TradeBulls

List of Stock Brokers Reviews:

TradeBulls is a full-service stockbroker based out of Mumbai. The full-service stockbroker was established in the year 2009 and has more than 1000 employees on its rolls.

As of now, the broker has a presence in 18 locations through its sub-broker and franchise offices.

The broker has a major presence in the states of Gujarat and Maharashtra and is looking to increase its coverage in other parts of the country.

TradeBulls Company Review

Let’s understand how well it is going for the broker.

It has memberships with NSE, BSE, MCX-SX, MSEI, NCDEX and MCX and allows clients to trade across the following segments:

- Equity

- Commodity Trading

- Currency Trading

- Derivatives

- IPO

- Personal Loans

- Insurance

- Portfolio Management

- Mutual Funds

“Tradebulls has an active client base of 69,501 for the financial year 2019-20.”

TradeBulls Owner

Dinesh Chhagganlal Thakkar, CEO & MD – TradeBulls

TradeBulls Trading Platforms

Here are the details on different trading platforms offered by this full-service stockbroker to its clients. All the platforms have been developed in-house and get upgraded on a continuous basis.

To access these platforms open the Tradebulls Demat Account.

TradeBulls Web Trading

TradeBulls Client is the web-based browser trading platform where users can directly login with valid username and password and start trading. There is no need to download or install any software in this and can be used across devices including Mobile, Desktop, Laptop or tablet.

It comes loaded with the following features:

- Multiple windows in a single screen allowed for quick analysis

- Lightweight and requires basic internet connection

- Live market streaming

- Research and recommendations available

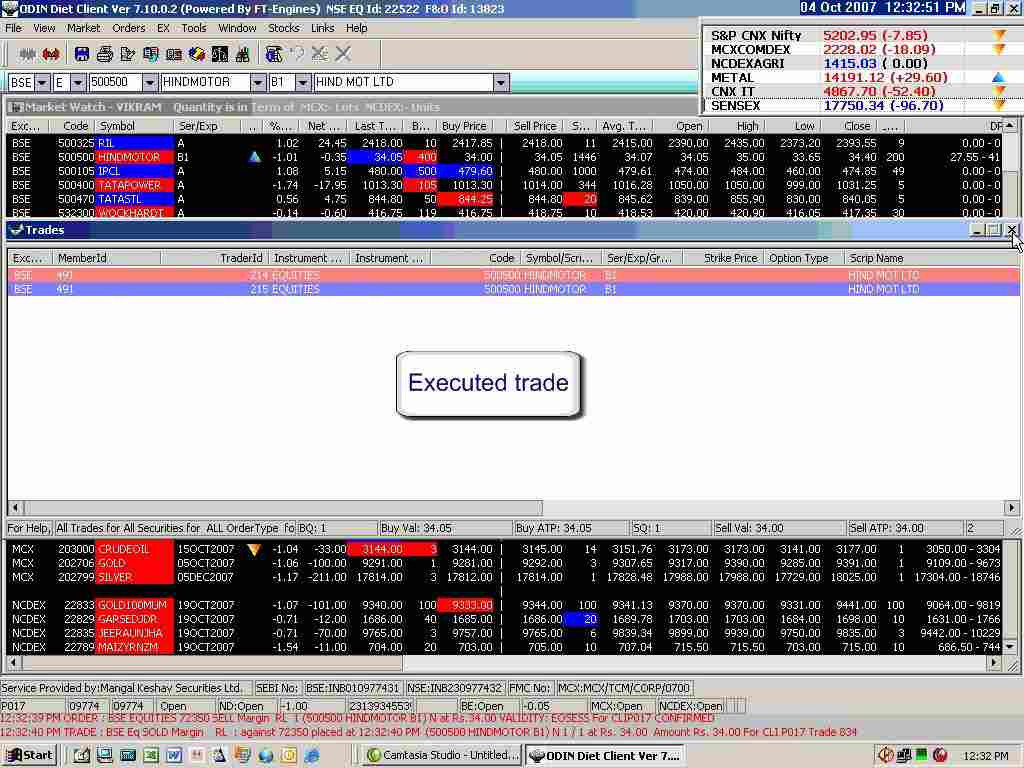

TradeBulls Diet

TradeBulls Diet is a trading terminal-based software best suitable for heavy traders who are looking to spend long hours in trading.

It is a high-performance platform which can be installed on a user’s laptop or desktop. Here are some of its features:

- Suitable for traders looking for high speed and performance especially in order execution

- Real-time quotes streaming provided

- Users provided with views of multiple exchanges in a single screen

- Users allowed to transfer funds from multiple banks

This is one of the views of the trading application:

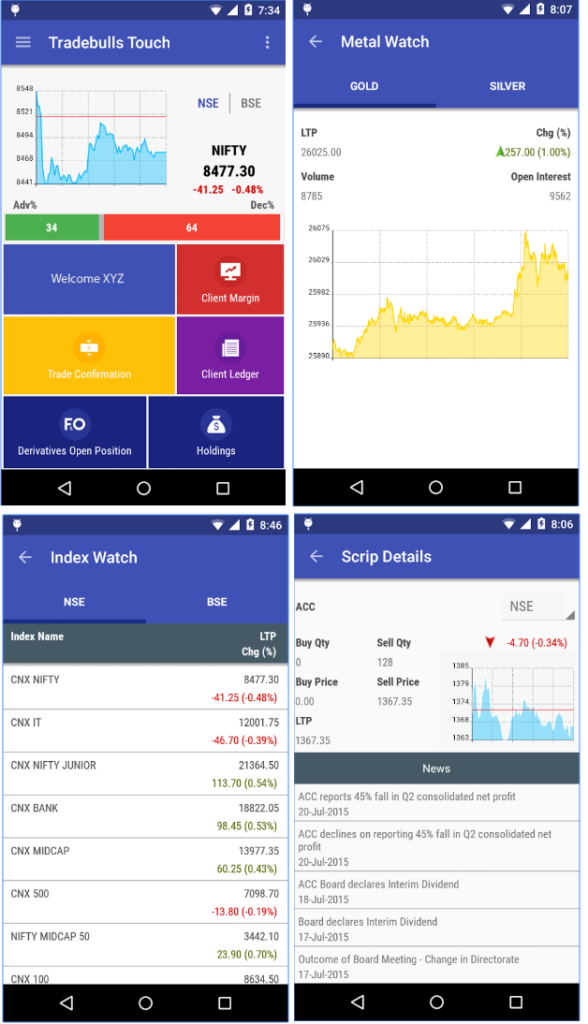

TradeBulls Touch

Tradebulls Touch is the mobile app from the full-service stockbroker. The app is rated at a mediocre level and provides an average performance to clients.

Here are some of the features provided by the mobile app:

- Track your trades and investments

- View stock market details like Index Watch, Global Watch, Metal Watch, News and Mutual Funds

- Place calls directly to your Relationship Manager

- View reports like Ledger, Holdings, Margin, Trade details, Derivatives and Open Position.

- Send service requests

Here are some of the screenshots of the mobile app:

Here are stats of the mobile app from the Google Play store:

Tradebulls Customer Care

The stockbroker provides the following channels of communications to its clients as listed below:

- Offline branches

- Phone

Generally, clients keep high expectations from full-service stockbrokers when it comes to customer support, but in the case of Tradebulls, customer service quality is below the industry average.

To give you a perspective, the broker has received around 70 feedbacks at Google play store and not even a single feedback has received a comment or acknowledgement from the broker, forget the resolution.

Furthermore, the broker lags in providing a consistent turnaround time to clients for different types of queries.

This is what generally expected from a professional stockbroker but this stockbroker seems to be a misfit as of now in this particular aspect.

Tradebulls Research

The full-service stockbroker provides research to its clients at the following levels with the corresponding frequency cycles:

- Daily Research Reports

- Daily Call Evaluation

- Weekly Research Reports

- Daily Newsletter

As far as accuracy is concerned, the stockbroker till now has failed to impress its clients with its accuracy, regularity and performance.

The recommendations and tips are provided through channels such as SMS, Email and also trading platforms across devices.

Depending on the segment you are interested in, corresponding research can be used for your order executions.

Users are suggested to perform their own analysis and not trust Tradebulls’ research as it is for their order executions since the feedback received from its existing client base is not positive by any standards.

TradeBulls Trading Charges

There are different costs associated when you start your trading journey. Here are the details listed:

TradeBulls Account Opening Fees

You can get your trading and demat account with this full-service stockbroker for free. Furthermore, the AMC charges are pretty nominal as shown below:

You can get your Annual maintenance charges waived off forever by paying INR 550 upfront.

TradeBulls Brokerage

Even though Tradebulls is a full-service stockbroker, still the brokerage it charges is pretty reasonable in nature. The way it works it simply too.

For instance, if you are trading in Equity Delivery segment and your overall trade value is ₹1,00,000 then you will be required to pay a brokerage of ₹200 at 0.2%.

Similarly, in other segments, corresponding brokerage charges will be calculated.

Here are the details:

Use this Tradebulls Brokerage Calculator for complete charges and your profit.

TradeBulls Transaction Charges

Like Account related payments and brokerage charges, the full-service stockbroker charges transaction charges at a reasonable level too.

There are few stockbrokers in India that take advantage of marketing low account opening or brokerage charges and compensate by transaction charges to an extent.

This stockbroker is not like such stock brokers though.

TradeBulls Margin

The full-service stockbroker provides exposure at an average level and plays safely.

We must inform you that although exposure or leverage has all the potential to bring lucrative returns, it is a risky concept too.

Thus, unless you understand the implications and risks of exposure, it’s better to avoid using it.

Tradebulls Payment

The Tradebulls payment process can be done at both online as well as offline levels. For online, you can perform fund transfers through the back-office or by using any of the trading apps.

For offline, you can either provide a cheque or deposit the amount to the sub-broker around your area. However, with such deposits make sure you take a receipt as well. Otherwise, the payment, if does not reach the record, might not be counted.

Tradebulls Payin

When it comes to Tradebulls Payin, following details need to be considered by the clients of this broker:

Tradebulls Fund Transfer

If you are looking to perform fund transfer, it can be done with the help of any of the trading apps mentioned above including Tradebulls App, Web & Terminal Software.

This fund transfer can be done with the help of the backoffice application too.

Here are the bank account details for your reference:

TradeBulls Disadvantages

Let’s talk about some of the concerns if you use this full-service stockbroker for your stock market trading:

- Low rating of mobile app implying few performance concerns with the app

- Be wary about the hidden charges

- Mediocre research quality across fundamental and technical levels

- Low-quality customer service

“Tradebulls has received 2 complaints about 2019-20 with the complaint percentage of 0.01% with respect to its active client base.

The industry average is just 0.01%. Thus, the full-service stockbroker needs to work in providing much better service to its existing client base and reduce the complaint percentage.”

TradeBulls Advantages

Also, you will get these benefits if you go ahead and open an account with this full-service stockbroker:

- Wide array of trading and investment segments for customers

- In-house developed trading platforms

- Reasonable brokerage within full-service stockbroking space

Conclusion

“Tradebulls is a recently established full-service stockbroker (the Year 2009) and is low cost in nature.

Be it account opening, maintenance, brokerage or transaction charges, the broker charges pretty nominal values. Thus, if you are looking for a low-cost full-service stockbroker, Tradebulls is certainly an optimal choice.

However, apart from cost, the broker does not really provide many values to its clients.

Be it exposure, trading platforms, customer service or research – the full-service stockbroker fails to impress its client base and provides average quality service across these facets.”

Interested in Opening an Account?

Enter your details and we will arrange the Free Call Back!

Next Steps:

You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review on Documents required for demat account.

Tradebulls Account Opening Form

If you are looking to open a demat account, you can provide your details in the form below:

However, for Tradebulls account opening, you can download this Tradebulls Account opening form.

Tradebulls Account Closure Form

If you are looking to close demat account, here is the Tradebulls Account Closure form for your reference.

Tradebulls Membership Information:

Here is the membership information of the broker with different exchanges and intermediate parties:

The details can be verified from the corresponding websites of the exchanges.

Tradebulls Address

If you are looking for the address of this full-service stockbroker, then it is located at:

Tradebulls House,

Sindhu Bhavan Road,

Bodakdev, Ahmedabad,

India -380054

Tradebulls Branches:

The full-service stockbroker is present in the following locations across different parts of the country:

Tradebulls DP Id

This full-service stockbroker is a member of CDSL and has the following DP Id:

Equity & FO: 12070200, Client ID: 00000192

Commodity: 12070200, Client ID: 00174469

TradeBulls Working Days

The stockbroker works 6 days a week i.e. Monday to Saturdays. Although the stock market is open 5 days a week, the broker works on one of the weekends.

However, the broker remains closed in line with the Indian Stock Market Holidays.

Tradebulls FAQs:

Here are some of the most frequently asked questions about this full-service stockbroker:

Is Tradebulls a reliable stockbroker? Is it trustable?

Although it is a full-service stockbroker, it’s not a long time since its establishment.

The broker is in a growing phase and needs to work on multiple aspects including the performance of trading platforms, accuracy of research and quality of customer service.

Thus, the broker is certainly trustable but needs to work on its reliability among its client base. That aspect is still missing.

What is the account opening charge at Tradebulls? How about AMC or annual maintenance charges?

There is no account opening charge at Tradebulls. Be it trading account or demat account, the account opening is free.

As far as AMC or annual maintenance charges are concerned, you are required to pay ₹350 every year. Thus, from the account perspective, the broker is one of the reasonable ones in the industry.

For more information, refer to the ‘Pricing’ section above.

Is Tradebulls suitable for beginner traders?

Not really. The broker as of now is just reasonable in its pricing but every other aspect is ‘work-in-progress’. Beginner traders require quite a bit of initial handholding, be it research, customer service, platforms etc.

This full-service stockbroker lags in all these aspects and needs to tighten up its values to its clients.

Thus, as of now, Tradebulls is one of the stockbrokers that is not recommendable for beginner traders.

How is the customer service quality of Tradebulls?

With limited communication channels, the quality of messaging and turnaround time – all customer support mechanisms need to see an overhaul.

Support executives must go through extensive training programmes on a regular basis to keep the overall communication quality consistent and at par with industry standards.

For more information, refer to the ‘Customer Service‘ section above.

What is the quality of research of Tradebulls?

Although the stockbroker has set up a process for its research as of now there are gaps in accuracy, regularity and performance of the tips and recommendations provided by the stockbroker.

For more information, refer to the ‘Research’ section above.

What trading and investment products are provided by Tradebulls?

This full-service stockbroker offers a wide range of the following trading and investment products to its clients such as Equity, Commodity, Currency, Derivatives, IPOs, Personal Loans, Insurance, Portfolio Management and Mutual Funds.

Thus, with all these options, clients do not need to open separate accounts with other financial houses.

You can check out detailed comparisons of Tradebulls Vs Other Stockbrokers here:

More on Tradebulls:

If you are looking to know more about this full-service stockbroker, here are a few reference links: