Check All Brokerage Reviews

5Paisa Brokerage charges are one of the lowest among the discount brokers in India. Even within the discount broking fraternity, the charges levied across the trading segments are pretty low.

With such brokerage charges, traders can feel free to place high-ticket value trades as well as a larger number of trades without thinking a lot about the commission the stockbroker is going to take away.

Let’s have a quick look at all the details in this complete review:

5Paisa Brokerage Charges

5Paisa is one of the leading discount stock brokers in India with ultra-low brokerage charges across segments. Some of the other values provided by this discount broker apart from cheap brokerage charges include:

- High-performance trading platforms

- Free online stock market education through 5Paisa School

- Quick Customer support

- Free Account Opening

- First 100 trades free on opting Ultra Trader Brokerage plan

When it comes to brokerage, 5Paisa is pretty consistent in its pricing. It charges a flat ₹20 per executed order irrespective of your trade value.

In simpler words, even if you trade for ₹1 Lakh or ₹ 10 Crore, you will still pay ₹20 as brokerage and nothing beyond.

Apart from Brokerage, like any other stockbroker. Here is the 5paisa charges list :

- Brokerage – Amount a stockbroker (here, 5Paisa) charges for providing trading services to you.

- 5paisa STT Charges – Securities Transaction Tax is charged by the Government of India.

- Transaction Charges – a charge levied by specific exchanges (NSE or BSE)

- SEBI Charges – SEBI is a regulatory body in the Indian stock market ecosystem and charges specific rates on your trades.

- GST – the much-talked-about Goods and Service tax is levied on the sum of the brokerage generated and transaction charges.

- Stamp Duty – is levied by your specific state in India and it varies based on the state you opened your trading account in.

For complete details, let’s check the 5Paisa brokerage charges across different segments:

5Paisa Delivery Brokerage

When you buy a set of stocks today and sell it some other day, your trade type is called Delivery. This type of trading is suitable for long-term investors or people who monitor and analyze specific stocks for their profits in the stock market.

When you trade-in Equity delivery segment, you are charged the following payments from 5Paisa:

| 5Paisa Delivery Brokerage | |

| Brokerage | Basic Plan: ₹20/trade |

| Ultra Trader: ₹10/trade | |

| Power Investor: ₹10/trade | |

| Transaction Charges | NSE: 0.00345% |

| BSE: 0.00345% | |

| STT | 0.10% |

| SEBI Charges | 0.00010% |

| Stamp Duty | 0.015% on buy side |

| GST | 18% (brokerage+transaction) |

STT or Securities and Transaction Tax are generally high in this trading segment (across stockbrokers). The stamp duty varies with the state.

For instance, in some states, there is NO stamp duty charged, while a few charge a small percentage, and then there are some that charge a flat charge as well.

You can use this 5Paisa Brokerage Calculator for a complete understanding of different charges levied in your Delivery trades.

5Paisa Intraday Brokerage

At the same time, if you are someone who looks to make quick profits from the stock market and buys & sells stocks within the same trading day – you are into intraday trading.

This type of trading is suitable for people who can sit all day in front of the trading terminal and want to report profits within from their trades on the same day.

Now again the intraday trading profit depends upon the brokerage charges as well. Here as discussed, 5paisa brokerage charges are ₹20 per trade. But if you are an active trader then you can opt for 5paisa Power Investor or 5paisa Ultra Trader at ₹449 and ₹899 respectively.

| 5Paisa Intraday Brokerage | 5Paisa Delivery Brokerage |

| Brokerage | Basic Plan: ₹20/trade |

| Ultra Trader: ₹10/trade | |

| Power Investor: ₹10/trade | |

| Transaction Charges | NSE: 0.00345% |

| BSE: 0.00345% | |

| STT | 0.10% |

| SEBI Charges | 0.00010% |

| Stamp Duty | 0.003% on buy side |

| GST | 18% (brokerage+transaction) |

5Paisa Futures Brokerage

You can do futures trade in the equity, commodity, and currency segments. Most of the brokers come up with different plans for each segment but 5paisa comes up with the benefit of flat brokerage fees of ₹20 per trade.

Further choosing Ultra Trader and Power Investor pack you can save more by paying the brokerage fees of ₹10 for each executed order.

Other than the brokerage, the detail of other charges imposed on your trade is given below:

| 5Paisa Futures Brokerage | |

| Brokerage | Basic Plan: ₹20/trade |

| Ultra Trader: ₹10/trade | |

| Power Investor: ₹10/trade | |

| Transaction Charges | 0.0020% |

| STT | 0.01% (on sell side) |

| 0.125% (on exercise) | |

| SEBI Charges | 0.00010 |

| Stamp Duty | 0.002% (on buy side) |

| GST | 18% (brokerage+transaction) |

5Paisa Option Brokerage

Next to the futures, there is the options segment in derivatives where you can hedge your risk. The brokerage charges for option trading in equity, commodity, and currency along with other charges are provided below.

| 5Paisa Options Brokerage | |

| Brokerage | Basic Plan: ₹20/trade |

| Ultra Trader: ₹10/trade | |

| Power Investor: ₹10/trade | |

| Transaction Charges | 0.053% |

| STT | 0.01% (on sell side) |

| 0.125% (on exercise) | |

| SEBI Charges | 0.00010% |

| Stamp Duty | 0.003% (on side) |

| GST | 18% (brokerage+transaction) |

5Paisa Currency Brokerage

Other than the equity segment one can trade in the currency to reap the benefit of trade. Again the currency can be traded in the futures & options by paying the flat brokerage fees as shown below:

| 5Paisa Currency Brokerage | |

| Brokerage | Basic Plan: ₹20/trade |

| Ultra Trader: ₹10/trade | |

| Power Investor: ₹10/trade | |

| Transaction Charges | Currency Futures: 0.0009% |

| Currency Options: 0.035% | |

| STT | Nil |

| SEBI | 0.00010% |

| Stamp Duty | 0.001% (on buy side) |

| GST | 18% (brokerage+transaction) |

Unlike the other segment, there are no STT charges to trade in currency trading segments in Choice Broking. Apart from this other charges gives you a better idea of total brokerage fees along with the profit you can make in a trade.

5Paisa Commodity Brokerage

Similar to the currency segment you can trade in the commodity segment where you can make a profit by trading in different agri and non-agri commodities. However, the brokerage is the same but it is a little different in other charges like transaction fees.

Also to trade in commodities one has to pay the CTT charges instead of STT charges.

You can grab the complete details of the fees and charges in the table below:

| 5Paisa Commodity Brokerage | |

| Brokerage | Basic Plan: ₹20/trade |

| Ultra Trader: ₹10/trade | |

| Power Investor: ₹10/trade | |

| Transaction Charges | Commodity Futures (Non-Agri): 0.0026% |

| Commodity Futures (Agri): 0.0005% | |

| Commodity Options: 0.0026% | |

| CTT Charges | 0.01% (Sell Future) |

| 0.05% (Sell Option) | |

| 0.0001% (On exercise purchaser) | |

| SEBI Charges | 0.00010% |

| Stamp Duty | Futures: 0.002% (on sell side) |

| Options: 0.003% (on buy side) | |

| GST | 18% (brokerage+transaction) |

5Paisa Brokerage Plans

As discussed above 5paisa offers different brokerage plans that offer an opportunity to active traders to reduce the brokerage charges thus helping the trader to maximize their profits.

5paisa offers two brokerage plans Power Investor Pack and Ultra Trader Pack at ₹449 and ₹899 respectively. Let’s dive into the details of both plans one by one.

5paisa Power Investor Pack

Power investor pack is the brokerage plan of 5paisa offered by the broker at ₹459 under which you need to pay the brokerage of ₹10 across segments.

| 5paisa Power Investor Pack Charges | ||

| Initial Cost | Monthly: ₹449 | |

| Brokerage (any value, any type, any order, any number of shares) | Equity | ₹10 per order |

| Currency | ₹10 per order | |

| Commodity | ₹10 per order | |

| Futures | ₹10 per order | |

| Options | ₹10 per lot |

Along with this, there are many more additional benefits of the pack that are described below:

- Free research reports of more than 4000 companies.

- Derivatives strategies for options trading.

- Portfolio analytic tool required for managing your portfolio.

- Free research ideas.

Ultra Trader Pack 5paisa

As per this pack, the broker can trade across segments at the flat fees of ₹10. To activate this pack, the trader has to pay the upfront fees of ₹899 per month.

The details of charges for the Ultra Trader pack is given in the table below:

| 5paisa Ultra Trader Pack Charges | ||

| Initial Cost | Monthly: ₹899 | |

| Brokerage (any value, any type, any order, any number of shares) | Equity | ₹10 per order |

| Currency | ₹10 per order | |

| Commodity | ₹10 per order | |

| Futures | ₹10 per order | |

| Options | ₹10 per lot | |

| The First 100 trades completely free of cost every month |

Now apart from the brokerage, you can reap many more benefits with the Ultra Trader Pack of 5paisa. Some of these are:

- First 100 trades for FREE.

- Zero DP charges.

- Free equity delivery charges.

- Tool for portfolio analysis.

- Free research tips.

- Derivatives strategies.

- Research tips for FREE.

5Paisa Transaction Charges

As mentioned above, apart from brokerage there are other charges you are supposed to shell out in your trades. Transaction charges are levied by Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) and are a small percentage of your trade value.

In other words, higher your trade value, the higher is the transaction charge you end up paying. But still, the percentage value is very minuscule as shown below:

| 5Paisa Transaction Charges | |

| Segment | Transaction Charges |

| Equity Delivery | NSE: 0.00345% |

| BSE: 0.00345% | |

| Equity Intraday | NSE: 0.00345% |

| BSE: 0.00345% | |

| Equity Futures | 0.0020% |

| Equity Options | 0.053% |

| Currency Futures | 0.0009% |

| Currency Options | 0.035% |

| Commodity | Non-Agri: 0.0026% |

| Agri: 0.00005%-0.001% |

5Paisa STT Charges

Apart from all the charges mentioned above, there could be few more charges that 5paisa might levy on you. However, these charges are not generically applied to everyone and are only applicable if you actually use any of these services.

For commodity trading, STT charges are replaced by CTT charges while for the currency trading segment you don’t need to pay any STT fees.

To trade in equity, you need to pay the following fees as the Securities Transaction Tax.

| 5paisa STT Charges | ||

| Segment | STT Charges | Transaction |

| Equity Delivery | 0.10% | Both Buy and Sell |

| Equity Intraday | 0.025% | Both Buy and Sell |

| Equity Futures | 0.01% | Sell Side |

| 0.125% | On Exercise | |

| Equity Options | 0.05% | Sell Side (on premium) |

| 0.125% | On Exercise | |

| Commodity Futures | NA | - |

| Commodity Options | NA | - |

| Currency F&O | 0 | - |

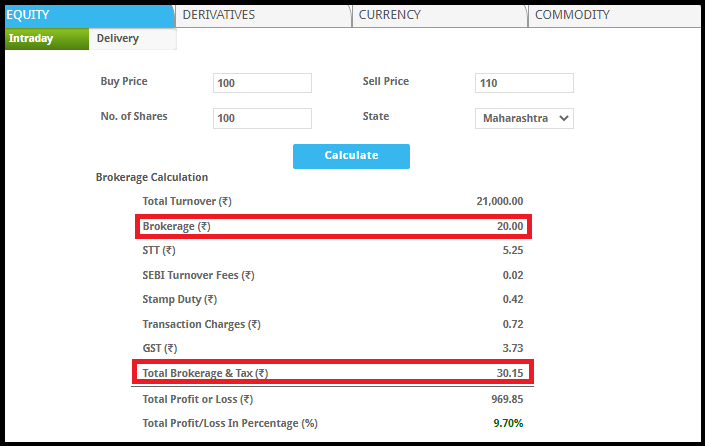

5Paisa Brokerage Calculator

Although the broker charges flat brokerage fees, as already discussed that apart from brokerage one needs to pay certain taxes and other additional fees.

These all charges often make it difficult for traders and investors to evaluate the exact brokerage. Also, it makes it challenging for them to evaluate the profit percentage.

To ease the overall calculation, here is the brokerage calculator that not only evaluates the brokerage fees but also gives you a complete idea of the profit you can make out of your trade.

Conclusion

No wonder seeing the above charges list assures that 5paisa charges the lowest brokerage fees among all the discount brokers in India.

Other than this, the broker is known for offering better services, advanced trading platforms, algorithmic trading features, and lots more.

So what are you waiting for, open a 5paisa demat account now and start trading without any further delay.

Looking to hear back from the executive of 5Paisa?

Provide your details in the form below and a callback will be arranged for you:

More on 5Paisa

In case you are interested to know more about this discount broker, here are a few reference articles for you: