock broker for your trades in the stock market:

- No Portfolio management services

- Provision to invest in Mutual funds, IPOs or FPOs not available

- Transaction cost in Equity options and currency options is pretty high

- Customer executives need better skills and professional training

- Low focus on providing in-house trading solutions

“Trade Smart Online has received 1 complaint from its clients in this financial year 2019-20.”

Trade Smart Online Advantages:

At the same time, here are some of the merits this discount stockbroker has to offer to its clients:

- Recent initiatives towards developing in-house technology-based trading platforms is a good sign for clients

- Flexibility in brokerage plans allow clients to choose the brokerage as per their trading preferences

- No requirement for a minimum balance amount to open an account

- Reasonable exposure, especially with the introduction of EquiMax and MAS (more details in the Exposure section above)

- ‘Bracket Orders‘ with an option of ‘Trailing Stop loss‘ for both Equity and F&O available for unlimited trading plan users.

Here is a quick link to the TradeSmart Refer and earn plan if you wish to refer any of your friends and family to this stockbroker. Ofcourse, you will make money by doing so.

Conclusion:

“At the end, Trade Smart Online is the good ones within discount broking space. But at the same time, it seems that they are more or less part of the herd that was created with the wave of discount broking in India. Setting up a sales team, offering low brokerage with the help of outsourced trading platforms shows high business opportunity but less responsibility towards clients.

If they want to place themselves in the industry, they certainly need to build solutions in the technology space that offer the best of trading experience to their clients.

Furthermore, the customer service team must be skilled and trained in such a way that the client base stays satisfied and is not left hanging in the middle.”

How to Open a Demat and Trading Account?

Enter Your details below and get a FREE call back.

Next Steps:

Post this call, You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months, cancelled cheque

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for Demat account.

Trade Smart Online Membership Information

Here are the details on the different membership details of the stockbroker:

| Entity | Membership ID |

| BSE Capital Markets | INB010964337 |

| BSE F&O | INF010964337 |

| NSE Capital Markets | INB230964330 |

| NSE F&O | INF230964330 |

| MCX | 16830 |

| NCDEX | 0502 |

| Registered Address | A-401, Mangalya, Marol, Near Marigold Residency, Andheri East, Gamdevi, Marol, Andheri East, Mumbai, Maharashtra 400059 |

The details can be verified from the corresponding entity websites.

Trade Smart Online FAQs

Here are some of the most frequently asked questions about Trade Smart Online you must be aware of:

Is Trade Smart Online a reliable broker? Is it safe?

Although Trade Smart Online is relatively new, the discount broker is a trading arm of VNS finance. This finance group has around for a while now and was established back in the 1990s. Thus, from the brand perspective, it certainly can be trusted.

At the same time, when it comes to trading using its platforms, there have been few instances reported about their performance. Client’s discretion is recommended.

How many complaints have been reported against TSO?

The parent group of the discount broker, VNS finance has seen 5 complaints about this financial year until May 2017 (in 2 months that is) which is basically 0.05% of their total client base.

The industry standard is around 0.15%, thus, the broker is certainly better than the industry average complaint percentage.

Which plan of Trade Smart Online is suitable for me?

It really depends on multiple factors such as your trading frequency, behaviour, capital etc.

Let’s take some instances into consideration:

- If you place relatively less number of trades over the month, with low trade value, then you should opt for the Value plan. In this plan, a specific percentage of your trade value (0.07% for delivery) will be charged as brokerage.

- If you trade relatively less number of trades over the month, with high trade values, then you should opt for the Power plan. In this plan, you will be charged ₹15 per executed order, irrespective of the trade value.

- Then, if you are a trader, who trades very frequently over the month with high trade values every time, then you can opt for the Infinity plan. In this plan, you will be charged a specific price for the whole month (depending on the segment you pick) without any cap on the number of trades you place or the amount of overall trade value.

Thus, it all really depends on your trading style at the end of the day.

How are the trading platforms of Trade Smart Online?

The discount stock broker a mix of in-house and out-sourced trading platforms.

However, the ones developed and maintained by the broker still need some time and innovation to show some maturity in terms of performance and exhaustiveness. Thus, it is suggested that you must use NEST or NSE Now for your trading if you are a client of the broker.

What is the account opening and maintenance charges at Trade Smart Online?

The account opening for this discount stock broker is ₹200 each for trading and Demat account, totalling ₹400 as the account opening charges. At the same time, the maintenance charges are at ₹300 every year, the first year being free.

Is Trade Smart Online the cheapest stock broker in India?

Trade Smart Online is a cheap stockbroker and is almost there in the cheapest brokerage range, but not the cheapest one. There are a lot of other discount stock brokers in India that offers brokerages in the range of ₹9-₹15. Furthermore, some of them have even lower account opening, account maintenance, and transaction charges.

How many active clients Trade Smart Online has?

Trade Smart Online has an active client base of 21,179 until 2018.

You can check out detailed comparisons of Trade Smart Online Vs Other stockbrokers here:

More on Trade Smart Online:

If you wish to learn more about this discount broker, here are a few reference links for you: