Zerodha

List of Stock Brokers Reviews:

If you have been a trader for a while, then you must be aware of the name – Zerodha. But for newcomers in the trading industry, it is necessary to learn the various aspects of a broker before subscribing to their facilities. So, let’s talk about Zerodha Review in detail.

Although Zerodha is a new brokerage firm, it is well known by almost every investor or trader of the industry and is the first-ever discount brokers of India.

The discount broker is registered with SEBI (Securities and Exchange Board of India) and a member of Central Depository Services Limited (CDSL), National Stock Exchange of India (NSE), Bombay Stock Exchange (BSE), and Multi Commodity Exchange (MCX).

The services offered by this broker are very similar to that of other discount brokers and full-service brokers. Still, there is a differentiating factor that has made it the top broker in the industry.

Wondering what it is?

Well! It is the low brokerage charges.

Traders always look ahead to save their money and to earn the maximum from the trade. In such cases, paying high brokerage charges is something that disappoints them.

You must be wondering that low brokerage charges are obvious due to it being a discount broker. But then, we never said it is the only factor.

Undoubtedly, many small services add to the characteristics and increase the company’s popularity exponentially.

Moving ahead in the discussion of Zerodha Review, Zerodha is one of the best discount stock brokers in India that came into existence in the year 2010. It offers low brokerage trading and investing services to its customers in the stock market.

It is a Bangalore-based company that now has gained a presence in multiple Indian cities through its form-collection centers.

These are not sub-broker or franchise offices but just offline centers where users can avail Zerodha account opening form and can open an account to trade in different products.

Here is the complete pack of information about Zerodha Reviews that will help you to know more regarding its services, trading platforms, and other benefits that it offers to its customers.

Moreover, we’ll attempt to answer the question – How is Zerodha?

Dive in!

Zerodha Review

As discussed before, Zerodha is a brokerage firm founded in 2010 by Nithin Kamath to create a high-tech trading platform with affordable brokerage charges.

For an older firm, Zerodha Review 2020 is necessary to study its performances and delivery since its inception.

In the last ten-twelve years of its existence, the firm has achieved great success directly proved from its 3.5 million Zerodha active client base.

The number contributed to a majority of the total retail trading volume of the country.

Apart from this, the company claims to handle a daily turnover of around ₹2000 crores. The discount broker also offers Varsity, a free online portal on basic and advanced education on trading.

Such initiatives easily create brand trust among the current and potential client base. At the same time, this discount stockbroker as an employer has more than 1300 employees throughout the country.

Another vital aspect to discuss under the umbrella of Zerodha Review is the total revenue and profit. The discount broker reported its total revenue to be ₹1000+ cr and a profit of ₹400+ cr.

This data implies that it is in decent profits, which translates to it being one of the country’s safest stockbrokers. It is famous for the regular innovations and breakthroughs in the financial investment industry.

Its products and collaborations, such as Smallcase Zerodha and tie-up with IDFC Bank, are trying to keep the overall investment and trading process uncomplicated and straightforward for clients.

You can now invest in more than 2000 direct mutual funds using your Zerodha Coin account. This product is another recent initiative by the broker to enlarge its product base for existing clients and, of course, the potential client base.

The trading platforms by Zerodha are an essential contributor to the Zerodha Review.

Multiple trading platforms like Zerodha Coin, Zerodha Kite, have added an undeniable contribution to the Zerodha rating.

Zerodha allows trading at low brokerage rates, and for traders planning to trade only in the delivery segment, there is no brokerage at all. In other segments as well, the brokerage is pretty low (explained later).

Zerodha has a total registered active client base of approximately 3.5 million according to the latest numbers issued by NSE on its official website.

Zerodha Trading

This broker is known for the online flat-free discount brokerage services and allows its customers to trade and invest in multiple Zerodha trading products. These products have been enlisted below:

- Equity

- Derivative Trading

- Currency Trading

- IPO

- Mutual Funds

- Commodity Trading

- Government Securities

Recently, clients are offered a Zerodha 3 in 1 account in partnership with IDFC bank, making you have Zerodha Multiple Accounts in one place.

The 3-in-1 account is the single account that helps traders to reap the benefit of trading, DEMAT, and bank account services in a single fold. Also, it adds brownie points to the Zerodha Review.

Here is a quick video reference:

Zerodha now provides its Demat account, unlike the early times when it had a partnership with IL&FS that provided the demat services to the clients of Zerodha.

These small changes have contributed a lot to the Zerodha ratings.

Nitin Kamath, CEO

Zerodha Account

Having a Zerodha account is the way of getting to trade with Zerodha. Additionally, it charges no fees for account opening. You have the facility to open the account either online or offline.

The only point to keep in mind is to have all the documents essential for opening the account.

For online account opening, you just need to visit the website and click on the Zerodha Account opening form. Fill the details and validate them instantly with Aadhaar.

The more easy these procedures are, the higher ratings are awarded in the Zerodha review.

Zerodha offers three types of accounts to its clients. They are as follows

Zerodha Demat Account

A Demat account is used to store the securities and other investment products you buy from the stock market.

If you have existing shares lying with you with any other broker, you may choose to transfer shares from one Demat account to your new Demat account with Zerodha.

For more information, you can check this detailed review of Zerodha Demat Account.

At the same time, you may choose to open your Zerodha Demat account offline as well. Check this piece of Zerodha Offline Account Opening for more details.

Willing to open the Demat Account

Zerodha Trading Account

When you buy or sell securities from the share market, you need a separate account for such activities. That account is called the Trading account, and Zerodha extends this facility. This point is vital in the Zerodha review.

This account is different from the Demat account since the storage of the bought securities is outside the scope of the trading account.

To understand the distinction in detail, you can check the difference between Demat and Trading account.

If you are a day trader and will be involved only in intraday trading, you require a trading account only, and opening a Demat account is not required.

Although the option to open only one account, i.e., a trading account, is not open to any trader or investor.

Also Read: Zerodha Bank Account

Zerodha Commodity Account

If you are looking to invest and trade in commodities, you would need to open your Zerodha commodity trading account. Furthermore, the trader or investor must open a Demat account as well.

Charges for all these types of accounts are separate at both account opening and account maintenance levels. For more information, we have a detailed review of Zerodha Commodity Charges for your reference.

Zerodha App

In the early days of Zerodha’s establishment, it offered many outsourced trading applications to its client base that was developed and maintained outside the control of the discount stockbroker.

These trading platforms play a huge role in the Zerodha review.

Over time, the broker has developed one of the best trading apps in India and has been able to produce high-quality trading applications across devices for its clients.

Significant aspects of trading platforms accounted for in the Zerodha trading app review have been taken care of while developing these applications.

These aspects are as follows:

- Design

- User experience

- Usability

- Performance

- Integrations, etc

In this detailed Indian trading app review, we will be talking about Zerodha’s online share trading app across devices. Here are the details:

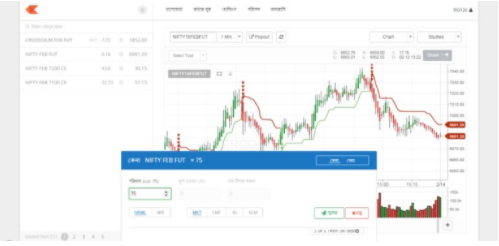

Zerodha Kite

Kite is a very light, responsive, but simultaneously quite powerful web and mobile online trading application. It comes with the following features:

- Works at a bandwidth consumption of fewer than 0.5 Kbps for a full market watch.

- Provides extensive charting with over 100 indicators and six chart types.

- Exclusive insights into Level 3 data or 20 market depth.

- Advanced order types like Bracket orders and cover orders.

- Millisecond order placements

- Form multiple baskets as per the trader’s requirements.

As per the discount stockbroker, this platform is used by more than 8,00,000 clients for searching from more than 90,000 trades, futures, and options.

This platform serves more than 200 million requests a day. These numbers speak volumes for the Zerodha review.

Here are a few screenshots of the tool’s look and feel:

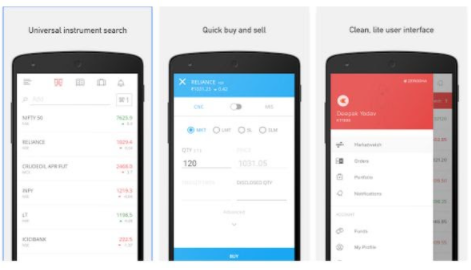

Zerodha Kite Mobile App

Kite Mobile is a mobile app version of the Kite Web and carries all the functionalities present in it. The tool was launched in November 2015 and can be used on all kinds of devices, including Desktop, laptop, mobile & tablet.

The latest Kite 3.0 version was launched in June 2019. It has competitive features and a more comfortable interface. Here are some of the top features of the app:

- Fast trade execution speed.

- Biometric login and enhanced security.

- TradingView charts with ChartIQ.

- One-tap universal instrument search for all contracts across all exchanges – NSE, BSE, MCX.

- Live streaming data.

- Multiple market watch and live market depths.

- Advanced chart with 100+ indicators.

- Years’ worth of free historical chart data.

- Push notifications for order updates.

- Upgraded filter and search options.

- Allow trade Equities, F&O, Commodities, Currency; thus, you can buy shares in Zerodha Kite.

- Various order types: Regular, AMO, BO (Zerodha Bracket order), CO (Cover orders).

- Help you learn about the used margin in Zerodha in Intraday Trade.

Here is how the app looks:

Zerodha Kite Connect

Kite Connect is marketed as ‘Platform As a Service’ and is undoubtedly an important contributor to Zerodha’s review. This tool is basically a set of simple APIs used as building blocks for building Zerodha’s web-based trading platform, Kite.

This platform allows the clients to get programmatic access to valuable data points such as profile and funds information, order history, positions, live quotes, and so on.

At the same time, it enables users to manage the portfolio as well as place orders at their convenience.

With Kite Connect API, users can build their own trading experience. This platform executes more than 2 million trades every day and has more than 200 million HTTP requests each day.

This is how it looks like:

Zerodha Open Trade

This service has been discontinued by Zerodha recently.

This platform is a unique proposition by the discount stock broker where a user can get real-time updates on trade from profitable traders to learn and improve their trading skills and, thus, make better decisions.

New users can follow traders and, thus, improve their trading skills over time. This platform is exclusively open to the clients of this discount stockbroker and played a significant role in Zerodha Review.

In today’s socially connected world, Zerodha has experimented with a social advisory initiative where the broker selects a set of traders from its trading community. These selected traders are filtered based on their profit trends while trading.

Regular traders or beginners or anyone can follow these selected traders and see what trades they are placing. The selected traders are provided with some fee charged as a subscription charge from the traders following them.

Thus instead of going for any advisory services, you may choose to follow such traders within this platform and place your trades accordingly.

Here is a glimpse of the look and feel of the tool:

Zerodha Pi

Zerodha Pi is a desktop trading application with features such as Trading, charting, scripting, and analysis. Users are required to download the software on their desktop or computer.

This brilliant trading platform is another feather in the Zerodha review.

This platform is known to be one of the high-performance trading applications with:

- High-speed order execution

- Varied features around fundamental and technical analysis, including charting with 70+ technical indicators. For more, check this detailed review on Zerodha Technical Analysis.

- Market watch provision

- Personalized notifications and alerts

Also Read: Best Online Trading Platforms In India

Zerodha is known for a wide range of trading platforms, and the focus of these trading platforms is primarily on speed and user experience. However, still, at times, these software programs fail to handle huge traffic numbers.

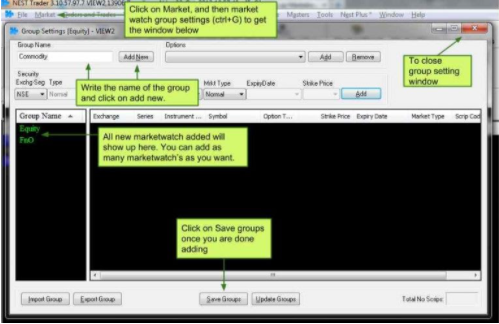

Zerodha NEST Trader

UPDATE: Zerodha has ended its dependency on this trading platform. The new customers will not log in through this software, and the old traders will be redirected to Zerodha’s platform – Kite.

Zerodha NEST Trader is a customized version of the terminal-based trading application – NEST (Next-generation Electronic Securities Trading).

This application allows you to trade across all financial segments like currency, commodity, equity, derivatives.

This platform is considered one of the best trading app in India.

The application works well on the Windows platform, but the MAC version of Zerodha trader is relatively elementary in terms of the number of features it provides.

The addition of this platform has impacted the Zerodha review in a big way.

Some of the features provided in this application include:

- Market Watch

- Span Calculator

- Multiple order types

- Personalization of shortcut keys

At the same time, here are a few concerns you must be aware of as well:

- Requires decent configuration

- Low Update Frequency

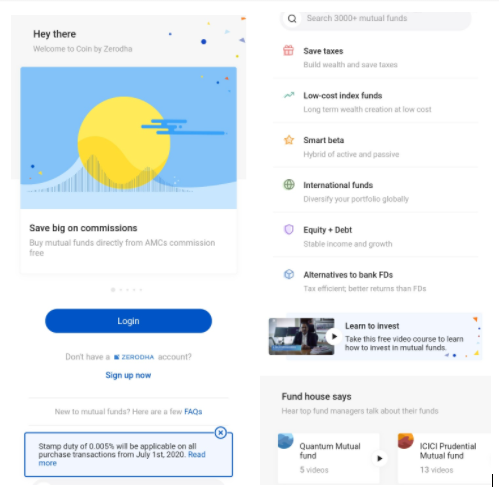

Zerodha Coin

The Coin is a recent initiative by Zerodha that allows clients to invest in mutual funds directly without any distributor or fund house.

This platform is a first-of-its-kind initiative where clients can place orders to buy mutual funds by clicking a couple of buttons after choosing the mutual fund.

Since this feature is exclusively available for the subscribers of this broker, it is necessary to include it in the Zerodha review.

The login page of the web version of this platform looks like this:

It’s highly attractive for people who want to place less risk through their investments and want a reasonable return. This platform houses mutual funds from more than 40 fund houses and has an active user base of 2.5l.

A total of 4,500 cr have been invested via Zerodha Coin.

The features of this app are:

- Flexibility to create, pause, and modify the SIPs.

- Discovering and searching for new funds.

- Viewing Scheme Holdings with multiple filters.

- Short videos with fund managers are included to explain the details and management philosophy.

- Instant payments using UPI.

There is an even Zerodha Coin Mobile App version for traders who prefer investments through their mobile phones. A few screenshots of the app are as follows:

Here is a quick video reference as well:

Zerodha Pulse

It is another free software application of Zerodha that comes under the News & Magazine category.

It is a stock market news app for Android and iOS platforms. It helps traders in making investment decisions by offering them the latest financial and market news from different sources like Money Control, Economic Times, Business Standard, etc.

No wonder, the app is helpful and beneficial as it keeps investors updated with real-time news sources. This app gives an additional edge to Zerodha’s review.

To experience, download the app now. A sneak peek into the app look is below:

Zerodha Streak

Zerodha Streak is one of the latest additions to the discount broker’s armory of trading applications and tools. Although Streak is a separate entity, Zeordha (through Rainmatter) has invested an amount of ₹2.25 Crores in it.

Streak is basically an algo trading analysis and signaling tool that directly helps you to use algorithms in your trades. It is listed as the best trading app in India.

All this is done without you doing any piece of coding or knowing how algo trading works.

It basically takes in some inputs around your trade and provides you with specific information on your profit returns while you backtest your strategy.

If you like it, you can choose to deploy the strategy and thus, input your order.

This platform has been said to be one the best online trading app in India for Algo trading and hence its mention in the Zerodha review is inevitable.

For more, you can also check this detailed review on Algo Trading with Zerodha.

A screenshot of the Zerodha login for Streak is below:

Smallcase Zerodha

Zerodha smallcase is basically a partnership between the discount broker and Smallcase (a small start-up) that works together to provide thematic investment options for their clients.

Users need to open a demat account with the discount stockbroker and they can access thematic investment options through their portal.

It’s an investment option for people who find it hard to perform fundamental analysis and are looking for an accurate investment advisory.

Zerodha allows its users to add extra protection to their positions by adding a bracket and trailing stop-loss order features to its platforms.

Zerodha Sentinel

Zerodha Sentinel is a price alerts tool that provides you with notifications even if you are not logged in the system. The tool comes with around 15 pre-defined conditions that a trader like yourself can configure as per your requirements and get notified on specific stocks or indices.

Sentinel comes in both free as well as paid versions. The free version allows 30 triggers while the paid version offers 100+ triggers with an advanced alerts mechanism.

Here is a video reference for you:

You can signup in the Sentinel using Facebook, Google, or Zerodha Login. The screenshots for the same are as follows:

Zerodha Console

Access to the broker’s back office eases a plethora of things for the trader or investor. The console is the back office portal of Zerodha. This portal is easy to use and was launched in the year 2018.

Before this update, the back office was called – ‘Zerodha Q’. Zerodha Q was the first back-office portal by Zerodha, launched in 2014.

It has been integrated with Zerodha Kite, and the new portal, Console, has been loaded with much more advanced technology.

The update of the back office portal has helped the broker gain popularity among the trader, and the Zerodha review would be incomplete without its mention.

The features of Zerodha Console are

- Traders can download margin statements, contract notes, etc.

- A host of analytical tools like a P&L heat map, trade book heatmap, etc. can be accessed.

- Multiple report retrieval.

- Viewing and tracking multiple portfolios.

- Keeping an eye on trading and demat accounts.

- Requesting a withdrawal.

A few sneak peek into the looks of the Console has been attached in the form of screenshots.

Zerodha Varsity

Zerodha is one of the few stockbrokers in India that provides stock market education content to users. You don’t need to be a client of this discount broker to access these education pieces, nor you need to buy any subscription.

The broker provides this educational content for free for all its website visitors. Also, a Varsity mobile app is there to assist mobile-based learners. A screenshot of the app is as follows:

The content covered is useful for all kinds of traders, whether you are a beginner, intermediate or advanced level trader.

Here is a video reference for you to understand it:

The web version of the app looks something like this:

Apart from Varsity, Zerodha has recently invested an amount of around ₹2 Crore into Learn App Zerodha, which is a video-course-based stock market education portal.

Lastly, a community named ‘Trading Q&A’ is also a Zerodha portal. This portal is dedicated to discussions and doubt clearing.

Zerodha Trading Review

After learning about the various trading platforms of Zerodha, a need to tabulate the points contributing significantly to the Zerodha review is mandatory. So, here’s a table with Zerodha’s trading review, comparing the mobile trading platforms.

| Mobile Application | Kite | Coin | Varsity | Pulse |

| Number of Installs | 1M+ | 500K+ | 500K+ | 100K+ |

| Mobile App Size | 9.6 MB | 9.4 MB | 13 MB | 2.1 MB |

| Google Ratings | 4.2 stars | 4.1 stars | 4.4 stars | 4.1 stars |

| Total Number of Reviews | 132 K | 7.8 K | 4.8 K | 700+ |

Zerodha Login

Once you open the account with Zerodha, you will be provided with the unique client ID and password.

These login credentials are sent to you to your email address registered with the broker.

You can use this ID to log in to the Demat account and trading account. Other than this, user id and password is used universally to access different apps, trading platforms, and back-office of Zerodha.

It makes it easy to remember the credentials, right?

Zerodha ETF

Zerodha Exchange Traded Funds offer you a unique trading experience. Here ETF is a mutual fund scheme listed and traded on the exchange (NSE).

It is considered similar to any other stock if it is unlisted on the exchange, is liquid and member investing in it has an asset with them.

Thus, Zerodha ETF allows you to trade in a scheme similar to what you do to buy and sell other stocks. Because of this distinguishing feature, the Zerodha review has risen.

In all, if done in the right way, it offers a better chance to gain profit.

Zerodha Customer Care

The discount stockbroker offers the following communication channels to its clients for using customer services:

- Zerodha Helpline

- Social Media

- Branches and Partner Offices

- Raise a ticket on the website

As can be seen, the broker offers multiple communication channels for its clients to reach out to them. Furthermore, sometimes, customer service lags in terms of quickness and actual resolution quality.

The support executives’ communication skills can also be improved as the brand Zerodha gets reflected through these touchpoints.

Although, as seen in many forums, Nitin Kamath, CEO of this discount broking firm himself, tries to resolve some of the queries raised by the users, that attitude certainly needs to be sprinkled across the customer relations team.

“This discount broker runs a Zerodha 60 day challenge where users trade for 60 days and can claim to win back all the brokerage generated for that period.”

Zerodha Research

As a discount broker, it does not have an in-house research team for its clients, but it has come up with solutions such as Open Trade, where users can connect with heavy traders and learn from their experiences on a real-time basis.

Other than that, clients need to perform their analysis and research for trading or investing in the stock market. The Zerodha review has a lesser contribution to this aspect due to Zerodha being a discount broker.

They have also recently collaborated with Thomson Reuters for advanced reports named StockReports+. With this feature, the clients of Zerodha can subscribe to different paid plans and receive multiple reports of various listed companies.

The plans are based on the specific frequency you are looking to subscribe for:

- 1 Month: ₹150

- 6 Months: ₹850

- 1 Year: ₹1440

Suppose you are opening an account expecting that the broker will provide you with regular intraday tips or fundamental research of any kind. In that case, you need to understand that it will not be possible. Like any other discount broker, Zerodha does not provide any research, tips, or recommendations to its clients as such.

But you can undoubtedly carry out Zerodha Fundamental Analysis through the trading platforms offered by the broker.

Simultaneously, there are a few Zerodha Intraday tips you may follow while trading through their trading platforms.

With that said, be wary of a few executives who may go ahead and make false promises to achieve their incentives. If they claim strongly, request them to show the same on the broker’s website to confirm their claim.

These false claims downgrade the overall Zerodha review.

Zerodha Expert Advisor

If you wish to code your trading strategy, you can do so using the Zerodha expert advisors platform.

First of all, you are required to code your strategy using the Tradescript tool, and then you can back-test and check out the past performance of this strategy using Zerodha Pi.

You can pick from more than 50 pre-coded strategies.

If the strategy works well in backtesting, you need to take it to LIVE and, thus, generate buy or sell signals for your trades.

Next, let’s talk about money.

Zerodha Charges

In this Zerodha Review, we will be talking about different facets of its pricing structure. Here we go:

As a prominent discount broker, it offers equity delivery investments at ₹0 brokerage, which is free. Intraday equity trading, as well as Zerodha futures & options trade, are at ₹20 or 0.01%, whichever is lower of the two, per executed order.

Even after charging the least brokerage charges, Zerodha can gain much profit. To learn more about the revenue of the company, read Zerodha Valuation.

Here is the detailed layout of the pricing structure:

Zerodha Account Opening Charges

To open an account with this discount stockbroker, you need to pay the following account opening and maintenance charges (payable every quarter):

These lower charges enhance the final Zerodha review rating. Although if you choose to open an account offline, you’ll be charged ₹300 additionally.

“There is no minimum balance requirement by Zerodha that its clients need to fulfill. It’s up to their preference, and accordingly, the trading account balance can be used for trading.”

Apart from that, you need to be aware of the Zerodha AMC Charges too as those are charged annually from your account.

Zerodha Brokerage

Depending on which particular segment you are looking to trade or invest in, corresponding brokerage charges will be levied against your account. The Zerodha review is heavily dependent on this aspect.

Here are the complete bifurcated details on brokerage and other charges concerning each segment:

Zerodha Delivery Charges

These are the Zerodha Equity charges levied in the delivery segment:

Zerodha Delivery Brokerage Delivery Brokerage Charges ₹0

Zerodha Intraday Charges

Here are the Zerodha Intraday trading charges details

Charges for quick short-term profits on a day-trading basis:

Zerodha Intraday Charges Intraday Brokerage Charges 0.03% or ₹20/Trade whichever is lower

Apart from that, other charges such as STT, Transaction charges, service tax, charges by SEBI are added up to the overall payment.

“One good part about the brokerage charges of Zerodha is to break even. The clients need to sell your holding just one and positions above the price at which you purchased. “

Zerodha Equity Futures Brokerage

If you are looking to trade in derivatives, Zerodha charges the following rates as the brokerage in the futures trading segment:

Zerodha Futures Brokerage Charges Future Brokerage Charges 0.03% or Rs. 20/executed order, whichever is lower

Zerodha Equity Options Brokerage

If you prefer performing options trading, then you get to use the Zerodha Sensibull trading app which is specifically designed and developed for this format of trading.

When it comes to Zerodha options trading, here are the Zerodha Options charges:

Zerodha Option Brokerage Charges Option Brokerage Charges Flat Rs. 20 per executed order

Zerodha Currency Futures Brokerage

Brokerage charges on Currency futures trading:

Brokerage 0.03% or Rs. 20/executed order, whichever is lower STT No STT Transaction / Turnover Charges NSE: Exchange txn charge: 0.0009% ; BSE: Exchange txn charge: 0.00022% SEBI Charges ₹5 / crore GST 18% of Brokerage + Transaction charges Stamp Charges* 0.0001% or ₹10 / crore on buy side

Zerodha Currency Options Brokerage

Here are Zerodha brokerage charges in the currency options segment:

Brokerage brokerage charges - 0.03% or Rs. 20/executed order, whichever is lower STT No STT Transaction / Turnover Charges NSE: Exchange txn charge: 0.035% ; BSE: Exchange txn charge: 0.001% SEBI Charges ₹5/Crore GST 18% of Brokerage + Transaction charges Stamp Charges* 0.0001% or ₹10 / crore on buy side

Zerodha Commodity Futures Brokerage

Similarly, brokerage charges for Commodity Futures trading:

Brokerage brokerage - 0.03% or Rs. 20/executed order whichever is lower STT 0.01% on sell side (Non-Agri) Transaction / Turnover Charges Group A: Exchange txn charge: 0.0026% * Far-month contracts: 0.0013% ; Group B: Exchange txn charge: CASTORSEED - 0.0005% KAPAS - 0.0005% PEPPER - 0.00005% RBDPMOLEIN - 0.001% SEBI Charges Agri: ₹1 / crore ; Non-agri: ₹5 / crore GST 18% of Brokerage + Transaction charges Stamp Charges* 0.002% or ₹200 / crore on buy side

Zerodha Commodity Options Brokerage

Lastly, this is what Zerodha charges for commodity options:

Zerodha Commodity Brokerage Charges Commodity Futures Brokerage Charges 0.03% or Rs. 20/executed order whichever is lower Commodity Options Brokerage Charges

BTST Charges in Zerodha

There is another kind of trade called BTST where you hold your position overnight but does not deliver shares in your demat account. Here is the detail of the charges;

| Zerodha BTST Charges | |

| BTST Charges | 0 |

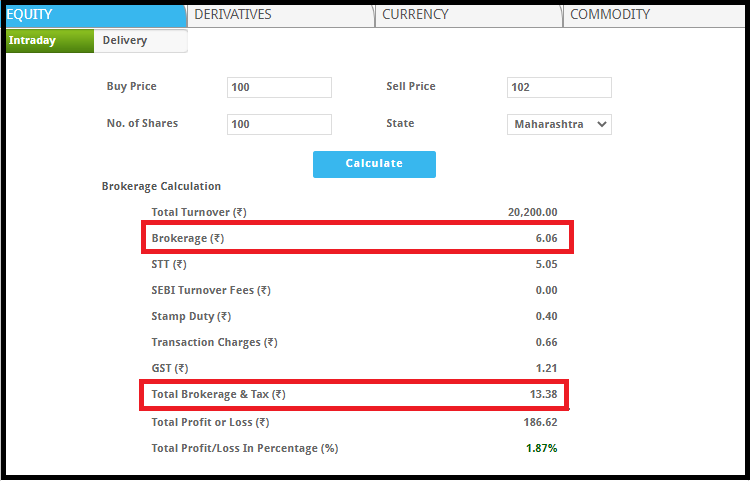

Zerodha Brokerage Calculator

Now along with the above charges, one needs to consider other taxes and fees imposed by the broker like stt charges in Zerodha to execute the trade in specific segment. No doubt it makes the overall calculation a little tougher.

To ease it, here we are with the brokerage calculator that not only helps you in calculating the charges but also the profit that you can earn in a particular trade.

DP Charges in Zerodha

Depending on the number of scrips you trade in a single trading day (without considering the quantity of scrip in a trade), you will be charged ₹13.50 + GST per scrip as DP Charges.

The broker has no commission or cuts in these kinds of charges.

Generally, these charges are not mentioned by many in the Zerodha review.

In this case, the charges are levied by CDSL.

Zerodha Transaction Charges

Like any other discount broker, Zeorhda levies transaction charges on the trades you place. These transaction charges are not kept by the broker but are passed onto different regulatory bodies.

In the case of this discount broker, these are the transaction charges levied:

| Zerodha Transaction Charges | |

| Segment | Transaction Charge |

| Equity Delivery | NSE: 0.00325% BSE: 0.003% |

| Equity Intraday | NSE: 0.00325% BSE: 0.003% |

| Equity Futures | NSE: Exchange txn charge: 0.0019% |

| Equity Options | NSE: Exchange txn charge: 0.05% (on premium) |

| Currency Futures | NSE: Exchange txn charge: 0.0009% BSE: Exchange txn charge: 0.00022% |

| Currency Options | NSE: Exchange txn charge: 0.035% BSE: Exchange txn charge: 0.001% |

| Commodity Futures | Group A Exchange txn charge: 0.0026% * Far-month contracts: 0.0013% Group B: Exchange txn charge: CASTOR SEED - 0.0005% KAPAS - 0.0005% PEPPER - 0.00005% RBDPMOLEIN - 0.001% |

| Commodity Options | Exchange txn charge: 0 |

These transaction charges play a massive role in the Zerodha review.

“Zerodha charges ₹50 per order execution for using a Call and Trade facility.

Further, ₹9 + GST is charged for each fund transfer through the payment gateway.”

Zerodha Margin

Zerodha review would be incomplete without the discussion of the margin facility. Zerodha offers basic margin values across the segments, for instance, Zerodha Option Selling margin is also available.

Although a Zerodha client does not get much leverage on buying or selling, still here are the details of whatever is open:

| Segment | Zerodha |

| Equity delivery | 1x |

| Equity intraday | 12.5x |

| Equity futures | 3-4 times |

| Equity options | 2-3 times |

| Currency futures | 3-4 times |

| Currency options | 2-3 times |

| Commodity futures | 3-4 times |

*For people who don’t understand the concept of Exposure or leverage, it is a short-term loan offered by the stockbroker to its clients so that they can trade or invest at a much larger scale. The loan is provided at an interest rate in the range of 15% to 20%.

Zerodha POA

The Zerodha POA or Power of attorney document is one of the mandatory documents you need to provide to the broker to activate your account with it.

It is a mere formality that needs to be taken care of with any broker for that matter.

You can easily download this form and it will already be pre-filled with your details. All you need to do is sign on the F13 & F14 signature boxes and then courier it to Zerodha’s address.

In case it is not pre-filled, you can ask your sales manager or Zerodha customer care to fill it for you so that you can sign and send it to the broker.

Zerodha Fund Transfer

There are multiple ways for you to transfer the funds to your trading account balance. More choices enhance the customer experience and help in Zerodha review. The various methods of fund transfer are:

- Zerodha Trader

This method is an easy way of transferring funds from your linked bank account into your trading account at Zerodha, but at the same time, you will be charged ₹9 per transfer.

Another simple way of online funds transfer and like, Zerodha Trader will also cost you ₹9 per transfer.

- Payment Gateway

With this Quick and free fund transfer method, your funds will be immediately transferred to the trading account.

- NEFT/RTGS/IMPS

This transfer mode is free, but it will take a few hours for the funds’ transfer to happen.

- UPI

The User Payment Interface or UPI is the latest way to transfer funds using a UPI Id. The amount is directly debited from the corresponding bank account.

- Cheque

With this offline method, you can undoubtedly transfer funds to your trading account through the cheque slip of your linked bank account. A scanned copy of the dropped cheque will be required to be submitted if you use this method.

Withdrawals can only be made through the back office where you need to raise a request, and all the requests are processed within a day or two.

Zerodha NRI Account

If you are looking for an NRI Demat account for your stock market investments, then Zerodha provides a provision for its Non-resident clients. This feature by the broker adds a lot to the Zerodha review.

However, you will not be able to trade in the currency or the commodity segments. You will be required to provide a PIS letter from the Reserve Bank of India. Your bank will be able to assist you in getting this letter.

The discount broker can currently take in clients who have a PIS from Axis Bank, Yes Bank, or HDFC Bank. You are required to take care of the following documentation to take steps ahead:

- PIS Letter

- FEMA Declaration

- PAN Card

- Indian Address Proof

- Photograph

- Passport

- Bank Account Proof

Zerodha Holidays

If the broker lists its holidays on its website, it enhances user satisfaction and translates to a better Zerodha review. Here is a list of holidays this discount broker for the current year:

- Fri, 21 Feb 2020

Mahashivratri - Tue, 10 Mar 2020

Holi - Thu, 02 Apr 2020

Ram Navami - Mon, 06 Apr 2020

Mahavir Jayanti - Fri, 10 Apr 2020

Good Friday - Tue, 14 Apr 2020

Dr.BabaSaheb Ambedkar Jayanti - Fri, 01 May 2020

Maharashtra Day - Mon, 25 May 2020

Eid-Ul-Fitr (Ramzan Id) - Fri, 02 Oct 2020

Mahatma Gandhi Jayanti - Mon, 16 Nov 2020

Diwali Balipratipada - Mon, 30 Nov 2020

Gurunanak Jayanti - Fri, 25 Dec 2020

Christmas

Zerodha Disadvantages

Without compiling the disadvantages, the Zerodha review would be inclusive. Here are some of the issues you might have to pass in case you are or want to be a client of this discount broker:

- Few concerns of software malfunction happening in few cases reported, especially in smaller cities.

- No research reports, market tips, or quarterly results as it is a discount broker.

- Not much exposure is offered to clients across segments.

- Good till Cancelled/Date orders available only for the commodity segment.

- Call and trade facility is provided at a specific price and is not free.

In total, 441 complaints have been lodged at NSE (National Stock Exchange) against Zerodha by its clients. Out of which, 362 have been resolved.

For more information, check this detailed review on Zerodha Complaints.

In most of the Zerodha Customer Reviews, we have seen that significant concerns are reported in their customer service, issues with order execution through Kite Mobile App (at times), and narrow margin. If you have gone across any such experience, feel free to share in the comments section below.

Zerodha Advantages

At the same time, the Zerodha review must include the advantages of the broker. So, this is how the discount broker proves beneficial for different kinds of traders:

- Equity delivery is provided at no cost and low brokerage in other segments.

- Free User education in trading and investment basics through Zerodha Varsity.

- Provides one of the best 3 in 1 Demat account in India in association with IDFC bank.

- Flat rate for stock trading, futures & options, currency, and commodity.

- Zerodha refer and earn gives you the access to earn commission on brokerage of your referral.

- Different tech partnerships like Zerodha Sentinel, Streak, Smallcase Investment to enable clients with better control.

- Innovative trading platforms across devices, including terminal software, web applications, and mobile app.

- There are no hidden charges involved, along with free software usage.

- Although Zerodha is a discount broker, it still provides an offline presence with more than 120 branches and partner locations in India’s different parts.

- Direct Mutual fund investments allowed through Zerodha Coin.

- No minimum brokerage charges condition.

- Zerodha Joint demat Account provision available.

- Its 60-day challenge is a unique proposition for clients.

- No minimum account balance is needed in your trading account.

- Algo-trading allowed with minimal manual effort.

- The facility of margin is provided to the clients across different trading segments.

- Own DP Service since 2016 and from then on it has its Zerodha DP ID.

- GTT or Good till triggered orders are allowed.

- NRI services are provided for trading.

How to Open an Account with Zerodha?

Enter your details, and we will arrange the Free Call Back!

OR

Provide your details here at the Zerodha Account Opening Form.

Post this, there are 2 ways to get started.

- If you have an Aadhar card, then the account opening process can be completed in a few minutes.

- Otherwise, you need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of Zerodha account opening documents.

Zerodha Membership Information

The broker’s membership information with different exchanges and intermediate parties is a key aspect of the Zerodha review. They are as follows:

Entity Membership ID BSE INB011390623 NSE INB231390627 NSDL IN-DP-NSDL-11496000 CDSL IN-DP-CDSL-00278209 MCX 46025 NCDEX INZ000038238 Registered Address Zerodha, #153/154, 4th Cross, Dollars Colony, Opp. Clarence Public School, J.P Nagar 4th Phase, Bangalore - 560078, Karnataka, India

The details can be verified from the corresponding websites of the exchanges.

Zerodha Head Office Address

As mentioned above, the discount broker is based out of Bangalore. For any direct contact with the broker, a customer chooses to visit or contact the head office. Thus, it is an inalienable part of Zerodha’s review.

Here are its address details for your reference:

#153/154, 4th Cross Dollars Colony,

Opp. Clarence Public School,

J.P Nagar 4th Phase,

Bangalore – 560078

Furthermore, the broker has more than 120 branch offices, partner offices, and support centers.

Conclusion

Zerodha was established in 2010 as the first discount broker in India. It was founded by Mr. Nithin Kamath and has grown into a massive company with its constant efforts.

Moreover, it was the one that introduced the concept of discount broking in India. Post this introduction, the overall dynamics of the stockbroking space have seen an enormous transformation.

Currently, Zerodha is the best discount stock broker in India. It is good with pricing, customer education, trading platforms, and thus, these are some of the reasons why they have been able to grab a high client base every year.

With the multiple services and most technologically advanced trading platforms, Zerodha has grown to be a massive competitor for full-service brokers.

It has the highest client base presently and is working continuously to improve its services and facilities. Further, with 13 platforms for varied aspects, Zerodha has undoubtedly captured the market of trading platforms.

It is also the first discount broker to extend 3 in 1 account facility, which is majorly common for bank-based stock brokers.

Their customer support and offerings in exposure or margin are a couple of areas where they need to get better. The brand, Zerodha has created for itself must be consistent across multiple facets of the broker.

We sincerely hope this Zerodha review has helped you in gaining informative insight into the stockbroker. If you still have any queries or doubts, you can comment below.

Zerodha FAQ

Don’t you think the Zerodha review must answer some of the Frequently asked questions about the discount stockbroker with complete information?

So, here are a few of them:

- What is Zerodha?

Zerodha is a leading discount broker in India. It offers low brokerage charges across investment segments because it suits people looking to place multiple trades daily. Moreover, the broker provides excellent performance in its trading software and average customer service. The broker has its headquarters in Bangalore but has over 120 other cities across different parts of India.

Last checked, the discount broker had an active client base of over 2.47mn and is the number one broker in India in terms of its client base. This huge client base does the talking in Zerodha review. Doesn’t it?

- Is Zerodha a Reliable Stock Broker?

If you are thinking about the reliability of its trading platforms, then yea, most of the time, all of its trading platforms perform well. Be it speed, order execution performance, features – you can undoubtedly rely on this discount stockbroker.

There are instances of high traffic where one or more applications get stuck, hang, or freeze. So it is advised to use a desktop or phone with a decent configuration to have a seamless trading experience.

- Is Zerodha a Depository Participant or Not?

Yes, it is now. Before 2016, Zerodha had a partnership, but they are currently registered as a Depository Participant.

- Is Zerodha Trustworthy? How Safe is Zerodha?

Yea, absolutely and this article on Zerodha review is a live reason. But, we’ll compile some of the significant reasons for you:

- This discount stockbroker was incorporated in 2010, so it has been a good ten years since its establishment.

- They filed a profit of ₹350 Crore for the Financial year 2018-19.

- Has an employee strength of more than 1300.

- Does a daily turnover of ₹2000 crores.

These reasons give a clear idea that this discount broker has been able to see scale and growth in the last ten years of its existence, and thus, clients can assume that it is a safe discount broker.

To know more, you can check this detailed review on Is Zerodha Safe?

- Where to send Zerodha documents?

Although you can upload the documents through their online portal while registering yourself as a client of the broker, you can also send the hard self-attested copies to Zerodha as well.

These documents need to be sent to:

#153/154 4th Cross Dollars Colony,

Opp. Clarence Public School,

J.P Nagar 4th Phase,

Bangalore – 560078

- How Zerodha Works? How Zerodha Makes Profits with Zero Brokerage?

Zerodha works as a broker that, instead of charging you a percentage of your trade value, charges you with a fixed maximum brokerage of ₹20 except in your delivery trades (which is free).

Since they do not provide research, offline assistance, etc., their operational costs are relatively lower than those of full-service brokers.

This discount broker plays a volume-based game and keeps its charges low so that the overall revenue and profit are sizable. Apart from that, Zerodha comes up with various subscription-based products that bring additional revenue streams for the broker from time to time.

- I forgot my Zerodha Password? How can I recover?

Retrieving your Zerodha password is a pretty straightforward task. All you need to do is click on the “Forgot Password” link shown on the Kite login page.

Enter your registered Email Id, PAN number, along with your User Id, and submit.

A new password will be auto-generated, and you can log in to your Zerodha account using those credentials. Simultaneously, you are suggested to change your password as per your preference right after you log in for the first time with the auto-generated password.

- I forgot my Zerodha User Id? How can I recover?

Your UserId is a 6 character alphanumeric Id that is used across platforms. In all the communication emails and definitely in your welcome email post account activation – this UserId is mentioned.

In case you do not have access to the system, you may choose to call Zerodha Customer Care with your registered mobile number, provide the executive with your PAN number and DOB – the UserId will be confirmed to you over the call itself.

- What is the maximum brokerage charged by Zerodha?

First of all, the broker does not charge anything on the delivery trades while in other products you are charged ₹20 or 0.03% of your trade value, whichever is lower. Pretty sweet deal!

- What are the different Zerodha Order Types Available?

This discount broker, through its different trading platforms and call & trade facility, allows its clients to trade in various types of orders as listed below:

- Limit Order

- Market Order

- Stop-Loss Order

- Good till canceled Order (only for commodity trades)

- Normal Order

- Bracket Order

- Cover Order

- After Market Order or AMO

- Can I Invest in Mutual funds using Zerodha?

Yes, you can do that in both direct and indirect ways. The indirect way is the conventional route where you can place buy orders on the chosen mutual funds. In a direct way, you can choose to use Zerodha Coin that gives you a ready-to-use platform to directly see the trend and patterns of mutual funds. This application gives you a provision to place direct mutual fund orders.

You can check out the detailed review of Zerodha Coin.

- Is IPO Investment possible with Zerodha?

Yes, IPO Investment is possible with Zerodha.

Visit their official website and under the menu button, you’ll find the tab named IPOs. Click it and you’ll be redirected to the corresponding web page.

- Does Zerodha provide Tips and recommendations?

No, the discount stockbroker does not provide tips, recommendations, research reports, etc.

- What are the pain problems with Zerodha?

There are few concerns with this discount stockbroker, such as:

- Customer service quality can be improved.

- Hiccups in their trading platforms when there is high traffic.

To know more, you can check this detailed review of Zerodha problems.

- Does Zerodha provide automated trading?

Yes, the retail clients of the discount stock broker can avail the feature of automated trading.

- How is the mobile app of Zerodha?

The mobile app is called Kite mobile and it is certainly one of the best-performing ones in the industry. You can check out the detailed review of Zerodha Kite Mobile App.

- How are the webinars offered by Zerodha on Youtube?

The discount stock broker provides webinars on its Youtube channel on a regular basis. These webinars are based on the trading platforms offered by the broker where different experts walk through the features of this software.

- How much is the Equity Leverage offered by Zerodha?

Leverage or margin varies by the script. It also depends on the volatility in the market for that particular day.

The broker offers a tool called SPAN Calculator where users can calculate the margin requirements for option writing/shorting or for multi-leg F&O strategies while trading equity, F&O, commodity, and currency.

- What are Zerodha rates for account opening?

To open a trading account and a demat account, you are charged ₹200 and for the commodity account, the cost is ₹100. Both of these charges are one-time costs.

- What are the Zerodha yearly charges?

Users are required to pay ₹300 + GST as annual maintenance charges or AMC on a yearly basis to this discount stockbroker. Although, these charges are deducted every quarter.

- I want to change my bank account linked with my Zerodha trading account. How can I do it?

If you are looking to change your primary bank account details, you need to fill in the Accounts Modification Form with specific information. Along with that, you need to provide a valid bank account proof, which can be any one of the following:

- Personalized Cancelled Cheque with your name printed on it

- Self-attested Bank Statement

- Self-attested Bank Passbook

The documents are then required to be sent to the broker’s headquarters in Bangalore.

- Can an NRI open a Demat account with Zerodha?

Yes, an NRI can legally open a demat and trading account with Zerodha; however, trading is not allowed in Currency and Commodity segments for such accounts.

You are required to obtain a PIS (Portfolio Investment Scheme) permission letter from the RBI along with the rest of the documents.

The bank where you have opened up your NRI account will assist you in getting the PIS once you provide them with a few documentation.

In order to open an NRI demat account, you need to provide the following documentation:

- PIS permission letter

- FEMA declaration copy

- PAN Card

- Overseas Address Proof

- Indian Address Proof

- Passport Photo

- Passport copy

- Bank Account proof

23. Can a Student open a trading account with Zerodha?

As long as you are looking to trade in derivatives, Yes – a student can open a trading account with Zerodha. All you need is to be of 18 years of age and have a valid PAN card.

Only income proof is required for derivative trading.

- How is Zerodha IPV done? Is it Mandatory?

IPV or In-Person Verification is definitely mandatory, not only with Zerodha but with all the registered stockbrokers in India.

Though an IPV, an in-person meeting is done by the executive of the broker with the client to confirm that the person who provided the documentation and the one being met are the same. This has been relaxed recently by the regulatory bodies and now the same verification can be done online through different video call mechanisms.

In the case of Zerodha IPV, this can be done through a webcam or even by Skype/Whatsapp call. An OTP will be sent to the registered email/mobile number and the client needs to show the same OTP on the screen in order to validate IPV.

A screenshot is taken as proof for any future references and the whole process gets completed within a few seconds without any requirement of a physical meeting.

- Where is the Zerodha office in Mumbai?

This broker has its registered office headquartered in Bangalore. You can check the details of Zerodha Branches and information on Stockbrokers in Mumbai as well.

- What is Zerodha Coin?

Coin is a new initiative from the discount stock broker where users can invest in mutual funds directly without using any intermediaries, distributors, or funds house.

Recently, the discount broker has made the platform free-to-use and there are no separate charges levied on your mutual fund investments through Coin.

- What is Zerodha Gold?

As mentioned earlier, the discount broker now offers Government securities, bonds including the Sovereign gold bond scheme. In this scheme, you can invest in Gold and get a fixed return of 2.5% along with the regular market returns on Gold on a yearly basis.

Kite application can be used for this investment.

- What is Zerodha Smallcase?

With this, users are given a provision to use the concept of thematic investing in their investments.

- How to Put Stop Loss in Zerodha?

Once you log in to the Kite application, look for the ‘More Options’ section.

For instance, if you are placing a Bracket order, you will input fields of Stop Loss and Target Price. Here you can enter the stop loss value and may choose to ignore the target price and the trailing stop loss fields.

In case you are placing a Cover order, there will be a range displayed along with the Stop Loss field. You can enter any value between the range in that field to set the stop loss.

Want to Open a Demat Account? Please refer to the form attached below

Know more about Zerodha

In case you are looking to know more about this discount broker, here are some reference articles for you:

Demat account is a must for an individual who is planning to buy and sell shares and can be used to hold shares in the electronic form. It was easy to transfer funds from my saving account to, so the high transaction charges did not bother me. Demat means dematerialising shares into digital format rather than on physical paper. The demat account is used as a bank where shares bought are deposited in, and where shares sold are taken from. You will get a single account for demat & trading.

First off I want to say awesome blog! I had

a quick question in which I’d like to ask if you don’t mind.

I was interested to know how you center yourself and clear your mind prior

to writing. I have had a difficult time clearing my thoughts in getting my thoughts out.

I truly do enjoy writing however it just seems like the first 10 to 15 minutes are generally

wasted just trying to figure out how to begin. Any ideas or tips?

Thanks!

Strongly suggest…don’t use their crazy service.

They are simply bloody suckers. Very very poor customer service. I realized this within few days that choosing zerodha for trading was a very wrong decision. But guess what, within one day I sent them request to close my account…which was not even active, but they simply denied my request. They don’t even returned my money which they deducted twice for opening an account. I simply got stuck, then I decide ok lets do it. But unfortunately, this was not the end. These people keep asking to send some stupid POA document by international courier from Denmark to India again and again and again.., and they won’t even accept it which I sent them. Having said that I showed them these docs by scanning before sending it by courier. But they don’t value their international clients time and money. Because they didn’t activate my account upto 3 weeks, I was only able to buy shares and can’t sell it. I requested them many time to please activate my account…all those docs are mine.,…I only sent them…but they refused all my request and I ended up losing all my money in that share which I wanted to resale at right time. I would strongly suggest please don’t ever open account with this stupid service so called Zerodha.

If you want more information you can directly write to me.

Nice

Zerodha is a good discount broker and no 1 in india

hi thanks for the information and posts

check best stock broker reviews