Shalby Hospital IPO Review

Check All IPO Reviews

Shalby Hospital Background

Shalby Limited / Shalby Hospitals is a chain of multi-speciality hospitals across India. The first hospital was a joint replacement centre which was established by Dr Vikram I. Shah in 1994 in Ahmedabad, Gujarat. This first hospital was a small six-bed single speciality unit which offered total knee replacement surgery.

Shalby Limited was incorporated in 2004.

The hospitals provide in-patient and out-patient service. In 2007, the Shalby hospital became a multispeciality hospital with 200-beds and now in 2017, the chain of Shalby Hospitals holds a bed capacity of over 2000 beds. The hospital offers care in over 40 medical disciplines such as:

- Knee and joint replacement,

- Cardiology,

- Dental cosmetic and implantology,

- Hair transplant,

- Intensive and critical care,

- General surgery,

- Dialysis and kidney transplant,

- Pediatric orthopaedics,

- Plastic surgery etc.

The Shalby hospital is certified by National Accreditation Board for Hospitals & Healthcare Providers (NABH). In 2011, the hospital-acquired 55% stake in Vrundavan hospital in Goa and in 2012, it acquired Krishna Hospital for ₹75 crore. After that, it has become the biggest private corporate hospital in Ahmedabad.

In 2013, Dr Shah claimed that the Ahmedabad hospital completes an average 30 joint replacement surgeries daily. Furthermore, Dr Vikram Shah invented ZERO Technique which reduced the average surgical time from 1 hour to 20 minutes.

The hospital has won several awards and claimed that by late 2016 they have performed more than 85,000 joint replacement surgeries in total.

Promotors of Shalby Hospital

The promoters of the Shalby Limited are Dr Vikram Shah, Dr Darshini Shah, Shanay Shah, Shah Family Trust and Zodiac Mediquip Limited.

Shalby Hospital IPO Data Points

The IPO of Ahmedabad based Shalby Limited will open on 5th December 2017 and close on 7th December 2017. Shalby Multispecialty Hospital will be the 36th mainboard IPO of India. The price band of the IPO is in the range of ₹245-248 per share.

Hospital IPOs have shown a mixed response – Narayana Hrudayalaya registered smart gains but Health Care Global made a tepid start. The Shalby Limited initial public offer aims to raise ₹480 crore. According to Ravi Bhandari, the chief executive of Shalby Hospitals this fund is proposed to use for:

- Full or part repayment of loans of ₹320 crore which was taken by the company and has been passed for expansion purpose

- Purchase of medical equipment for existing, recently set up and upcoming hospitals- ₹58 crore

- Purchase of furniture and allied infrastructure for upcoming hospitals – ₹18 crore

- To meet general corporate purpose

In addition to this 10 lakh shares will be sold by Offer For Sale (OFS) route at the upper end of the price band. This will yield another ₹24.8 crore. These shares will be sold by the promoter of the Shalby Limited Dr. Vikram Shah.

Remember, there is a huge difference between an IPO vs OFS and this particular IPO has an OFS portion as well.

Shalby Hospital Revenue and Other Financial Information

The financial data of Shalby Limited seems quite strong.

The company has shown a steady growth in revenue from past few years. In 2013, the total revenue of the company was around ₹229.8 crore and in 2017 it reached to ₹332.9 crore.

The profit after tax (PAT) is also increasing over the years. In 2017, the company has shown 66% growth in the profit after tax compare than 2016.

The table below will give you a quick idea about the financial performance of Shalby Hospitals in the past some years. All Numbers are in ₹ Crore:

Shalby Hospitals are famous for their orthopaedics services. The hospital has 15% market share of all joint replacement surgeries conducted by the private hospitals in India which seems quite good for a new company. The company is positioned nicely in the market to take the benefit of the growth in future.

The Shalby Limited adopted the strategy to stay away from the metropolitan market and focused on the Tier – I and Tier – II cities.

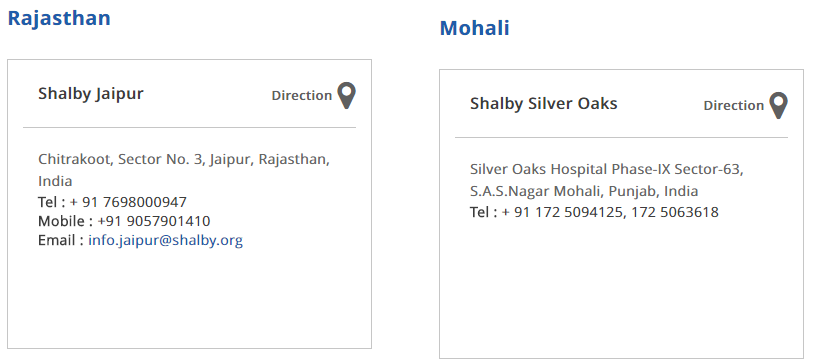

The strategy gives an advantage of getting quality manpower at low cost which is a great advantage in the long run. Most of the Shalby Hospitals are present in the western and central India but they have the plans to expand to new geographies.

Shalby Hospital IPO Events

Shalby Limited IPO will open on 5th December 2017 and close on 7th December 2017. The band of the issue is fixed at ₹245 at the lower level and ₹248 at upper levels.

The shares of the company are proposed to issue on National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). IIFL Holdings, IDFC Bank Ltd, and Edelweiss Financial Services Ltd. are managing the Shalby Limited IPO.

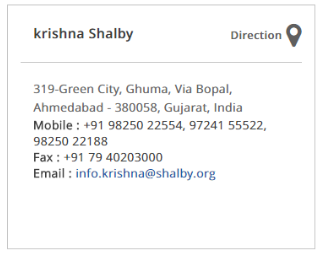

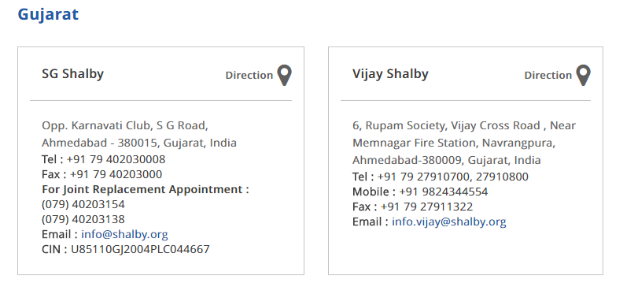

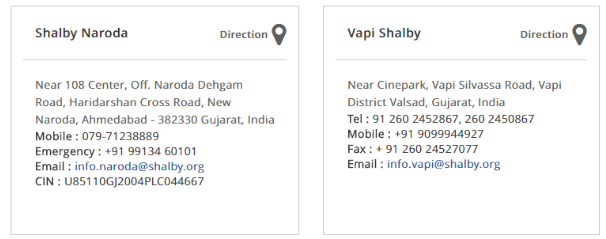

Shalby Hospital Contact Information

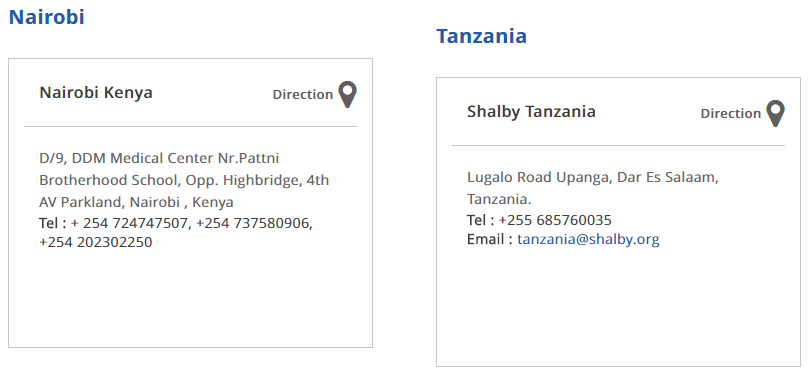

Shalby Limited has eleven hospitals and their contact information is given below. You can also visit their website for more information.

You will also get a chat option on the website so you can also discuss the things online.

Here are the different locations where Shalby Hospital has a presence in:

Our Recommendation on Shalby Hospital (Buy/Avoid)

Though the company is owned by a family, however, it is managed professionally. The financials of the company are good and showing a positive growth for years. Earlier the hospitals were focused on the joint replacement surgeries but now they have diversified their areas of operation and treating more than 40 medical conditions. This is a big positive for the company.

The Price/Earnings Ratio of the company is around 34.4 and is very high in comparison to Fortis Healthcare’s 14.9. The margins of Shalby Limited are 19% compared to Narayana Hrudayalaya’s 12% and Apollo Hospitals 21%.

From past one year, four healthcare service providers tapped the primary market to raise funds which includes Thyrocare Technologies Ltd, Eris Lifesciences Ltd, HealthCare Global Enterprises Ltd, and Narayana Hrudayalaya Ltd.

These companies have collectively raised ₹4,116 crore from the primary market.

- the listing price of Eris Lifesciences Ltd. was ₹600 and now it is trading on ₹796,

- the listing price of Thyrocare Technologies Ltd was ₹420 and its shares are currently trading at ₹663,

- the listing price of HealthCare Global was ₹205 and the current price is ₹299,

- the listing price of Narayana Hrudayalaya Ltd. was ₹245 and the share of the company are currently trading at ₹294.

So there is a positive growth in the share price of all these healthcare service providers. This makes a positive outlook for the Shalby Hospitals.

Shalby Limited is an experienced player in the healthcare industry and showing a handsome growth from years. Some of the key strengths of Shalby Hospitals include:

- Leadership in orthopaedics and other specialities

- Professionally managed company

- Qualified and experienced management team

- Integrated and scalable business model

- Good track record of growth and financial performance

One thing which seems quite negative is that the company is significantly dependent on the services of its promoter Dr Vikram Shah and a disruption in his services can adversely affect the company.

Healthcare is an evergreen industry though there is not a tremendous growth the healthcare companies have the potential to grow over the years. According to our opinion, Shalby Limited may not have a high growth in short-term but the long-term future of the company looking quite positive.

So investors should consider the company for a long-term investment purpose.

Furthermore, if you are looking to open an account, you can provide your details in the form below: