TradeJini

List of Stock Brokers Reviews:

TradeJini is a discount stockbroker that was incorporated in 2012. This stock broking company has an accreditation from BSE, NSE, MCX and MCX SX and offers its clients to trade across multiple segments.

TradeJini Review

At the same time, the customer can reap the benefit of the Tradejini Demat Account through CDSL. TradeJini claims to have more than 10,000 clients from more than 1000 locations of the country.

The broking firm was founded by Kishore Kumar J and Dinesh Kumar M and presently the firm has its corporate office in Bengaluru, with an employee strength of around 60.

With this discount broker, you can trade and invest in the following segments:

- Equity

- Derivative Trading

- Currency Trading

- Commodity Trading

- Mutual Funds

- Debt Instruments

From L-R: Dinesh Kumar M, Kishore Kumar J (Founders, TradeJini)

TradeJini Trading Platforms

TradeJini offers different trading platforms to its clients based on their preferences and requirements.

The worrisome part with this discount broker on this point is that it does not have anything to offer when it comes to in-house trading applications. All of the softwares offered are licensed applications through NSE.

“The concern with 3rd party softwares is that control of maintenance does not lie with Tradejini. It’s up to the tech team of NSE when to update the applications with new features.”

Here are the details:

NEST

NEST is a complete trading solution for heavy traders. The software can be installed on a desktop or laptop and traders can carry out trading at a really quick speed.

Some of the top features of the platform are:

- Real-time access to market quotes and trends

- A highly encrypted and secure trading environment with two-level authentication

- Place, modify or cancel orders

- View Order book, Trade book and position book

Here is a demo video of one of the features:

NSE Now

NSE Now is another trading platform offered by this discount broker that can be accessed from any browser without any installation or download.

This web-based platform is basically an offering from NSE to which this discount broker has subscribed through a license. With this license, this stockbroking firm allows its clients to use NSE NOW for trading services.

The platform is pretty flexible and hassle-free in terms of usage and trading experience. Some of the features of the platform are:

- Clients can access NSE servers directly without any third-party server intermediation. This helps the clients to trade at a pretty quick execution speed.

“Funds transfer with more than 25 banks allowed while using the services of Tradejini.”

- Notifications and alerts are available as per clients preferences and trading patterns. Clients can choose to get notifications on mobile phones by SMS or email.

- Access advanced technical charts to make an objective judgment before trading or investing.

NSE Mobile Trading App

TradeJini allows its clients to trade using the NSE Mobile Trading app, an app developed by Dotex International.

Although the app is offered through NSE, the credential details are provided by the stockbroking firm in content, in this case, which is TradeJini.

Some of the features this app is loaded with are:

- Comprehensive market trends and monitoring information

- Real-time quotes, market watch and charts available

- Detailed information on market movers both on the gainers as well as losers sides

Here are some of the screenshots of the app:

Some of the concerns with this mobile app are:

- Low update frequency cycle

- Sub-quality user experience

- No new technical incorporations

Here are the stats about the mobile app from Google Play Store:

| Number of Installs | 1,000,000 - 5,000,000 |

| Mobile App Size | 37.4 MB |

| Negative Ratings Percentage | 13.9% |

| Overall Review |  |

| Update Frequency Cycle | 1 year |

TradeJini Customer Care

The discount broker offers limited communication channels in the form of:

- Phone

- Social Media

Now the concern does not stop at the limited number of communication channels only. But the overall service quality is below par. It can be understood that discount brokers generally do not provide high-quality customer service, but in case of Tradejini, things are completely south – be it the time taken to resolve the concern, communication quality, executive training and so on.

TradeJini Funds Transfer

There are multiple ways for you to transfer funds into the trading account:

- ATOM Gateway

With this facility, users have the option to transfer funds across 25 banks of the country with instant credit. This is charged at ₹9 plus service tax for each transaction.

- NEFT/RTGS

Using this service, users can transfer funds to the HDFC account of Tradejini. This is a free service but the transfer completion takes some time.

Similarly, payouts can be done using the back-office itself.

“Each fund transfer with the Atom gateway service is charged at ₹9 plus the service tax”

TradeJini Charges

Let’s discuss the pricing of Tradejini one by one. Make sure to understand different aspects of pricing even including STT, Taxes, transaction charges, stamp duty etc. unless you want to get surprised later. Here we go:

TradeJini Account Opening Costs

Here are the account opening costs with TradeJini:

| Demat Account Opening Charges | ₹300 |

| Trading Account Opening Charges | ₹695 |

| Demat Account Annual Maintenance Charges (AMC) | ₹300 |

| Trading Account Annual Maintenance Charges (AMC) | ₹0 |

TradeJini Brokerage

At a basic level, here are the brokerage charges TradeJini levies on its customers. Since TradeJini is a discount broker, the size or value of the transaction does not really matter. Here are the details:

| Equity Delivery | ₹20 per executed order or 0.10% of Turnover whichever is lower |

| Equity Intraday | ₹20 per executed order or 0.01% of Turnover whichever is lower |

| Equity Futures | ₹20 per executed order or 0.01% of Turnover whichever is lower |

| Equity Options | ₹20 per executed order |

| Currency Futures | ₹20 per executed order or 0.01% of Turnover whichever is lower |

| Currency Options | ₹20 per executed order |

| Commodity | ₹20 per executed order or 0.01% of Turnover whichever is lower |

“In case you are looking for Call and trade option, ₹20 per executed order will be charged.”

For complete details on TradeJini Brokerage and other charges, click HERE.

Use this Tradejini Brokerage Calculator for complete charges and your profit.

TradeJini Transaction Charges

Apart from the brokerage, account opening and maintenance charges, you need to pay transaction charges and taxes to the stockbroker. Here are the details on the charges levied:

| Equity (Cash & Delivery) | 0.00325% |

| Equity Futures | 0.0020% |

| Equity Options | 0.053%(on Premium) |

| Currency Futures | 0.00125% |

| Currency Options | 0.0435%(on Premium) |

| Commodities: MCX | 0.0030% |

| DP Transaction charge | ₹15 /Debit Transaction |

| Dial & Trade | ₹20 per executed order |

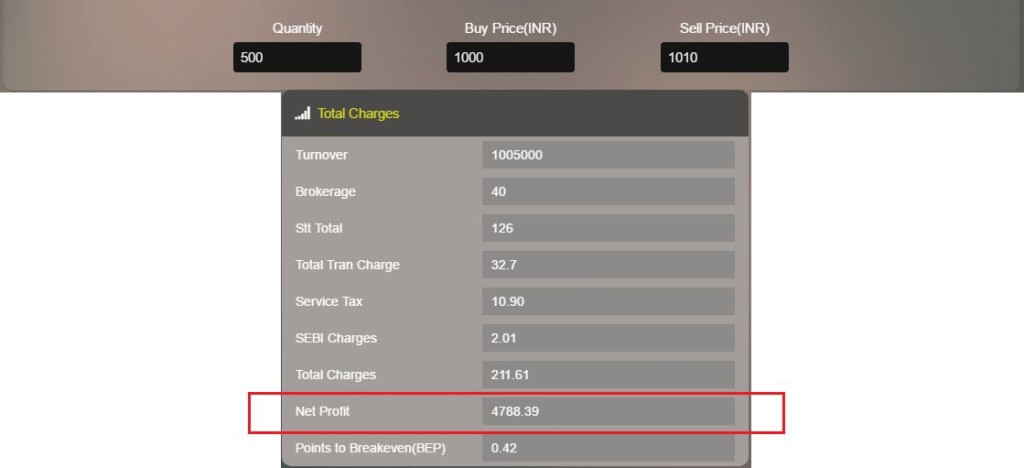

To provide you with a snapshot of the brokerage and complete charges for a specific trade using Tradejini, here is a screenshot:

TradeJini Margin

Here are the exposure or intra-day leverage details:

| Equity Delivery | No Leverage |

| Equity Intraday | Normally 4-10 times with stop loss upto 20 times |

| Equity Futures | Normally 2.5 times with stop loss upto 5 times |

| Equity Options | Buy side – 100% margin ; Sell side – Margin like Futures required. Exposure normal 2.5 times |

| Currency Futures | Normally 2.5 times with stop loss upto 5 times |

| Currency Options | Buy side – 100% margin ; Sell side – Margin like Futures required. Exposure normal 2.5 times |

| Commodity | 3 times for Intraday |

Tradejini Disadvantages

Here are some of the concerns about this discount broker that you must be aware of:

- For commodities trading, only non-agriculture based commodities allowed

- No facility to invest in IPOs, Fixed deposits, FPOs, NCDs etc

- Trust factor needs to be gained by the broker.

- No focus on in-house trading platforms development. This is one big concern as they rely 100% on NSE or Financial technologies based trading platforms.

- Customer Service needs to be improved at multiple levels.

Tradejini Advantages

At the same time, here are the benefits of using the services of this discount broking firm:

- Instant Fund PAYIN feature that allows the customer to transfer from 28 prominent banks of the country.

- A unique Client referral program that allows existing clients to earn 10% on the brokerage generated from the referred clients

- Low Brokerage charges

- No turnover commitment or minimum deposit or minimum contract charge

Conclusion

“Tradejini is one of the decent stockbrokers when it comes to pricing, exposure, transaction charges, pay-ins and so on.

Thus, if you have been around in the stock trading space for a while then certainly it is one of the economical options for you to consider.

But if you are a beginner and still looking for tips and recommendations, in that case, either you can opt for full-service stockbrokers or discount stockbrokers such as 5Paisa or Fyers that provide assistance in tips and research to their clients.”

How to open a Demat and Trading Account?

Enter Your details below and get a FREE call back.

Next Steps:

Post this call, you need to provide few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months, cancelled cheque

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

Frequently Asked Questions about Tradejini (FAQs)

Here are some of the frequently asked questions about Tradejini:

Is Tradejini Reliable? Is it safe to open an account with Tradejini?

Well, Tradejini has been around for 5 years now but still has a long way to go as far as building its own brand and a sort of trust factor among clients and prospect customers are concerned.

Yes, they have a decent number of offerings but when it comes to owning responsibilities such as developing and maintaining in-house trading platforms, providing quick customer service – some of these areas are a little grey.

All of its trading platforms are outsourced, customer service is majorly salsy in nature and is not able to resolve client queries in quick time. Thus, as of now, reliability is tough to claim.

What is the account opening charge at Tradejini?

Even though Tradejini is a discount stockbroker, but it still charges close to ₹1000 for opening a Demat and Trading account from its clients. Check out the ‘Pricing section’ above for further details.

Is Tradejini the cheapest stock broker in India?

The discount broker charges ₹20 per executed order across segments. It is a cheap brokerage rate but not the cheapest by any means. There are brokers such as 5Paisa or Prostocks that charge brokerage in the range of ₹10 and ₹15 respectively. Check out this detailed article on Lowest Brokerage Charges in India for more details.

What is Equity Intraday exposure provided by Tradejini?

Exposure at Tradejini is provided in a wide range, depending on your trading history, overall turnover and negotiation skills. It varies between 4 to 10 times and in rare cases, it has even touched up to 20 times as well.

At the same time, it is advised that unless you understand the intricacies of usage of exposure or leverage, it’s better not to use it. It has the potential of eating up your capital if you use it without caution and understanding.

Does Tradejini provide research and tips?

Tradejini is a conventional discount stock broker and does not provide any kind of research reports or tips to its clients. Thus, you will have to perform your own fundamental or technical analysis or you may choose to hire professional research and advisory service.

At the same time, the discount broker launched an initiative called ‘Jiniversity‘ where users can learn about the

basics and fundamentals of trading and investing in a passive way. This is helpful for beginners and small investors and is available for free at Tradejini’s website.

How is the mobile trading app of Tradejini?

Tradejini does not really have its own in-house developed mobile app and they primarily rely on the NSE mobile trading app for its clients.

The app is maintained by the technical team of the index and thus, in case a client has any feedback or comment towards the mobile app, it can’t be fixed through Tradejini.

That particular concern is always going to stay as long as the discount broker does not set up its own mobile trading app.

At the same time, the NSE mobile app is a decent performing one with multiple features, good speed. User experience and design are couples of concerns with the application though.

How do I close my account at Tradejini?

Closing a demat account is relatively tougher than opening an account with most of the stockbrokers, including with Tradejini. You are required to go through some basic steps, fill up some forms etc. Here is a detailed step by step understanding on how to close your demat account.

Also, check out the detailed comparison of Tradejini with other stockbrokers:

More on Tradejini:

If you want to learn more about this discount broker, here are a few reference links for you: