Angel Broking

List of Stock Brokers Reviews:

Angel Broking (now called Angel Broking Limited), headquartered in Mumbai, is an Indian Full Service Stock Broking company established in the year 1987.

With the recent pivot towards flat brokerage charges, Angel Broking comes out as a much more value-for-money-oriented stockbroker.

With low brokerage charges, you get free research, tips, and the offline presence of a full-service stockbroker, which is rare.

Let’s have a quick look at the different aspects of this stockbroker for you to decide whether it is good enough for you or not.

Angel Broking Review

Angel Broking is a depository participant with CDSL and is a member of the Bombay Stock Exchange (BSE), National Stock Exchange (NSE), National Commodity & Derivatives Exchange Limited (NCDEX), and Multi Commodity Exchange of India Limited (MCX).

When it comes to offline presence, the company has more than 11,500 sub-brokers and franchise outlets in 900+ cities across India.

As of now, the SEBI registered stockbroker boasts of more than 1 Million clients in its lifetime till now.

Thus, there are reasonable chances of you finding its office around your area, especially if you are living in the 1st, 2nd, or 3rd tier city.

Also Read: Is Angel Broking Safe?

“Angel Broking boasts of an impressive 10,09,199 active clients by 2020-21 this financial year.”

Listen to this podcast of Angel Broking here:

The company has been recently awarded the “Fulcrums of Commodity Derivatives Market” award by MCX for FY 2018-19.

Angel Broking management has recently announced that they are going to come up with an initial public offering in the next few months in the range of ₹600 Crore. For more information, check this detailed review on Angel Broking IPO.

Dinesh Thakkar, Managing Director

“Angel Broking is known for the wide offline presence that it has been able to capture in the last three decades of its establishment.

Started as a small broker, Dinesh Thakkar has been a remarkable personality in taking this full-service stockbroking house to multiple levels of growth.”

Angel One Features

After discussing the company, let’s have a look at some of the advanced features of the stockbroker. The stockbroker has recently changed its name from Angel Broking to Angel One to offer a better and advanced trading experience to its clients.

Here are some of the advanced features:

- Comprehensive guide to stock market investing.

- ARQ Platform for a free stock market recommendation.

- High-Frequency Trading with Smart API.

- Smart Buzz for the latest market updates.

- Community Learning with Smart Store.

Angel Broking Products

Angel Broking primarily provides financial services to retail clients. Having an account with the stockbroker provides traders the opportunity to invest in the following investment products:

- Equity

- Commodity Trading

- Currency Trading

- Portfolio Management Services (PMS)

- Life Insurance

- ETFs

- IPOs

- Mutual Funds

- Loans Against Shares

Angel Broking is one of those stockbrokers that has put its consistent focus on technology.

These can be exemplified through the trading applications it offers to its clients including Angel Speed Pro, Angel Broking Trade, Angel Broking App.

One of the recent additions has been their automated investment engine named – ARQ that runs completely on algorithms and has no human intervention in its processing.

This automated engine recommends different investment products that you can invest in based on different trends and future estimations (more on this later).

Angel Commodity

Angel Broking offers its clients the opportunity to trade in the commodity segment through MCX and NCDEX. In Commodity trading, traders carry out trade in commodities, such as:

- Precious metals

- Base Metals

- Energy

- Agricultural Products

You’d need to open a separate commodity trading account to carry out your investments in this particular trading segment.

Angel Broking Trading Platform

Angel Broking always has had a close association with technology as can be seen from their state of art investment engine – ARQ.

Similarly, the stockbroker has been including the latest technology in their trading platforms available across desktop, web, and mobile.

In this Angel Broking review, we will talk about the various trading platforms the stockbroker has to offer:

- Angel SpeedPro – Desktop Trading Platform

- Angel Broking App – Mobile Trading Platform

- Angel Broking Trade – Web Trading Platform

Although all the trading platforms by the stockbroker are packed with numerous innovative features. However, only Angel Broking Trade and Angel Broking App are powered with ARQ Technology.

Not only this, the broker is known for offering better services and is continuously coming up with innovative ideas and plans. The latest transformation of Angel Broking to Angel One going to prove beneficial both to the broker and its customers.

Here are the full details of all the Angel Broking trading.

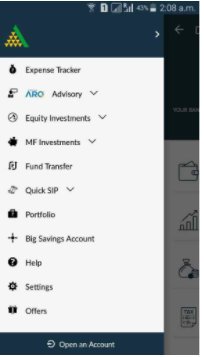

Angel Broking App

Angel Broking app is a comprehensive mobile trading app by the stockbroker. Powered by the Hi-tech auto advisory engine – ARQ, the app packs quite a punch with all the exciting features it has on offer.

ARQ helps users to stay invested in the top-performing stocks and mutual funds, while the smarter trading platform makes online trading pretty simple.

There are few innovative features such as faster stock-tracking with multiple watch lists, auto news updates & real-time fund transfer-ability through multiple banks.

Here are some of the features of the Angel Broking mobile trading app:

- Live Market Data – A trader gets access to market data in real-time such as livestock prices, emerging trends, etc.

- ARQ – Personalized advisory offering index-beating returns.

- Charts – 21+ Intraday charts to help day traders.

- Integration With Multiple Banks – Angel broking app is integrated with 40+ banks which further enhances the ease of trading.

- Apply For IPO – Traders can apply for IPO through the platform with 3 clicks.

- Technical Indicators – Technical chart indicators and overlays to analyze each and every aspect of the stocks.

- Notifications – Personalized notifications for trades and ideas.

Here are some of the screenshots of the app that tell us about How to use Angel Broking App :

Some of the concerns with the Angel broking mobile app include:

- Connectivity issues in smaller cities

- User experience can be improved

- A limited number of features as compared to other mature mobile apps for trading

This is how the mobile app is rated at the Google Play Store:

| Number of Installs | 1,000,000+ |

| Mobile App Size | 22 MB |

| Negative Ratings Percentage | 15.2% |

| Overall Review |  |

| Update Frequency | 2-3 Weeks |

| Android Version | 4.2 and Up |

| iOS Version | 9.0 and Up |

Angel Broking Trade

Angel Broking Trade is a web-based trading platform by the stockbroker. The platform can be accessed from – trade.angelbroking.com.

Angel Broking web-based trading platform has been in the service of traders for a while now. The user does not need to install anything while using this platform and can trade directly through a web browser.

Some of the features of Angel Broking web trading platform include

- Track Portfolio – On the Angel Broking Trade app, a trader can track investments across all asset classes and for your entire family from a single place

- Research – Traders get access to the latest market data, news as well as Angel Broking research reports which will help them analyze the stocks better, and manage risks accordingly.

- User Friendly – Easy to use & intuitive navigation with custom authentication for added security.

- Notifications – A trader can set alerts on investments and get notified through email or SMS, as soon as an opportunity, or deadline arrives.

- Ease of Trade – Trade from the comfort of your home with the high-speed trading platform. Shuffle between multiple exchanges, and enjoy easy access to live streaming quotes.

Here is a screenshot of Angel Broking Trade

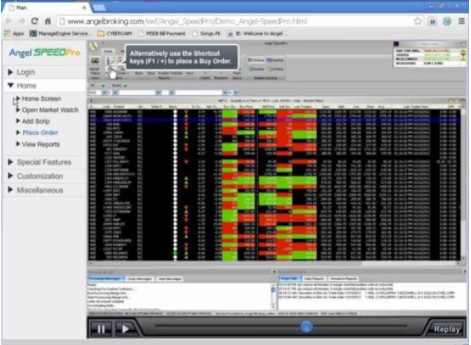

Angel Speed Pro

Angel Speed Pro is the desktop trading platform by the stockbroker. The Angel Broking App Download can be done for the website and installed on a laptop, PC, desktop.

Some of the features of Angel Speed Pro include:

- Live Market Watch – Traders can keep track of multiple stocks by adding them to their watchlist. Further, the traders can customize their watchlists as per requirements

- Extensive Data – 30 days intraday and 20 years of historical data with 70 + studies for advanced technical analysis

- Real-Time Rate Update – The feature of real-time market updates on Angel Broking Speed Pro ensures that traders never miss out on trading opportunities.

- Portfolio – A trader can manage all of the investments in their portfolio. Analyze purchase prices, day’s gains and losses per stock, and the overall profit loss at a single glance

- Integrated News Flash and Reports – Angel Speed Pro has a feature of live news flash and research reports which ensures traders take note of any upcoming opening. The Research reports will assist traders in making a more refined decision.

Here is a screenshot of SpeedPro Angel Broking

Angel Bee

Angel Bee (previously called Angel Wealth) is basically an investment management mobile app from Angel Broking.

The app allows you to plan out your investment goals, provides you with recommendations for investments in equity and MF based on ARQ – the automatic investment engine from this full-service stockbroker.

Some of the features of Angel Bee are:

- Shows your current holdings and positionings across different financial products

- Allows you to open a Big savings account which gives potentially higher returns as compared to a standard savings account.

- The mobile app is sleekly designed and is optimal for beginner users as well.

This is how the app looks like:

Below are the Angel Bee Reviews on Google Play Store:

| Number of Installs | 500,000+ |

| Mobile App Size | 18 MB (Android), 67.4 MB (iOS) |

| Negative Ratings Percentage | 17% |

| Overall Review |  |

| Update Frequency | 3-4 weeks |

| Android Version | 4.2 and up |

| iOS Version |

In conclusion, if you are a beginner-level trader, you may choose to use either the Angel Broking Mobile App or the web trading platform.

Users who are relatively experienced and are looking for a wider number of features may opt for the terminal application i.e. Speed Pro.

Angel Broking Demat Account

To reap the trading benefit with Angel Broking, the foremost step is to open a demat account with the broker.

The broker although offers 2 in 1 account but you can easily link your bank account and trade smartly and effortlessly with the broker.

Also, the broker offer the online and offline mode to open a demat account.

Let’s dive in to learn how you can activate the services and start trading right away.

Angel Broking Demat Account Opening

To open a demat account simply you need to fill in some basic details and submit few essential documents like a PAN card and Aadhar card.

Also, you can open a demat account with Angel Broking with an Aadhar card, for which you need to follow a little different method of e-Mudra verification.

Now to open a demat account with all the required documents just follow the steps:

- Visit the website of Angel Broking.

- Fill in the details like name, mobile number, and city.

- On verification of mobile number, you can proceed further to upload the documents like PAN card and Aadhar card.

- Further, link your trading account with the bank account using a simple method.

- The last step is the e-sign where you need to enter the Aadhar card and OTP received on the registered mobile number.

- Once done the account gets activated in few minutes.

Angel Broking Demat Account Opening Form

Other than the above method you can open an account via the offline method.’

- Visit the website and download the account opening form.

- Now fill in the required details and sign at the required field.

- Submit it to the nearest branch along with the self-attested photocopies of the documents.

Click here to download the form and open a demat account offline.

Angel Broking Charges

Full-service stockbrokers generally charge higher brokerage values because of the range of services they offer to their clients, and Angel Broking is no exception.

Although Angel broking brokerage charges are reasonable if the initial deposit is fair enough.

Further, there are other charges such as Angel Broking account opening charges, Angel Broking transaction charges, etc.

In this Angel Broking review, we take a look at all the charges related to the account:

Angel Broking Account Opening Charges

Angel Broking account opening charges include – Demat and Trading account opening and account maintenance charges.

One of the biggest attractions of having an account with the stockbroker is the prospect of a free Demat account in Angel Broking, wherein a trader doesn’t have to pay a penny for opening an Angel Broking 3 in 1 Demat account.

| Angel One Account Opening Charges | Angel Broking Account Opening Charges | |

| Account Opening Charges | NIL | |

Being a full-service stockbroker, it charges its clients a percentage-based commission. This basically implies that depending on your trade value a specific percentage will decide the actual brokerage you are going to pay for that particular trade.

For instance, if you are trading for ₹1,00,000 at the delivery level and your brokerage percentage is 0.40%, that would mean you are going to pay ₹1,00,000 X 0.40% or ₹400 as the brokerage for that particular trade.

Angel Broking Demat Account Charges

Angel Broking is known to provide the best in industry brokerage rates. The stockbroker has come up with a new flat fee brokerage plan by the name Angel Broking iTrade to suit any and every type of trader.

All the details of this Angel Broking brokerage plan are listed below:

Angel iTrade Prime

Angel Broking has introduced a flat-rate brokerage charge plan titled ‘Angel iTrade‘.

Under this plan, any investor or trader can get all the benefits such as research, customer support, offline assistance from this full-service stockbroker while paying a fixed brokerage rate.

Unlike in the rest of the brokerage plans (discussed below), there is no percentage-based commission charged by the broker.

However, there are a couple of slabs that decide this fixed brokerage rate:

- For Delivery based trades in the angel broking Equity brokerage charges is ₹0.

- For the rest of the segments including Derivatives, Intraday, Commodity and Currency trades, the brokerage charged by Angel Broking is ₹20.

There is no condition of an initial deposit. In fact, you can open a ZERO-deposit Angel Broking demat account under this plan. Also, know about How To Operate Angel Broking Demat Account and clear your confusions that may arise post opening the account with the stockbroker.

Furthermore, you can certainly negotiate on the brokerage charges you pay to the broker. This depends on a couple of factors:

- Your initial deposit

- Your negotiation skills

If you are starting with ₹50,000 or more, then certainly you can get much lesser brokerage charges after a round or two of negotiations with the executive.

In order to start using Angel iTrade, make sure you activate Angel iTrade plan on your trading account.

Angel Broking Transaction Charges

Apart from the brokerage charges, you, as a client are also required to pay few taxes and transaction charges. Generally, these charges are at a percentage level and depending on your trade value, the actual monetary value gets calculated.

Here are the Angel Broking transaction charges:

| Segments | Brokerage Charges |

| Equity Delivery | Rs. 0 |

| Equity Intraday | Rs. 20 / Executed Order Or 0.25% (Whichever Is Lower) |

| Equity Futures | Rs. 20 / Executed Order Or 0.25% (Whichever Is Lower) |

| Equity Options | Rs. 20 / Executed Order Or 0.25% (Whichever Is Lower) |

| Currency Futures | ₹ 20 Per Executed Order Or 0.25% (Whichever Is Lower) |

| Currency Options | ₹ 20 Per Executed Order Or 0.25% (Whichever Is Lower) |

| Commodity Futures | ₹ 20 Per Executed Order Or 0.25% (Whichever Is Lower) |

| Commodity Options | ₹ 20 Per Executed Order Or 0.25% (Whichever Is Lower) |

Angel Broking DP Charges

There is another form for charge i.e. the DP charge that is applicable for delivery-based trading only.

When you sell off the shares from your demat account, then the depository in place requires you to pay them for delivering your shares to the buyer. These charges are applicable only on the sell side of the trade and can be levied once per scrip per day.

In the case of Angel Broking, those charges are INR 20 per scrip per day.

STT Charges in Angel Broking

Apart from GST, there are few other charges levied by the central government. One of those is STT.

STT implies Securities. and transaction taxes and in case of Angel Broking, these charges vary based on the trading segment you trade.

Here are the details:

| Security Type | Transaction Type | STT Rate | STT Levied On |

| Equity | Buy (Delivery) | 0.10% | Purchaser |

| Equity | Sell (Delivery) | 0.10% | Seller |

| Currency Derivatives- Future | Buy | Nil | – |

| Equity Derivatives-Future | Sell | 0.01% | Seller |

| Currency Derivative-Option | Buy | Nil | – |

| Equity Derivative-Option | Sell | 0.05% | Seller |

| Equity Derivative-Option (When Option Is Exercised) | Sell | 0.13% | Purchaser |

| Equity Mutual Funds- Close Ended/ ETF | Sell | 0.00% | Seller |

| Equity Mutual Funds- Open Ended | Sell | 0.03% | Seller |

| Equity Mutual Funds-Intraday (Non-Delivery) | Sell | 0.03% | Seller |

Angel Broking Margin

In case you are looking for margin in your trades across segments, then Angel Broking Margin Funding provides the highest margin values, which is the highest among other competitors.

This holds true, especially for derivatives trading and Intraday in Angel Broking.

Please refer to the below table to find details on the Margin provided:

| Angel Broking Margin | ||

| Segment | Margin Provided | |

| Equity | Approx 8 times for majority of the stocks - Delivery Upto 48 times for the approved stocks - Intraday | |

| Futures Delivery | 20 times for Index and 10 times for stocks | |

| Futures intraday | 60 times for selected contracts | |

| Options Delivery | Premium Levied by the Exchange | |

| Options intraday | 6 times for Option buy and 60 times for option sell for selected contracts | |

Angel Broking Account Opening Offers

The stockbroker regularly comes up with exciting offers from time to time. Some of the currently run Angel Broking offers are:

- Free Demat Account in India

- Free Trading Account

- Free Annual Maintenance Charges

- Flat Brokerage across trading segments

You may fill the form and get access to all these exclusive offers right away!

Angel Broking Customer Care

Angel Broking, being a full-service stockbroker, has higher expectations from its client base when it comes to quality and speed of resolutions.

The broker provides the following communication channels for clients in order to reach out to it:

- Angel Broking Customer Care Number

- Online Customer Service Centre

- Phone

- Offline Branches (Sub-brokers and Franchise offices)

When it comes to the ground reality though, Customer Service is one of the biggest concerns for this full-service stockbroker.

Be it any aspect such as Quality of Service, Communication, Time taken for issue resolution – the service level is below average.

Thus, it becomes super-important for this full-service stockbroker to make sure their service lives up to the brand they are looking to create for their clients.

Angel Broking Research

Angel Broking research is considered by many, especially novice traders, investors to be their most appealing feature. The research reports help them in gaining information and analyze various stocks, businesses.

In total there are 2 types of Angel Broking research reports.

Here in this Angel Broking review, we learn about the research facility extended by the stockbroker:

- Angel Broking Fundamental Reports – These reports help traders conduct a fundamental analysis of stocks. A trader is provided with a list of best stocks, detailed company reports, IPO reports and a daily market performance report.

- Angel Broking Technical Reports – These assist traders in conducting thorough technical research of stocks. Further, there are 3 types of Angel Broking research technical reports – Daily, Weekly and Rollover report.

Angel Broking – Investing in IPOs

There are a couple of ways in which you can invest in IPO (Initial Public Offerings) using Angel Broking services. Here are those listed:

- Online

The online process is pretty easy using the desktop trading application or the mobile app when it comes to IPO applications. You can also edit or modify your application using these trading platforms.

- Offline

Then, there is the offline way in which you can visit the sub-broker or franchise office of this full-service stockbroker, fill in the ASBA Form, provide information such as Bank account information, a PAN Card, and Demat account.

Angel Broking Fund Transfer

Angel Broking fund transfer is one of the finest services offered by the stockbroker. There are 4 different ways through which clients can transfer funds from their bank account to their angel broking trading account.

Below are the 4 ways through which Angel Broking online fund transfer can be executed:

Angel Broking Trading Platform

You can transfer funds to your trading account using any of the trading platforms such as Angel Broking Web, Angel Broking Mobile App, or Angel Speed Pro.

Using this softwares, you can transfer funds from more than 40 banks in India through the payment gateways provided.

Remember, there is a small fee associated with when you use payment gateways for fund transfer.

Angel Broking Back Office

Apart from the trading platforms, the back office can also be used to transfer your funds into your trading account with the broker.

There are multiple options to choose from such as NEFT, RTGS, and IMPS. While the first two options are free to use, IMPS may come up with some charges when you transfer funds.

Demand Draft

Clients can also use the Demand draft along with the requisite documents for the funds’ transfer process. This is free to use.

Cheque Deposit

You can drop a cheque from any of your linked bank accounts with the broker. However, this process takes a few business days for the funds to get transferred.

The cheque deposit has no transfer fee associated.

Angel Broking Advantages

There are some benefits of opening your demat and trading account with this full-service stockbroker. Here in this Angel Broking review, we list a few:

- Well Established Name – Angel Broking is one of the biggest full-service stockbrokers in India. The stockbroker is among the top 5 brokers in terms of the NSE active client base.

- Trading Platforms – The platforms offered by the stockbroker are based on advanced technology ever-evolving trading platforms across devices.

- Automated Investment Engine – Introduction of new investment engine, ARQ that helps clients with stock market predictions.

- Vast Investment Options – A wide range of trading and investment products offered to clients be it Angel Broking Equity, Commodity, Currency, Angel Broking PMS, Insurance, Mutual funds, IPO etc.

- Fund Transfer Facility – Funds transfer provision available to more than 40 banks in India.

- There are multiple Angel Broking Account Types including Demat, Trading, Joint, Minor etc.

- Offline Presence – Huge offline presence with its sub-broker and franchise offices.

- Research – A prominent team of research experts providing market research reports, recommendations and tips. Angel broking research is regarded as among the best in the industry.

- High Margin – High margin values offered, especially if you are an intraday trader.

- Trusted Brand – Large brand equity with a high trust factor gained from its client base.

- Ease of Investing in Mutual Funds – Easy Mutual fund investments through recent initiatives such as Angel Bee.

- Hassle-Free Account Opening Process – Completely online account opening process with minimum hassles for traders.

- The whole Angel Broking Account opening time is pretty low too. So, in case you are in some hurry to trade, well this broker is a good option for you.

Angel Broking Disadvantages

Well, there have been few concerns raised by different customers with their experiences. We have listed some of the Angel Broking Disadvantages below:

- Customer Service – Customer service has a relatively higher turnaround time

- Fund Transfer Facility – Funds transfer from your trading account to a bank account is a relatively cumbersome process and is not directly available through online platforms.

- Call and Trade – Angel Broking charges for trades placed through their call and trade facility.

“Angel Broking has received around 41 complaints for the financial year 2019-20 at BSE and NSE. The complaint percentage stands at 0.01% while the industry average is 0.01%.”

Angel Broking Account Opening

If you wish to open an account with this stockbroker, you can get in touch with any of its sub-broker by locating the Angel Broking Sub Broker Near me.

The sub-broker helps you with any queries and help you in meeting your trading targets effortlessly.

You may also choose to fill up the below-displayed angel broking account opening form and a callback will be arranged for you:

Post this call, there are 2 ways to get started.

- If you have an Aadhar card, then demat account opening process can be completed in a few minutes.

- Otherwise, you need to provide a few documents to start your account opening process. The Angel Broking Account Opening Documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

eKYC Angel Broking

In order to perform eKYC (e-Know Your Customer), you need to provide some basic documentation to the broker along with performing an IPV i.e. in-person verification.

However, if you already had done your eKYC with some other stockbroker, then you do not need to go through this process.

At the same time, Angel Broking has a DKYC process as well, where the complete documentation and verification process can be done online. In this format, there is no physical or manual verification is part of the process.

This brings in ease, efficiency and convenience to both sides.

Angel Broking Membership Information

Here is the membership information of the broker with different exchanges and intermediate parties:

| Entity | Membership ID |

| SEBI | INZ000042935 |

| BSE | INF010996539 |

| NSE | INE231279838 |

| MSEI | INE261279838 |

| CDSL | IN-DP-CDSL-234–2004 |

| PMS | INP000001546 |

| MCX | MCX/TCM/CORP/12685 |

| NCDEX | NCDEX/TCM/CORP/00220 |

| Registered Address | Angel Broking Private Limited, Registered Office: G-1, Ackruti Trade Centre, Road No. 7, MIDC, Andheri (E), Mumbai – 400 093 |

The details can be verified from the corresponding websites of the exchanges.

Conclusion

Established in 1987, Angel Broking is one of the earliest full-service stockbrokers of India, and enjoys trust among traders.

This can be seen from the fact that they rank number 4th in terms of active clients with the number going upwards of 10 lakh. In addition, the stockbroker has physical branches in more than 900 cities of the country.

Angel Broking offers its clients vast options when it comes to providing trading platforms. They have trading platforms available for desktop, mobile as well as a web-based trading platform.

All of which score well on user experience, performance, exhaustibility. However, it is their automated investment engine, ARQ which is the USP of the stockbroker.

Although, it has shown a good amount of growth as far as technology is concerned, however, there is a lot that it can work upon when it comes to Customer Service.

This particular area definitely needs immediate attention from the broker.

To conclude this Angel Broking review, this broker has been doing a reasonable job when it comes to areas such as Technology, Research and offline assistance.”

Angel Broking FAQs

Here are some of the most frequently asked questions by existing and potential clients of this stockbroker

- What is Angel Broking?

Angel Broking is a full-service stockbroker that provides you with an environment to trade in the Indian stock market across different investment products.

The broker offers you multiple services in terms of research, trading platforms, customer support, education, local help so that you can invest your capital.

The broker is based out of Mumbai and has a presence with more than 11,500 offices in different parts of India. It was established in 1987.

2. How Angel Broking works?

The broker works in a pretty straightforward way. Its business model is based on the commissions generated from the trades placed by its client in the stock market.

As a trader or investor places his money in the stock market, there will be a small percentage of commission or brokerage that Angel Broking will charge.

This brokerage collectively from all its client base becomes the revenue the broker generates.

It is also involved in institutional trading, however, its scale is much smaller as compared to retail trading.

3. What is the meaning of Angel Broking?

There is no specific meaning attached to the brand name Angel Broking. It is just the registered name of the company that operates as a stockbroker in India.

4. How easy is it to open an Angel Broking account?

It is pretty easy to open a demat account with this full-service stockbroker, especially if you have an Aadhar card. The account with this full-service stockbroker can be opened within 4 hours, ideally.

5. Can students open a demat account in angel broking?

Yes, students can certainly open a demat account. At the same time, an income statement is a mandate to activate your demat account.

If you do not have any income then there are other alternatives. Please fill in the form above to know more.

6. Can I invest in IPOs with Angel Broking?

Yes, IPO investment is possible.

7. Is there any Angel broking windows phone app?

No, as of now the broker provides only android and iOs versions of mobile apps.

8. What is Angel Broking Eye?

It is a web-based trading platform from the full-service stockbroker. It can be accessed from any device and any browser. This web app is now known as Angel Broking Web.

9. What is Angel Broking ARQ?

ARQ is an automated recommendations engine introduced in 2016 by the full-service stockbroker.

The broker claims that this engine runs on millions of data points and recommends stocks and investment products to clients based on their risk appetite, investment preferences, demographic information and more.

10. What is the employee strength of Angel Broking?

More than 7000. However, in the recent past, the broker has seen a lot of changes in its top management to go along with high attrition in the last 1 year or so.

11. How is Angel Broking Research?

The broker has been known for high-quality research with their expert team in the past. Recently, the broker has seen 2 heavy exits with two major research heads leaving the company (one each in technical and fundamental research).

Thus, with the new team, the broker needs to prove its mettle in the coming time.

12. What kind of brokerage plans are offered by Angel Broking?

There are four plans offered by the full-service stockbroker – Classic, Preferred, Premier, and Elite. Your brokerage percentage is decided based on the plan you pick, which is further based on your initial trading amount deposit.

13. What are Angel Broking Demat Account Charges?

₹0, based on the initial trading deposit you provide to the broker.

14. What are Angel Broking Demat Account Annual Maintenance Charges?

₹450. The amount can be further levied if you start with a reasonable trading account balance (at least ₹50k). However you can get an exemption from paying AMC charges under certain plans, thus you can enjoy the benefit of free demat account with no annual charges.

15. How is Angel Broking Customer Care Quality?

Although this is a full-service stockbroker, it falls very short when it comes to delivering quality through its customer service.

It has multiple communication channels such as Email, Toll-free number, and support by the call but on the ground, the quality of communications, skill set of executives, and turnaround time can be improved.

16. How many complaints have been registered against Angel Broking by its clients?

There have been 149 complaints officially registered against this full-service stockbroker at NSE this year and the broker has kept a 100% resolution success rate in the recent past.

Furthermore, Angel Broking goes hand in hand with a 0.02% complaint rate implying 2 out of 1000 clients file a complaint.

For more information, you can check this review on Angel Broking Complaints.

17. How to close Angel Broking Account?

If you are looking to close your account, you will be required to fill in the account closure form, clear all the dues (if any) and submit this form either to your local sub-broker or you can send it to the customer support of the broker.

Once all the formalities are completed, the account closure process generally takes 2-3 business days.

For more information, you can check this detailed review on how to close demat account.

18. How many branches does Angel Broking have?

The full-service stockbroker has a presence in around 900 cities of India with more than 8500 sub-broker and franchise locations (explained later).

Also, check out these detailed comparisons of Angel Broking Vs other stockbrokers:

Angel Broking Sub Broker

As mentioned above, this stockbroker has a huge offline presence in different forms such as franchises, sub-brokers, master franchises, remisiers, authorized personals etc.

Thus, go through Angel Broking Sub Broker list and become a partner with them, with Angel Broking Sub Broker Commission, you can reap the benefits and earn as per your convenience.

If you wish to become one, you’d need to provide some basic documentation along with taking care of a few formalities such as:

- Setting up an office (depends on your partnership type)

- Initial Deposit

- Business experience in the domain

The revenue model, in this case, is pretty straight-forward too. The broker offers you a revenue share (generally in the range of 40% to 80%) from the overall brokerage generated by you.

Angel Broking Branches

Here are the different locations across states where the full-service stockbroker has the presence in:

| States/City | |||||

| Andhra Pradesh | Chittoor | Hyderabad | Kakinada | Medak | Nellore |

| Rajahmundhry | Vijaywada | Vizag | Wrangal | ||

| Bihar | Patna | ||||

| Chhatisgarh | Bilaspur | Raipur | |||

| Delhi/NCR | Gurgaon | Noida | Faridabad | New Delhi | |

| Gujarat | Ahmedabad | Amreli | Anand | Baroda | Bharuch |

| Bhavnagar | Deesa | Gandhidham | Gandhinagar | Nadiad | |

| Himatnagar | Jamnagar | Junagadh | Mehsana | Porbandar | |

| Palanpur | Patan | Vapi | Gondal | Surat | |

| Rajkot | |||||

| Haryana | Ambala | Hisar | |||

| Jharkhand | Jamshedpur | ||||

| Karnataka | Bangaluru | Belgaum | Hubli | Mangalore | Mysore |

| Udupi | |||||

| Kerala | Kochi | Kottayam | Thrissur | Trivandrum | |

| Madhya Pradesh | Bhopal | Chattarpur | Indore | Gwalior | Rewa |

| Maharashtra | Ahmednagar | Amravati | Jalgaon | Kolhapur | Mumbai |

| Nashik | Pune | Nagpur | |||

| Orissa | Bhubaneswar | ||||

| Punjab | Amritsar | Chandigarh | Jalandhar | Ludhiana | Patiala |

| Rajasthan | Ajmer | Beawar | Bikaner | Kota | Jaipur |

| Udaipur | Jodhpur | ||||

| Tamil Nadu | Chennai | Coimbatore | Erode | Madurai | Salem |

| Trichy | |||||

| Uttar Pradesh | Agra | Allahabad | Bareilly | Dehradun | Ghaziabad |

| Lucknow | Meerut | Varanasi | Sonebhadra | Kanpur | |

| West Bengal | Asansol | Durgapur | Kolkata |

Thinking to open a Demat Account? Please refer to the below form

Know more about Angel Broking