Zeroshulk

List of Stock Brokers Reviews:

Zeroshulk has gone through various business transitions in the past 31 years or so. It started as V.Kumar & Co., then renamed the business to Zeroshulk finance and investment private limited in 1996.

Let’s find out more about the discount broker in this review.

Zeroshulk Review

The business then expanded its operations into the commodities market in 2003 under the title Zeroshulk Commodities private limited. The company also became the member of MCX Stock exchange in the year 2008.

Today Zeroshulk is a mainstream discount stockbroker and claims to have 9000+ customers who transact across multiple segments. This discount broker is part of Vikson securities, another stockbroking firm and is based out of Chandigarh, Punjab.

Both the firms run under the same operational team. Zeroshulk alone claims to have more than 100 employees under its belt.

“Zeroshulk through its listed parent Vikson Securities has 3500+ active clients by 2018.”

With this discount stock broker, clients can trade and invest in the following segments:

- Equity

- Commodity Trading

- Currency Trading

- Bonds

- Insurance

- Fixed Deposits

Rohit Joshi, CEO – Vikson Securities (Zeroshulk)

Zeroshulk Trading Platforms

The stockbroker provides trading platforms across the web, desktop and mobile devices.

Zeroshulk Desktop Based Terminal Software

The desktop trading platform comes with the following features:

- User-friendly Interface – the platform can be customized in the terms of its look and feel. There are high-quality charts that display the latest trends, technical reports from the market etc.

- High Stability – data processes at relatively higher speed even during events of high transactions

- Storage – Personalized trading reports and files can be saved on Zeroshulk storage.

- Shortcuts allowed for different features so that users can make quick movements.

This is the basic look and feel of the terminal based application:

Zeroshulk Web Application

The web version of the platform is a browser-based application that provides flexibility and accessibility of the system to the users. Some of the features of this web application include:

- Compatible with most of the prominent browsers.

- A wide range of technical analysis tools such as charts, graphics, indicators.

- Lightweight application with low configuration requirements.

This is how the web-based browser application looks like:

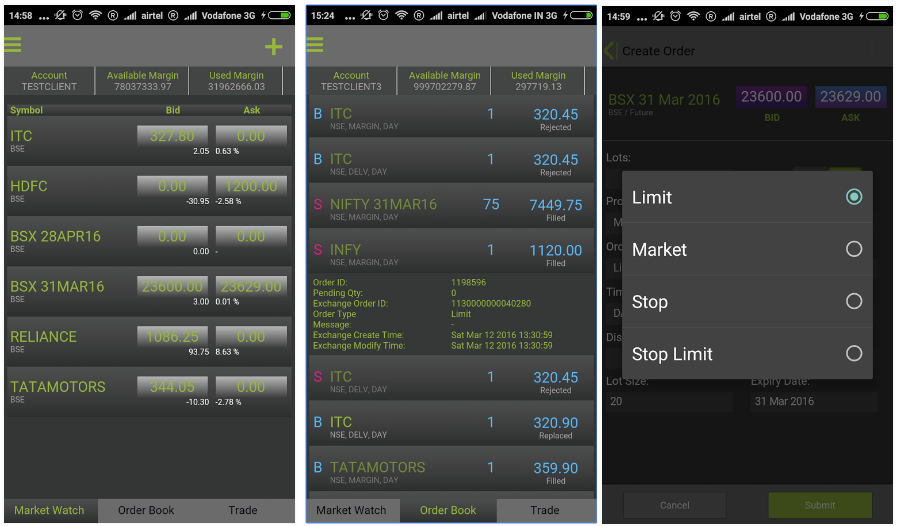

Zeroshulk Mobile App

The mobile app allows you to trade from a smartphone. To use the app, open the Zeroshulk Demat Account. It comes with the following features:

- Better connectivity

- Higher security

- Much easier to us

Here is the mobile app snapshot from Google Play Store:

| Number of Installs | 500 - 1,000 |

| Mobile App Size | 17 MB |

| Negative Ratings Percentage | 5% |

| Overall Review |  |

Apart from the above-mentioned trading platforms, the stockbroker also provides different types of calculators such as Brokerage Calculator, Span calculator to its clients for their usage.

Users also have the option to use NSE based applications such as NSE NOW or NEST while using Zeroshulk’s services.

Also Read: Best Online Trading Platforms in India

Zeroshulk Customer Service

Zeroshulk is an evolving discount stock broker, however, it provides various communication channels such as:

- Web Chat

- Phone

- Social Media

Although the discount broker has been successful in providing multiple channels for customer service the overall tones still seems to be a little salesy. It would be better if the support executives are trained to bring quality to the overall communication rather than pitching their products and positioning most of the times.

“Zeroshulk claims to provide 16 hours of IT support starting from 8 am in the morning until 12 am late night.”

Zeroshulk Pricing

Being a discount stock broker, the charges are pretty nominal across segments. Here are the details for your reference:

Zeroshulk Account Opening Charges

The account opening charges are free of cost with no annual maintenance charges for the first year. From the second year onwards, the AMC is charged at ₹300 per year.

Zeroshulk Brokerage

“Zeroshulk offers multiple brokerage plans to its clients based on different trading styles.”

This discount stockbroker comes with 3 pricing models. Here is the detailed information:

| Flat Trading Plan | Monthly Trade Plan | Unlimited Trading Plan | |

| Price | INR 15/Order | INR 999/Month | INR 2499/Month |

| Features | Flat Pricing per order | No restrictions on number of trades | One time payment |

| Customer can pick from Equity Cash, Equity Futures & Commodities | No limit on volume |

Use this Zeroshulk Brokerage Calculator for complete charges and your profit

There are few other aspects on top of the pricing set up explained above:

- Call & trade options are available at INR 20/order

- Intraday limits up to 20X on Equity, 4X on future trades, 4x for commodity and currency trades.

Zeroshulk Transaction Charges

Apart from the other payments, you are supposed to shell out transaction charges as well. The percentages shown below are multiplied by your trade value to calculate the overall transaction charges to be paid:

| Segment | Transaction Fee |

| Equity Delivery | 0.00325% |

| Equity Intraday | 0.00325% |

| Equity Futures | 0.0019% |

| Equity Options | 0.05% |

| Currency Futures | 0.0019% |

| Currency Options | 0.05% |

| Commodity | 0.0031% |

There are few stockbrokers that entice clients with low brokerage charges but then charge higher transaction charges to compensate for the loss of brokerage. Zeroshulk is not part of that list and charges nominal transaction charges across segments.

Thus, you can be assured of low charges levied by the broker. Having said that, make sure you understand any potential hidden charges. Once finalized, get these details emailed from the official email account of the broker for any future usage.

Zeroshulk Exposure or Leverage

The discount broker offers decent exposure across segments. Here are the details listed:

| Equity | Upto 10 times for Intraday |

| Equity Futures | Upto 3 times Intraday |

| Equity Options | No Leverage |

| Currency Futures | Upto 3 times Intraday |

| Currency Options | No Leverage |

| Commodity | Upto 3 times Intraday |

The broker offers average values of exposure across segments. Thus, users looking for high exposure values may look for some other stockbroker.

Disadvantages of Zeroshulk

Here are some of the concerns you must be aware of this discount broker:

- Relatively a new name in the discount broking segment

- Other discount brokers offer similar services at 15% to 25% less cost per executable order

- Relatively untested trading platforms

“For this financial year 2018-19, Zeroshulk has received 5 complaints at NSE which translates to 0.10% of its active client base. The industry average is 0.02%.”

Advantages of Zeroshulk

At the same time, let’s talk quickly about some of the positives this discount broker brings along:

- Charges relatively low brokerage with zero account opening charges

- Annual maintenance fees for the first year is free

- Different fixed price brokerage plans allow clients to pay as per their trading habits.

How to Open a Demat and Trading Account?

Enter Your details here to get a callback.

Next Steps:

Post this call You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review on documents required for demat account.

Zeroshulk Membership Information:

Here is the membership information of the broker with different exchanges and intermediate parties:

| Entity | Membership ID |

| BSE | INB 011381036 |

| NSE | INB 231381030 |

| MCX SX | INE261319631 |

| CDSL | IN-DP-CSL-578-2010 |

| MCX | INZ000023634 |

| NCDEX | 0414 |

| Registered Address | SCO-58-59 Sector 17D, Jan Marg, Bridge Market, 17D, Sector 17, Chandigarh, 160017 |

The details can be verified from the corresponding websites of the exchanges.

Some Frequently Asked Questions About Zeroshulk (FAQ):

What are the account opening charges at Zeroshulk?

The account opening cost for this discount stock broker is free and you are not required to pay anything to open your demat account and trading account with the broker. Furthermore, the AMC (annual maintenance charges) is free for the first year and is INR 300 from the second year.

Overall, pretty reasonable in its charges.

What are the brokerage charges levied by Zeroshulk?

The discount stockbroker has 3 kinds of brokerage plans for its clients.

First one is flat INR 15 per executed trade. Users entering into stock trading or beginner level users, in other words, can start with this brokerage plan.

Secondly, there is a monthly plan that allows you to trade on an unlimited basis in a specific trading segment of your choice. This plan costs INR 999 per month. The plan is suitable for traders that perform medium to heavy trading and are looking to save brokerage charges against their trades.

Then, there is another unlimited trading plan for traders who are looking for a long-term career in trading. This plan costs INR 2499 as a one time cost for a lifetime. Once subscribed, users can trade for unlimited level forever.

How is the customer service at Zeroshulk?

With few communication channels, the discount stock broker provides around average customer service to its clients. The broker needs to certainly work on the training of its support staff to improve the overall quality of customer support provided by the broker.

How is the performance of the trading platforms at Zeroshulk?

The discount stock broker is still getting mature as far as its trading platforms are concerned. It has a presence on devices alright, but the quality of the trading platforms still will take some time to get to an optimal level. As of now, the terminal based trading application of the broker is relatively better in terms of performance and usability as compared to other trading applications.

What exposure or leverage values are offered by Zeroshulk across segments?

The discount stock broker plays pretty safely when it comes to exposure. It only provides 10 times exposure for intraday trading, 3 times for futures trading and none for options trading. Thus, users looking to make big using exposure might have to settle with some other stock broking house.

You can check out the comparison of Zeroshulk Vs Other Stock Brokers here:

More on Zeroshulk:

If you are looking to know more about Zeroshulk, here are a few reference links for you:

Zeroshulk Review  | Zeroshulk Hindi Review  |

Zeroshulk Comparisons  | Zeroshulk Brokerage Calculator |

| Zeroshulk Transaction Charges | Zeroshulk Demat Account |

Video Review; Video Review; |

Zeroshulk Web Application

Zeroshulk Web Application