Fyers

List of Stock Brokers Reviews:

Fyers is a recently launched discount broker in India and is based out of Bangalore. It was incorporated in 2015, and it claims to offer the best online trading experience through its trading platforms.

As a comparatively new player in the market, a Fyers Review is necessary to analyze its performance.

So, let’s begin.

Fyers Review

Before we jump to the information related to this broker, do you know what Fyers is? The team at Fyers comprises young entrepreneurs, which is why they have carefully chosen the brand name.

Fyers stands for “Focus Your Energy & Reform the Self”.

Thus, reasonably better services are expected from the broker. The discount broker is registered with SEBI and is a member of NSE (National Stock Exchange), BSE (Bombay Stock Exchange), CDSL (Central Depository Services Limited), and MCX (Multi Commodity Exchange).

You can trade or invest in the following segments using its service:

Tejas Khoday (Founder & CEO) – Fyers

Fyers Trading Platforms

The discount broker offers some unique and one-of-its-kind features in its three trading platforms. These products contribute significantly to the Fyers review. Below are the details:

Fyers One

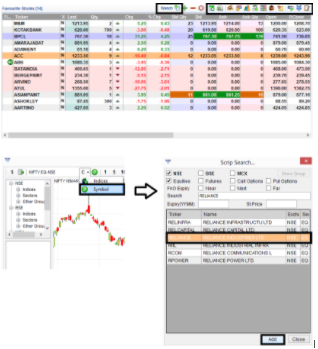

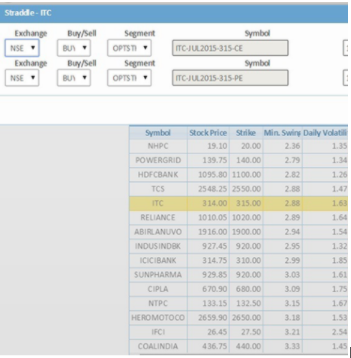

It is a trading terminal software that can help technical traders and fundamental investors at the same time.

Clients need to download and install this application on their desktop or computer. Some of the features the trading application provides are:

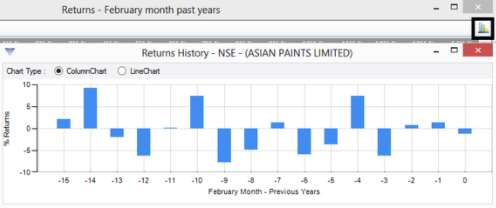

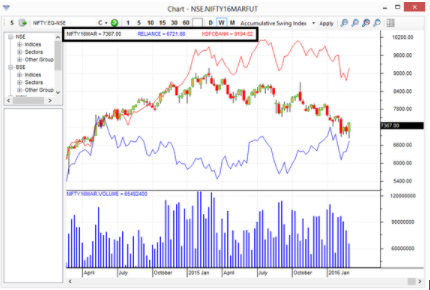

- Advanced charting functionality with up to 30 days of Intra-day and more than ten years of historical EOD data with more than 60 indicators. The platform also claims to be the only stockbroker to provide intraday charts for indices.

- “Stock Screeners” functionality helps track, filter, and research stocks as per user’s preferences. It is an excellent source to encash profits.

- Get a 360-degree view of the world market with minimal clicks.

- Real-time exchange updates and announcements of crucial board meetings and market happenings

- Advanced features such as “Heat Maps” can save a fair amount of time that might get wasted in going over the numbers one by one at crucial moments.

- It facilitates traders with a fast and accurate platform for Derivatives trading.

- The unique feature of a portfolio tracker.

- Ten flexible and intuitively designed workspaces.

This trading platform is undoubtedly a great addition to the Fyers review. Here are some of the screenshots of this application:

There is Fyers One Demo also available if you’d like to try.

Fyers Markets

This mobile app uses minimal internet data to provide full information and trading at a fast speed. The mobile app is available in Android as well as iOS versions and comes with the following features:

- Data Analytics with maximum relevant information and less data cluttering can be confusing.

- Variety of charts with 65+ indicators.

- Multiple lists, watchlists, etc. created using Fyers Web are accessible.

- User-friendly interface.

- A highly secured app.

- Direct access to the back office.

- The stock screener feature allows us to analyze and find trading opportunities across different sectors and indices simultaneously.

- It is fast and reliable.

“Fyers is known to provide some of the best trading platforms to its clients, especially in the desktop and mobile-based trading software.”

- Get access to more than 43 different options strategies.

- Funds transfers with more than 25 banks allowed using the mobile app.

- Highly interactive charting available.

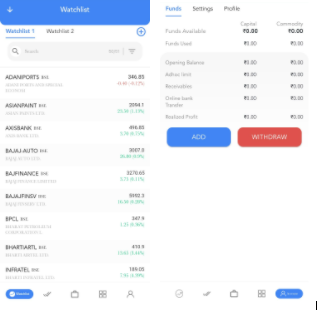

This mobile app for trading enhances the Fyers review. Here are some of the screenshots of the mobile app:

Here are the stats of the mobile app from the Google Play Store:

| Fyers Mobile App | Fyers | |

| Number of Installs | 5L+ | |

| Mobile App Size | 31MB | |

| No. of Charts | 6 | |

| No. of Indicators | 130+ | |

| Overall Review |  | |

The broker can undoubtedly work to quicken up its update frequency cycle, especially if you look at the competition and the kind of cutthroat mobile apps provided by other brokers to their clients.

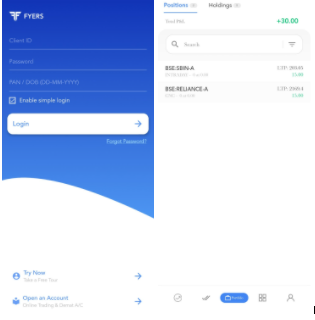

Fyers App

Mobile trading is necessary to facilitate clients with trading anytime, anywhere. Fyers App is a mobile trading platform that offers many attractive features. A more accessible platform affects the Fyers review in a big way.

Some of these features are as follows:

- It has 22+ years of historical data. For intraday, the information is for more than two years.

- Offers more than 65+ technical charts.

- It is fully synced with the Fyers web platform.

- Facilitates creating multiple watchlists, chart settings, drawings, etc.

- User-friendly interface.

- Easy to navigate through the app.

- Allows access to the back office.

- Is fast and reliable.

Some sneak peek of the app are as follows:

Here are the stats of the mobile app from the Google Play Store:

| Number of Installs | 50K+ |

| Mobile App Size | 14 MB |

| Google Reviews | 700+ |

| Overall Review | 3.8 stars |

| Update Frequency | 3 - 4 weeks |

Fyers Web Trader

Another trading platform is a browser-based lightweight trading application that allows you to trade online. It is intentionally designed with minimal features to keep things easy and smooth for traders.

Platforms like these give a certain edge to the broker.

Some of the basic features of this application include:

- Portfolio tracking available with fund allocation

- Advanced charts with 70+ indicators.

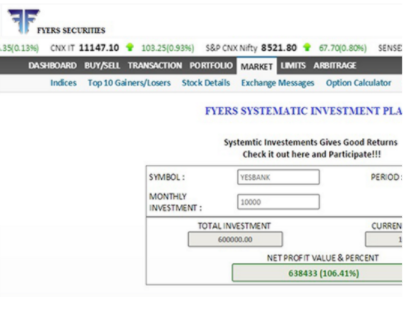

- An innovative equity SIP calculator.

- Price ladder trading for intraday traders.

- Place, modify, cancel, and monitor your trades from the charts.

- Inbuilt option strategies that are auto-screened to make it easy to understand.

- Simple user interface.

- Intuitive dashboard.

Here are some of the screenshots of this web-based application:

Fyers API Dashboard

This facility offered by the broker enables its users to create innovative trading platforms and deploy algorithmic trading. These APIs are eligible for creating reliable platforms.

These are robust and tested by third-party trading systems. Further, they are easy to integrate using extensive documentation, and the most exciting thing about these APIs is that they are free of cost.

This translates to users using them with no barriers whatsoever.

The multiple integration methods are – Python, rest, and Node.js.

This platform is highly useful for startups and algorithm traders. The more user-friendly these platforms are, the better the Fyers review is.

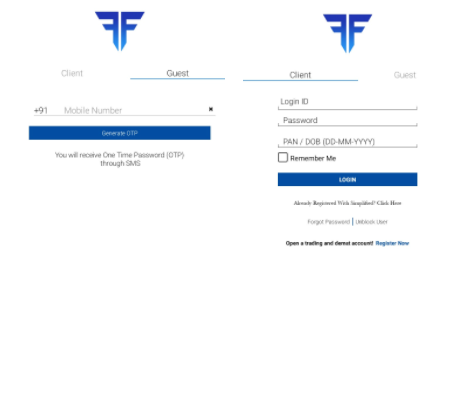

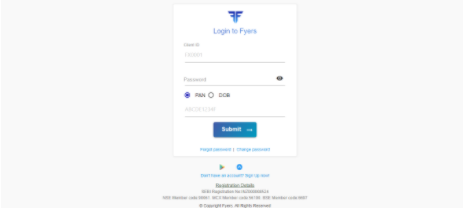

A look of the Fyers login page is below:

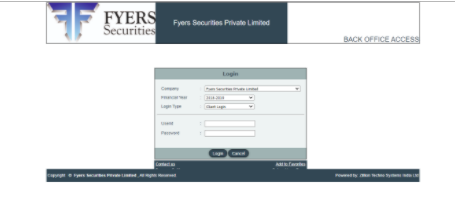

Fyers Back Office

Brokers have recently started to extend the service of the back office to its clients. This service has increased the experience of customers and eased many tasks related to trading. Backoffice is home to multiple services like:

- Transaction reports.

- Easy fund transfer method.

- Customer support and much more.

The login page of the back-office is as below:

Fyers Fund Transfer

Fund transfer is an important aspect of trading. A more painless process increases the fame and popularity of the broker. Fund transfer is a two-way process – Depositing funds in your account and Withdrawal of funds.

Let’s first talk about the process of depositing funds.

Fund deposit can be carried out in the following ways:

- NEFT/RTGS

You can transfer up to ₹5,00,000 with a charge of ₹10 on every transaction. This payment option is available with Fyers Web, Fyers Markets, Fyers One, and Thematic Investing platform.

Fyers has tie-up with more than 24 banks for instant payments.

- UPI

UPI payment option allows the user to deposit funds with zero transaction fee. It is available on both web and mobile trading app.

- Net Banking

Fund transfer using net banking can only be done using the registered bank account. The time required for the process is 2 hours but it might take longer than that. It depends on the transaction type.

Below are the registered bank accounts of Fyers:

| Account Name | Type | Account Number | Bank | Branch | Account Type | IFSC Code |

| Fyers Securities Pvt Ltd Client AC | Equity, FNO and Currency | 57500000358111 | HDFC Bank | Richmond Road, Bangalore | Current Account | HDFC0000523 |

| Fyers Securities Pvt Ltd MCX Client AC | Commodities | 57500000358226 | HDFC Bank | Richmond Road, Bangalore | Current Account | HDFC0000523 |

Moving ahead to the process of withdrawing your funds, the process can be initiated using Fyers back office/ account, Fyers Web, and Fyers Markets.

This process takes up to 24 hours to get completed. Multiple ways of fund transfer add brownie points to the Fyers review.

FYERS Pricing

The broker is pretty much transparent with its pricing. Here are charges around the opening and maintaining a trading and demat account:

| Account Opening Charges | ₹400 |

| Annual Maintenance Charges (AMC) | ₹300 + GST/ annum (this amount is charged quarterly) |

You can apply for the Fyers Demat Account by submitting all the relevant documents and details.

Fyers Brokerage

Brokerage charges are flat across trading segments. Since the brokerage charges for this broker are easy to remember, is improved. These charges are listed below:

| Equity Delivery | ₹0 |

| Equity Intraday | Rs. 20 per executed order or 0.03% (whichever is lower) |

| Equity Futures | Rs. 20 per executed order or 0.03% (whichever is lower) |

| Equity Options | ₹20 per executed order |

| Currency Futures | Rs. 20 per executed order or 0.03% (whichever is lower) |

| Currency Options | ₹20 per executed order |

| Commodity Futures | Rs. 20 per executed order or 0.03% (whichever is lower) |

| Commodity Options | ₹20 per executed order |

The way it works is simple. The maximum brokerage you are going to shell out is ₹20 per executed order. However, there is no minimum brokerage limitation.

There are users providing brokerage in few paise (less than a rupee) in their trades with this discount stockbroker.

More or less, it can be said that brokerage is at a similar level as other competitive discount brokers in India such as Upstox, Zerodha or 5Paisa.

Use this Fyers Brokerage Calculator for complete charges and your profit

There are few more charges that are outside brokerage or Fyers account opening such as:

- Turnover charges

- Securities transaction charges

- The government levied applicable taxes

- The state levied applicable stamp duty

- SEBI Turnover fees

These are generally the same for every broker and thus make no significant change to the Fyers review.

Fyers Transaction Charges

Here is a glimpse of turnover and other charges:

| Call & Trade Services | Rs. 20 per executed order |

| Admin Square Off Charges | Rs. 20 per executed order |

| Physical Contract Note Charges | Rs. 20 per physical contract note + courier charges |

| Physical Delivery | 0.5% of the contract value |

| Expires / Exercised / Assigned Futures & Options Contracts | Rs. 20/- |

| Cheque Bounce Charges | Rs. 350/- |

| Payment Gateway Charges | Rs. 10/- |

| Annual Maintenance Charges | Rs. 0 |

| Credit Charges (Buy Receive) | Nil |

| Debit Charges (Sell ) | Rs. 10/- + Rs 5.50/- (CDSL Charges) |

| Pledge Request | Rs. 50/- + Rs. 12 per request (CDSL Charges) |

| Unpledge Request | Rs. 50/- + Rs. 12 per request (CDSL Charges) |

| Pledge Invocation | Rs. 50/- |

| Dematerialization Charges | Rs. 100/- per certificate |

| Rematerialization Charges | Rs. 100/- per certificate + (CDSL Charges) |

| Conversion of MF Units / Destatementisation | Rs. 100/- per certificate |

| Reconversion of MF units in to SOA or Redemption/Restatmentisation Per SOA | Rs. 100/- per certificate + (CDSL Charges) |

| Stamp Charges | Rs. 50/- |

| Failed / Rejected Transactions | Nil |

| Periodic Statement | Nil charges by Email. Rs. 50 + courier charges at actuals for physical statements |

| Ad Hoc / Non Periodic Statement Requests | Nil |

| Additional Delivery Instruction Book (5 leaves) | Rs. 100 + courier charges at actuals |

| Modification in Client Master List (CML) | Rs. 50/- |

| Modification in KRA / Download | Rs. 50/- |

Fyers Margin

Since you can earn profit with Fyers Intraday trading, but do you know that you can multiply your profit by availing the benefit of Fyers Margin.

Being a discount broker offers many advantages in brokerage, but along with this to gain more fame it comes up with the leverage of margin trading.

This helps you to trade more in the particular stock even with limited funding.

Specifically for the intraday trade, the broker provides a margin of up to 16 times. Thus if you are having ₹1000 in your hand, then after maintaining a minimum initial margin in your account, you can trade up to the value of ₹16000.

Now let’s assume that you are willing to trade in a stock having a share price of ₹100 per share. Then in ₹1000, you can trade in 10 stocks, but with 16000, you can actually 160 stocks.

So here if the stock price rises to ₹20. So by selling a share at ₹20 each you can gain ₹3200 unlike the ₹200 that you made with the limited fund (₹1000) in your hand.

Apart from the intraday, you can avail a little margin for other segments like equity, delivery, futures (up to 4x), options (up to 4x).

To make the process seamless, the broker comes up with the new Fyers Single Margin Account that make it easy for traders to reap the leverage in equity and commodity segments without any hassle.

Fyers Calculator

Apart from the trading platforms mentioned above, the discount stock broker provides multiple calculators as well for the usage by the clients and users. These are as follows:

Fyers Option Calculator

This tool is useful for beginners or small investors that are looking for some assistance in setting up strategies for their investments.

With this tool, clients can find the most optimal strategies that may go well with their preferred industry and stock types. Clients have the option to choose from 44 possible options strategies including 2,3 as well as 4 legged options strategies.

By the look of this, it might be looking a lot of technical – which is true. But the way a beginner can learn and understand these strategies is simply amazing.

Fyers Margin Calculator

The margin facility takes minimal inputs from the users and assists with the calculation of margin across different segments. These exposure values can also be calculated at specific stock levels at a given price.

The other similar tools add a lot of value to the customer experience and Fyers review as well. They are as follows:

- Brokerage calculator

- Fibonacci calculator

- Pivot point calculator

- Brokerage comparison calculator

Fyers Customer Care

The broker offers many channels for resolving the issues of its clients. These multiple ways add to the Fyers review. The following communication channels are available for customer service:

- Multiple phone numbers (9 am to 11:55 pm)

- Social Media (YouTube, LinkedIn, Twitter)

- Play Store

- Support Portal

The overall turnaround time in the case of this broker is good and users can expect a quality resolution to the concern in quick time.

Fyers offers thematic investing to clients, using which clients can just invest algorithmic-based stocks from different themes (or industries) offering consistent long-term returns.

HOW TO OPEN A DEMAT AND TRADING ACCOUNT?

Fill in your required details in the below form, and a call back will be arranged for you.

Next Steps

Post this call You to need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

Fyers Advantages

At the same time, you get the following advantages while trading through Fyers. These advantages are necessary to compile the Fyers review.

Some of the most certain advantages are:

- Transparent and reasonable pricing.

- Advanced trading tools across devices.

- Allows automated trading.

- Mobile app on Android as well as iOS platforms available.

- Fyers refer and earn services that help the user to generate passive income.

Fyers Disadvantages

Before we conclude, here are some of the major concerns of using the services of this discount stockbroker:

- Relevantly new in the market, so less trust gained.

- Investment in bonds or Insurance not possible.

- No toll-free customer service available.

“Funds Transfers using trading platforms will cost you INR 10 per transfer. The payout can be requested through many trading platforms of Fyers or by using the back-office.”

Conclusion

Fyers is one of those stockbrokers that has evolved pretty well in quick time. Most of its growth’s credit goes to its focus on trading platforms across devices to go along with quick customer service.

Its trading platforms have been appreciated a lot and the clients appreciate the innovative and technologically advanced approach. Although they need some alterations, they are decent performers in the race.

At the same time, they must be making sure to cover as many financial trading products as possible for their clients. Further, they can also introduce some monthly fixed brokerage plans for their clients.

Overall it certainly is one of the reasonable performing and well-growing stock brokers in India right now and certainly is a potential choice for beginners and small traders. That was all about the broker in the Fyers review.

FYERS FAQs

Here are a few frequently asked questions about Fyers Securities you must be aware of:

- Is Fyers a good broker for new traders or beginners?

First of all, we need to understand what exactly are beginners looking for?

- Low brokerage

- Assistance in investing

- Quick customer service

- Relevant information

- Analysis tools

It is one of the very few stockbrokers that is able to provide all of this. With thematic investing, users actually do not need to perform any analysis on their own as the method is meant to guide users directly into specific investment pools.

Then, the broker is able to provide decent customer service, high-performance analysis tools (such as Scanners, heatmaps, calculators, etc) at a pretty much low brokerage.

All of this points to the fact that yes, this broker is one of the suitable ones in India.

2. How safe is Fyers? Is it a reliable stockbroker?

Although the broker is a new addition to the category of discount stock brokers in India, the firm and its management seem to have a clear understanding of where it is leading to. It provides clear propositions to its clients and cuts away any high-cost frills that help them to avoid levying high brokerage charges on its clients.

The web application is one grey area in its overall value system that certainly needs to be fixed but on a general note, Fyers is certainly one of the reliable stock brokers that you can look out for.

3. How can I transfer my shares from Upstox to Fyers?

You can transfer your shares from any stockbroker to Fyers very easily. You can opt for the offline way where you need to fill in the slip, submit it to your current broker with the mention of DP Id of Fyers. There is an online way to perform this process as well.

You can check out this detailed step by step guide on How to Transfer shares from one demat account to another for further reference.

4. How are the trading platforms provided by Fyers?

The discount broker is known for its decent performing trading platforms across devices (minus the web version, which needs some improvement in a few aspects). The broker offers Fyers One, a terminal-based software that is quite exhaustive in its features to go along with Fyers Markets, a decent designed, developed, and maintained mobile trading app.

Both of these trading software are easy to use, provide multiple features, are good for technical as well as fundamental analysis of stocks.

5. What are the extra features available on the Fyers trading platform?

Although its web-based application is minimalistic in nature, the other trading platforms of the broker do provide some unique features, especially for analysis. Some of those features include:

- More than 65 technical indicators

- Sector, index, stock, industry level heatmaps

- Buy and Sell signals

- Stock Screeners that takes away all the clutter and irrelevant information

- Workspace customization and personalization

It really depends on your trading style and behavior and based on that, you can choose to use specific features listed above.

6. How do I open an account with Fyers?

Opening a trading account with a discount stock broker is pretty easy. All you need is a few documents (listed above), account opening fee is nil but you will be required to pay the AMC amount upfront.

Also, check out detailed comparisons of Fyers Vs Other Stock Brokers:

Have you got impressed and thinking to open a demat account? Please refer to the below form

Know more about Fyers

Their customer service is too poor. Shows how bad this broker will be in future