Zerodha ETF

More on Zerodha

Zerodha ETF or Exchange Traded Funds is listed on NSE that brings the change in the way you invest in the stock market.

Before going in deep let’s first clear the idea of ETF.

ETF is the kind of mutual fund scheme that is listed and traded on an exchange like stocks. The price of ETF changes continuously and one can deal with such stocks all throughout the trading day.

Buying and selling ETF with Zerodha is similar to buying and selling of any other stocks. It offers an advantage to investors as they can reap the benefit of intraday price movements.

Also, it enables the investor to buy one single unit thus giving them the chance to make the least possible investment.

The ETF is considered as stock as long as they fulfill the following conditions:

- It is traded on the exchange.

- The member investing in it has an asset with them.

- ETF is liquid.

ETF with Zerodha is available at the least brokerage charges and many benefits. Grab the full information and start investing in the ETF scheme.

Zerodha ETF Brokerage

It is a basket of securities that keep track of underlying indexes like NIFTY, Gold, etc. It is an ideal scheme as it is simple to understand, cost-efficient, thus increasing the chance to gain profit.

Zerodha offers a great opportunity for investors to buy or sell ETFs at the reduced cost thus offering more benefits. On buying ETF with Zerodha it gets transferred to your Zerodha Demat account in two days.

Zerodha ETF Brokerage Charges

The charges of ETF with Zerodha is the same as that of delivery-based trades but it does not include any STT charges as it is not a security.

Since these funds are traded on the secondary market, it does not include any entry or exit load.

So the actual charges of ETF with Zerodha are the transaction charges that are equal to 0.00325% on turnover.

It is calculated as:

Quantity x Price plus 18 percent GST.

SEBI charges Rs 10/crore plus the stamp duty on the ETF. The stamp duty varies with the state of the correspondence address.

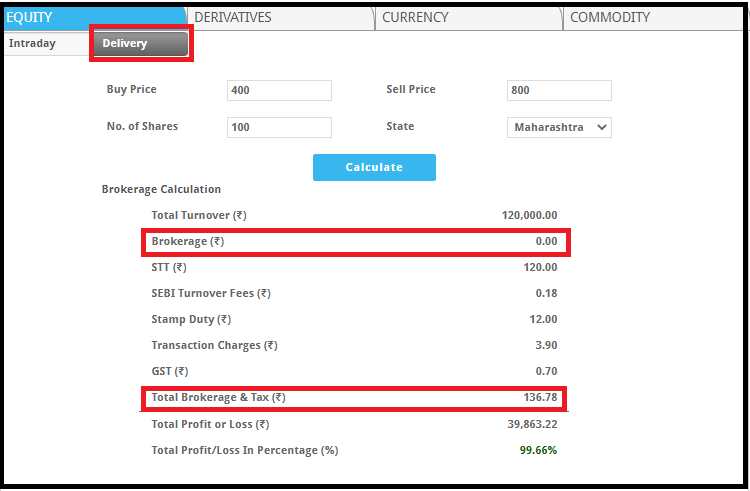

Zerodha Brokerage Calculator for ETF

All these charges are calculated simply by entering the buy or sell prices. This helps you in finding taxes and other fees associated with the trade.

It can be calculated using the delivery segment.

Zerodha ETF App

Trading in Zerodha Gold ETF is very simple. If you are familiar with the trading in equity shares than it would be easy for you to trade in this scheme as well.

Make sure you have a trading or Demat Account with Zerodha.

After opening the account you can buy an asset and can deal with them using the Zerodha Kite.

You can trade in ETF by logging into the app called Zerodha Kite.

In order to buy an ETF search for symbol and add market watch followed by placing an order.

Thus, one can easily place order and trade in ETF with the user-friendly app of Zerodha, KITE.

Conclusion

It enables investors to explore the brilliant opportunity of investing and trading in ETF using the Zerodha platform. With this, you can reduce the investment cost and increase the probability of earning more profit.

Also, ETF can be collateral for cash margin at Zerodha with the least cut of 10% thus offering good margin benefits to Zerodha.

Enter Your details here and we will arrange a FREE Call back.

More On Zerodha

In case you are looking to know more about this discount broker, here are some reference articles for you: