Zerodha FAQ

More on Zerodha

Zerodha is one of India’s leading discount brokers offering brokerage-free equity investments. Since it is leading in the trading world here are the most searched Zerodha FAQ.

The larger the number of clients, the more are the chances of confusion and questions. Dive In to get the best answer for your queries!

Zerodha Frequently Asked Questions

Learn more about Zerodha by getting the best answers on some of the commonly addressed Zerodha faq.

1. Is Zerodha safe?

Zerodha is best known as a discount broker that offers a fixed price brokerage i.e, ₹ 20 per trade. Not only Zerodha is the cheapest broker but also a credible and genuine one.

Being paranoid is justified when money is concerned but with Zerodha, you can be assured that your money is safe. The company is registered with reliable authorities like SEBI, BSE, NSE and is regularly audited by them.

Listed below are some authentic Zerodha related info that showcases its genuinity:

- Zerodha was registration with NSE on Jun 30, 2010

- Zerodha was registration with BSE on May 17, 2012

- Zerodha DP ID

2. Is Zerodha free?

Zerodha’s discount module has attracted numerous investors from pan India. Not only is this module affordable but also thriving for thousands of budding traders.

Zerodha offers free stock trades to investors holding their shares for more than a day. The company’s unbeatable pricing exclusively has flat fees and no hidden charges.

Zerodha charges no money for equity delivery and direct mutual funds. While, a nominal fee of ₹20 is charged on intraday equity transactions, options, and futures.

You can easily open a Zerodha account with a zero amount of investment. Besides, the cost of intraday trade and F&O trade is flat ₹20.

For an executed order at Zerodha, you maximum pay an amount of ₹20, irrespective of the number of trades taking place to execute that one order. For instance, an order for 500 shares, that are bought in 10 different trades of 50 shares each shall cost only ₹20.

Therefore, Zerodha charges only for executed orders and not for placing, canceling and modifying an order.

3. How long does it take to withdraw from Zerodha?

From your Zerodha account, you can withdraw funds from and transfer them to your bank account on the same day. This is applicable on all 7 days of the week.

As per the RBI’s order on NEFT payments, all banks are mandated to make the NEFT payments system available 24/7. This came into effect from December 16 and has ensured round-the-clock NEFT availability on all weekdays as well as on holidays.

Zerodha processes its fund withdrawal requests at the end of each day which is then submitted and processed using NEFT.

Zerodha clients who have their bank accounts in HDFC shall receive funds instantly. While fund withdrawals to all other banks are credited on the next working day.

Also, any request for withdrawal that is placed on Saturday, Sunday or on public holidays may take more than a day to be processed. To summarize, Zerodha processes withdrawal requests from Monday to Friday at 8:30 PM for equity and at 9:00 AM for commodity.

Therefore, the withdrawal of funds from an equity trading account means that the request must be placed before 7:30 PM. Likewise, in the case of commodities, the withdrawal request must be before 9:00 AM.

4. How much time does it take for funds to reach the account from Zerodha bank account?

Zerodha’s banking partner is HDFC therefore, for all clients associated with HDFC bank, the fund withdrawal takes about 3 to 4 hours from the time of processing the request. This is because such transfers fall under the category of an intra-bank transfer.

In case, of any other bank account, fund transfers are done using NEFT/RTGS. This particular transfer takes a while and is processed only the next morning. Thus, such funds would ideally appear in the bank account by the evening of the next day.

As per Zerodha’s fund transfer policy, it takes typically 1 day (24 hours) to process the withdrawal request. However, once the request is processed, the time taken for the funds to appear in one’s bank account solely depends on the NEFT and respective banks and not on Zerodha.

Point to be noted: If a client requests fund withdrawal after Friday, it shall be processed by Zerodha only on Monday. The specific time slots for Friday for the same are – 9 am for commodities and 7:30 pm for equity.

5. Is Zerodha a good platform for beginners?

Taking its revolutionary discount module into consideration, Zerodha can be considered a productive platform for budding traders and investors.

It’s backend platform ‘Zerodha Q’ or Zerodha Console allows you to review your trades on exclusive charts. This actually allows traders to learn from their previous mistakes.

A combination of discounted brokerage, affordable fee, and an informative platform makes Zerodha truly beginner-friendly.

Know many more Zerodha FAQ addressed under different categories.

Zerodha FAQ Kite

In what follows, discussed are some Zerodha FAQ on it’s in-house “kite”.

1. What is Zerodha Kite?

Zerodha Kite is the company’s in-house online trading platform. It is super innovative and is built with advanced technology that suits all investors and addresses their needs correctly.

Zerodha kite is instilled with dynamic features namely charting tools and integration with third-party apps. All these ensure a fast and easy trade.

Besides, Zerodha kite facilitates integrated apps with small base and streak thereby allowing access to quant. This facilitates fundamental analysis using behavioral analytics.

Smallcase, which facilitates thematic investing with a single click clubbed with Streak that allows creation, backtest, and deploying algo without coding have rendered kite an even stronger platform.

2. What are the features of Zerodha Kite?

The two major products offered by Zerodha Kite are Kite 3.0 and Kite mobile.

Kite 3.0 is Zerodha’s web-based trading platform. You can use it for streaming market data, multiple types of order as well as advanced charts.

On the other hand, kite mobile is a trading application that can be installed on Android and iOS devices for free. The mobile app gives its users access to:

- Portfolio tracking

- Multiple Market watching

- Funds transfer

- Advanced charting

- Placing and viewing orders

Also, Kite has a customer-friendly user interface with some very impactful data widgets and universal instrument search.

3. What is Zerodha kite used for?

One can easily use Zerodha kite for fund transfers, depositing as well as withdrawals of money from their Zerodha account.

There are several options provided by Zerodha for depositing money. Namely – Zerodha UPI, payment gateway and IMPS/NEFT/RTGS.

Also, you can place fund withdrawal requests in ‘Q’ since it is integrated with Kite.

All withdrawal requests of Equity, F&O, and currency are processed by Zerodha at 7 PM. While commodity withdrawals are processed at 9 AM (only on weekdays).

4. How can I withdraw money from Zerodha kite?

Not only does Zerodha Kite offer a good user interface but it also provides multilingual support and a wide range of relevant features. With Zerodha kite, you can place withdrawal requests online.

If you wish to withdraw using your mobile phone, you must first open Console on your mobile browser. After this enter the withdrawal amount and click on proceed to place your withdrawal request.

A minimum amount of ₹100 is mandatory for withdrawal.

All withdrawal requests of Equity, F&O, and currency are processed by Zerodha at 7 PM. While commodity withdrawals are processed at 9 AM (only on weekdays). It takes 24 hours for the amount to get credited in your account.

5. Is Zerodha kite free?

Unlike other stockbrokers, Zerodha has effectively changed the stereotypes of investments and trading. Designated as India’s first discount broker, the company has been thriving since it’s commencement in 2010.

Zerodha Kite, for that matter, has also inherited the traits of its parent company (Zerodha) in terms of being pocket-friendly.

Yes, Zerodha Kite is absolutely free for all Zerodha customers. Besides, It should be noted that Zerodha does not charge anything for Fund withdrawal.

Zerodha FAQ Margin

Discussed below are the topmost Zerodha FAQ on margin/leverage.

1. How much margin does Zerodha give?

In any form of trading, borrowed capital or margin plays a vital role. Zerodha offers leverage or margin through the following product types – MIS, BO & CO.

- For MIS (Margin Intraday Square up), Zerodha provides a margin of 3 to 12.5 times depending on the scrip. The exact leverage for every scrip can be found on the Margin Calculator.

- For Index futures & option writing, 35% of the NRML margin is required.

- For Stock futures & option writing, 45% of the NRML margin is required.

- For Commodities & Currency futures, 50% of the NRML margin is required.

If compared with MIS alone, BO (Bracket Order) and CO(Cover Order) provide a higher margin.

A margin of 2.45% of the contract value is mandatory for equity derivatives as well as CO and BO. While that required for Index derivatives is 1.45% of the contract value.

To find out the exact leverage for every scrip, you may use the Zerodha Margin Calculator.

2. What is the Zerodha margin calculator?

Zerodha Margin Calculator is nothing but an online tool. Using this you can calculate the exposure provided by Zerodha for intraday, delivery, F&O, currency, and commodity.

This online tool facilitates the calculation of Zerodha margin funding. Moreover, it can also calculate the extra shares that you are capable of buying, with any extra leverage provided by the stockbroker.

3. What is the Zerodha brokerage margin?

Understanding brokerage in terms of trade would be the amount one pays to his broker. Brokerage typically gives the user access to trade through the broker’s platform.

Trading can be done on various platforms. For Zerodha, the specific trade platforms are NSE, BSE, MCX as well as MCX-SX.

Following are the Zerodha brokerage that apply to online customers, call & trade customers and walk-in clients:

- Equity Delivery trades – No brokerage

- Equity Intraday trades – 0.01% or ₹20 per trade

- Equity Futures – 0.01% or ₹20 per trade

- Equity Options – 0.01% or ₹20 per trade

- Currency Futures – 0.01% or ₹ 20 per trade

- Currency Options – 0.01% or ₹ 20 per trade

- Commodity – 0.01% or ₹20 per trade

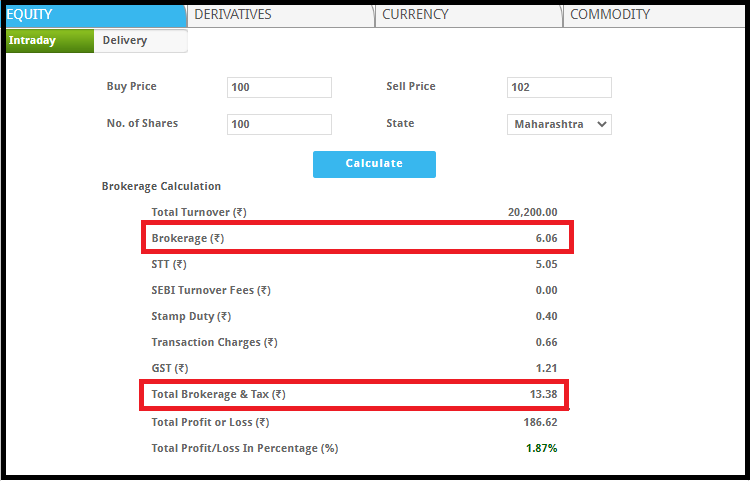

4. How to Calculate Brokerage in Zerodha?

Zerodha is known for offering trading services at the least brokerage. But here comes the question of how to evaluate the total fees after considering stamp duty and other taxes.

Well for that you can refer to our brokerage calculator.

Here all that is required is to enter the price of the share and the number of shares.

Click on calculate and you would be able to know the total brokerage and the profit percentage.

Zerodha Account FAQ

Want to have in-depth knowledge on the Zerodha account? Here are some Zerodha FAQ on account opening and other related concerns.

1. How can I open a Zerodha account?

Zerodha offers an online procedure for opening an account wherein you are required to fill all your details. Post this, you have to get it printed and then post it to Zerodha’s office address.

Here’s a step by step guide:

- Firstly, to open an account in Zerodha, you must visit https://zerodha.com/open-account. To start with the sign-up process, you will have to enter your mobile number.

- Your PAN number, bank account number, and personal details are further required to go ahead in the process.

- In case you face difficulties during this procedure, feel free to contact your assigned Zerodha Sales Manager. You may also call Zerodha on – 080 4913 2020.

- If you wish to indulge in trading or investments, a trading account and a Demat account needs to be opened. However, if you plan to trade only in derivatives, a Demat account is not mandatory.

2. What kind of accounts can be opened at Zerodha?

At Zerodha, 3 types of accounts can be opened namely:

- Trading account (for equity and currency derivatives)

- Demat account (for delivery of stocks)

- Zerodha Commodity trading account (for trading commodity futures on MCX)

- Zerodha 3 in 1 Account

Besides, you can also open a two-in-one account which is a combination of trading and Demat accounts. The advantage of such an account is that it offers smooth transitions between the two accounts.

As an existing Zerodha customer, you can access all the segments. However, each segment needs to be enabled separately during opening the account.

It takes 2 working days for your account to be open officially. Once your account is opened, you will receive an email confirmation.

In case you do not receive an email after 2 days of your online application, you must contact Zerodha support immediately.

Also, you can open a Zerodha 3 in 1 Account as well.

3. How to open a Zerodha offline account?

Zerodha has two ways of account opening – online and offline.

You can also open your Zerodha account offline at a cost of ₹400 for trading & Demat account and ₹ 600 for trading, Demat and commodity account.

- For this, you must download the application form from the Zerodha website.

- Get a print out of the forms and fill it correctly. For any assistance, call 080 4913 2020.

- Courier the printed hard copies to Zerodha’s address – 153/154 4th Cross Dollars Colony, Opposite Clarence Public School, J.P Nagar 4th Phase, Bangalore – 56007 along with the required documents.

- The print outs should include:

- Application form of trading & Demat account for the equity segment

- Application form for the commodity segment

- POA (Power Of Attorney). The above application form already includes it

- ECN (Electronic Contract Note) for enabling the commodity segment. (This is already included in the second application form)

- Nomination form If you wish to appoint a nominee to your trading and DEMAT account. (Maybe your wife, father, mother or any other person)

Also, the documents required for opening a Zerodha account offline are similar to those required in the online process.

A photocopy of PAN, address proof – Aadhar Card, Driving License, Voter-Id, Cancelled Cheque/Bank statement, Income proof, and passport size photographs. Do not forget to cross sign as self-attest on all of these documents.

Get a detailed review on the documents required to open a Zerodha Account.

Or else, you can schedule a meeting with the Zerodha representative at your desired date and time. For doing so, contact the account opening cell at 080 4913 2020.

If you opt for this, you will be contacted by a Zerodha representative. He/she will take the necessary signatures and your self-attested documents.

The complete Zerodha Account Opening time will vary depending on whether you did the offline or the online process.

4. What is the account opening charges in Zerodha?

Both online and offline charges vary for opening an account at Zerodha.

In the online process, a Demat and trading account can be opened for ₹200 while a commodity account can be opened for ₹100.

For trading in equity as well as commodities, the account opening charge is ₹ 300. The same for just trading in the equity is ₹ 200 only.

The cost of opening a Zerodha account offline is ₹400 for trading & Demat account. The same is ₹ 600 for trading, Demat and commodity accounts.

Zerodha Coin FAQ

Zerodha FAQ is meant for meeting the demand and to clear doubts of its clients to the best.

Dive in for the Zerodha FAQ on Coin!

1. What is Zerodha coin?

Zerodha coin is a platform where traders can buy mutual funds directly from asset management companies.

No commissions are charged here plus you can track your investment performance as well as redeem it at your convenience.

Moreover, Zerodha coin gives access to single capital gain statements and P&L visualizations.

2. What are Zerodha coin charges?

Good news, Zerodha coin is absolutely free! If all you want to invest in direct mutual funds, Zerodha Coin has got your back.

Zerodha Coin not only saves costs but also provides the convenience of buying in Demat. Moreover, it offers flexibility in customizing SIPs.

Earlier, Zerodha charged ₹ 50 every month for using Coin. This tended to a lot of people not opting for Coin at all.

Pertaining to this, Coin has now been made completely free by Zerodha, making it coincide with the idea of a brokerage-free plan.

Therefore, all the investments on Coin, irrespective of the amount, are complimentary.

Bottom Line

All in all, the Zerodha FAQ discussed elaborately in this blog must clear things out for you to a great extent.

Hope the above Zerodha FAQ helped you in clearing your doubts. Any raised query must be well addressed and this is the sole purpose of this write-up. Happy trading!

Enter Your details here and we will arrange a FREE Call back.

More On Zerodha

In case you are looking to know more about this discount broker, here are some reference articles for you: