KIFS Trade Capital

List of Stock Brokers Reviews:

KIFS Trade Capital is a trading arm of KIFS Group and is based out of Ahmedabad. This full-service stockbroker was established in the year 1995 and by today, it has around 800+ sub-brokers and franchise offices across different parts of India.

It is one of the very few stockbrokers that provide a live-chat facility on its trading platforms. Thus, if you are a client and are stuck in a trade, you can easily get in touch with the support team of the broker and ask for a solution.

Let’s talk at length about this stockbroker so that if you are thinking about opening a trading account with them, you are sure enough to do so.

KIFS Trade Capital Review

KIFS Trade Capital has relatively less focus on technology through its trading platforms, but nonetheless, provides a couple third part trading software. The broker has running memberships with NSE, BSE, MCX, NCDEX.

As of 2020 financial year, this full-service stockbroker has an active client base of 17,877.

With KIFS Trade Capital, you can trade and invest in the following segments:

- Equity

- Commodity Trading

- Derivative Trading

- Depository Services

- IPO

- Mutual Funds

- Insurance

Kushal Khandwala – Director, KIFS Trade Capital

KIFS Trade Capital Trading Platforms

The full-service stockbroker provides a decent range of trading applications across devices. Here are some details discussed below:

ODIN Diet

ODIN Diet is a third party terminal-based software that needs to be downloaded and installed on your computer or laptop. Once done, you can start trading by putting valid credentials provided to you by the full-service stockbroker. Some of the features of this trading platform include:

- An exhaustive number of features in terms of technical/fundamental analysis, order execution etc.

- Single and Multi-leg Order Entry and SOR

- Optional UI themes and customizable views

- Secured data transmission using advanced SSL and military-grade encryption

This is how the ODIN Diet looks like:

There are a couple of concerns in using ODIN Diet as mentioned below:

- The application is a little bulky in size and thus, you have to make sure that you use a machine that has a reasonable configuration

- Since the application is third-party software, in case you have any feedback or comment, that will be taken care of by the technical team of financial technologies (which originally developed this software).

KIFS Trade Capital Mobile App

The mobile app from this full-service broker is actually somewhere around basic in performance and usability. Some of the features of this mobile app include:

- Watchlist

- Market data across difference indices

- Charting for technical and fundamental analysis

- Research and tips available within the app

Some of the concerns with the mobile app include:

- Regular OTP Issues

- Confusing design and interface

- A limited number of features

This is how the mobile app is rated at Google Play Store:

| Number of Installs | 1,000-5,000 |

| Mobile App Size | 14 MB |

| Negative Ratings Percentage | 25.7% |

| Overall Review |  |

| Update Frequency | 6 months |

KIFS Trade Capital Customer Service

To support its clients, KIFS Trade Capital provides the following communication channels to its clients:

- Offline Branches

- Phone

- Webform

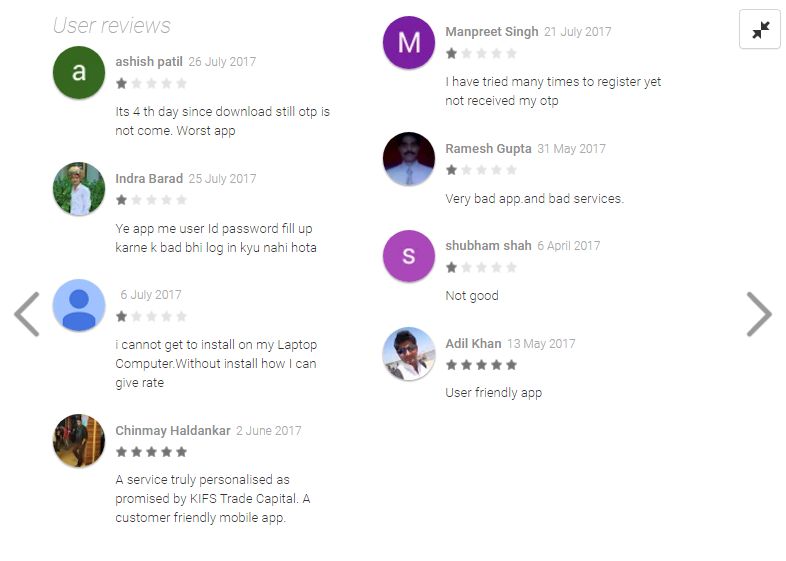

With a limited number of communication channels, the full-service stockbroker has a lot to improve when it comes to turnaround time, listening to customer issues and getting them a personalized response. For instance, here is the snapshot of their Google play store page where few users have provided their feedback on their mobile app:

Not even a single feedback from the clients of the full-service stockbroker has received even a single response. Google play store is one good platform to hear user feedback and provide them with a quick response and a resolution time period. Furthermore, it helps to improve your own product in the first place.

However, KIFS trade capital seems to have missed the trick here and has not been able to capitalize on such valuable inputs from the clients.

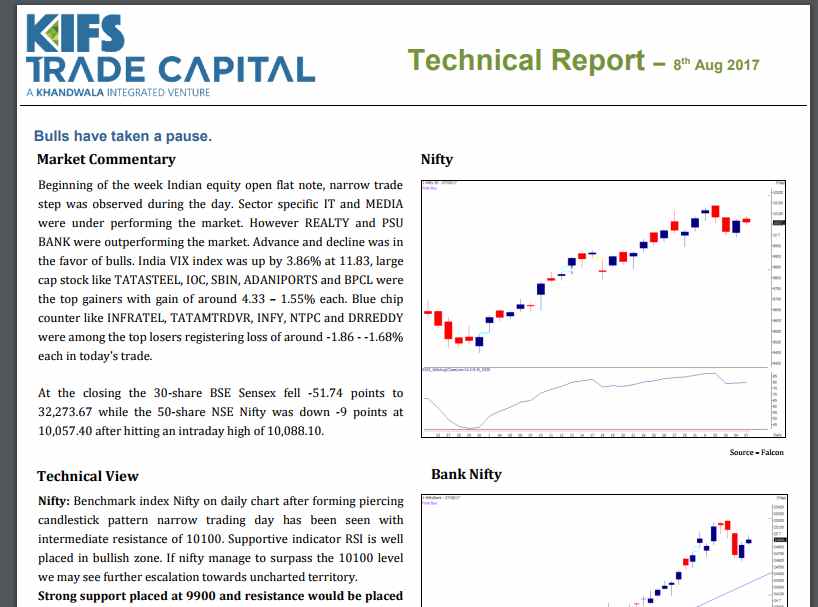

KIFS Trade Capital Research

Research and advisory is an integral part of the services provided by full-service stockbrokers.

In the case of KIFS Trade Capital, you will get research at both technical and fundamental level from your local dealer that has an affiliation with this full-service stockbroker.

These communications can be done through email, SMS, Whatsapp or phone depending on your preferences as the client of this full-service stockbroker.

At the same time when it comes to the quality of this research, the performance is just around average. This basically implies that you should perform your own analysis as well along with taking in inputs from the broker.

Make sure each investment you place, has the backing of your own analysis or any advisory firm you might have opted for.

Here is a small snapshot of one such technical report from this full-service stockbroker:

KIFS Trade Capital Pricing

As a full-service stockbroker, the pricing, in this case, is relatively expensive as compared to discount stock brokers. However, within the full-service broking community, KIFS Trade Capital can certainly be tagged as one of the most reasonably priced ones.

In the sections below, we talk about pricing and charges at different levels.

Users are advised to perform their own maths to see whether this broker suits them on pricing or not.

KIFS Trade Capital Account Opening Charges

Here are the details on opening an account with this full-service stockbroker. It must be known that the commodity trading is treated completely separately here and thus, the account opening and AMC charges might also be different.

| Demat Account opening charges | ₹0 |

| Trading Account opening charges | ₹0 |

| Demat Account Annual Maintenance Charges | ₹0 |

| Trading Account Annual Maintenance Charges | ₹345 |

KIFS Trade Capital Brokerage

As it is known that full-service stockbrokers charge a percentage based commission or brokerage based on the trade and investment value of their clients. Higher the trading amount, higher is the brokerage and vice versa. Here are the complete details along with separate plans provided by this full-service stockbroker:

If you start with a margin of ₹25k to ₹50k, these are the brokerage charges that will be applicable:

| Equity Delivery | 0.3% (Negotiable) |

| Equity Intraday | 0.03% |

| Equity Futures | 0.03% |

| Equity Options | ₹30 per lot |

| Commodity | 0.3% |

For an initial margin of ₹50k to ₹1 Lakh, here are the brokerage charges:

| Equity Delivery | 0.2% (Negotiable) |

| Equity Intraday | 0.02% |

| Equity Futures | 0.02% |

| Equity Options | ₹25 per lot |

| Commodity | 0.02% |

Users starting with an initial deposit of more than ₹1 Lakh get the following brokerage rates:

| Equity Delivery | 0.1% (Negotiable) |

| Equity Intraday | 0.01% |

| Equity Futures | 0.01% |

| Equity Options | ₹20 per lot |

| Commodity | 0.01% |

Use this KIFS Trade Capital Brokerage Calculator for the complete calculation of all the charges and your profit at the end of the trade.

Furthermore, you can certainly negotiate the brokerage even below than the rates mentioned above. It has a lot to do with a couple of things,

1. your negotiation skills and

2. your initial margin or trading account deposit.

The best part is that although you start high and deposit an initial deposit in your account, you can withdraw any amount back to your bank account as per your preference.

KIFS Trade Capital Margin

KIFS Trade capital is not known to provide high exposure across most of the segments. Although, in case of leverage as well, you can negotiate with the broker to an extent but not so much. Here are the details:

| Equity | Upto 10 times Intraday, Upto 6-7 times delivery |

| Equity Futures | Upto 4-5 times for Intraday |

| Equity Options | Upto 6 times for Intraday |

| Commodity | Upto 4-5 times for Intraday |

Conclusion

“KFIS Trade Capital is an average performing stockbroker. It certainly is not one of those stockbrokers that will push you to trade (just to earn brokerage for themselves) but at the same, is overlaid back in its attitude.

With a low focus on technology in such a cut-throat competitive environment, the broker certainly has a lot to work on when it comes to its trading platforms.

Overall with low brokerage, free account opening, it tries hard to be value for money for you but has forgotten that to sustain clients, continuous innovation and improvement is a necessity.”

KIFS Trade Capital Disadvantages

Be aware of these concerns if you go ahead with this stockbroker:

- No trading in Currency possible

- Limited focus on Technology

- Customer service can be improved

KIFS Trade Capital Advantages

At the same time, you will get the following benefits while trading through KIFS Trade Capital:

- Free Trading and Demat account

- Reasonable offline presence

- Good brokerage charges, especially with a high initial deposit

- A wide range of trading and investment products

Looking to Open Trading and Demat account?

Enter Your details here :

Post this call, you need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for Demat account.

KIFS Trade Capital Membership Information

Here are the details on the membership of this full-service stockbroker with different entities of the stock market:

| Entity | Membership ID |

| BSE | INZ000004234 |

| NSE | INB230776034 |

| Registered Address | KIFS Trade Capital Pvt. Ltd. B-81, Pariseema Complex,C.G. Road, Ellisbridge,Ahmedabad – 380006 Gujarat, India |

More on KIFS Trade Capital:

If you wish to know more about KIFS trade capital, here are a few reference links for you:

| KIFS Trade Capital Review |

| KIFS Trade Capital Brokerage Calculator |

| KIFS Trade Capital Transaction Charges |

| KIFS Sub Broker |

Very bad services. they all are working fraud people specially RASHMIK PATEL AND JATIN PARMAR they both are did fraud with me they did play nifty on my share stock without my permission and end of the they sold my share and when amount get over they demanding money from me. they both did more harassment and presser to sell all my stock otherwise give me check.

Dear all Be aware with this kind of guy.

I just wanted to Activate online account but dono sale bikhari haramchodo ne mere paiso per game khel dala. ALL ARE CHITTER COCK

Isi type k employees se company barbad hota hai.

online account abhi tak na activate huva uper se 38000 ka payment karna pada.

End of going to transfer my account at HDFC SECURITIES.

Worst trading company i have seen my life … they fool you and do trading to make their brokerage they spend all your hard earned money….. zero knowledge of trading but they will make you believe that they have all insider news of market ……

I lost 1 lac in one day because their broker did not put a stop loss to my order. They refuse to take responsibility. They only want to give calls in bank nifty and make money for themselves. Be careful with this trading company.