Wisdom Capital

List of Stock Brokers Reviews:

Wisdom Capital is one of the evolving discount stockbrokers in India. The major value proposition this stockbroker has to offer is its leverage across the trading segments, especially when it comes to Intraday trading.

Of course, being a discount broker it provides low-brokerage trading as well but leverage is definitely a bigger differentiator.

Let’s chalk down some more details about this broker in this review.

Wisdom Capital Review

Incorporated recently in the year 2013, Wisdom Capital is a discount stockbroking company in India. A subsidiary of Ashlar Group of Companies (established 1996), Wisdom Capital has memberships with NSE, BSE, MCX – SX, MCX and USE with which it allows its clients to trade across:

- Equity

- Futures Trading

- Options Trading

- Currency Trading

- Commodity Trading

- Depository Services.

“Wisdom Capital has an active client base of around 7,619 only.”

Although Wisdom Capital is a discount stockbroker, it has an offline franchise coverage in 250 locations across the country, thus, supporting both online trading as well as broker supported trading. As far as the brokerage is concerned, Wisdom capital charges a fixed periodic fee (more on that later).

There are multiple brokerage plans offered at trade, monthly, yearly and lifetime level. Further, the broker is known to provide high exposure values across the segments.

Deb Mukherjee, CEO – Wisdom Capital

Wisdom Capital Apps

Wisdom capital has almost no focus when it comes to developing and maintaining their in-house trading platforms.

They rely 100% on the softwares by stock exchanges and thus, in a way shy away from one of the major responsibilities of setting up a brokerage house.

Here you can find the details on the different platforms ‘licensed’ by Wisdom Capital:

NEST Trader

Wisdom capital employs Nest, which is a trading platform licensed through NSE that can be downloaded and installed on the user’s laptop or desktop. This trading terminal connects to a highly robust server that takes minimal time in fetching latest data along with the trading provision. It comes loaded with the following features:

- Interactive Charting with multiple indicators at an intraday, comparative and historical level.

- Market watch to go with order placement and risk management

- Alerts and notifications as per set by the user

- Hourly Statistics and heat maps for quick technical analysis and judgment

NEST is known to be one of the most mature trading platforms with an exhaustive number of features, multiple setups for your technical or fundamental analysis. The user experience of the application, however, can be improved to an extent.

Furthermore, this trading platform is a 3rd party software and is not maintained or developed by Wisdom Capital.

BSE Bolt

BSE Bolt is a trading application by BSE on trade across the stocks listed on it. The trading software has been there for a while and is regularly updated in terms of usability and functionality. It comes with the following features:-

- Live reports with information on highest gainers and losers, advances or declines in stock values with layouts for the last 52 weeks.

- Bulk deals, block deals and margin trading

- Surveillance on market trends with Price Monitoring

Like in the case of NEST, this application is also a third-party software and is not maintained by the discount stockbroker.

“Wisdom Capital does not really focus much on developing its own trading platforms and offers 3rd party softwares from NSE and BSE.”

NSE NOW

NSE Now is again a trading platform from NSE except the fact that this is a web trading application and is responsive in nature. Users don’t need to download or install this application but can directly access it as well. Registered clients get login credentials before they start trading with Wisdom Capital.

The application is compatible across browsers and users can access it from anywhere be it desktop, mobile, tab or laptop.

Here is the demo video of the integrated trading platform:

Wisdom Capital is coming up soon with Trading Platform – Alpha Trading. More developments on that soon. Here is an introductory video for reference:

NSE Mobile App

For users who prefer to carry out their trading through a mobile app, the discount stockbroker provides the NSE Mobile App. As most of the trading platforms offered by the broker, this app is also an outsourced trading application and is maintained by NSE itself.

The mobile app comes with the following features as shown:

- Multiple features available

- Different types of orders allowed

- Charting and technical indicators available for fundamental and technical analysis.

- Basic UI with very fewer updates

Here are the stats of the mobile app from Google Play Store:

| Number of Installs | 1,000,000 - 5,000,000 |

| Mobile App Size | 37.4 MB |

| Negative Ratings Percentage | 13.9% |

| Overall Review |  |

| Update Frequency Cycle | 1 year |

This mobile app is used by multiple stockbrokers who either don’t have a mobile app of their own (such as Wisdom Capital) or their own mobile app is low performing.

Wisdom Capital Customer Care

The discount stockbroker offers the following communication channels to its clients:

- Toll-Free Number

- Phone

- Web Form

- Chat

The number of communication channels is wide but customer service quality is pretty ordinary. The discount broker can certainly work in specific service areas such as turnaround time, quality of messaging, the skill set of executives, hold time and the final resolution quality of queries raised by clients.

A lot of users have complained about the professionalism of the executives where the general tone of communication is ‘salsy’ in nature.

Wisdom Capital Charges

In this Wisdom Capital Review, we will talk about different charges levied by Wisdom Capital – as listed here:

Wisdom Capital Account Opening Fees

Here are the account opening charges explained below:

| Trading Account Opening Charges | ₹0 |

| Demat Account Opening Charges | ₹0 |

| Trading Account Annual Maintenance Charges | ₹0 |

| Demat Account Annual Maintenance Charges | ₹999 Lifetime |

“If you want to arrange a pick-up of forms from your home or office, additional charges of ₹500 per segment will be levied to your account.”

Wisdom Capital Brokerage Charges

There are 3 plans offered by Wisdom capital to its clients based on their trading needs and habits. The most prominent one is the ‘Freedom Plan’ which is charged per trade, monthly and overall lifetime level.

Here are the details:

| Default Brokerage | ₹9 per executed Trade |

| Monthly Charges | ₹999 for unlimited trades |

| Lifetime Charges | ₹9999 for unlimited trades |

Wisdom Capital Plans

There is a Pro plan that stays at trade level itself and charges ₹9 per executed order. Then, there is the Ultimate plan where clients are charged a percentage commission of 0.01%.

Finally, the broker offers a Lifetime Freedom plan where you have to pay ₹1947 for a one time charge and you can trade for free for your complete stay with Wisdom Capital. In this plan, the user has the options of:

- Free usage of NEST Trading platform

- Relatively better customer service

- Option to Upgrade Advance Add-on Tools

Use this Wisdom Capital Brokerage Calculator for complete charges and your profit.

“Call and Trade charges stay at ₹20 per executed order or at ₹500 per month for unlimited trades.”

Wisdom Capital Transaction Charges

Apart from the account opening fees and brokerage charges, here are the transaction charges levied by BSE or NSE (depending on the traded index):

| Segment | Transaction Charges |

| Intraday | 0.00325% |

| Futures | 0.00300% |

| Delivery | 0.00325% |

| Equity Options | 0.0590% |

| Currency Futures | 0.00175% |

| Currency Options | 0.00175% |

| Commodities | 0.00300% |

As per industry standards and the norms set up by Wisdom Capital charges relatively higher brokerage charges from its clients across the segments. Thus, be wary of all kinds of charges and make sure to have a detailed discussion on all kinds of charges levied on you before you open the account with the broker.

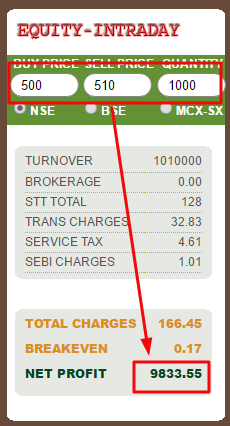

Just to provide you with an idea of how the overall charges are calculated by Wisdom Capital, let’s take an example.

For instance, if you bought 1000 shares of Infosys at ₹500 each and sold all the shares for ₹510 within the same trading day, this is how your overall charges will be calculated along with your takeaway profit:

“Hard copies of contract notes are charged at ₹20 per contract along with extra courier charges.”

Wisdom Capital Margin

Wisdom Capital provides the following margin values to its clients depending on the traded segment:

| Segment | Margins |

| Intraday | 5 times to 40 times depending on the Brokerage plan |

| Futures | 5 times to 20 times depending on the Brokerage plan |

| Delivery | 5 times to 40 times depending on the Brokerage plan |

| Equity Options | 5 times to 20 times depending on the Brokerage plan |

| Currency Futures | 4 times to 15 times depending on the Brokerage plan |

| Currency Options | 4 times to 15 times depending on the Brokerage plan |

| Commodities | 5 times to 20 times depending on the Brokerage plan |

We would like to mention here that Exposure is a risky concept. Unless you understand how it works and what are its implications, our suggestion would be not to use it on top of your capital. Once you get an idea of how things go, you will be much more comfortable and safe while using it.

Wisdom Capital Cons

Here are some of the concerns about using the services of this discount stockbroker:

- Wisdom Capital does not allow clients to trade in a few financial instruments such as IPOs, Mutual Funds, NCDs.

- No innovation in trading platforms.

- Below average customer service.

- Limited trading and investment products offered.

“Wisdom Capital has received 8 complaints in this financial year 2020-21. These 8 complaints comprise 0.10% of its total client base.

The industry-standard average is 0.05%.”

Wisdom Capital Pros

And of course, there are some merits of using the services of this discount broker as well:

- Low brokerage charges with the flexibility of plans so that clients can choose as per their preference.

- There is no minimum brokerage charge levied

- High exposure offered across segments, especially intra-day.

Interested to open a Demat account?

Enter Your details below and we will arrange a Free Call back for you.

Next Steps:

Post this call, You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

Wisdom Capital Membership Information

Here are the details on the different membership details of the stockbroker:

| Entity | Membership ID |

| NSE Capital Markets | INB231371833 |

| NSE F&Os | INF-231371833 |

| BSE | INB011371839 |

| MCX | INE261371833 |

| Registered Address | Wisdom Capital, A-38, Sector-67, Noida: 201301 Delhi & NCR |

The details can be verified from the corresponding entity websites.

Wisdom Capital Frequently Asked Questions

Here are some of the most frequently asked questions about Wisdom Capital that you must be aware of:

- What is the account opening charge at Wisdom Capital?

Account opening at this discount stock broker is free, be it demat or trading account. There is a one-time maintenance cost of ₹999 which is applicable till the time you keep the account open with the broker.

- Which Wisdom Capital brokerage plan is suitable for me?

As shown above, there are multiple brokerage plans offered by this discount stockbroker. It really depends on your trading frequency since all the offered plans are fixed price in nature.

Thus, if you place a very few trades over the whole month, you can choose the default brokerage plan of ₹9 per executed order.

At the same time, if your trading frequency is pretty high across all the trading days of the month, in that case, you can opt for the monthly brokerage plan. Finally, if you have been trading for a while and/or look to trade regularly in the future, then the yearly plan suits your needs.

- Is Wisdom Capital trustable?

Wisdom Capital is the discount trading arm of Ashlar Securities private limited, which has been around for a while. In fact, the broker itself is not listed on the exchange yet, it still is listed as the child company of Ashlar group (Ashlar was established in 1994). Thus, from the background perspective, Wisdom capital sounds fine.

However, the broker certainly needs to work upon a few areas such as in-house trading platforms to prove its seriousness and commitment to its clients, increase and maintain its client base and customer service.

- Is it compulsory to open the Wisdom Capital Demat Account?

No, it is not mandatory to open the demat account with the discount stockbroker. You can connect your existing demat account with some other broker with the trading account with Wisdom capital.

- What is Wisdom Capital Trading School?

Trading School is an initiative by this discount stock broker where they hold classes in Delhi NCR region as well as Online. In these classes, registered users can learn about the basics of trading and investment. Further, there are 2 stock market courses offered by the broker, the first one is for beginners with 3 hours classes over the weekends lasting 2 months. The course fee is ₹20,000.

The second type, of course, is for day traders where live market trading is shown for a total of 50 business hours. This course is for 2 weeks and the pricing is disclosed on request.

However, there are so many professional advisory and research firms out on the market. Thus, this particular initiative seems to be part of the crowd with no differentiating factor.

- Does Wisdom Capital have a mobile app?

The broker does not have its own in-house developed mobile app for clients. However, it has licensed NSE Trading app, which is maintained by the technical team of the exchange (details mentioned above under the trading platforms section).

- How Wisdom Capital offers such high exposure values?

Before we answer that, we would like to describe what exactly exposure is. Basically, its a short-term loan offered by a stockbroker such as Wisdom Cap, at a specific interest rate. Now, exposure values are generally provided by the brokers based on the trading account balance set by its clients.

For instance, if there are 5 clients with each depositing ₹20,000 in their respective trading account balances, the overall capital with the broker becomes ₹1,00,000. Now, it’s up to the broker how much exposure it can offer to its clients based on the overall capital it has under control.

- Does Wisdom Capital provide any research or tips?

No, like other conventional discount stockbrokers, Wisdom Capital does not offer any research reports, recommendations or tips to its clients.

You can check out the detailed comparison of Wisdom Capital Vs Other stockbrokers:

More on Wisdom Capital:

To know more about Wisdom Capital, feel free to check out the below-mentioned links:

Dear friend, Wisdom capital has own mobile app, and it’s reasonably well. Customer service is also good. Thanks.

Dear Support Team,

It was really a bad experience for me today when the company Squareoff all my position (in 100%) at 12:31 PM.

I purchased 390000 shares of Ashokleyland at Buying average rate of Rs 87.73

and Shares prices falls down continuously and reached below Rs 86.

Whenever share price falls by 5-10 paisa, I am getting reminders/popup of MTM Margin above 75% etc and I also received a call from Support team (around 12:20PM) in which I clearly instructed him – that I will square off my position before 3:20 today which is normal company practice.

My question is that: When I had clearly instructed to executive that I will clear it myself, then How can the company square off all my position at 12:27 PM (in between the day) by squaring off all my 100% position (390000 shares of Ashokleyland squareoff by HO). See the screenshot attached.

Due to it, I resulted to a loss of Rs 8.15 Lakh rupees.

After 12:30 PM, Share price.. reaches above Rs 86 many times and I will be in better position to square off my position. You can see the Share chart for more details. See screenshots attached (Share Price at 3:01 showing MTM Loss of Rs. 6.36 Lac, Share Price at 3:12 PM showing MTM loss of Rs. 5.58Lac, Share price at 3:15 PM showing MTM loss of 4.80 Lac, Share Price at 3:18PM showing MTM loss of Rs 4.61 lac, Share Price at 3:24PM showing MTM loss of Rs 4.41 lac, Share Price at 3:25PM showing MTM loss of Rs 4.22 lac, Share Price at 3:26PM showing MTM loss of Rs 4 lac).

It clearly shows that if I square off my position manually or company will auto-squareoff as per their standard timings, My actual loss was below Rs. 5 lac but due to company auto-squareoff at 12:30PM (between the day), I resulted to actual loss of Rs. 8.14 lac. Who will compensate this loss difference (Rs 8.14 Lac – Rs 5 Lac = Rs. 3.15 Lac in total)?

Also, If square off is really needed, then company can square off half of my position so that I will have half shares available with me to square off at better price and by doing so, company Margin percentage goes down below 50%.

It really hurts me a lot when all of my investment gone to “zero” because of company’s silly mistake.

I never forgive Ashlar / Wisom capital for this silly mistake and will highlight the issue with SEBI / Consumer Court / Social media.

Can you please give me any Justified reason for why company squareoff all my 100% position at 12:30 PM and not waited upto 3:20 PM (which is normal company squareoff time)?

Amit Nanda

Mb : 9872509510

User/Customer ID : WU80