Way2Wealth

List of Stock Brokers Reviews:

Way2Wealth is a full-service stockbroker based out of Bengaluru and is part of Coffee Day group. Established in the year 1984, Way2Wealth has a presence across 570+ locations across different parts of India through its offices and handles a work-force of around 1000.

The broker has recently won the ‘Leading Broking House of the Year’ award from MCX. This is seen as a promising recognition in the industry.

Having said that is this broker good enough for you? Shall you be opening your demat account with it? Let’s figure out the answer to these questions in this detailed review.

Way2Wealth Review

Being a full-service stockbroker, Way2Wealth provides research, recommendations and tips across multiple trading and investment products at a regular level (more on that later).

As far as trading and investment products are concerned, the broker is known to provide exhaustive services across financial space, including:

- Equity Trading

- Commodity Trading

- Currency Trading

- Derivatives Trading

- Mutual funds

- Insurance

- Loans

- IPO

- Portfolio Management Services

Furthermore, Way2Wealth has memberships with SEBI, NSE, BSE, MCX – SX, NSDL, CDSL and thus, in this way, allows its clients to use different financial services under its gamut.

Shashibhushan M R, CEO – Way2Wealth

Way2wealth Trading Platforms

Way2Wealth provides trading platforms across devices i.e. mobile, desktop and computer. Depending on your preference and quality of the respective trading application, you may choose one or more platforms for your trading usage. For instance, if you have a day job and don’t really have time to continuously sit across a computer for regular trading, you may choose to use a mobile application for your trading purpose.

Nonetheless, we will discuss these trading platforms provided by Way2Wealth one by one:

W2W Direct

W2W Direct is a web-based browser application that does not require any download or install from your end. You are required to just browse a specific link, put in your valid credentials and you can start trading. This lightweight application is suitable for beginners and provides the following features:

- Can be used across devices including mobile, tablet, laptop, computer and desktop

- reasonable speed and performance

- Quick order placement

- Average user experience

W2W Pro

W2W Pro is a terminal based trading application where you are required to download and install an application on your computer or laptop. The application is suitable for intermediate level regular traders but certainly not yet apt for expert users.

Some of the features of this trading application include:

- W2W Pro integrates your banking, trading and demat accounts, which enables you to trade without going through any concerns of writing cheques, transferring shares, following up on pay-outs etc.

- Market watch feature allows you to monitor specific stocks across BSE, NSE and other member exchanges

- Live quote streaming across indices

- The application allows you to set alerts and notifications so that you can set specific targets and stop loss for your trades and enter/exit at the right time.

Way2Wealth Mobile Pro+

The Way2Wealth mobile app is one of the lowest performing trading applications in India. The full-service stock broker provides an app that has limited features, an ordinary user interface and an average trading experience. Some of the features provided in this mobile app include:

- Provides technical research ideas for quick market momentum analysis

- Fund transfers allowed

- Personalization of features such as Market Watch, News, Quotes, Positions, Holdings, Order & Trade Book allowed

- Voice commands for few actions allowed

- Free guest access allowed

At the same time, here are some of the concerns reported by users about this app:

- Performance and/or speed related issues

- Limited options to perform technical or fundamental analysis

- Slow update frequency

Here are some of the stats of this mobile app from Google Play Store:

| Number of Installs | 5,000 - 10,000 |

| Mobile App Size | 8.4 MB |

| Negative Ratings Percentage | 33.8% |

| Overall Review |  |

| Update Frequency | 20-24 weeks |

Way2wealth Research

The full-service stockbroker here – Way2wealth provides research and recommendations at multiple levels to its clients. Some of the research products include:

- Fundamental Investment Ideas

- Daily Technical Ideas

- Morning notes

- Special reports

- Mutual Fund research

- Derivative Strategies

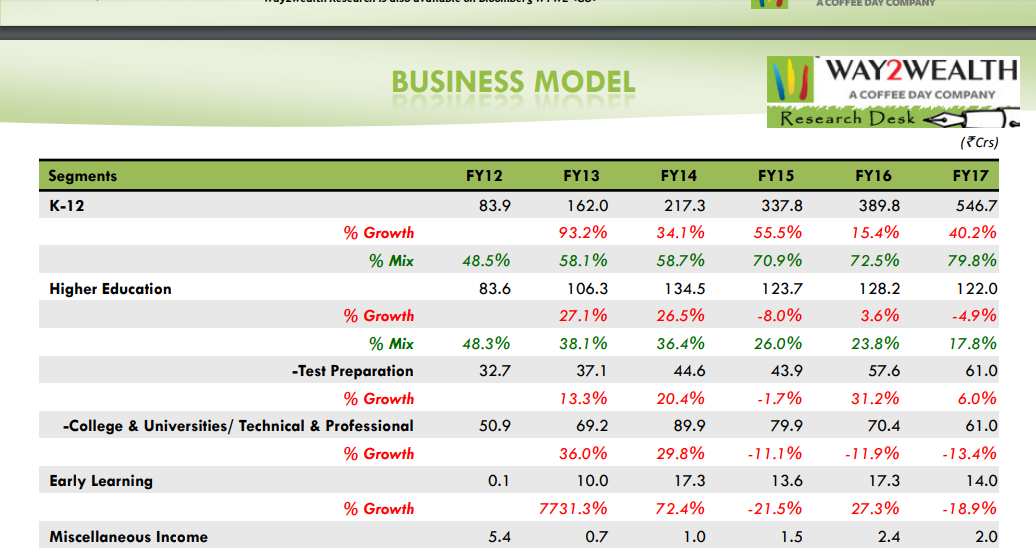

If you are somebody who needs assistance with long-term investment ideas, then you can refer to some of the fundamental research reports published by the broker. There are way too many factors that need to be considered while making the final selection of your long-term investment portfolio, thus, fundamental research must be very thorough.

Yes, reports like shown below help but overall accuracy is around average when it comes to Way2Wealth. Thus, you are advised to perform a second level analysis at your level as well before going ahead with your investments.

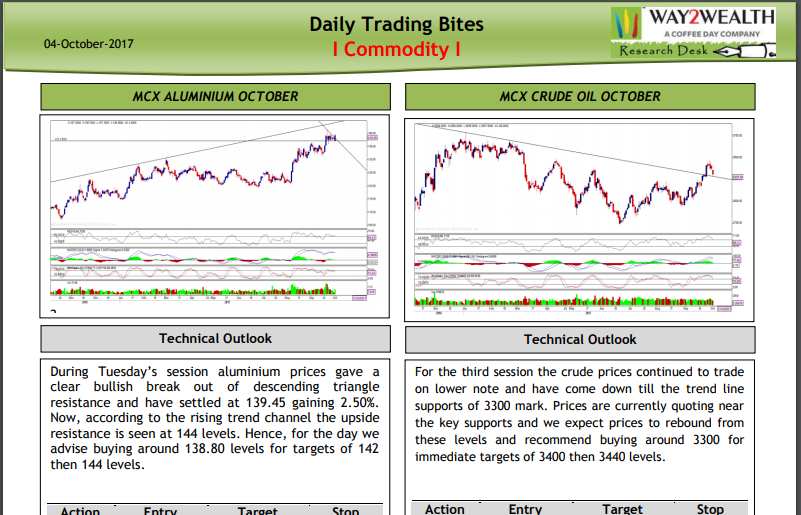

At the same time, if you are looking to make short-term quick profits, then you would need regular intraday tips across multiple communication channels.

Way2Wealth provides daily morning notes and technical research ideas for quick judgments. These ideas are provided around Equity, Currency, Commodity and derivative segments and you may choose to use any of these tips for your trades.

Overall research quality in case of Way2wealth can be rated around slightly better than average. The major analysis provided by the research team of the broker works at an objective level (primarily based on numbers) and one thing that is missing from the overall research quality is – experience. And that is what has a lot to do with advisory quality.

Way2wealth Customer Care

The full-service stockbroker here has the following channels of communication open for its clients:

- Toll-Free number

- Offline Branches

- Phone

Although users have high expectations from full-service stock brokers, simply because of the kind of brokerage charges a user pays. However, on the ground, there is a major lag when it comes to turnaround time. Way2Wealth is way too slow in reaching back to its clients in case of a query or a concern.

At the same time, the broker has not been able to realize the importance of Social media when it comes to customer issue redressals. This holds true for even Google Play Store where the mobile app has seen a lot of criticism from its users base but there has been no active reciprocation to use the platform for client satisfaction.

Way2wealth Pricing

When it comes to pricing, there are various types of payments you will be required to make at different points in time.

Here are the details:

Way2wealth Account Opening Charges

To open an account, you are required to pay a specific amount and along with that to maintain that very account, there will be few charges levied as well every year.

Here are the requisite charges:

| Trading Account Opening Charges | ₹350 |

| Demat Account Opening Charges | ₹0 |

| Trading Account Annual Maintenance Charges | ₹0 |

| Demat Account Annual Maintenance Charges | ₹300 |

Way2wealth Brokerage

Like other full-service stockbrokers, Way2Wealth charges a specific percentage of your trade/investment value as brokerage. Although, while talking to the executive of the broker before you open an account, make sure to negotiate to the utmost length you can. The broker is open to negotiating the brokerage rates against the ones mentioned below:

| Equity Delivery | 0.4% |

| Equity Intraday | 0.04% |

| Equity Futures | 0.04% |

| Equity Options | ₹50 per lot |

| Currency Futures | 0.04% |

| Currency Options | ₹50 per lot |

| Commodity | 0.04% |

Looking at the brokerage values, Way2Wealth comes out as one of the expensive stockbrokers. Thus, it is really difficult to see it as a value-for-money stockbroker.

Nonetheless, you may use this Way2Wealth Brokerage Calculator for calculation of complete charges and your profit.

Way2wealth Margin

If you don’t know or understand the concept of exposure or leverage, we would suggest you have a complete understanding of that first. Once you know the intricacies or risks associated with exposure, you will be in a much better position to use it.

In the case of Way2wealth, the following values are provided across different segments:

| Equity | Upto 6 times Intraday |

| Equity Futures | Upto 2 times for Intraday |

| Equity Options | No Leverage |

| Currency Futures | Upto 2 times for Intraday |

| Currency Options | No Leverage |

| Commodity | Upto 3 times for Intraday |

Way2Wealth provides one of the lowest margin values across trading segments. From a competitive point of view, there are stockbrokers such as Angel Broking that go as high as 40 times for Equity intraday segment while Way2Wealth struggles at around 6 times.

In other words, you may be disappointed if you are looking for margin from Way2Wealth.

Way2wealth Disadvantages

Here are some of the concerns of trading through Way2Wealth:

- Customer support, especially the turnaround time can be improved.

- Limited technology advancement in trading platforms provided. This is one of the biggest concerning area of this stockbroker since technology can work as a make or break deal for the trader, most of the times.

- Below-average margin values across segments

Way2wealth Advantages

At the same time, Way2Wealth provides the following merits to its clients as well:

- The broker provides a wide range of trading and investment products

- Multiple offline branches across different parts of India

- Reasonable research quality

- An old name in the stockbroking space in India, this, trust factor comes implicitly.

Way2wealth Membership Information

Here are the details of different licenses attained by Way2Wealth:

| Entity | Membership ID |

| BSE | INB011150233 |

| NSE | INB231150237 |

| NSDL | IN-DP-NSDL-253-2005 |

| CDSL | IN-DP-CDSL-526-2009 |

| PMS | INP000000829 |

| MCX | INZ000049130 |

| NCDEX | INZ000049130 |

| Registered Address | 46/5, Double Road Junction Bangalore, Karnataka 560027, Mission Rd, Bengaluru, Karnataka 560027 |

If you are looking to open a demat and trading account, you can provide your details in the form below:

Next Steps:

Post this call You need to provide few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review on documents required for Demat account, and who can open a Demat account in India.

Way2Wealth FAQs

Here are some of the most frequently asked questions about Way2Wealth:

Is the account opening free with Way2Wealth?

The broker allows you to open a free demat account in India, however, the trading account is priced at ₹350. Although, if you start with reasonable margin money, there are chances that your trading account opening and annual maintenance charges may be levied off.

Make sure you have a detailed discussion with the broker executive while discussing the other formalities.

What is the lowest brokerage I can get from Way2Wealth?

Although, the broker starts with the brokerage range of 0.40% for delivery and o.04% for intraday trading. However, with good trading turnover and initial deposit, the brokerage charge may go as low as 0.1% and 0.02% respectively.

Does Way2Wealth provide research and tips to their clients? Can I trust their tips?

Yes, the stockbroker provides you with tips, research, recommendations, IPO reviews, fundamental and technical analysis etc. But, the quality of these research tips is not that great and the accuracy falls below 60% at times. You are strong adviced to perform your own analysis on top of the tips provided by Way2Wealth.

Is Way2Wealth Trustable?

The broker has more than 25,000 active clients and presence around 100s of locations across India. The complaint percentage against the broker is pretty low as well.

Thus, in a sense, the broker is trustable from the numbers point of view. At the same time, you are advised to keep a close eye on the contract notes and the trading account balance at regular intervals.

More on Way2Wealth:

If you want to learn more about Way2Wealth, here are a few reference links for you:

Way2Wealth Review  |

| Way2Wealth Transaction Charges |

Way2Wealth Brokerage Calculator  |

| Way2Wealth Franchise |