Kotak Securities

List of Stock Brokers Reviews:

Kotak Securities, a subsidiary of Kotak Mahindra Bank was founded in the year 1994 and is a bank-based full-service stockbroker.

The broker provides investment and trading services in a variety of financial products to its clients. The variation is that wide that it even provides portfolio management services to its HNI (High-net-worth Individuals) clients.

In this detailed review, we will have a quick look at some of the most crucial aspects of this broker so that you can decide on whether to go ahead with it or not.

Kotak Securities Review

Kotak securities claims to have a client base of around 12 lakh and running over 5 lakh trades on a daily basis. The stockbroking firm has a sound offline presence in around 360 cities of the country with 1255 branches.

Since it is a bank-based stockbroker, it also offers you a 3 in 1 demat account which basically smoothens the overall fund transfer process between your trading and demat accounts. Furthermore, it offers a Kotak NRI Trading account for Indian traders living outside India.

Such accounts are easy to manage and are suitable for beginners who might find it relatively hard to understand the intricacies of stock trading and investing.

If you are here to get the answer to a very obvious question that Is Kotak Securities good for you or not, this is the perfect spot across the internet to get it!

Furthermore, the broker recently came up with a low-cost intraday trading option for its clients called Kotak Securities FIT Plan. We will talk about that later in the review.

Kotak Securities Products

With a running membership of Bombay Stock Exchange (BSE) and National Stock Exchange (NSE), it offers services such as:

- Equity

- Derivative Trading

- Mutual Funds

- IPO

- Kotak Demat Account

- ETF (Exchange Traded Funds)

- Currency Trading

- Tax-Free Bonds

- Portfolio Management Services

“Kotak Securities has an active client base of 2,68,459 as per the latest active clients count.”

Uday Raj Kotak – Kotak Securities, Owner

Kotak Securities Apps

Kotak Securities offers 5 different trading platforms across devices to its clients. It provides a Trading terminal, a mobile trading app, web trading and lighter versions of their trading software. Detailed information follows

Kotak Stock Trader Web

Kotak Securities through their browser-based trading application allows its clients to trade directly through the website. You don’t need to download or install any particular software to start trading through this cloud-based trading solution.

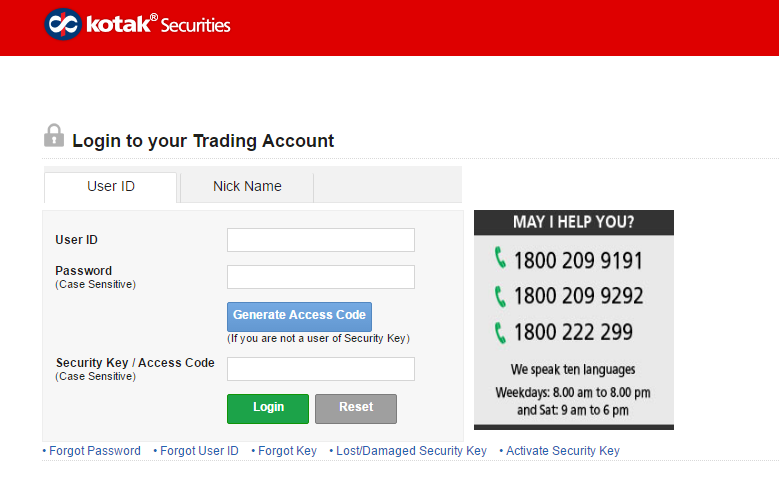

Once you reach the login screen, the user just needs to enter the credentials (username and password) and he/she can directly start trading from there.

This is how the login screen of Kotak Web Trading looks like:

Kotak Securities XTRALITE

Users with a relatively slower internet connection or from remoter areas of the country can use a lighter version of the web trading application – XTRALITE.

The lighter version of the application allows the users to trade at a good speed without the concern of their slower internet connection. The application allows you to trade in Equity and derivative trading segments.

Some of the features of this application are:

- Works with complete responsiveness across devices be it mobile, desktop, laptop or tab

- Order monitoring and placing order features

- Get market research reports to make sound trading and investment decisions

Keat Pro X

Keat Pro X is an installable trading terminal for serious traders. It a full-fledged trading platforms with all major features that are must for such an application:

- Best of the research reports and market tips within the software that help you in taking the right decision at the right time.

- Get access to market information with real-time stock movements, top gainers and losers, updates on various indices etc.

- Personalized watchlist feature that allows you to add up to 100 scrips within a watch list. Users can combine scrips across BSE, NSE and currency segments

- Interactive charts and graphs to make the client’s life easier

The trading software can be installed by logging into the Kotak Securities Web platform (explained above), click on ‘Trading Tools’ and select KEAT Pro X. The application can be run on both Windows (XP and above) as well as Mac (OS C Leopard or higher).

Here is the demo of Keat Pro X from Kotak Securities:

Kotak Securities Fastlane

If your computer is old or just has very slow speed or your office network infrastructure does not allow you to download software – then Fastlane is just the right thing for you.

This is a light Java-based trading application that takes minimal of machine’s processing speed and still runs at a good speed.

Fastlane comes with the following features:

- Access to company reports and market research

- A list of S&P CNX NIFTY scrips stream LIVE on it by default.

- Unlimited watchlist

Kotak Stock Trader

Stock Trader is a mobile trading app and it allows clients to trade across Equity, Derivatives and currency and also has features such as access to live market trends, Portfolio tracking etc.

Detailed features of the mobile trading app are listed below:

- Customized Watch-list creation

- Funds transfer

- Connected with LIVE TV (facilitated by Bloomberg TV)

- Multi-level security

- Get live market updates through integration with Times of India, Economic times or Money Control

- Trade rectification and cancellation allowed through the mobile app itself.

- Intraday charting functionality available

- Stop-Loss provision (learn more from How to Put Stop Loss in Kotak Securities)

Here is the demo of the mobile trading app:

Here are the stats of the mobile app from Google Play Store:

| Kotak Mobile App | ||

| Number of Installs | 10L+ | |

| Mobile App Size | 29 MB | |

| No. of Charts | 4 | |

| No. of Indicators | 100+ | |

| Overall Review |  | |

Kotak Trade Smart

This is another terminal application from this stockbroking house in case you are looking for multiple options. The terminal application allows trades to analyze at both technical as well as fundamental levels.

You can trade across multiple segments and at the same time place different kinds of orders as well.

Kotak Securities Customer Care

Kotak Securities offer customer support services.

If you are an existing customer or want to avail of the information related to the trading account, product information, or technology platforms, etc then you can call them from Monday to Friday between 9:00 AM to 6:00 PM.

Kotak Securities Call and Trade facility is also there for you to make your trades offline.

The bank-based stockbroker provides the following channels of communication to its clients including:

- A toll-free number (1800 209 9191/ 1860 266 9191)with support in 10 different languages

- Email support (service.securities@kotak.com)

- Web assistance

- Phone

- Offline branches

- Webchat

Although the stockbroker provides multiple modes of communication but quality-wise it still has a lot to improve.

First and foremost, the broker needs to train its support staff to make sure the communication and messaging done is personalized in nature.

As of now, it is a simple copy and paste template-based communication to most of the queries or concerns raised.

Furthermore, the broker can also set specific timelines to different kinds of queries, thus, creating a sense of trust among the client base when it comes to the turnaround time of issues. There seems to be no process followed at this point in time.

Kotak Securities Research

The full-service stockbroker provides research and recommendations at multiple levels as listed below:

- Investor’s research – this is done at the fundamental level for clients who are looking for long-term investments including:

- Fundamental research

- Macroeconomic research

- Industry or sector research

- Company research

- Special reports

- Morning insights

- Stock ideas

- Portfolio advice

- Mutual fund research

- Trader’s research – this research helps day traders to make use of market opportunities for the day by keeping a close eye on the market movements. Under this, users get:

- Market morning

- Weekly technical analysis

- Stock ideas

- Derivative reports

Apart from research, Kotak Securities also provides trading and investment education to its clients through different modes. The broker calls it ‘Kotak University‘ with multiple modules such as:

- Equity Section

- Derivatives

- Mutual funds

- Financial planning

- Hindi University

- Kotak Securities videos

- Fundamental analysis of stocks

- Technical analysis of stocks

Thus, in a sense, the bank-based full-service stockbroker takes care of its clients from multiple dimensions including technical and fundamental research as well as education.

Kotak Demat Account

With Demat Account, it becomes easy for traders to convert into electronic form.

Kotak Securities Demat Account offers many benefits.

- Post Kotak Securities Account Opening, you can link all your accounts.

- Apart from this, there are other benefits associated with it.

- Helps in doing an in-depth analysis and stock recommendation.

- Completing trade in minutes

- Offers free intraday trading by paying Rupees 999/ year.

To open a Demat Account one need to submit few documents like:

- Identity Proof (Aadhar Card/ License)

- Address Proof (Ration Card/ Passport/Rent Agreement)

- Income Proof (Income Tax/Salary Slip)

- PAN Card

- Photographs

Kotak Securities Charges

Kotak Securities has one of the most expensive stock in India across all dimensions including account opening, maintenance, brokerage and so on.

Kotak Securities Account Opening Charges

Kotak Securities offers the service to open a stock trading account and the Demat account service.

All these involve certain charges and commissions.

Here are the charges and Annual Maintenance Fees involved in opening an account with Kotak Securities.

| Kotak Securities Account Opening Charges | ||

| Transaction | Fees | |

| Trading Account Opening Charges | ₹750 | |

| Trading Annual Maintenance Charges (AMC) | ₹0 | |

| Demat Account Opening Charges | ₹0 | |

| Demat Account Annual Maintenance Charges (AMC) | ₹600 | |

If you are looking to start with a higher initial deposit and/or looking to have a high turnover on the stock market, we would suggest you negotiate to the last drop and get yourself a decent deal from the broker.

Otherwise, it’s a costly affair.

Here are the details:

Kotak Securities Demat Account Charges

To open a Demat and trading account, here are the initial charges a client needs to take care of:

| Kotak Demat Account Charges | ||

| Dematerialization | 150 per certificate + 50 per request courier charges | |

| Rematerialisation | Rs.10 for 100 securities | |

| Pledge Charges | Rs.20 per ISIN | |

| Invocation of Pledge | Rs.20 per ISIN | |

| Charges for client master change (Applicable for Address, Email, Mobile and Bank Updation) | Rs.50 per modification request | |

| DIS Re-Issuance | DIS Re-Issuance | |

| Charges for CAS (Hardcopy) | Rs 200 per statement per year + Rs 50 courier charges (Digital is free) | |

Kotak Securities Brokerage

When it comes to brokerage fees, it becomes important to understand on how does Kotak Securities charges brokerage as the broker offers multiple brokerage plans.

To give you the context, the major brokerage plans offered by Kotak Securities are:

- Kotak Securities Trade Free Plan

- Kotak Securities Trade Free Max Plan

- Kotak Securities Zero Brokerage Plan

- Kotak Securities Dealer Assisted Plan

Here is a brief on what benefits are offered by these plans:

-

Kotak Securities Trade Free Plan

The trade-free plan is beneficial for intraday traders as this plan comes with the benefit of free intraday trading.

Here are special features of this plan:

- Free Account Opening

- AMC: ₹50 per month

- Validity: Lifetime

- MTF: 12.49% per annum

Stock Used as Margin for Derivatives Trade: 16.99% per annum (applicable only on non-cash collateral limits used above 50% of the total margin requirements).

Find the details of this plan in the table below:

| Kotak Securities Trade Free Plan | ||

| Trading Segment | Brokerage | |

| Equity Delivery | 0.25% or ₹20 whichever is higher | |

| Equity Intraday | Zero | |

| Equity Futures | ₹20 per order | |

| Equity Options | ₹20 per order | |

| Currency F&O Intraday | Zero | |

| Currency F&O Delivery | ₹20 per order | |

| Commodity F&O Intraday | Zero | |

| Commodity F&O Delivery | 0.25% | |

| Commodity F&O Intraday | Zero | |

| Minimum Brokerage | ₹20 | |

2. Kotak Securities Trade Free Max Plan

If you are into margin trading and looking for the MTF at the minimum rate, then the plan has something to offer you.

Under this plan, you can enhance your buying power up to 4x as the broker offers you the margin funding at the minimum interest of 8.75% per annum.

Also, by subscribing to this plan, one can reap the benefit of brokerage cashback of up to ₹4,128 for 90 days on all trades post first MTF trade.

Some of the features of the Trade Free Max plan are as follows:

- Free Account Opening

- AMC Charges: ₹50 per month

- Subscription fees: ₹2499 per annum

- Validity: 1-year

- MTF: 8.75% per annum

- Stock used as margin for derivatives trades: 16.99% per annum (applicable only on non-cash collateral limits used above 50% of the total margin requirement)

Other details of this plan are provided in the table below:

| Kotak Securities Trade Free Max Plan | ||

| Trading Segment | Brokerage | |

| Intraday | Free | |

| Equity Delivery | 0.25% or ₹20 whichever is higher | |

| Futures | ₹20 per trade | |

| Options | ₹20 per trade | |

| Carry Forward (in all segments) | ₹20 per order | |

3. Kotak Securities Zero Brokerage Plan

Next is the zero brokerage or no brokerage plan, exclusively for traders who are less than 30 years of age.

With this plan, the trader can reap the benefit of free trading across segments, however, there is an annual subscription fee of ₹499+GST.

Here are the features of this plan:

- Zero Account Opening

- AMC Charges: ₹50 per month

- Subscription Fees: ₹499

- Validity: 2 years

- MTF: 12.49%

- Stock Used for Margin for derivatives trades: 16.99% per annum (applicable only on non-cash collateral limits used above 50% of the total margin requirement).

Find out the details and benefits of this plan in the table below:

| Kotak Securities Zero Brokerage Plan | ||

| Trading Segment | Brokerage | |

| Intraday | Free | |

| Equity Delivery | ||

| Futures | ||

| Options | ||

4. Kotak Securities Dealer Assisted Plan

If you are a beginner in trading and investment then you can reap the benefit of trading with Kotak Securities at the minimum brokerage along with the services of the dedicated dealer.

There is no subscription plan but one has to pay one-time account opening fees of ₹499+GST. The dedicated dealer discusses plans and strategizes your investment to help you earn maximum benefits.

Here is the detail of the brokerage charges under this plan:

| Kotak Securities Dealer Assisted Plan | ||

| Trading Segment | Brokerage | |

| Equity Delivery | 0.39% of the turnover or ₹21 whichever is higher | |

| Equity Intraday | 0.039% of the turnover or ₹21 whichever is higher | |

| Equity Futures | 0.039% of the turnover or ₹21 whichever is higher | |

| Equity Options | ₹39 per lot | |

| Currency Futures | ₹9 per lot or ₹21 whichever is higher | |

| Currency Options | ₹5 per lot or ₹21 whichever is higher | |

| Commodity Futures | 0.039% of the turnover or ₹21 whichever is higher | |

| Commodity Options | ₹39 per lot | |

You can also use this Kotak Securities Brokerage Calculator for complete charges information and your profit at the end of the trade.

Kotak Securities DP Charges

Apart from all the charges mentioned above, there are DP charges that are levied by the broker for some of the specific services it provides.

The details are mentioned below (remember to understand these charges, otherwise, you may believe that these were hidden charges that were not discussed during the account opening process):

| Charge Type | Charges | Minimum Charges |

| Dematerialisation | ₹50 per request and ₹3 per Certificate | NA |

| Rematerialisation | ₹10/- for 100 securities (shares, bonds, mutual fund units etc) | ₹15 |

| Regular (Non- BSDA Account) Market / Off-Market Transactions (Sell) BSDA Account (For Individual Accounts only) Market / Off-Market Transactions (Sell) | 0.04% of the value of securities (Plus NSDL Charges) 0.06% of the value of securities (Plus NSDL Charges) | ₹27/- (Plus NSDL charges as applicable) ₹44.50/- (Plus NSDL Charges) |

| Regular Account Maintenance Charges | Resident ₹65 p.m. for up to 10 debit transactions ₹50 p.m. for 11 to 30 debit transactions ₹35 p.m. for more than 30 debit transactions NRI - ₹75 p.m | NA |

| Pledge Charges | 0.05% of the value of securities | ₹30 |

| Invocations of Pledge | 0.04% of the value of securities | ₹30 |

| Charges for client master change (Applicable for Address, Email, Mobile and Bank Updation) | ₹49/- per modifi cation request | NA |

| DIS Re - Issuance | ₹99/- per DIS Booklet | NA |

| Charges for CAS | ₹3/- per month | NA |

Apart from all these, you must be aware of the STT charges in Kotak Securities. All of such sorts of charges add up against the profit you take home from your trades.

Kotak Securities Margin Calculator

The broker also offers the service of Margin Trading funding of 8.49% as a part of paid feature.

Margins offered by the stockbroker are explained below:

| Equity | Upto 15 Times for Intraday, For Delivery upto 3 times |

| Equity Futures | Upto 5 times Intraday |

| Equity Options | Buying No Margin, Shorting upto 2 times for Intraday |

| Currency Futures | Upto 2 times Intraday |

| Currency Options | Buying No Margin, Shorting upto 2 times for Intraday |

| Commodity | Upto 2 times Intraday |

Apart from the Equity intraday, the full-service stockbroker does not offer much exposure to its clients across segments.

Thus, it really depends on the kind of trading segment you are looking to put your money into and correspondingly you can make a choice.

Kotak Securities Disadvantages:

Here are some of the concerns about opening your demat and trading account with this bank-based full-service stockbroker:

- Brokerage charges are relatively high, especially with the availability of discount brokers

- DP charges have complained few times around its non-transparency in the recent past

- The broker does not allow its clients to trade in the Commodities segment.

“There have been 8 complaints registered against the stockbroker in this year 2019-20 which converts to 0.01% of its total active client base. Interestingly, the industry average is 0.01% as well.”

Kotak Securities Advantages:

At the same time, here are some of the positives of Kotak Securities too:

- 3-in-1 account provision available due to Kotak Securities’ backing from Kotak Mahindra banking services

- Trading platforms across devices available even with the lighter versions that can be used at remote locations or by people having a slower internet connection

- There is a Kotak Securities Refer and Earn scheme available where you can make money on referring your network to this stockbroker.

- All sorts of trading and investment segments available for clients

- Online chat available which is rarely available among full-service brokers

Conclusion

“Kotak Securities is one of the trustable brands in the financial industry in India. Their banking services have been around for a while and when it comes to the stockbroking space, they have been able to create a space for themselves.

They are known to be a reliable name with decent research and trading platforms. At the same time, the broker does understand its limitations in customer service and pricing.

Users looking for value for money services must definitely lookout for some other player as Kotak is certainly going to be heavy on your pockets.

At the same time, users looking to enter into the stock trading space and are finding some hard time in trusting any specific stockbroker may opt for Kotak Securities as their initial stockbroker.

But again, once you get an idea of how the stock market works, it makes total sense to switch to a value-for-money broker rather than paying hefty charges at multiple levels.”

Looking to open an account and Start Trading?

Enter Your details below and get a FREE call back.

Next Steps:

You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

Kotak 3 in 1 Account

As mentioned at the onset, this stockbroker provides a provision of a 3 in 1 demat account where you get:

- Demat Account

- Trading Account

- Bank Account

All these accounts are integrated with each other in the backend with your details. This helps in automatic transfers of funds and shares from and to different types of accounts against your name.

For more information, check out this detailed review on Best 3 in 1 Demat Account.

Kotak Securities Information:

Here is the membership information of the broker with different exchanges and intermediate parties:

| Entity | Membership ID |

| BSE | INB 010808153/INF 011133230 |

| NSE | INB/INF/INE 230808130 |

| MSEI | 260808130/INB 260808135/INF 260808135 |

| NSDL | IN-DP-NSDL-23-97 |

| CDSL | IN-DP-CDSL-23-97 |

| PMS | INP000000258 |

The details can be verified from the corresponding websites of the exchanges.

Kotak Securities Head Office

If you are looking to find where Kotak Securities is located physically, then here is the address of its headquarter office:

| Entity | Details |

| Registered Address | 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra (E), Mumbai 400051 |

Kotak Securities DP Id

The DP ID or the Depository participant ID of Kotak Securities is IN300214.

This information is as per the official records of NSDL or National Securities Depository Limited. For complete verification, you are advised to make a quick check on the NSDL’s website as well.

Kotak Securities Login

As mentioned above, this stockbroker has multiple trading platforms that you can use to place your trades.

In order to login into any trading apps, you need to have valid credentials i.e. username/password which you get after your trading account is activated with the broker.

If you are looking to log in to its web trading app, you can use this link and enter your details to get started with your stock market investments.

Kotak Securities NSDL or CDSL

Kotak Securities is affiliated with the NSDL or the National Securities Depository Limited.

Kotak Securities Account Closure

If in case, your experience with the broker has not been good enough, you may choose to close your account.

The account closure process requires you to download and submit the account closure form along with the requisite documents. The form & the documents are supposed to be submitted to the closest branch of the broker (Kotak Securities, in this case).

You need to ensure that the demat account does not have any shares lying in it and the trading account is also checked out with the balance. Furthermore, there must not be any outstanding that you need to pay.

All these details will be validated and once you deposit the form, it takes 7-10 business days for the overall process to complete and for your account to get closed.

Kotak Securities Account Closure Form

In order to start the formalities of your Kotak Securities Account Closure, fill this Kotak Securities Account Closure Form and submit to the executive of Kotak Securities in a branch closest to you.

Kotak Securities KYC Form

There are times when you need to update your phone number, email address or even your residential address etc.

In such cases, you are required to fill the Kotak Securities KYC Form with updated details. If you are opening your account for the first time, you’d need to fill this form as a mandate, nonetheless.

With these details, your information is submitted in the database as a customer. Later, other parties can access this data as well post your consent.

Kotak Securities Fund Transfer

When we talk about fund transfers, it is a 2-way process.

Either you are looking to transfer your funds from your bank account to your trading account or the other way around.

For the first case, when you want to transfer funds from your bank account to your trading account, you need to login to your web trading application.

Here you will find the menu item titled ‘Trading’. Under this, there will be a section called ‘Money Transfer’.

Select ‘Bank To Equity’ and Submit. Then you’d need to select your bank name out of the list.

Furthermore, you will need to add the amount that you are looking to transfer. With all these details, you will be directed to the bank’s website where you need to complete the transfer process.

For the second case, you will need to follow the same steps initially but choose ‘Equity to Bank’ opposite to what you chose in the first case.

Once you submit, the amount will be transferred to your bank account post checking the minimum margin and other considerations.

Kotak Securities FAQs:

Here are a few frequently asked questions about Kotak Securities:

What are the account opening charges at Kotak Securities? What about annual maintenance charges (AMC)?

Like other bank-based stockbrokers, Kotak Securities is one of the expensive ones in the industry.

To open your trading account with the broker, you are required to pay a one-time cost of ₹750 and further to maintain your demat account with the broker, an annual payment of ₹600 is required to be made.

To understand why this broker is expensive, industry standards for account opening and maintenance are somewhere around ₹200 to ₹600 while this broker charges more than double at ₹1350.

For more information, you can check this detailed review on Kotak Securities AMC Charges.

What are the brokerage charges at Kotak Securities? Please illustrate with an example.

There are multiple brokerage plans offered by the bank based stockbroker and more or less, the percentage depends on the overall turnover you produce in your trading.

Generally, you are charged 0.50% for delivery trades in equity but it can go as low as 0.3% as well if your turnover is higher.

The way it works is also simple to understand.

For instance, if you place an order in Equity delivery for a value of ₹1,00,000 then you will be charged 0.5% of it as brokerage, implying you will be required to shell out ₹500 as brokerage charges which are pretty high.

Furthermore, when you talk to the stockbroker executive, they have a knack for saying that your brokerage will be”5 Paisa” or “10 Paisa”. Now, this is sort of their slang language and you must not confuse yourself with 5Paisa or 10 Paisa as literal values.

When the executive mentions 10 Paisa, that basically means 0.10% of your trade value and thus, final brokerage calculated is dynamic in nature. It’s better to have a clear understanding in the first place rather than feeling sorry later.

How can I activate my demat account at Kotak Securities?

Once you have filled in all the forms, provided all the necessary documentation, deposited the requisite fees – you will have to go through a verification process called IPV (In-person verification).

Once that is done, you will get notified by email and SMS that the demat services have been activated against your account.

Furthermore, you will also receive credentials (username/password) of your trading softwares so that you can access and start trading.

How can I close my demat account at Kotak Securities?

The closing of a demat account is certainly not as easy as opening one. You will be required to fill in the account closure form, pay off any pending dues or balances, fill in the shares transfer form (if you are looking to transfer your shares to any other demat account), return all unused DIS slips.

Check out this detailed article with all account closure forms on How to close your demat account with a video review.

How is the research quality at Kotak Securities?

The full-service stockbroker provides one of the best research across fundamental and technical levels. The quality of research is also pretty good and better than the industry benchmarks.

For more details, check out the Research section above.

Is Kotak Securities suitable for beginners and small investors?

Not really.

For beginners, it is only suitable if they are finding it tough to trust any other mainstream stockbroker and want to be “feel” 100% safe with a bank based stockbroker ONLY.

Furthermore, the broker will provide you with a 3 in 1 demat account which is not available other full service and discount stock brokers. Although with the introduction of payment gateways and mobile wallets, the importance of 3 in 1 demat account has only seen a decline.

How are the trading platforms of Kotak Securities?

The stockbroker provides multiple trading platforms including Keat Pro X, one of the top-performing trading applications in the industry. This application is known for its wide range of features to go along with decent speed and performance.

The broker also offers a well designed and mature mobile trading application Stock Trader. This application is pretty robust and at the same time, provides a decent user experience to all kinds of traders and investors.

All and all, the stockbroker offers high-performance trading platforms that help to take the industry benchmarks to a new level.

You can check out the detailed comparisons of Kotak Securities Vs Other Stock Brokers:

More on Kotak Securities:

If you want to learn more about this full-service stockbroker, here are a few reference links for you:

I opened Kotak account few days back. Customercare sucks. Platform not at all user friendly. Brokers do not understand simple option terminologies. Fake commitments related to margins. The list can go on.,….. I will never recommend Kotak to anyone.

Stupid broker wasted my one week.

Kotak Group of Companies and Customer Services has no relationship. Kotak only knows hoe to take money form customer and services is not in their business agenda at all. I am one of the most sufferer form Kotak. Me and my family pray to Lord Krishn that Kotak should get their punishment as soon as possible. For none of our mistakes they made us suffer since 2009 till today.

Even if we went to RBI, Kotak manipulated their report and all my complaints were closed without getting my consent. This is what we suffer in India.